Canadian commercial real estate market update – Q3 2025

Canada’s CRE market slowed in Q3 2025 as capital moved to value plays and resilient regions, revealing which sectors and cities are still holding their ground.

Key highlights:

Canada’s commercial real estate market recorded a contraction this quarter, with total year-to-date investment volume at $36 billion, a year-over-year decrease of 12%

Investment volumes declined across all major markets, except for Calgary and Edmonton, which were up 3% and 25%, respectively

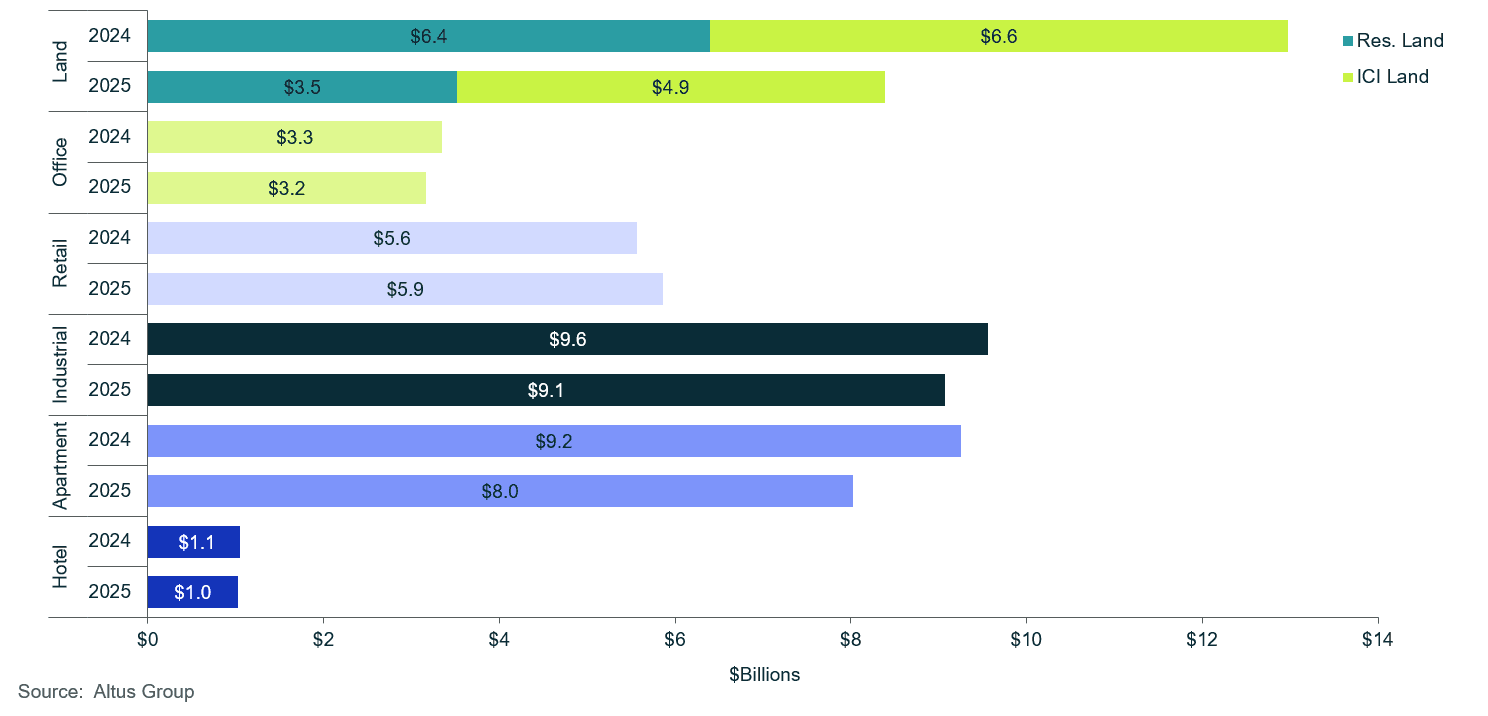

Retail was the only sector to report a year-over-year increase, up 5% with nearly $5.9 billion in dollar volume transacted

The office sector reported $3.2 billion in dollar volume transacted, a 5% decrease year-over-year, with Class AAA properties continuing to dominate leasing activity

The industrial sector recorded nearly $9.1 billion in dollar volume transacted, down 5% year-over-year, as US tariffs impacted investor confidence and delayed capital deployment

The multifamily sector saw $8 billion in dollar volume transacted, a notable 13% year-over-year decrease

The land sector recorded $8.4 billion in dollar volume transacted, down 35% year-over-year, with the residential sub-sector bearing the brunt of the residential new homes slowdown

The hotel sector posted $1 billion in dollar volume transacted, a slight 2% decrease year-over-year

Investment volume and core drivers of contraction

By the close of the third quarter, the Canadian commercial real estate (CRE) market experienced a deceleration in investment activity. Total investment volume reached $36 billion year-to-date, representing a decline of 12% compared to the same period in the preceding year (Figure 1). This contraction was attributable to a confluence of factors:

The market’s initial reaction to a proposed increase in the capital gains inclusion rate in mid-2024

A static interest rate environment throughout the first half of 2025

Prevailing geopolitical tensions with the US, which introduced uncertainty

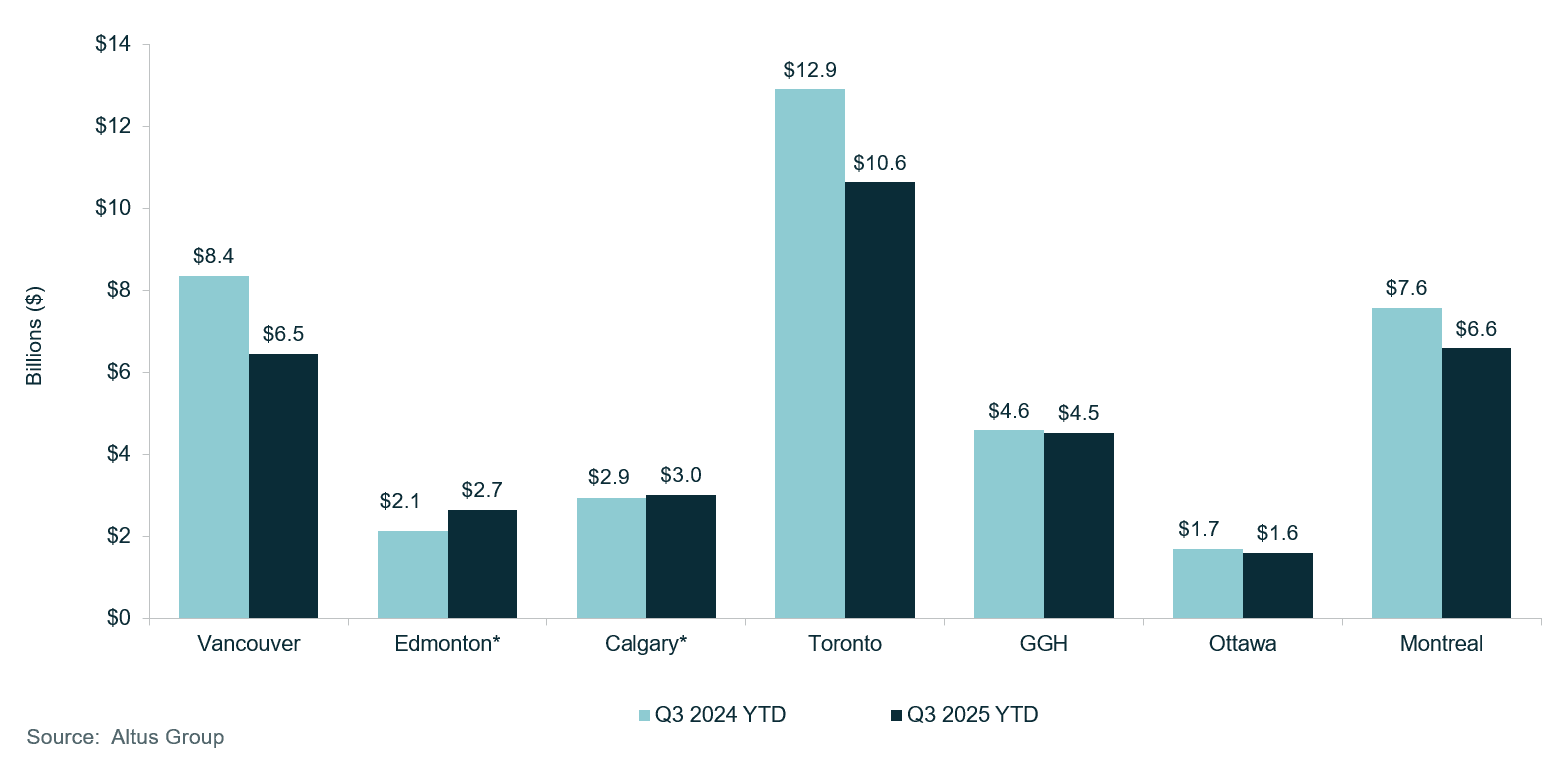

Figure 1: Canada’s total investment activity YTD – All sectors by region (Q3 2024 vs. Q3 2025)

A primary driver of the year-over-year decline was an anomalous pull-forward of investment activity during the second quarter of 2024. The anticipation of a proposed, then cancelled, increase in the capital gains inclusion rate motivated investors to expedite transactions. This reactive surge created an unusually high spike in investment volume in the preceding year, which, in turn, caused the first half of 2025 to appear disproportionately subdued in comparison. The earlier volume, therefore, was not reflective of underlying, sustainable market strength.

Beyond internal fiscal adjustments, the Canadian CRE market continued to weather significant headwinds from broader geopolitical and domestic economic pressures. The perceived deterioration of Canada’s economic outlook was noted in several key indicators during the third quarter:

The national unemployment rate held steady at 7.1%, which signalled a diminished labour demand across the economy, impacting sentiment and spending power

On a per-capita basis, GDP grew 0.5% in Q3 after a 0.5% contraction the previous quarter, a modest rebound that still underscores how difficult stronger per-capita growth has been to achieve

An upward trend was observed in the Consumer Price Index (CPI), which increased to 2.4% in September from 1.9% in August, indicating persistent cost pressures

The Bank of Canada (BoC) responded to these cooling economic conditions and persistent inflation concerns by restarting the easing cycle. It reduced its key interest rate by 25 basis points to 2.50% on September 17th, 2025, to better balance risk and support economic activity.

In light of these market conditions, some investors postponed major investment decisions, while others reallocated their portfolios. This risk-averse approach focused capital on assets with reliable defensive cash flow opportunities, primarily in more affordable regions across the country.

Investors began diversifying their holdings away from the historically higher-priced Greater Toronto Area and the Metro Vancouver Regional District markets. Consequently, investment volumes in these markets experienced the highest year-over-year contraction, down 23% in Vancouver and 18% in Toronto. As a result, institutional capital continued to accumulate on the sidelines while investors waited for clearer geopolitical and economic signals.

Regional investment performance and market bifurcation

By the close of the third quarter, commercial real estate investment activity declined across all major markets, with the notable exception of Calgary and Edmonton (Figure 2).

The fundamentals in Alberta remained the strongest in Canada, supported by robust demographic and economic indicators. Despite the national slowdown in international immigration, Alberta registered the greatest increase in population among all Canadian provinces, primarily fuelled by interprovincial migration.

The province’s economy has demonstrated continued resilience, with the Government of Alberta forecasting its real GDP growth to lead the country in 2025 at 2.0%, marking a 0.2 percentage point increase from the budgeted forecast. These factors supported ongoing investment in Alberta’s CRE markets.

The Calgary market reported $3 billion in dollar volume transacted, while the Edmonton market reported $2.7 billion, representing year-over-year increases of 3% and 25%, respectively. Due to a significant backlog in the Alberta land titles office, the total investment volume for both markets is expected to increase once all third-quarter land titles are fully processed.

Figure 2: Canada’s property transactions by asset class YTD (Q3 2024 vs. Q3 2025)

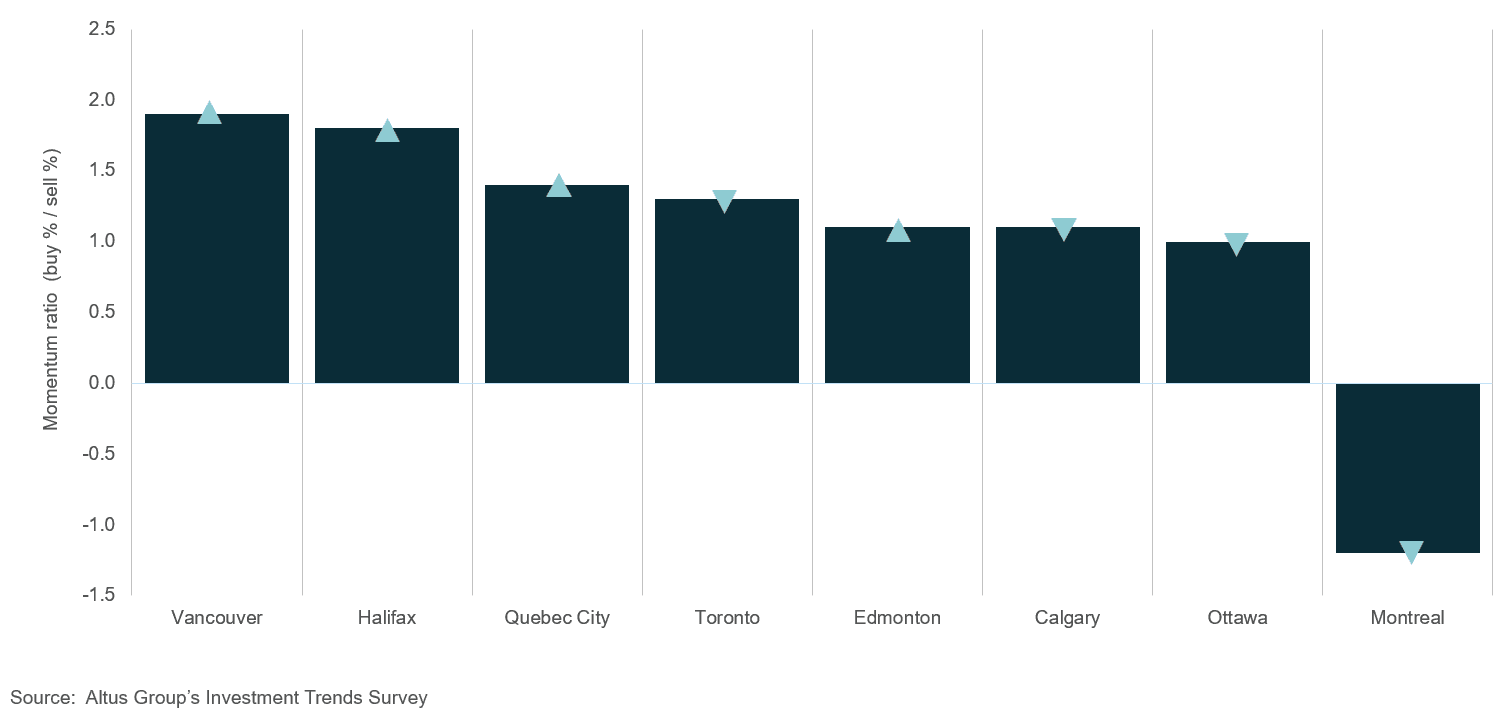

Conversely, Vancouver and Toronto reported the highest year-over-year contraction in investment volume. The Vancouver market reported $6.5 billion in dollar volume transacted, while the Toronto market reported $10.6 billion. Despite the sharp pullback, Altus Group’s latest Investment Trends Survey (ITS) shows Vancouver has reclaimed the top spot as investors’ preferred market across all asset classes. The market registered a positive momentum ratio, a strong indication of a greater intention to buy than sell among survey respondents (Figure 3).

Toronto’s position in the national investment landscape softened, slipping from third to fourth this quarter – with Québec City moving into the third-place spot. Vancouver and Toronto shared similar sectoral performance, with the retail sector reporting the highest year-over-year growth at 31% and 12%, respectively. Meanwhile, the industrial sector and ICI land sub-sector reported the greatest year-over-year declines as developers were likely delaying new projects amid softening demand and higher capital costs.

Figure 3: Investment Trends Survey (ITS) - Location barometer (Q3 2025)

Similarly, Montreal experienced a notable slowdown in investment activity, ending the quarter with $6.6 billion in dollar volume transacted, a 13% year-over-year decrease. However, when accounting for the prior year’s anomalous spike and observing comparisons to long-term historic benchmarks, Montreal has performed more favourably than Toronto and Vancouver. This relative robustness was driven by significant year-over-year growth in the office, hotel, and multifamily sectors. While the retail sector experienced a steep 33% year-over-year decline, the year-to-date volume demonstrated sustained investor interest when measured against historical investment benchmarks, a trend that was consistent among other major Canadian markets.

Ottawa and Greater Golden Horseshoe (GGH) also displayed resilience, reporting modest investment declines of 5% and 1% year-over-year, respectively. These markets displayed diverging sector preferences:

Ottawa saw a rebound in land transactions, with $505 million in dollar volume transacted, up 61% year-over-year. After very quiet activity in 2023 and 2024 in the residential sub-sector, the $100 million sale of 1020 March Road in June 2025 was a key transaction that inflated the quarterly volume totals.

In the GGH, industrial investment rose 56% year-over-year to $1.3 billion, reflecting its role as a major industrial hub. At the same time, land transactions fell 32% year-over-year, with residential land absorbing most of the decline.

Both Ottawa and the GGH maintained robust retail sectors, with $222 million and $998 million in dollar volume transacted, a 25% and 44% year-over-year increase, respectively, indicating that core retail assets remained attractive to investors.

Retail sector

Canadian consumers continued to practice a cautious spending approach in 2025, a behaviour necessitated by the higher cost of living, weakened labour market conditions, and volatile geopolitical and economic conditions.

According to Statistics Canada’s September Retail Trade release, the largest increase in core retail sales in September originated from food and beverage retailers, up 0.8%. Within this subsector, supermarkets and other grocery retailers experienced 0.3% growth compared to August, underscoring the prioritization of household spending on essential goods and services.

Investors, in direct response, strategically prioritized neighbourhood and regional shopping centres anchored by essential retailers such as grocery stores or general merchandise retailers, as well as properties identified for their long-term redevelopment potential.

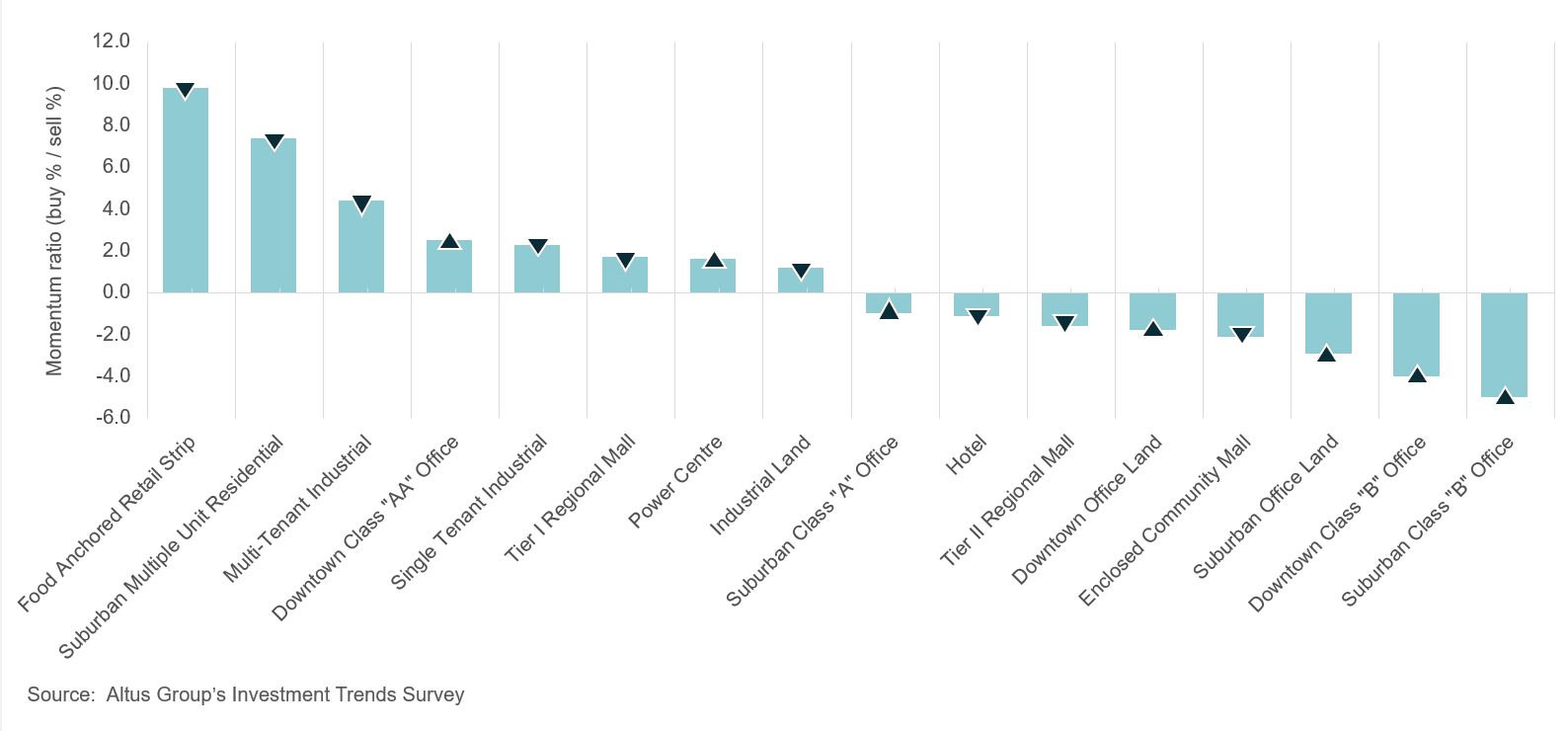

Altus Group’s latest ITS identified food-anchored retail strips as the most preferred property type among investors for the seventh consecutive quarter (Figure 4). These assets offer higher occupancy, lower turnover and stronger resistance to e-commerce, making them attractive defensive and inflation-hedging holdings.

Figure 4: Investment Trends Survey (ITS) - Property type barometer - All available products (Q3 2025)

This elevated, targeted demand exacerbated an existing inventory shortage, as many owners retained these income-producing assets. At the same time, limited debt lending and the high cost of capital severely restricted new development.

Consequently, near-term investment activity remained constrained by the lack of available products and high financing costs. Retail was the only sector to report a positive year-over-year increase in investment activity, with national transaction volume totalling $5.9 billion, marking a modest 5% year-over-year increase.

Regionally, there were notable variations in performance:

Edmonton reported the highest year-over-year growth in retail investment volume, with $469 million in dollar volume transacted, up 81% year-over-year

The GGH, Vancouver, Ottawa, and Toronto markets were up 44%, 31%, 25% and 12%, respectively

Montreal reported $879 million in dollar volume transacted, a 33% year-over-year decrease; however, as noted, the sector demonstrated sustained investor interest compared to historic averages

Calgary reported $450 million in dollar volume transacted, a 38% decrease year-over-year

While demand for food-anchored retail in suburban areas continued to be strong and mixed-use developments are gaining popularity, Calgary’s pace of construction has been unable to keep up with this demand, resulting in an acute shortage of prime retail properties and, therefore, constraining transaction activity.

Office sector

The office landscape continued to contend with shifting workplace preferences, increasing return-to-office mandates, more efficient space planning, a lack of new supply, and weakened labour market conditions earlier in the year, which have collectively manifested in a pronounced market bifurcation.

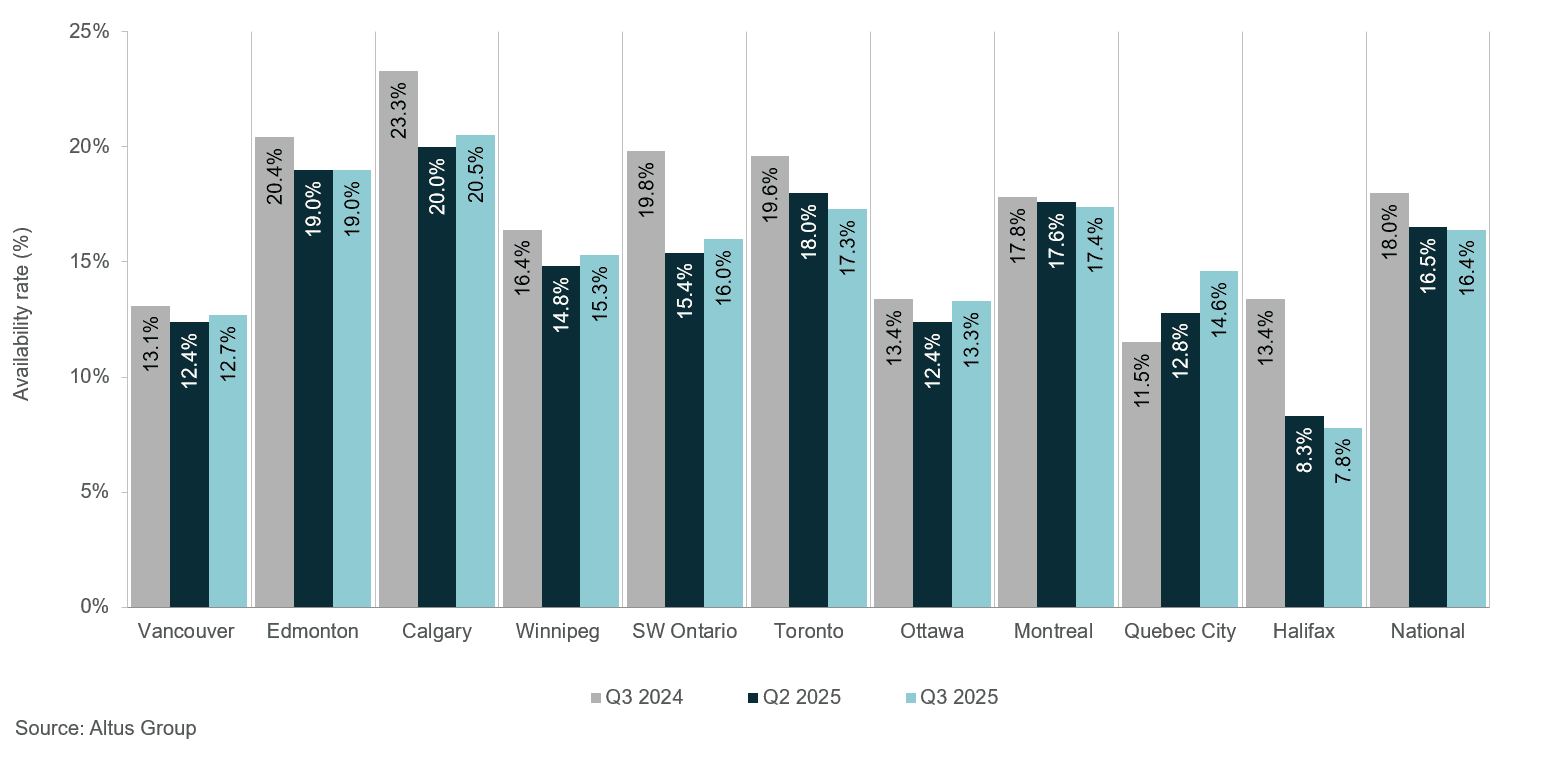

According to Altus Group’s latest Canadian office market update, the national office availability rate decreased by 160 basis points year-over-year to 16.4% (Figure 5). This tightening was driven by increased demand for Class AAA office space, a significant reduction in new office construction, and re-occupancy of previously subleased spaces by businesses as they rightsized their operations. The convergence of these factors was expected to further tighten availability rates, increasing the focus on re-evaluating and repositioning older Class A office assets and, to a lesser extent, some Class B assets in specific markets. This need arose as tenants were forced to expand their search beyond the shrinking supply of new, top-tier inventory.

Figure 5: Office availability rates (Q3 2024 vs. Q2 2025 vs. Q3 2025)

The office sector reported $3.2 billion in dollar volume transacted, a modest 5% decrease year-over-year.

Regionally:

Calgary registered the greatest year-over-year growth, with $524 million in dollar volume transacted, representing a significant 145% year-over-year increase

Following this performance, Montreal reported $459 million, while Vancouver reported nearly $1.2 billion, representing a 31% and 4% year-over-year increase, respectively

Ottawa reported the greatest year-over-year decrease of 70%, with $80 million in dollar volume transacted, signalling a pause in capital deployment in the federal capital market

Increased focus on in-office work has contributed to a tightening of available premium space, as evidenced by the national downtown direct Class A availability rate, which plateaued at 14.7% year-over-year. Leasing activity reinforced investor and occupier preference for high-quality, amenitized spaces in well-located areas:

Class A transactions constituted the majority of the activity, accounting for 384 deals, encompassing 12.9 million square feet, demonstrating a clear flight to quality

Conversely, Class B office space saw considerably less demand, comprising only 116 transactions, which totalled approximately 2.2 million square feet, highlighting the growing obsolescence of older buildings

Another driver of occupancy shifts, particularly in downtown cores, was the implementation of stricter return-to-office mandates. Several major financial institutions in Canada, alongside the Ontario, Alberta, and Nova Scotia provincial governments, have mandated workers to return to the office. The rapid implementation of these mandates drew significant internal and public criticism in some organizations. The increase in daily in-office population exposed a lack of adequate traditional office space in certain premises, which led to employees being forced to work out of cafeterias and other common spaces. This overflow into non-dedicated workplaces was reported to compromise both productivity and employee well-being, highlighting the operational challenges of quickly adjusting physical infrastructure to meet mandated, high-density occupancy levels.

In the third quarter, six new office buildings were completed, accounting for 875,000 square feet, with 47% of the space available. Nationwide, 21 projects are under construction, representing nearly 3.8 million square feet, of which 25% was available for lease, indicating ongoing demand for modern office spaces. These developments aimed to meet changing tenant needs, with greater emphasis on collaboration areas, integrated technology, and amenities that support employee well-being. The main challenge for the market remained balancing new supply with broader shifts in office utilization patterns.

Industrial sector

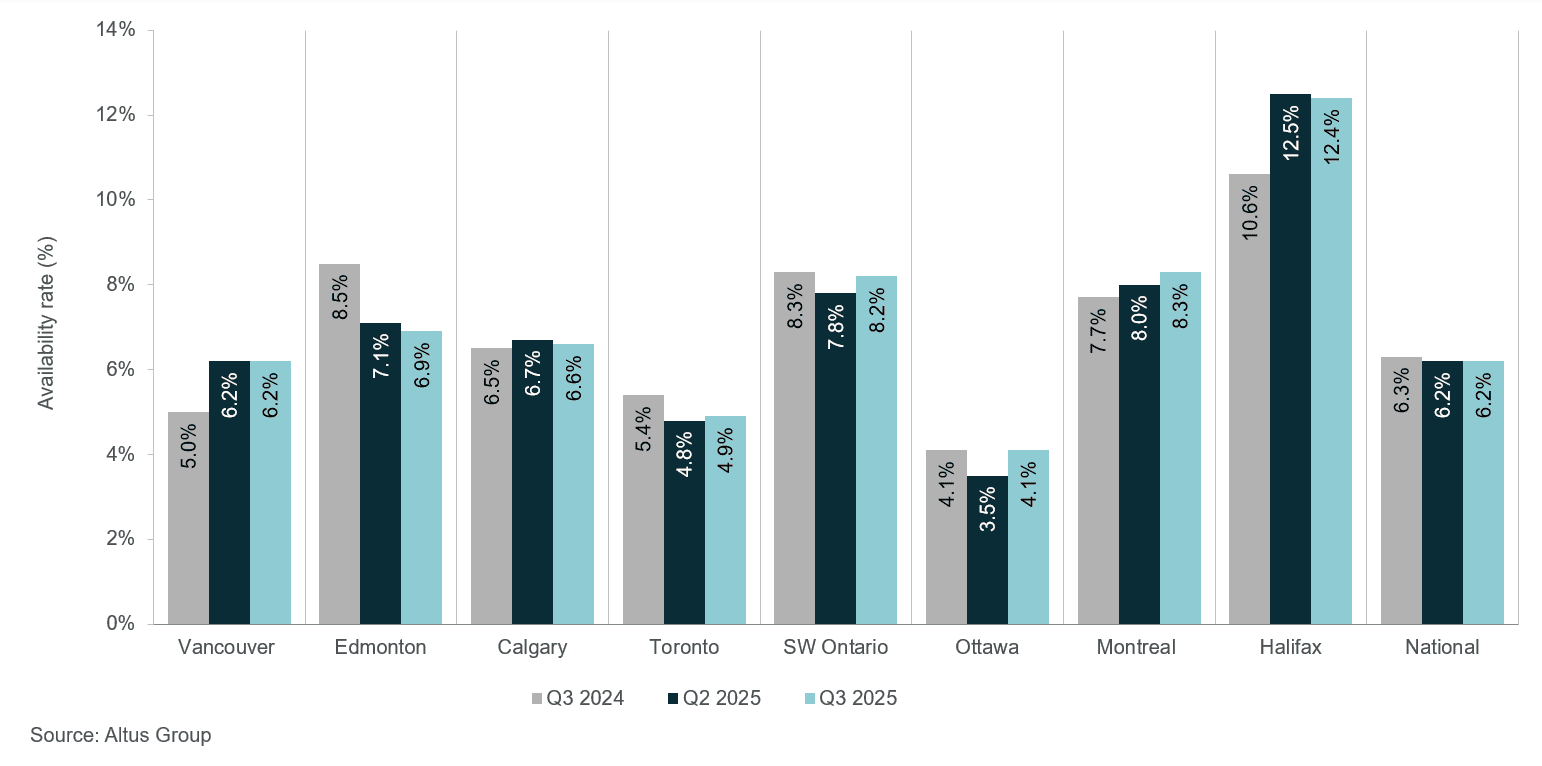

The Canadian industrial sector continued its trend of moderation throughout the third quarter of 2025, navigating disruptions from US tariffs and broader economic shifts. Some markets continued to grapple with the absorption of substantial industrial space delivered in 2023. According to Altus Group’s latest Canadian industrial market update, the national availability rate remained at 6.2% (Figure 6). Moreover, rental rates have largely flattened, with rents softening in specific regions. These factors collectively weighed on investor sentiment.

While the added supply has given tenants more access to higher-quality spaces at more competitive rental rates, it also led to a stagnant national industrial availability rate and a pullback in investment volumes. Total investment volume reached nearly $9.1 billion, representing a modest 5% year-over-year decrease.

Figure 6: Industrial availability rates (Q3 2024 vs. Q2 2025 vs. Q3 2025)

Regionally, performance varied significantly:

Calgary reported the highest year-over-year increase of 71%, with $840 million in dollar volume transacted, highlighting the strength of Alberta’s economy and the market’s favourable positioning for interprovincial and international distribution

Following Calgary, the GGH reported nearly $1.3 billion in dollar volume transacted, while Edmonton reported $671 million, 56% and 49% year-over-year increases, respectively, highlighting pockets of resilience and selective demand in these growing markets

Toronto and Ottawa reported modest declines of 1% and 5%

Montreal reported the highest year-over-year decline of 52%, with $967 million in dollar volume transacted

Vancouver followed with $1.1 billion in dollar volume transacted, a 27% year-over-year decrease, reflecting a broader capital retraction from the traditionally high-priced market

On the development front, 23 buildings totalling 3 million square feet were completed in the third quarter, of which 52% of the space was still available for lease. Ongoing construction activity showed a measurable contraction, with 129 buildings in the pipeline. Of this future supply, 62% remained available for lease, indicating a strategic pause in activity among developers in response to the increased availability rate and high cost of capital.

The Greater Toronto Area remained at the epicentre of industrial development, with 41 buildings under construction, totalling 3 million square feet, with 49% of the space available for lease.

While the first half of 2025 was marked by a deliberate pause in capital deployment as investors awaited greater clarity concerning geopolitical tensions, the third quarter saw a renewed sense of confidence in Toronto and the GGH, as both markets observed investment volumes shift onto an upward trajectory. This suggested that investors were beginning to move beyond the market’s peak uncertainty, focusing capital on core, strategically important logistics hubs.

Market outlook

By the end of the third quarter of 2025, Canada’s commercial real estate market had moved through a period of slower investment and shifting capital allocation. The overall 12% decline in national investment volume was primarily a function of non-recurring market anomalies from the previous year, specifically the investment pull-forward induced by the proposed capital gains change, coupled with sustained headwinds from high financing costs and geopolitical uncertainty. The dominant characteristic of the market was a pronounced bifurcation, creating a clear divergence between resilient regional markets and struggling legacy financial hubs.

Calgary and Edmonton demonstrated superior stability and growth, directly benefiting from strong interprovincial migration and a robust economic forecast. Conversely, Toronto and Vancouver experienced the steepest contractions, as investors sought value in more affordable and demographically high-growth regions.

This shift reinforced demand for defensive assets, with retail being the only asset class to report a national year-over-year increase. Growth in this sector was driven entirely by the enduring appeal of grocery-anchored and essential-service properties, which offered reliable income streams and acted as an effective inflation hedge.

In the office sector, investment activity focused heavily on premium Class A spaces as the flight to quality trend, spurred by return-to-office mandates and efficient space planning, drove a tightening of the best assets, leaving older stock obsolete and underutilized.

Looking ahead into the final quarter of 2025 and early 2026, the market appears to be at a crucial juncture, awaiting clearer signals on monetary policy. The BoC’s easing cycle is expected to gradually lift investment activity by reducing borrowing costs and narrowing the seller–buyer price gap, helping to release capital from the sidelines.

The trend of regional diversification is projected to continue, with high-growth markets outside Toronto and Vancouver, particularly Calgary, Edmonton, and the GGH, remaining attractive targets due to their demographic fundamentals and lower operating costs. The market’s recovery will ultimately be contingent upon the sustained commitment to the easing cycle and a stabilization of geopolitical trade relations, which would allow for greater capital certainty and reduce risk premiums currently embedded in investment valuations across the nation.

Disclaimer

This publication has been prepared for general guidance on matters of interest only and does not constitute professional advice or services of Altus Group, its affiliates and its related entities (collectively “Altus Group”). You should not act upon the information contained in this publication without obtaining specific professional advice.

A number of factors may influence the performance of the commercial real estate market, including regulatory conditions and economic factors such as interest rate fluctuations, inflation, changing investor sentiment, and shifts in tenant demand or occupancy trends. We strongly recommend that you consult with a qualified professional to assess how these and other market dynamics may impact your investment strategy, underwriting assumptions, asset valuations, and overall portfolio performance.

No representation or warranty (express or implied) is given as to the accuracy, completeness or reliability of the information contained in this publication, or the suitability of the information for a particular purpose. To the extent permitted by law, Altus Group does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. The distribution of this publication to you does not create, extend or revive a client relationship between Altus Group and you or any other person or entity. This publication, or any part thereof, may not be reproduced or distributed in any form for any purpose without the express written consent of Altus Group.

Want to be notified of our new and relevant CRE content, articles and events?

Authors

Jennifer Nhieu

Senior Research Analyst

Ray Wong

Vice President, Data Solutions

Authors

Jennifer Nhieu

Senior Research Analyst

Ray Wong

Vice President, Data Solutions

Resources

Latest insights