Weak Toronto new home sales threaten construction jobs in the years ahead

New home sales in the GTA have dropped sharply, threatening tens of thousands of construction jobs and billions in housing pipeline investment.

Key highlights

New home sales in the GTA are on pace for their lowest level in decades, with single-family sales down over 50% and condo apartment sales down nearly 65% year-over-year

A prolonged sales slump could slash construction activity by more than half, dropping single-family housing construction from $6.7B in 2024 to $1.9B by 2029

Toronto’s new housing pipeline is a critical job engine, but if sales don’t rebound, up to 41,000 jobs could be lost in the local economy

The construction sector is already feeling the squeeze, with employment falling to its lowest point since 2021 and Ontario’s construction unemployment rate topping 10%

If barriers to homeownership aren’t addressed soon, the economic ripple effects could be severe and long-lasting

What a prolonged sales slump could mean for construction

New home sales by home builders in the Greater Toronto Area have been falling off significantly in the past few quarters, and 2025 is shaping up to be the lowest number of sales in the decades that Altus Group has been tracking the data.

Single-family sales (single-detached, semi-detached and town homes) have fallen over 50% so far this year over the same period last year, and condominium apartment sales have fallen almost 65%.

Figure 1 – New home sales by type, Greater Toronto Area

The new housing sector in Toronto operates on a ‘pipeline’ that begins, typically, with a pre-construction ‘sale’, then follows with a construction ‘start’, then finally a ‘completion’ when the unit is ready for its owners or tenants to move in. There can be months and even years in between the various stages. For the time between a unit’s start and completion it is said to be under construction and the volume (in $) of total construction activity underway at any given time is related to the number of units that are under construction.

The volume of construction activity drives the number of jobs in the construction sector directly related to housing.

In this research note, we’ve modelled out the potential effects on the construction pipeline from a prolonged period of low sales. Importantly, this is not a forecast or projection; there may be many reasons why sales will recover. However, we simply want to see the implications of sales that do not recover in the immediate years ahead, in order to better understand the urgency in addressing barriers to homeownership in the current environment.

In this scenario some key outcomes would be:

By 2029 starts and completions of single-family units could bottom out at about 4,000 units. If this were to happen, the total volume of construction activity would gradually fall to about $1.9 billion in 2029 from $6.7 billion in 2024; and

Starts and completions of apartment units could fall to about 10,000 units (note this includes an assumption of about 7,100 purpose-built rentals per year) driving construction volumes down to $2.6 billion from $7.5 billion last year.

Figure 2 – Single-family pipeline assuming sales stay low

Figure 3 – Apartment pipeline assuming sales stay low

A trusted jobs engine may be stalling

New housing construction is an important generator of jobs in Toronto. Previous work by Altus Group has shown that each single-family home generates some 3.8 person years of employment (3.8 jobs for one year, for example) and each apartment unit some 1.5 person years of employment.

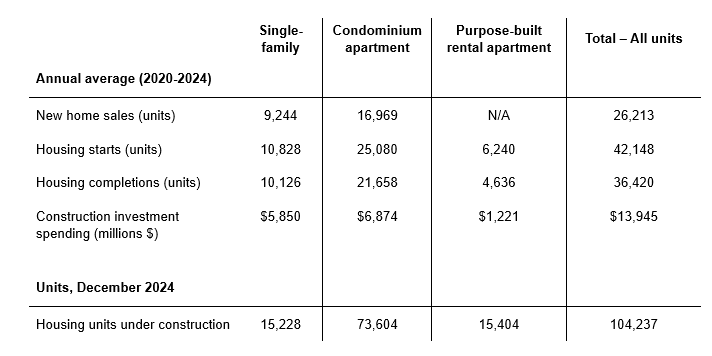

Given the volumes of new homebuilding activity in Toronto CMA recently, we estimate that on average over the past five years (2020-2024) there have been some 87,500 jobs supported in the economy from new home building alone. These estimates include:

40,000 direct jobs (generally construction)

And two categories of ‘spin off’ jobs:

30,000 indirect jobs (suppliers to construction)

17,500 induced jobs (those jobs dependent on the pay cheques and spending by the direct and indirect rounds)

However, the sharply lower volumes of construction activity that could come about from a prolonged weak sales period and drying up of the pipeline could mean that this trusted and important jobs engine will stall. In the scenario set out above with construction spending contracting over the next five years, the jobs implication would be:

A loss of up to 18,500 direct jobs (a 47% decline)

A loss of 22,500 spin off jobs

For a total decline of almost 41,000 total jobs across the economy

Figure 4 – Key housing metrics, Toronto CMA

Labour market conditions are already softening

Construction employment (across all types of construction) in Toronto fell in May of this year to its lowest level since the spring of 2021. From its recent peak in late 2023, the number of jobs have fallen 34,600. Ontario’s construction sector unemployment rate topped 10% in April which is its higher rates since the depth of the pandemic interruptions. Meanwhile the number of vacant construction jobs (i.e., unfilled positions) in Ontario, which had been as high as 8% of all jobs in 2022 has fallen to a low of 2.6; a sign of slackness in the market not seen for many years.

Figure 5 – Labour market conditions

Ontario’s and Toronto’s labour market conditions in the construction sector are already strained and will become worse so with continued deterioration in jobs related to new residential construction being lost as the pipeline of new projects continues to dry up.

Concluding remarks

This analysis is not a forecast of future activity. New sales are currently very depressed in Toronto and this analysis shows the implications on jobs if they do not improve materially over the next few years.

There are an array of barriers in the way of a more buoyant new home sales market, including elevated prices, an inappropriate mix of units currently in the approval pipeline and excessive government taxation.

The message from this analysis is to raise the urgency of addressing barriers now, before these longer-term implications on the pipeline of construction and ultimately on jobs and the broader economy set in.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Peter Norman

Vice President and Economic Strategist

Author

Peter Norman

Vice President and Economic Strategist

Resources

Latest insights