Canadian commercial real estate market update - Q2 2025

In our quarterly update on Canada's commercial real estate market, we discuss investment trends across Canada’s major markets.

Key highlights:

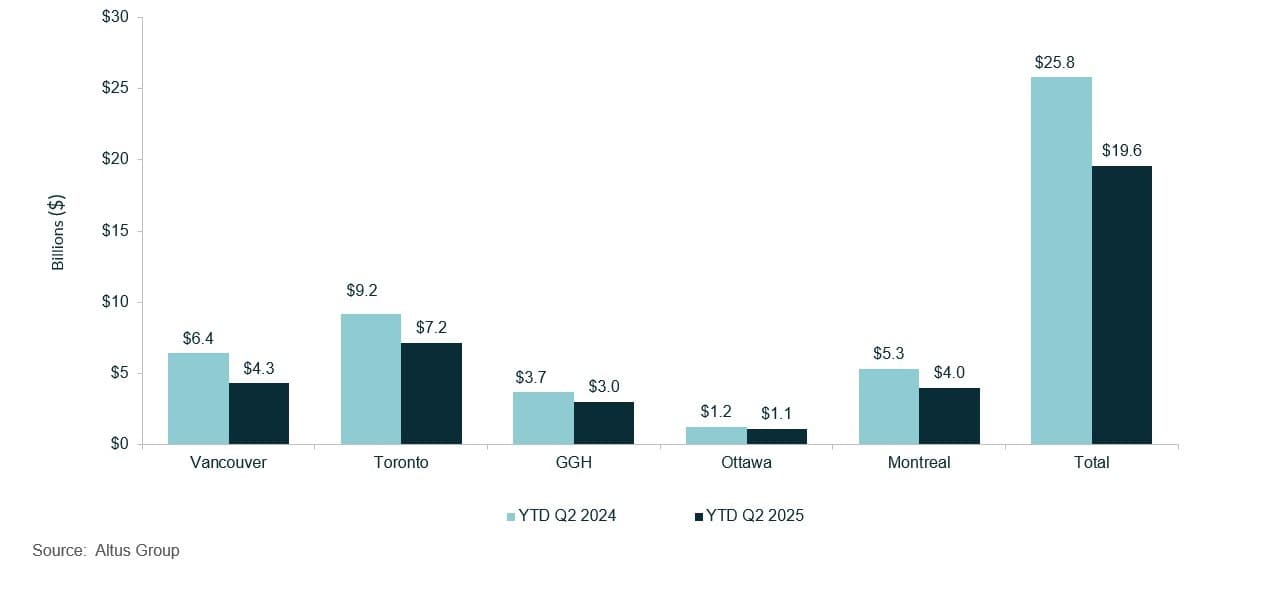

Canada’s commercial real estate market recorded a contraction in the first half of 2025, with total investment volume at $19.6 billion, a substantial decrease of 24% compared to the same period in the previous year

Investment volumes declined across five major Canadian markets on a year-over-year basis, with Vancouver registering the most significant decrease at 33%

The retail sector was relatively stable, with $3.5 billion in dollar volume transacted, a 5% increase year-over-year, attributable to strategic investment in food-anchored retail strips and properties with redevelopment potential

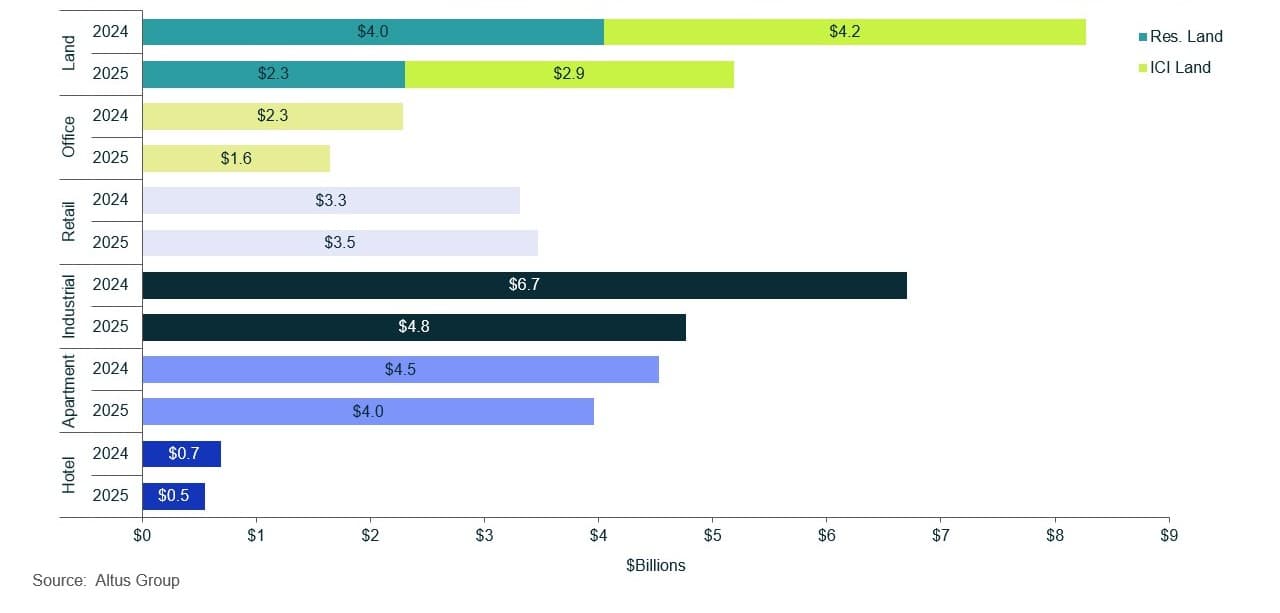

The residential land sector experienced the greatest year-over-year contraction of 43%, with a total investment volume of $2.3 billion in dollar volume transacted

The industrial sector posted a 29% year-over-year decline in investment volume as it contended with rising availability rates resulting from increased supply and waning demand

The multifamily sector experienced continued volatility stemming from immigration policy changes and persistent affordability challenges, which resulted in a 13% reduction in year-over-year investment volume

The office sector has hit an inflection point, with declining availability rates and Class A properties continuing to dominate leasing activity

Read the latest update of the Canadian commercial real estate market update.

Canada’s commercial real estate market: a period of rebalancing and strategic adaptation

Throughout the first half of 2025, the Canadian commercial real estate market encountered considerable challenges, characterized by increased uncertainty and a significant contraction in investment activity. The total investment volume amounted to $19.6 billion, representing a substantial decline of 24% in comparison to the same period in the preceding year (Figure 1). This decline was driven by several factors, including the market’s initial reaction to a proposed increase in the capital gains inclusion rate, a static interest rate environment, and prevailing geopolitical tensions with the US.

Figure 1: Canada’s total investment activity - All sectors by region (Q2 2024 vs. Q2 2025)

The initial proposal for an increase in the now-cancelled capital gains tax inclusion rate prompted a reactive surge in real estate transactions during the second quarter of 2024. In a strategic move to secure the existing, lower tax rate, investors hurried to finalize deals. The rush drove an anomalous spike in investment volume, which distorts year-over-year comparisons. As a result, the decline in the first half of 2025 looks more pronounced than it would under typical market conditions.

Beyond domestic tax policy shifts, the Canadian commercial real estate market faced substantial headwinds from broader geopolitical and economic factors. A primary source of increased investor uncertainty was a perceived weakening of Canada’s economic outlook. This sentiment was largely driven by geopolitical tensions with the US, Canada’s largest trading partner. Specifically, investors remained cautious regarding the unpredictable nature of the projected tariff policies under the Trump administration. The uncertainty surrounding potential trade disruptions fostered a cautious market environment, as investors feared that new tariffs could negatively impact Canadian economic growth and corporate profitability.

In response, the Bank of Canada (BoC) maintained interest rates at 2.75% throughout the first half of 2025. While a static interest rate environment can offer a degree of predictability, this maintained rate, combined with the broader cautious economic outlook, did not stimulate the borrowing and investment activity that lower rates might typically encourage.

Further complicating the market’s challenges were several domestic factors. Changes in immigration policy and stagnant employment growth collectively subdued the demand outlook for commercial real estate. Reduced population inflows could have slowed tenant demand growth across sectors, while a sluggish labour market directly affected office space utilization and consumer spending in retail. These cumulative factors prompted investors to adopt a more strategic and cautious approach to capital deployment, emphasizing risk mitigation over expansion. This hesitation in capital deployment was a direct consequence of the prevailing economic and political uncertainty, leading to reduced transaction volumes. Simultaneously, some investors strategically redirected their portfolios toward asset classes perceived as more stable and less susceptible to market fluctuations. Such sectors included food-anchored retail, student housing and retirement homes, often at the expense of more volatile property types.

Investor preferences and sector performance

During the first half of 2025, commercial real estate investment activity in Canada experienced a broad downturn across all markets and asset classes. Despite this overall contraction, notable shifts in investor sentiment and demand across specific property types emerged, reflecting pockets of resilience and renewed interest.

The Vancouver and Montreal markets witnessed the most significant year-over-year declines in investment volume, and the retail sector showed the greatest stability. Vancouver experienced the most substantial contraction, with investment volume decreasing by 33% to $4.3 billion. Montreal saw investment volume declining by 25% to nearly $4 billion. In contrast, Ottawa’s market proved to be more stable, recording a more modest 9% drop to $1.1 billion. These regional disparities in performance indicated varied levels of sensitivity to prevailing economic conditions and market-specific markets.

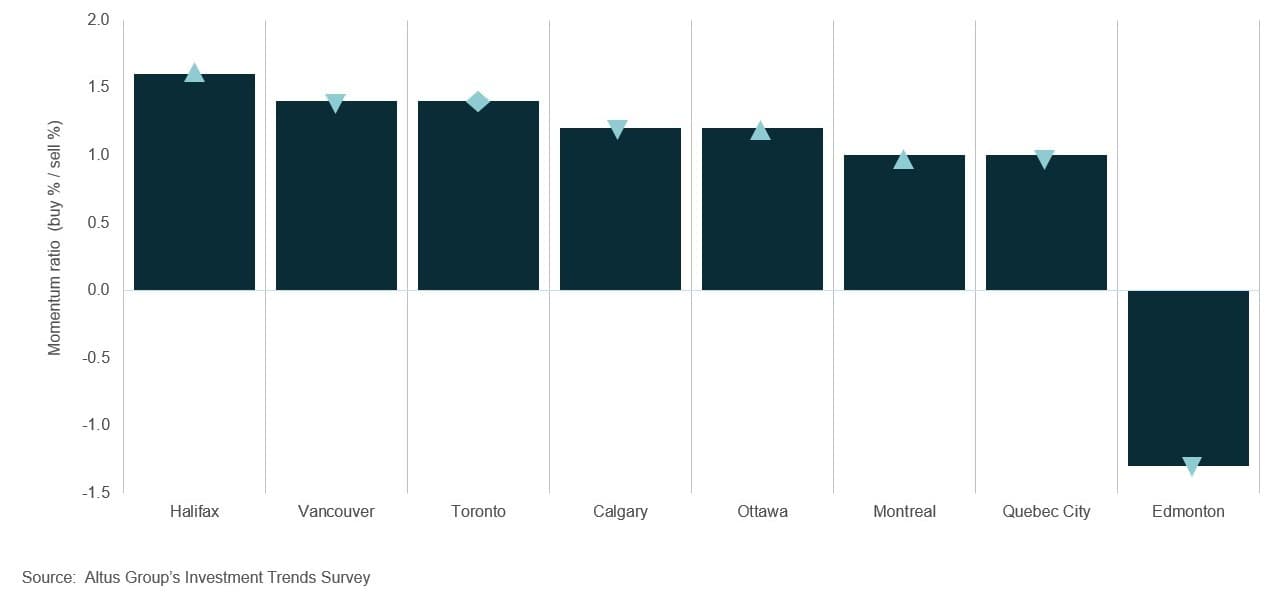

According to the latest Investment Trends Survey (ITS) conducted by Altus Group, there was a significant shift in investor preferences (Figure 2). Halifax emerged as the top preferred market for all property types, reflecting its growing appeal and robust market fundamentals. Vancouver, despite its substantial decline in investment volume, maintained a top three ranking for the seventh consecutive quarter, underscoring its long-term strategic appeal to investors. Toronto surpassed Edmonton to secure the third-place position, while Edmonton experienced a steep decline in sentiment, plunging to last place in the rankings. These changes highlighted a reallocation of capital toward markets perceived to offer greater stability and potential for future growth.

Figure 2: Investment Trends Survey (ITS) - Location barometer (Q2 2025)

All asset classes recorded a year-over-year decline in transaction volume, with the exception of the retail sector (Figure 3). It demonstrated the most resilience, recording a year-over-year increase of just 5% to $3.5 billion. This stability was largely attributed to the robust performance of necessity-based retail formats. Conversely, the residential land subsector experienced the most severe decline, with a year-over-year contraction of 43% to $2.3 billion. This sharp drop was likely influenced by rising interest rates, increased construction costs and a lack of sales volumes, which dampened developer confidence and project feasibility.

Figure 3: Canada’s property transactions by asset class YTD (Q2 2024 vs. Q2 2025)

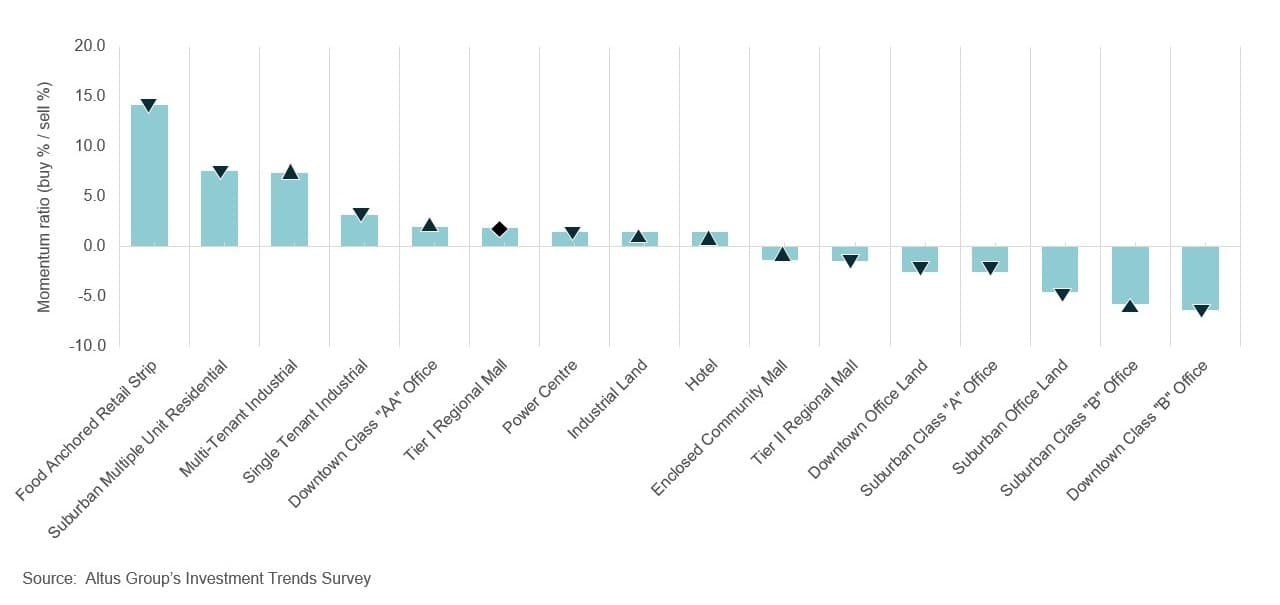

Of the surveyed property types, food-anchored retail strips were the most sought-after property type, retaining their top ranking for a sixth consecutive quarter (Figure 4). This continued preference was driven by persistent demand for necessity-based goods and services, their stable tendency and consistent foot traffic. Additionally, suburban multi-unit residential and multi-tenant industrial properties were highly desirable during the second quarter. There was a notable increase in investor interest for certain product types that had previously been less favoured, specifically downtown Class AA office, Tier I regional malls, and power centres. This shift in interest was attributed to improving operating fundamentals and strong redevelopment potential. The office and industrial markets, in particular, exhibited bifurcation, with prime, high-quality assets performing well and attracting capital, while older or less amenitized properties struggled. These pockets of strength provided evidence of a flight-to-quality trend among businesses.

Figure 4: Investment Trends Survey (ITS) - Property type barometer - All available products (Q2 2025)

Industrial market momentum reserves course

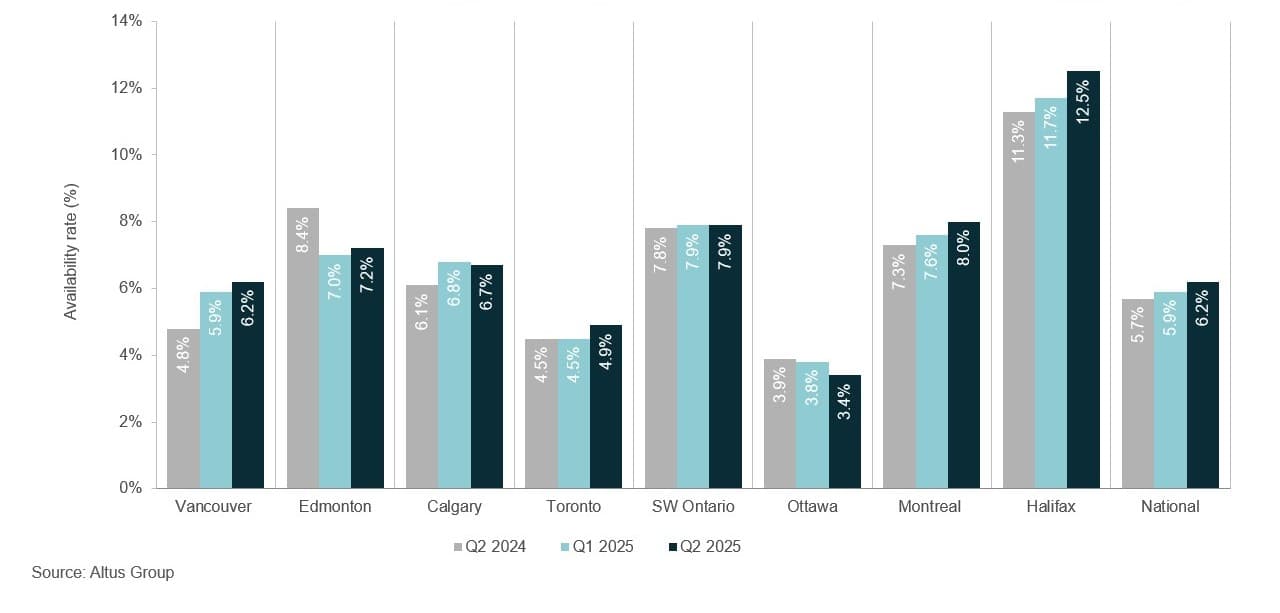

The Canadian industrial sector experienced a notable contraction during the second quarter, driven by underlying trade tensions with the US and rising availability rates. Investment volumes declined, with a total of nearly $4.8 billion in dollar volume transacted, representing a 29% decrease year-over-year. The industrial sector entered a period of adjustment marked by increased supply, rising vacancy rates and waning demand. According to Altus Group’s latest Canadian industrial market update, the national industrial availability rate rose by 50 basis points to 6.2% year-over-year (Figure 5). Faced with market uncertainty, occupiers increasingly sought flexibility through short-term leasing arrangements, particularly subletting, which saw a 70 basis point year-over-year reduction in the percentage of available space to 14.6%.

Figure 5: Industrial availability rates (Q2 2024 vs. Q1 2025 vs. Q2 2025)

While challenges persisted across the sector, investment volume contracted in all regions except for the Greater Golden Horseshoe (GGH). The GGH recorded positive growth, with $648 million in dollar volume transacted, a 3% increase year-over-year. In contrast, Montreal saw the most significant reduction, with investment volume down 62% year-over-year, followed by a 38% decline in Vancouver. As demand cooled, national absorption turned negative after two consecutive quarters of positive absorption.

On the construction front, there were 127 projects under construction across Canada, totalling approximately 20.9 million. Of the upcoming space, 65% remained available for lease, a clear sign of softening demand. Toronto remained the most active market, accounting for the majority of the construction activity at 8.3 million square feet. This continued development signalled developers’ confidence in the region’s long-term market fundamentals, even as immediate leasing momentum slowed.

The trajectory of the Canadian industrial market will largely hinge on several critical factors. A clearer and more stable direction regarding Canada-US trade policies is paramount, as the current volatility is anticipated to prolong the observed hesitation in capital deployment and investment. The market’s ability to absorb the substantial volume of speculative space currently under construction, particularly in key markets such as Toronto, will be crucial for stabilizing vacancy rates. Should demand remain tempered, a slowdown in new construction starts could be observed in the latter half of 2025, as developers re-evaluate their pipelines and leasing prospects. Furthermore, the performance of the broader Canadian economy, including retail sales and employment figures, will serve as key indicators for a potential rebound in the overall industrial demand. The sector is expected to remain in a period of rebalancing, with occupiers continuing to prioritize efficiency and flexibility in their real estate strategies.

Resilience and adaptation in the retail sector

Canadian consumers continued to adopt a cautious spending approach, a behaviour primarily driven by the higher cost of living, softened economic conditions and weakened labour market conditions. This led consumers to prioritize spending on essential goods and services, which had a direct impact on real estate investment strategies. In response to this sustained focus on essential spending, investors strategically prioritized specific retail properties. This included neighbourhood and regional shopping centres anchored by essential retailers such as grocery stores or general merchandise retailers, as well as properties identified for their long-term redevelopment potential. The enduring appeal of essential goods and services was further substantiated by ITS, which identified food-anchored retail strips as the most preferred property type among investors for the sixth consecutive quarter. These property types maintained their attractiveness as investment opportunities, reflecting the enduring demand for destinations that fulfilled essential shopping needs.

This targeted investment strategy allowed the retail sector to record the only year-over-year increase compared to the other primary real estate sectors. Regionally, there were notable variations in performance. Vancouver, the GGH, and the GTA reported positive year-over-year growth, registering a 17%, 19% and 5% increase, respectively. This regional strength indicated continued investor confidence in these major economic hubs. Conversely, Montreal and Ottawa reported year-over-year decreases of 20% and 13% respectively, signalling potential regional challenges or shifts in local investor behaviour.

A major development that significantly impacted shopping centres throughout Canada was the nationwide closure of all Hudson’s Bay department stores. This historic departure resulted in a considerable amount of vacant anchor space across numerous shopping centres across the country. While this presented an immediate challenge, it also opened opportunities for urban revitalization and property reimagination. Given the limited pool of single tenants capable of occupying such large-format units, property owners will be compelled to pursue innovative redevelopment and revitalization strategies. This scenario reflected the industry’s response to previous major anchor tenant exits, where property owners successfully reimagined and diversified their retail offerings. These strategies often integrated experiential elements, mixed-use components or a curated selection of smaller, specialized retailers to attract new clientele and enhance foot traffic. Ultimately, the ability of property owners to adapt swiftly and creatively was essential in mitigating the substantial impact of these vacancies and maintaining the vibrancy of these vital retail hubs.

Adapting to policy and demand shifts in the multifamily sector

In a strategic effort to mitigate the pressures of rapid population growth, the Canadian federal government announced a planned 21% reduction in permanent resident targets for 2025 and the years ahead. This policy initiative was observed to have initiated a noticeable deceleration in population growth, a trend evidenced by Statistics Canada’s latest Canada’s population estimates report. As of April 1, 2025, Canada’s population experienced its smallest quarterly growth since the third quarter of 2020, a period when stringent border restrictions were imposed due to the pandemic. This marks the sixth consecutive quarter of slowing population growth.

Despite this slowdown, Canada continued to contend with a severe housing affordability crisis, which had been exacerbated by years of unprecedented population expansion without a corresponding increase in housing supply. A range of factors contributed to the short-term volatility in the housing sector. These difficulties encompassed, but are not limited to, persistently high construction expenses, elevated land costs, a persistent skilled labour shortage in the construction industry, restrictive planning policies, and significant development charges and municipal fees. Furthermore, a discernible increase in economic uncertainty contributed to developer hesitation regarding the demand outlook for 2025. This uncertainty led to diminished demand for residential land assets, which contributed to a 43% contraction in investment volume, the largest decline compared to the other sectors. This trend was reflected in the downward trend of multifamily investment volume, which registered a notable 13% year-over-year decrease nationally to nearly $4 billion.

A comparison of the major markets revealed consistent investment trends. All markets observed a contraction in investment volume, except for the GTA and Montreal, which both experienced a plateau in their year-over-year investment volume. Vancouver experienced the greatest contraction in dollar volume transacted, down 50% year-over-year.

While these tight market conditions generally provided long-term support for rental demand, the considerable volume of new supply created challenges for property owners. This eroded both the stability of rental income and the prospect of consistent capital appreciation. The confluence of heightened risk and elevated carrying costs for investors contributed to a reduction in overall investor confidence and fostered a more cautious approach to acquisitions, as they navigated a market with both long-term demand and short-term supply-side challenges.

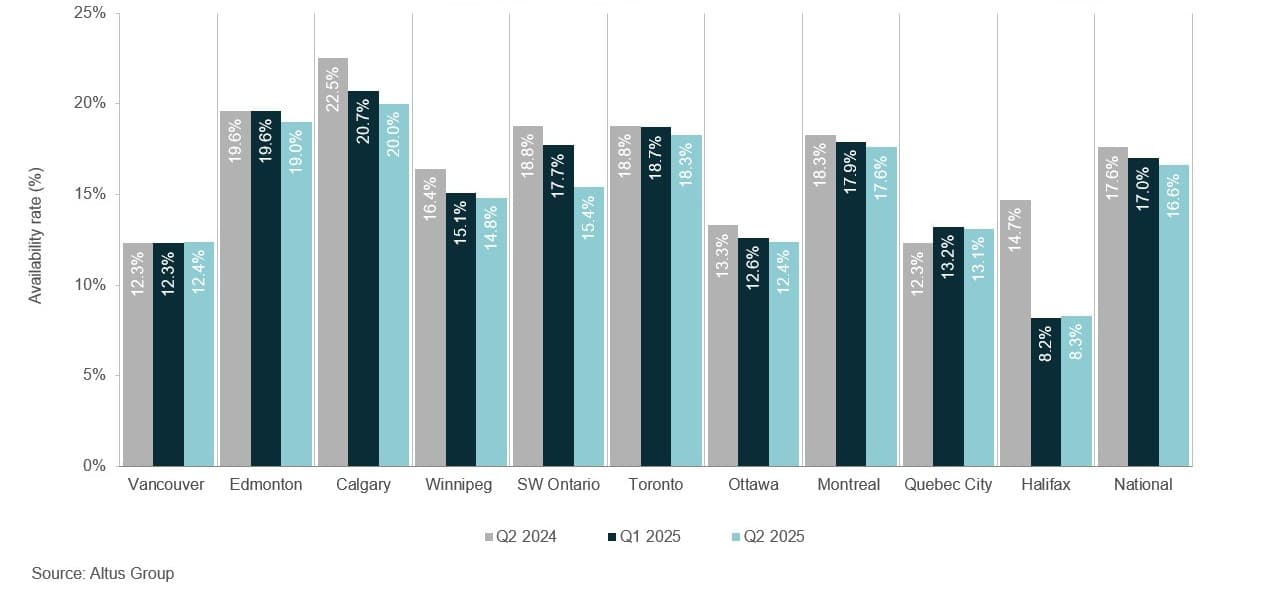

Signs of stabilization amid continued headwinds in the office sector

In the first half of 2025, the Canadian office sector continued to contend with shifting workplace preferences and increasingly uncompromising return-to-work mandates. The sector recorded $1.6 billion in dollar volume transacted, marking a 28% year-over-year decrease. According to Altus Group’s latest Canadian office market update, the national office availability rate decreased by 100 basis points year-over-year (Figure 6). This decline can be attributed to a slowdown in new construction and the reoccupancy of existing space.

Figure 6: Office availability rates (Q2 2024 vs. Q1 2025 vs. Q2 2025)

A substantial contributing factor to the decreasing availability rate was the sustained decline in available sublet space. This downward trend, which reached a low of 14.2% in the second quarter of 2025, represented a notable year-over-year decrease of 310 basis points. This figure provided compelling evidence that a greater number of businesses were actively reoccupying previously subleased portions of their office space. This reoccupancy directly contributed to the overall reduction in the national availability rate, as space that was once available on the secondary market was pulled back into active use by original tenants.

The first half of 2025 revealed a clear bifurcation within the office market, characterized by a pronounced preference for newer, premium Class A spaces, which saw a 120 basis point year-over-year reduction in its availability rate. This trend not only underscored the widening disparity between high-quality Class A properties and older Class B and C stock but also highlighted a further segmentation within the Class A category itself. Specifically, a discernible distinction emerged between standard Class A and top-tier Class AAA buildings. The latter frequently commanded higher rental rates and experienced low vacancy rates, reflecting strong demand for prime office environments equipped with modern amenities.

Regional disparities in investment volume were also evident. Montreal demonstrated robust office investment activity, experiencing a 51% year-over-year increase in investment volume, the highest among the major markets. This surge was primarily attributed to a single, significant transaction, KingSett Capital acquiring the office complex located at 1200 McGill College Avenue and 900 Sainte Catherine Street West for approximately $100.6 million. This transaction alone accounted for a third of Montreal’s total office investment volume, skewing the city’s overall office sector performance. Conversely, Ottawa’s office sector faced considerable turbulence, registering a 74% year-over-year decrease in investment volume, which represented the largest decline nationally. The primary reason for this decline was the federal government’s real estate strategy, which had a significant impact on Ottawa’s office market. The government’s reduced physical footprint and lack of funding to transition from aging buildings to new, modern spaces have considerably affected institutional investment volume and created ongoing uncertainty.

By the end of the first half of 2025, the national office market appeared to be gradually recovering, displaying cautious signs of stabilization. The office construction pipeline continued its contraction, with approximately 3.9 million square feet of office space under construction, down 44% year-over-year. Of this new supply, 35% remained available for lease. This metric, when considered alongside the gradual decline of overall availability rates, indicated a movement towards a stabilized and healthier market equilibrium. However, this cautiously optimistic outlook was tempered by an increasing scarcity of premium Class AAA office space. This presented a challenge for tenants seeking high-quality amenitized spaces in prime locations, intensifying competition for businesses and investors.

Want to be notified of our new and relevant CRE content, articles and events?

Authors

Jennifer Nhieu

Senior Research Analyst

Ray Wong

Vice President, Data Solutions

Authors

Jennifer Nhieu

Senior Research Analyst

Ray Wong

Vice President, Data Solutions

Resources

Latest insights