Montreal commercial real estate market update – Q4 2025

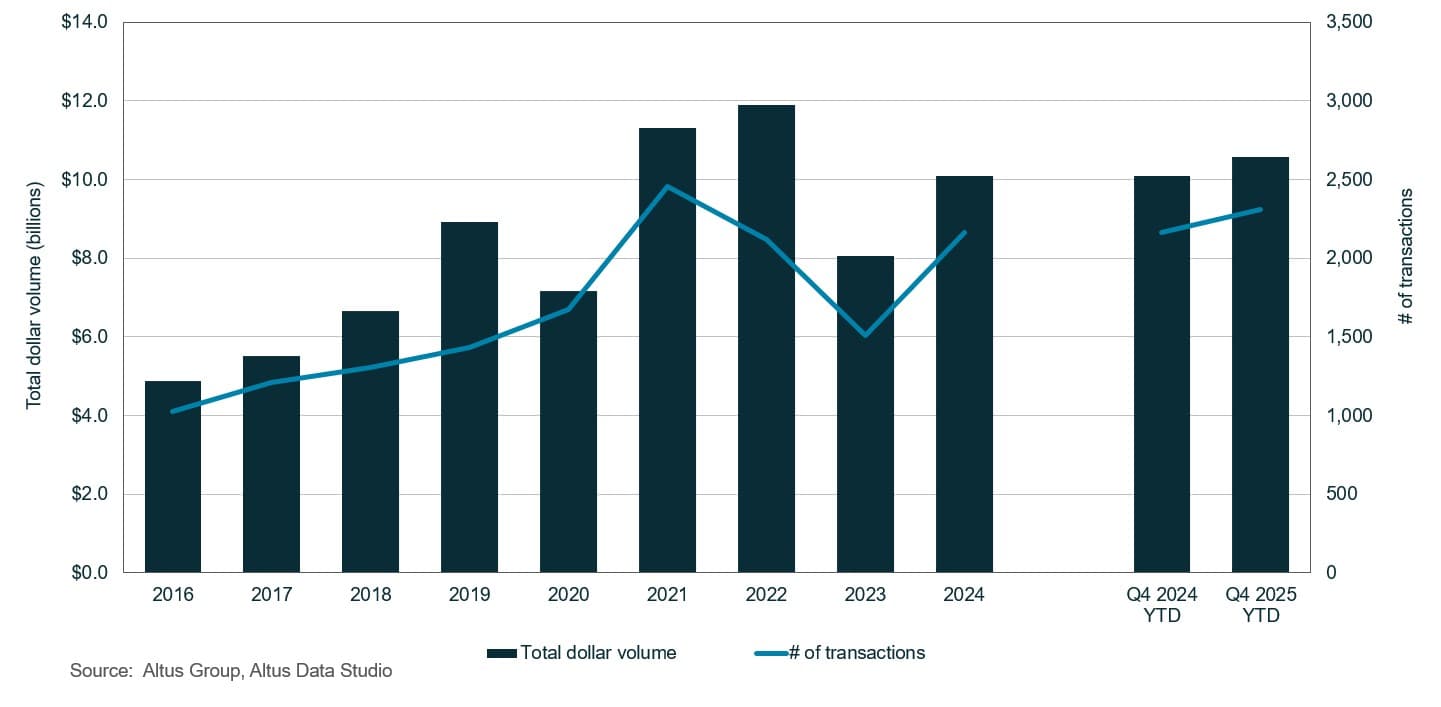

The Montreal commercial real estate market concluded the year with a total investment volume of $10.6 billion, a nominal 5% year-over-year increase.

Key highlights:

Source: Altus Data Studio market data and analysis

By the close of the fourth quarter, Montreal reported a 5% year-over-year improvement in overall investment activity, with $10.6 billion in dollar volume transacted

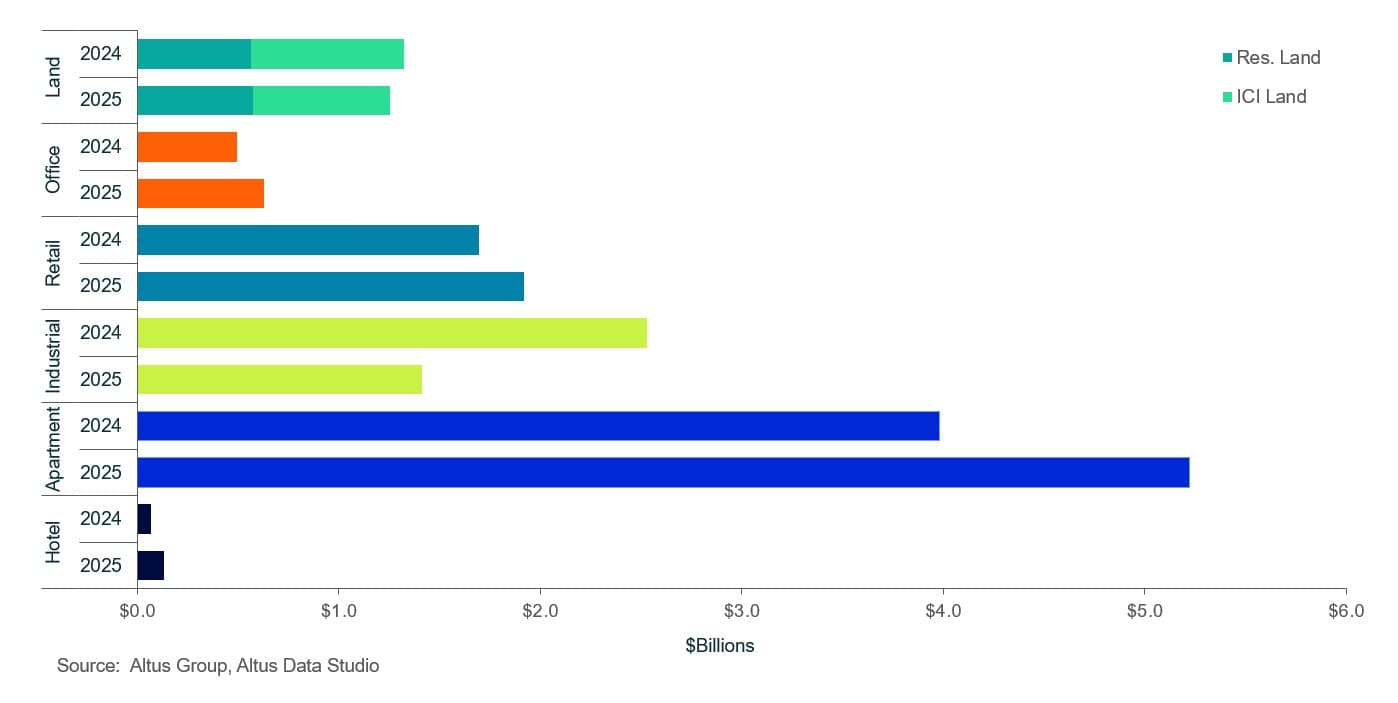

The multi-family sector demonstrated stability, with investment volume up 31% year-over-year to $5.2 billion, comprising 49% of the market’s total transaction volume

The industrial sector experienced a significant downturn, recording $1.4 billion in dollar volume transacted, a significant 44% year-over-year decrease

The retail sector saw sustained investor interest with $1.9 billion in dollar volume transacted, up 13% year-over-year

The office sector saw a notable increase, recording $626 million in dollar volume transacted, representing a 27% year-over-year increase

The land sector recorded nearly $1.3 billion in transaction volume, down 5% overall, with the ICI sub-sector reaching $681 million and residential land totaling $574 million, down 10% year over year and up 2%, respectively

By the final quarter, Montreal demonstrated resiliency, with investment volume up 5% year-over-year

The Montreal commercial real estate market underwent a period of recalibration in 2025. Based on data from Altus Data Studio, Montreal concluded the year with structural resilience and a total investment volume of $10.6 billion. While this represented a nominal 5% year-over-year increase, the growth trajectory was obscured by an atypical “pull-forward” of investment activity during the second quarter of 2024, when investors accelerated deal closures to precede a proposed capital gains tax hike. Although the policy change was subsequently cancelled, the resulting surge established an artificially elevated benchmark for year-over-year comparisons. Despite persistent interest rate pressures and shifting corporate requirements, the year ended with a clear indication that investor confidence in core assets remained intact. This normalization phase proved essential for overcoming prior volatility and establishing a sustainable foundation for future valuation growth.

Figure 1: Montreal property transactions - All sectors by year

The broader macroeconomic landscape was initially defined by heightened investor caution, which peaked during the second quarter of 2025 amid geopolitical tensions and shifting perceptions of the Canadian economy. However, stability improved during the latter half of the year, supported by the legal framework of the Canada-United States-Mexico Agreement (CUSMA), which acted as a safeguard against US trade protectionism. Monetary policy reached a pivotal turning point on December 10, 2025, when the Bank of Canada (BoC) maintained its overnight rate at 2.25% following two consecutive reductions. This pause was supported by a 2.6 annualized GDP rebound in the third quarter and a stabilizing labour market, where the employment rate settled at 6.8% by December.

In response to this complex environment, the investment community adopted a disciplined strategy characterized by capital preservation and the prioritization of defensive asset classes. According to the latest Altus Group Investment Trends Survey (ITS), Montreal ranked as the fifth most attractive Canadian market for investment across all property types. While Montreal’s ranking did not exceed fifth place in 2025, the market demonstrated structural resilience within the retail, hotel, office, and multi-family sectors. The prevailing fiscal environment prompted property owners to prioritize balance sheet management through careful refinancing and reduced speculative development. This conservative approach characterized the year, as developers favoured liquidity over aggressive expansion while awaiting clearer central bank signals regarding long-term neutral rates.

Multi-family investment activity

The multi-family sector solidified its status as the premier asset class within the Montreal commercial real estate landscape, accounting for approximately 49% of the total transactional volume by the end of 2025. Total investment volume reached $5.2 billion, a 31% year-over-year increase. This performance underscored the robust fundamental demand for rental housing, which remained resilient despite broader macroeconomic caution.

While the Island of Montreal maintained its historical dominance, securing nearly $3.4 billion in investment in 2025, the regional narrative was increasingly defined by a strategic expansion into the peripheral markets. The Laval region recorded the most dramatic growth, with transaction volume surging by 383% year-over-year to $848 million. This increase was largely driven by major institutional acquisitions, most notably significant portfolio additions by Broadwalk REIT and CAPREIT.

Throughout 2025, developers and investors remained highly active in Montreal’s suburban rings. This activity reflected a strategic focus on increasing density within peripheral areas to leverage their relative affordability and expanding population bases. The sector’s overall stability was further supported by a persistent housing supply-demand imbalance, ensuring that multi-family assets remained a preferred choice for capital allocation.

Office investment activity

The Montreal office sector demonstrated a decisive recovery in leasing momentum during the final quarter, supported by a significant increase in capital allocation. The market recorded $626 million in dollar volume, marking a notable 27% year-over-year increase. This resurgence in investment activity was primarily driven by the broad adoption of intensified return-to-office mandates among major employers and a pronounced “flight-to-quality” trend. These factors collectively channelled institutional demand toward premium, strategically located Class AAA assets, which have increasingly become the focal point of the regional market recovery.

The renewed focus on high-performance physical workspaces resulted in a tightening of the premium market segment. According to the latest Altus Group Canadian office market update, Montreal’s office availability rate contracted by 80 basis points to 16.9% year-over-year. The downtown Class A segment exhibited even greater compression, with the availability rate decreasing by 40 basis points to 15.3%. Leasing data further underscored the dominance of top-tier assets, with Class A transactions accounting for 74 deals, totalling nearly 2 million square feet. In contrast, Class B office space comprised 34 transactions, totalling approximately 743,000 square feet, highlighting a widening bifurcation in the market as older, functionally obsolete inventory struggled to meet contemporary corporate standards for technology and amenities.

The market's structural balance was further influenced by the complete halt in new office completions during the fourth quarter. The regional development pipeline remained devoid of any future office projects, as the ongoing repositioning of existing assets deterred speculative building. This absence of new supply is anticipated to serve as a critical catalyst for further availability tightening throughout 2026, as existing inventory, particularly within the Class A segment, continues to be absorbed by firms prioritizing centralized, high-quality corporate environments.

Industrial investment activity

The industrial sector experienced a significant contraction in investment volume throughout 2025, culminating in a sharp 44% decline, with total transactions amounting to $1.4 billion. This period of turbulence reflected a fundamental shift in investor sentiment as the market adjusted to a more cautious economic climate. The primary catalyst for the rising availability rate was a marked reduction in demand for specific product categories, particularly large-bay buildings. According to Altus Group’s latest Canadian industrial market update, Montreal’s availability rate reached 8.4% by the end of the year, representing a year-over-year increase of 60 basis points.

Geography remained a defining factor in the evolution of the regional industrial landscape. Inventory located on the Island of Montreal was characterized by aging facilities with lower clear heights and elevated operating costs, which increasingly failed to meet modern logistics requirements. Conversely, the South Shore emerged as a primary hub for new distribution development, offering superior land availability and modern specifications. Net asking rents showed a marginal decline during the fourth quarter, settling at an average of $13.99 per square foot, though they have essentially plateaued within the $13 to $14 range for 11 consecutive quarters. To sustain these high face rents, property owners increasingly relied on concessions, such as free-rent periods, particularly when negotiating long-term lease commitments.

The fourth quarter saw the completion of five industrial buildings, totalling nearly 1.5 million square feet, with 32% of that space remaining available for lease at the time of delivery. The development pipeline subsequently contracted to 12 buildings, representing 2.8 million square feet currently under construction. Given that roughly 63% of this future supply remained unleased, a further marginal increase in the availability rate is anticipated as these projects reach completion. A meaningful rebound in overall industrial demand remained contingent upon improvements in global trade stability and a more robust domestic manufacturing outlook as stakeholders monitored the long-term impact of shifting supply chain strategies.

Hotel investment activity

The hotel sector recorded $130 million in dollar volume transacted, representing a 93% appreciation year-over-year. This growth was underpinned by strengthening market fundamentals and a sustained increase in demand for hospitality assets. The sector benefited from a revitalized professional landscape and a robust recovery in high-volume tourism, both of which served to bolster asset performance and valuations throughout 2025.

This upward trajectory was further supported by return-to-office mandates across Montreal’s business district, which catalyzed a resurgence of corporate travel and the resumption of large-scale international conventions. Furthermore, the leisure tourism segment demonstrated exceptional resilience, anchored by the city’s status as a premier destination for global sporting and cultural events. The annual Formula 1 Canadian Grand Prix continued to provide a guaranteed seasonal peak in occupancy and revenue. At the same time, the return of international music festivals and film events drove record summer hotel stays.

From an investment perspective, the hospitality asset class was increasingly repositioned as a strategic necessity within diversified institutional portfolios. Investors favoured the sector for its unique operational flexibility, particularly the ability to adjust average daily rates in real time. This mechanism provided a critical hedge against institutional risks and allowed owners to respond dynamically to shifting market conditions and the province's evolving economic landscape.

Retail investment activity

The retail sector saw a gradual acceleration in the latter half of 2025, culminating in a total transaction volume of $1.9 billion. This figure represented a 13% year-over-year increase, bolstered by a fourth quarter that recorded the highest investment volume tracked in nearly a decade. This historic surge surpassed the previous record set in the third quarter of 2024 and was primarily attributable to the landmark $565 million acquisition of the Promenades St-Bruno shopping centre by Primaris REIT.

According to Altus Group’s latest Canadian Investment Trends Survey, food-anchored retail strips remained the most preferred product among investors within the Montreal market for the fifth consecutive quarter. These essential service assets garnered intense demand as they were highly valued for their defensive qualities, including historically high occupancy rates and low tenant turnover. Investors prioritized these properties for their inherent resistance to e-commerce disruption and their relative immunity to broader macroeconomic volatility, viewing them as stable income-producing vehicles in an otherwise uncertain fiscal environment.

The sustained demand for necessity-based retail, coupled with the asset class’s efficacy as an inflation hedge, resulted in an acute inventory shortage across the market. Property owners increasingly retained these high-performing assets rather than bringing them to market. At the same time, restrictive lending environments and the elevated cost of capital severely limited the feasibility of new development projects. Consequently, near-term investment activity remained largely constrained by a lack of available products and the persistence of high financing costs. The focus remained on intensification of existing sites, with owners exploring the addition of residential components to suburban shopping centres to maximize land value and create mixed-use hubs that benefit from built-in consumer traffic.

Land investment activity

The land sector in Montreal, encompassing both residential and ICI land, experienced a slight contraction in investment activity. The total transaction volume for the period reached nearly $1.3 billion, representing a modest 5% decrease year-over-year. This downturn indicated a more cautious investment climate and deceleration in development activity across the region, as stakeholders navigated broader economic uncertainties and elevated borrowing costs that impacted project feasibility.

A closer examination of the market revealed that the ICI land segment was primarily responsible for this broader slowdown. Transaction volume for ICI land totalled $681 million, marking a 10% year-over-year decrease. This decline reflected a strategic postponement of commercial and industrial development plans, as developers held off on speculative builds in response to softening tenant demand and the higher cost of capital required for large-scale constructions.

Conversely, the residential land sector experienced a marginal increase in activity, reporting $574 million in dollar volume for a 2% year-over-year improvement. While this suggested that fundamental housing demand persisted, it also highlighted a transition in developer behaviour toward more selective land acquisition. This overall reduction in land transactions served as a clear indicator of an industry-wide shift toward risk mitigation. Developers and investors prioritized a conservative approach to future pipelines as they re-evaluated long-term strategies in response to evolving market fundamentals.

Figure 2: Property transactions by total by asset class YTD (2024 vs 2025)

Notable Montreal property transactions

The following are the notable transactions for the Q4 2025 Montreal commercial real estate market update:

Promenades St-Bruno, Saint-Bruno-de-Montarville – Retail

Les Promenades St-Bruno was divested in mid-October 2025. This $565 million transaction represented a unit price of $440 per square foot, establishing it as the highest-value acquisition in Montreal for the fourth quarter and in 2025. This sale marked the second disposal by Cadillac Fairview (CF) within Montreal, following the $279 million sale of the Tour Deloitte office tower.

CF further reduced its retail footprint by selling Lime Ridge Mall in Hamilton, Ontario, for over $415 million. Both assets were acquired by Primaris REIT. These sales aligned with CF’s strategic pivot toward portfolio diversification and mixed-use integration, exemplified by their $4.7 billion residential program, which included the development of 365 units at Carrefour Laval.

7050 Saint-Patrick Street, Montreal (LaSalle) - Industrial

Ranked as the second-largest industrial transaction in Montreal for the fourth quarter, 7050 Saint-Patrick was sold in November for $27.5 million. The 195,000 square foot facility traded at $142 per square foot.

This transaction was part of a larger portfolio deal between Crystal Water Investments and Nexus REIT, which included 2370 de la Province Street in Longueuil. Both assets were tenanted by Aqua Leader at the time of the sale. The total portfolio valuation reached $40.1 million, reflecting a blended price of $145 per square foot and a 6.6% capitalization rate.

3510-3540 Saint-Laurent Boulevard, Montreal (Le Plateau-Mont-Royal) – Office

Situated on a major commercial artery, 3510-3540 Saint-Laurent Boulevard was recorded as the highest value office transaction in Montreal in the fourth quarter, with a sale price of $33 million. The sale was executed as part of a broader divestment strategy by Allied Properties REIT.

Since late 2023, Allied sold six office assets in Montreal, three of which were located within a two-kilometre radius of Saint-Laurent Boulevard, for a cumulative total of $145.5 million. Although these transactions reduced holdings, Allied maintained that the assets were classified as non-core and reaffirmed its position as a dominant stakeholder in the Montreal commercial real estate market. By the end of 2025, the REIT’s portfolio consisted of approximately 26 properties totalling 6 million square feet.

256 Notre-Dame Street, Repentigny - Apartment

Located on Montreal’s North Shore, the “Azalis” complex at 256 Notre-Dame Street ranked as the third largest transaction of the fourth quarter, selling for $111 million. This asset was one of four senior living residences acquired by Chartwell in Montreal throughout 2025.

The acquisition reflected Chartwell’s strategic focus on modern assets with premium amenities. Notably, three of the four acquired properties were constructed within the last decade. Chartwell’s total investment for 2025 reached $411.5 million, which represented an average price per unit of $273,847.

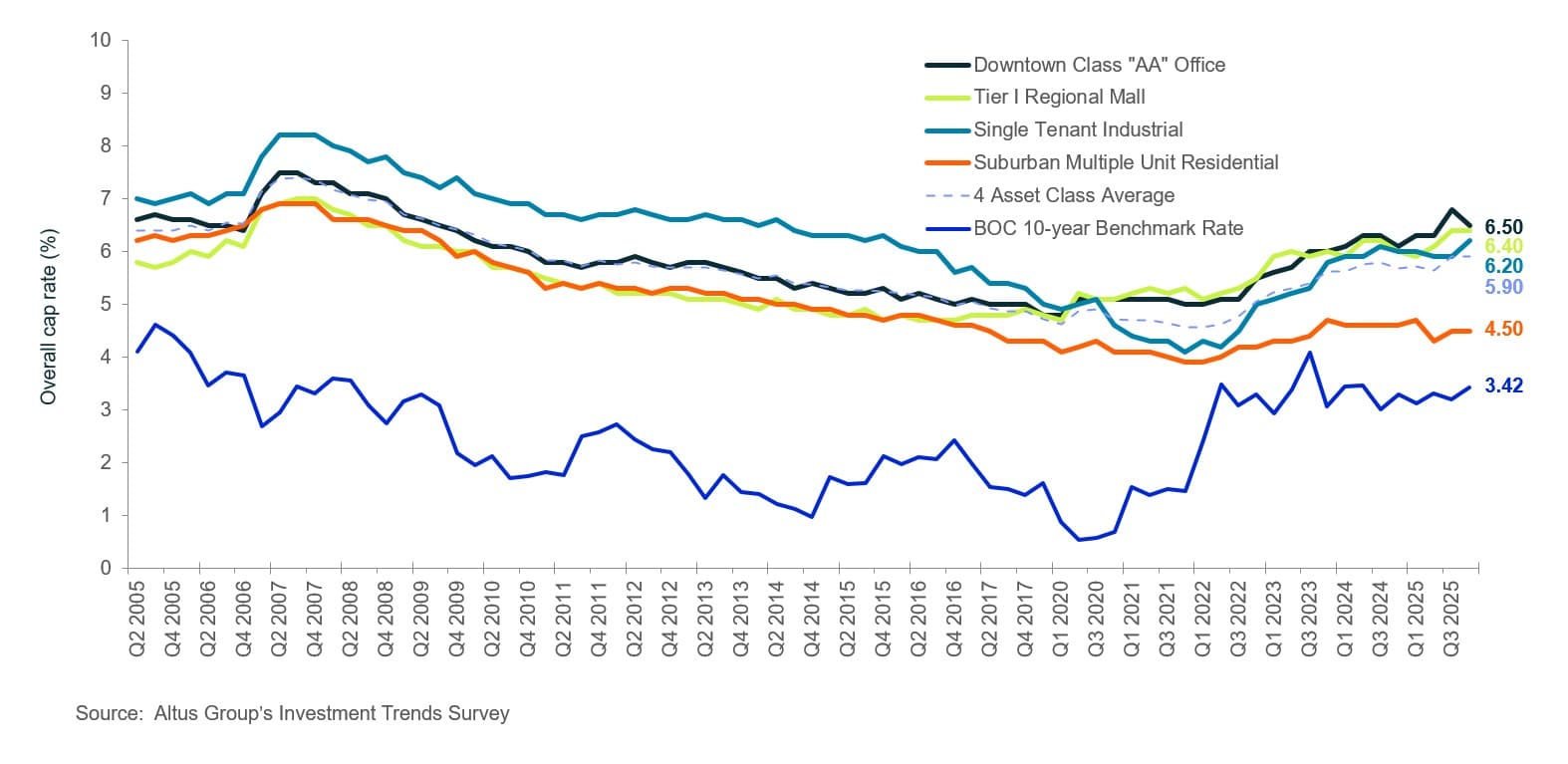

Figure 3: Montreal OCR trends across four benchmark asset classes

Looking ahead

Looking ahead into 2026, Montreal’s commercial real estate market appears to be shifting from a period of defensive posturing to one of strategic growth. Investor sentiment is noticeably on the rise, with investors anticipating increased activity as the bid-ask spread begins to narrow. This renewed optimism was largely driven by the expectation that borrowing costs would continue to stabilize, allowing institutional and private capital to move off the sidelines. The upcoming year is expected to be defined by a “flight to quality,” where investors prioritize high-performing assets in prime locations and transit-oriented hubs like those surrounding the expanding REM networks.

While the overall sentiment is opportunistic, 2026 will likely be a year of bifurcated growth. Discipline has replaced aggressive expansion, and underwriting has become more rigorous, focusing on long-term income stability rather than quick appreciation. Investors are keeping a close watch on shifting federal policies and global trade dynamics, yet Montreal’s relative affordability compared to other major Canadian cities continues to make it a standout choice for those seeking a reliable hedge against inflation. As the market enters this new cycle, the focus will remain on assets that offer operational flexibility and cater to essential needs, positioning Montreal for a steady, grounded recovery throughout the year.

Want to be notified of our new and relevant CRE content, articles and events?

Disclaimer

This publication has been prepared for general guidance on matters of interest only and does not constitute professional advice or services of Altus Group, its affiliates and its related entities (collectively “Altus Group”). You should not act upon the information contained in this publication without obtaining specific professional advice.

A number of factors may influence the performance of the commercial real estate market, including regulatory conditions and economic factors such as interest rate fluctuations, inflation, changing investor sentiment, and shifts in tenant demand or occupancy trends. We strongly recommend that you consult with a qualified professional to assess how these and other market dynamics may impact your investment strategy, underwriting assumptions, asset valuations, and overall portfolio performance.

No representation or warranty (express or implied) is given as to the accuracy, completeness or reliability of the information contained in this publication, or the suitability of the information for a particular purpose. To the extent permitted by law, Altus Group does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. The distribution of this publication to you does not create, extend or revive a client relationship between Altus Group and you or any other person or entity. This publication, or any part thereof, may not be reproduced or distributed in any form for any purpose without the express written consent of Altus Group.

Authors

Jennifer Nhieu

Senior Research Analyst

Daniel Marro

Senior Market Analyst

Authors

Jennifer Nhieu

Senior Research Analyst

Daniel Marro

Senior Market Analyst

Resources

Latest insights