Canadian industrial market update – Q2 2025

Our quarterly update on the Canadian industrial market, including availability rate, completions and under construction data

Key highlights

The imposition of US tariffs significantly impacted the Canadian economy, dampening investor confidence and leading to a “wait-and-see” approach for capital deployment across the industrial sector in the first half of 2025

Canada’s national industrial availability rate increased by 50 basis points to 6.2% in Q2 2025, as absorption returned to negative territory following two quarters of positive growth, compounded by an uptick in available sublet space

The effects of trade disputes extended beyond the industrial sector, contributing to cautious retail spending and exacerbating unemployment, particularly in auto-dependent regions of Southern Ontario such as Windsor, Oshawa, and Toronto

While Ottawa maintained the tightest industrial availability rate at a remarkably low 3.4%, other major markets like Toronto and Vancouver experienced upward movements in their availability rates, and Halifax continued to register the highest rate in Canada at 12.5%

National industrial completions marked a downward trend in the second quarter of 2025 compared to prior robust periods, yet a substantial 70% of the 18.3 million square feet currently under construction across Canada remained available for lease, underscoring a significant pullback in demand and speculative pipeline

National industrial availability rate increased to 6.2% in the second quarter of 2025

In the first half of 2025, the Canadian industrial sector contended with significant challenges. The imposition of tariffs by the United States introduced considerable volatility into the Canadian economy, which subsequently dampened investor confidence and led to delays in capital deployment. This was largely attributable to the deeply intertwined nature of the Canada-US trade network. Consequently, investors appeared to adopt a temporary wait-and-see approach as they strategically assessed the potential ramifications of committing to new investments during this volatile period. The long-term effects of this policy shift were anticipated to be substantial, and the immediate consequence was a palpable hesitation within the investment community.

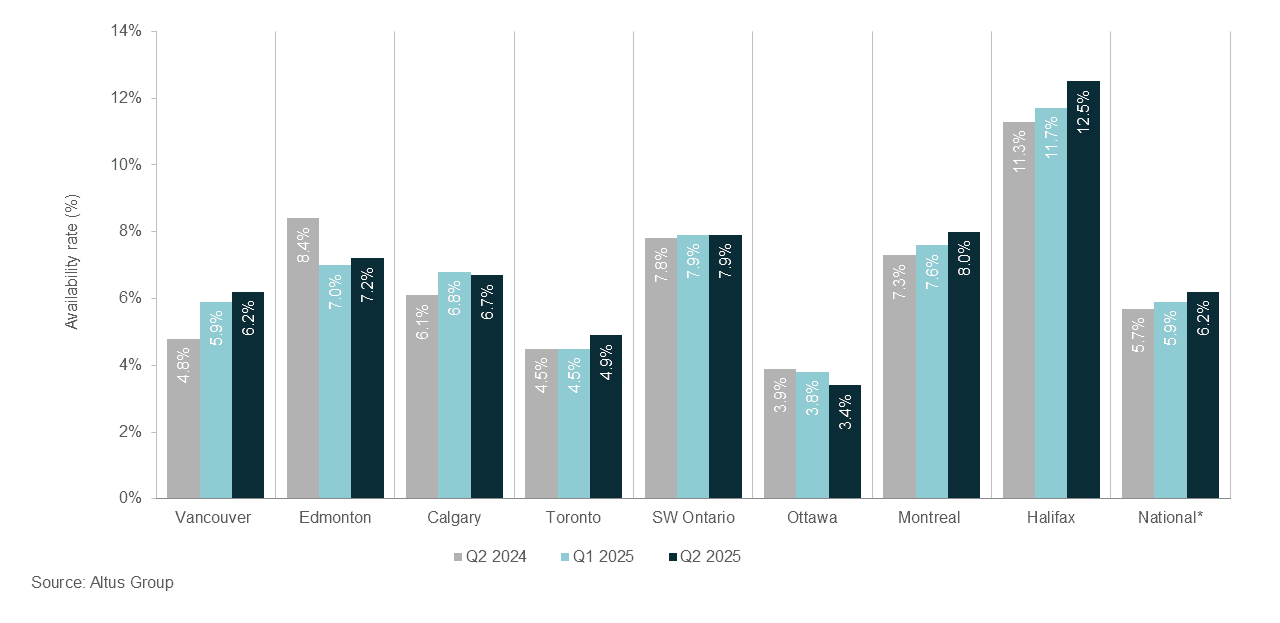

These disruptions contributed to Canada’s national industrial availability rate increasing by 50 basis points from the previous quarter, reaching 6.2% in the second quarter of 2025 (Figure 1). After two consecutive quarters of positive absorption, the sector slipped back into negative territory as it continued to rebalance supply and demand amid an unpredictable market. Furthermore, the amount of sublet space available observed a slight uptick, representing 14.2% of the total available space. This increase in sublet availability suggested that some businesses were rationalizing their real estate footprints, potentially due to reduced operational demand or a strategic effort to mitigate costs amidst the uncertain economic environment. The rise in sublet space often signalled a cautious outlook among occupiers, who were seeking greater flexibility or were facing pressure on their existing commitments.

Figure 1: Industrial availability (Q2 2024 vs. Q1 2025 vs. Q2 2025)

These challenges faced by the industrial sector were not isolated but indicative of a broader economic strain. Beyond industrial real estate, the Canadian economy experienced widespread implications stemming from the ongoing trade tensions with the US. In April 2025, Statistics Canada reported a modest 0.3% increase in retail sales, reaching $70.1 billion. While six of the nine subsectors saw sales increases - largely driven by motor vehicle and parts dealers - the underlying sentiment among businesses remained cautious. A notable 36% of retail businesses indicated they were negatively impacted by price increases, shifts in demand, and supply chain disruptions attributable to the trade tensions. This suggested that despite some subsectors posting monthly gains, all nine retail subsectors ultimately experienced a detrimental effect on sales due to the challenging economic climate.

The impact of these trade disputes was particularly acute in regions with a strong industrial base, such as Southwestern and Southern Ontario, which were heavily reliant on the automotive industry. According to Statistics Canada's Labour Force Survey (LFS) in May 2025, tariffs on motor vehicle and parts exports imposed by the US created serious economic instability. This was evident in the highest unemployment rates across Canada’s 20 largest census metropolitan areas, which were recorded in Windsor (10.8%), Oshawa (9.1%), and Toronto (8.8%). These regions, where thousands of jobs depended on the auto industry, bore the brunt of the economic fallout, highlighting the widespread ramifications of the trade disputes across various sectors, from industrial activity and investment to retail consumption and employment.

Regional market dynamics

A closer examination of Canada’s major industrial markets in the second quarter of 2025 revealed diverse conditions. Ottawa continued to distinguish itself by registering the tightest industrial availability rate in the country, dropping to a remarkably low 3.4%. This exceptionally tight market underscored persistent strong demand and constrained supply within the nation’s capital, largely driven by its stable public sector employment base and a growing technology sector that increasingly required industrial and flex-space facilities. Despite the economic headwinds that affected other regions, Ottawa's industrial sector observed sustained tenant demand, helping maintain some of the highest rental rates in the province.

Following Ottawa, the consistently competitive markets of Toronto and Vancouver experienced upward movements in their industrial availability rates. Toronto’s availability rate rose to 4.9%, as new supply outpaced demand and was not fully absorbed. While new construction targeted long-term demand, some businesses simultaneously adjusted their space requirements in response to market shifts, softening overall conditions. This environment also saw a notable increase in overall available space within the existing stock in the Greater Toronto Area (GTA), pushing the market into negative net absorption for the quarter. Similarly, Vancouver reached an availability rate of 6.2% as new completions entered the market, contributing to a slight increase in available space there as well. Despite this uptick, Vancouver’s underlying demand remained robust, particularly for newer, large-bay distribution facilities, and the market continued to be characterized by strong fundamentals, albeit with some caution from tenants awaiting clarity on trade policies.

Halifax, however, continued to register the highest availability rate among Canada’s major industrial markets, reaching 12.5%. This elevated figure was primarily attributable to a softened demand environment that struggled to absorb existing industrial inventory. Distinct from some larger, more diversified markets, where rising availability rates were influenced by the delivery of new construction, Halifax recorded no new industrial completions during the second quarter of 2025. Instead, the observed increase in available space stemmed from a lack of robust tenant demand for properties already in the market, coupled with instances of existing tenants vacating or electing to sublease their premises. This indicated a period of adjustment for the Halifax industrial market, as it worked to integrate its current supply into an environment of more tempered occupier demand.

National industrial completions and new supply dynamics

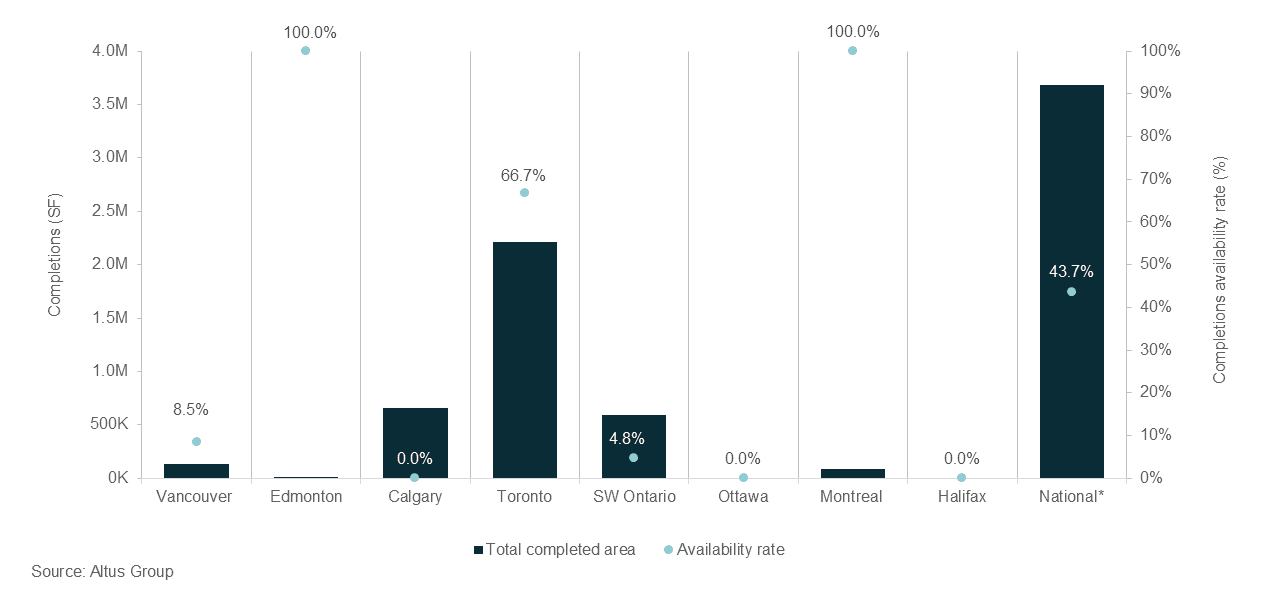

In the second quarter of 2025, the Canadian industrial sector observed a continued moderation in development activity. A total of 20 new industrial buildings were completed across Canada, collectively adding nearly 3.7 million square feet to the national inventory (Figure 2). This volume of new industrial space marked a downward trend in completions compared to the robust delivery levels observed in 2024 and 2023. This moderation reflected a strategic response by developers to the current economic climate and dampened market demand, with a greater emphasis placed on aligning new supply with actual absorption rates.

Figure 2: Industrial completions and availability

More than half of this newly constructed space was introduced in Toronto. Specifically, Toronto contributed 11 industrial properties, totalling 2.2 million square feet of the national inventory. This new supply predominantly consisted of speculative development, with a significant 67% of the space remaining available for lease upon its completion, rather than being fully pre-leased through build-to-suit arrangements. This substantial unleased inventory directly contributed to the rise in Toronto’s availability rate for the quarter. The introduction of this significant volume of unabsorbed new space, combined with instances of existing tenants vacating or subleasing properties, placed notable pressure on the market’s balance of supply and demand, contrasting with previous periods of positive net absorption.

In contrast, Calgary’s market highlighted successful, built-to-suit demand with the Interlink Logistics Park Building 2B, a 660,000 square foot fully leased, single-tenant distribution centre in Rocky View County. This project exemplified the continued strategic demand for large, pre-committed distribution facilities in key trade hubs.

National industrial construction pipeline

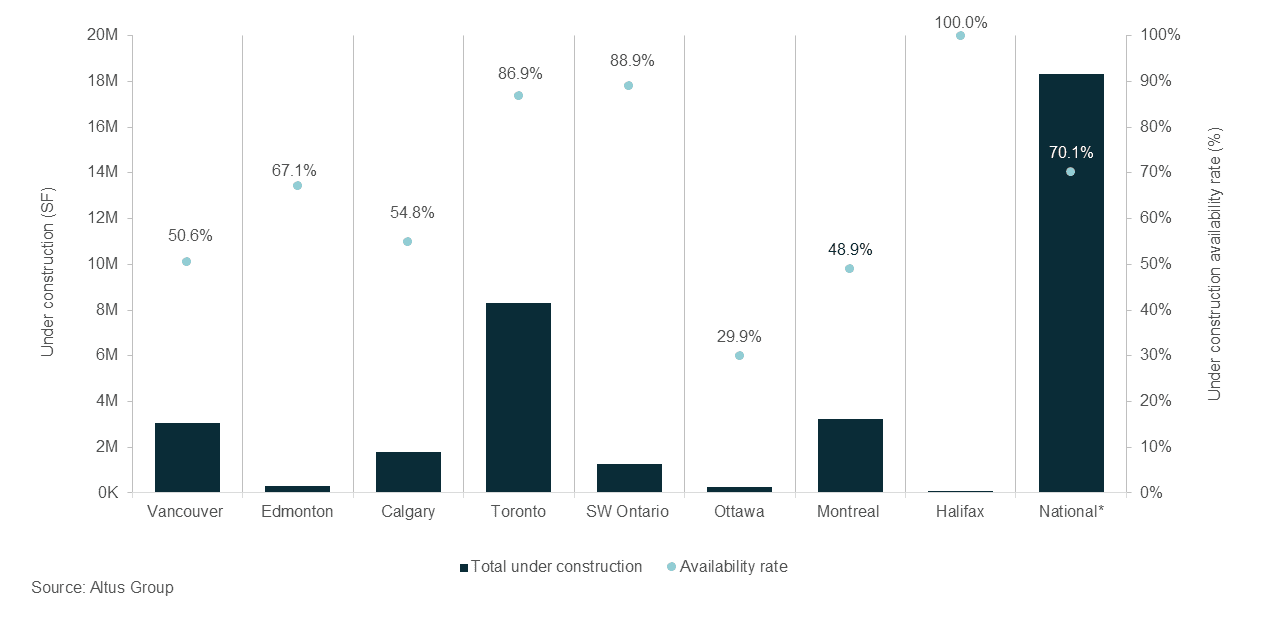

As of the close of the second quarter, the national industrial construction pipeline comprised 119 projects actively under construction, collectively contributing an aggregate of 18.3 million square feet across Canada (Figure 3). A notable challenge in pre-leasing activity was evident, as approximately 70% of this upcoming space remained uncommitted. This elevated availability rate suggested a cautious approach from occupiers, largely attributable to a discernible softening in overall tenant demand experienced during the period.

Figure 3: Industrial under construction and availability

Toronto continued to solidify its position as the national leader in industrial development, with over 8.3 million square feet under construction as of the second quarter of 2025. The predominantly speculative nature of its pipeline was evident, as 87% of this space was available for lease. This indicated developers’ continued confidence in the region’s long-term market fundamentals, even as immediate leasing momentum slowed.

Following Toronto, the Montreal and Vancouver markets also demonstrated significant construction activity. Montreal had nearly 3.2 million square feet under construction, with 49% of this space available for lease, suggesting a more balanced approach to new projects. Similarly, Vancouver reported approximately 3.1 million square feet under construction, with 51% of its upcoming space available for lease. These figures highlighted continued investment in key logistics and distribution hubs across Canada, albeit with varying degrees of pre-leasing success that reflected local market conditions and occupier confidence.

Navigating future market dynamics

The first half of 2025 proved to be a challenging period for the Canadian industrial sector, as it navigated the complexities stemming from Canada-US trade tensions and broader economic shifts. These factors collectively dampened investor confidence, contributed to a national increase in industrial availability, and led to a return to negative absorption following previous periods of growth. While regional markets displayed varied conditions, the overall trend pointed to softened demand across most major Canadian industrial hubs.

Looking ahead, the trajectory of the Canadian industrial market will largely hinge on several critical factors. A clearer direction regarding Canada-US trade policies is paramount, as continued volatility in this relationship is anticipated to prolong the observed hesitation in capital deployment and investment. The ability of the market to absorb the substantial volume of speculative space currently under construction, particularly in key markets like Toronto, will be crucial for stabilizing availability rates. Should demand remain tempered, a slowdown in new construction starts could be observed in the latter half of 2025, as developers re-evaluate their pipelines. Furthermore, the performance of the broader Canadian economy, including retail sales and employment figures, will serve as key indicators for a potential rebound in overall industrial demand. The sector is expected to remain in a period of rebalancing, with occupiers continuing to prioritize efficiency and flexibility in their real estate strategies.

Want to be notified of our new and relevant CRE content, articles and events?

Authors

Jennifer Nhieu

Senior Research Analyst

Ray Wong

Vice President, Data Solutions

Authors

Jennifer Nhieu

Senior Research Analyst

Ray Wong

Vice President, Data Solutions

Resources

Latest insights