Key highlights

Vancouver saw $5.8 billion in dollar volume transacted through the first three quarters of 2023, marking a 55% decrease year-over-year

All sectors reported a decline in investment volume, with the industrial sector reporting the lowest year-over-year decrease of 23%

The residential land sector posted $1.3 billion in dollar volume, while the ICI land posted $1.2 million, a year-over-year decrease of 70% and 52%, respectively

Vancouver reported $524 million in apartment sales, a 57% decrease year-over-year

Vancouver’s office sector posted $493 million in Q3 2023, a 36% decline year-over-year

The retail sector reported $541 million in dollar volume transacted, a year-over-year decrease of 67%, primarily due to interest rate hikes and inflationary pressure

Vancouver market slowdown persists into Q3 2023, with transaction volume down 55%

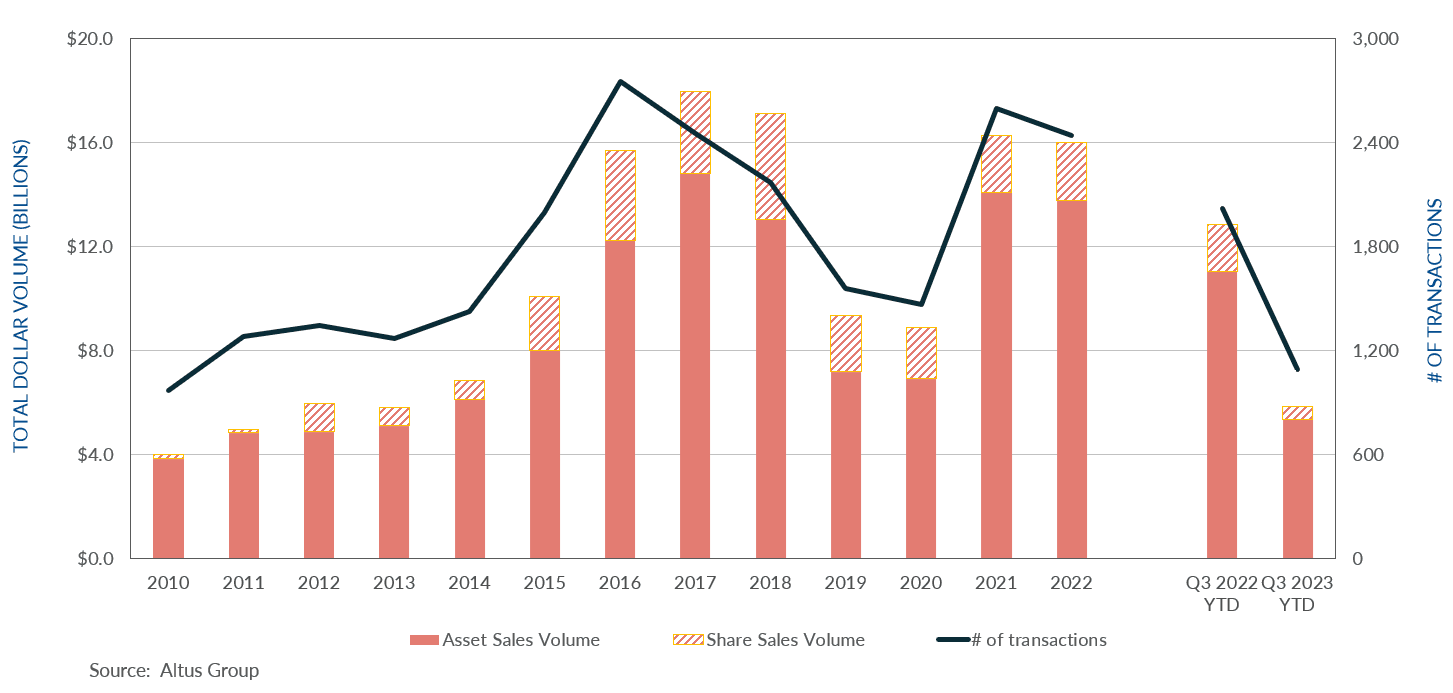

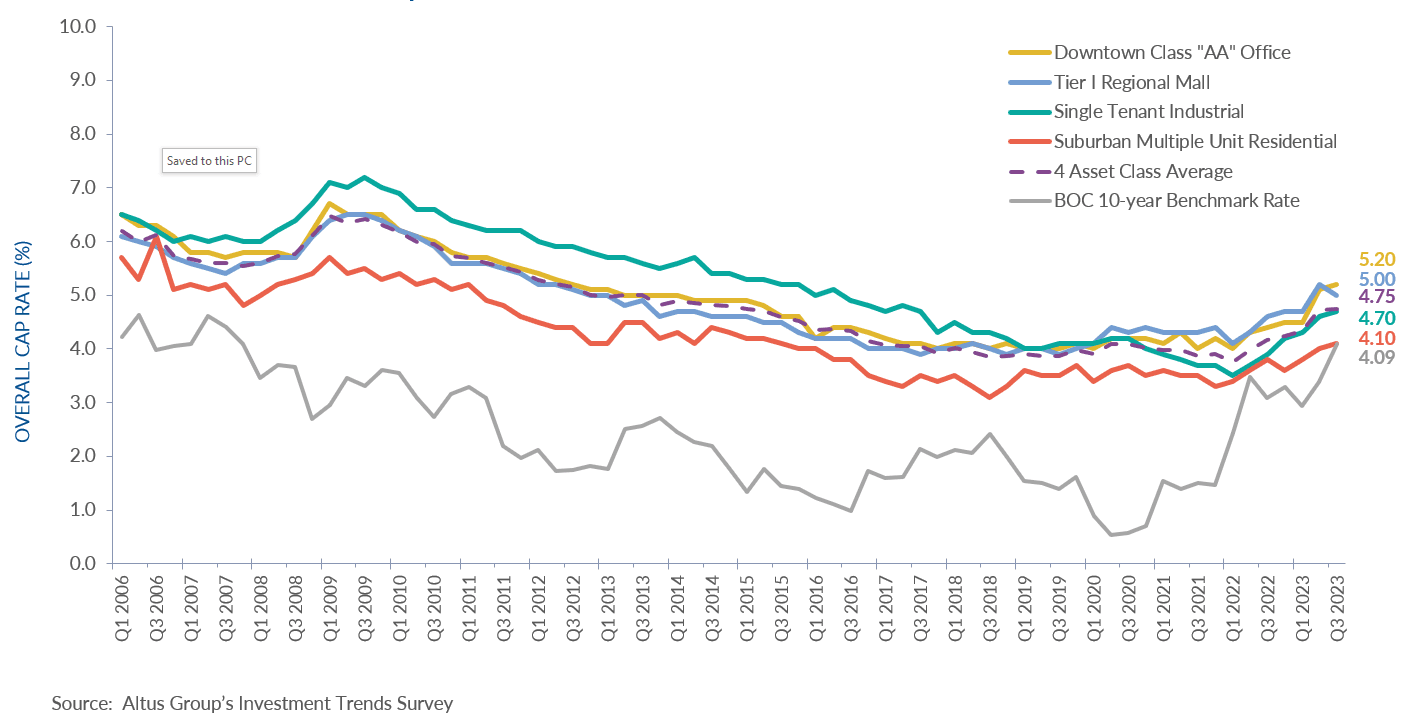

Higher interest rates and inflationary pressures have hampered investment activity in the Vancouver market, with $5.8 billion in dollar volume transacted through the first three quarters of 2023, marking a 55% decrease year-over-year. Furthermore, all sectors reported a decline in investment volume, with the industrial sector reporting the lowest year-over-year decrease of 23%. Moreover, overall capitalization rates (OCR) have also risen slightly to 4.75% in Q3 2023 compared to the previous quarter at 4.73%, with all sectors reporting increases except for tier I regional malls.

Figure 1 - Property transactions – All sectors by year

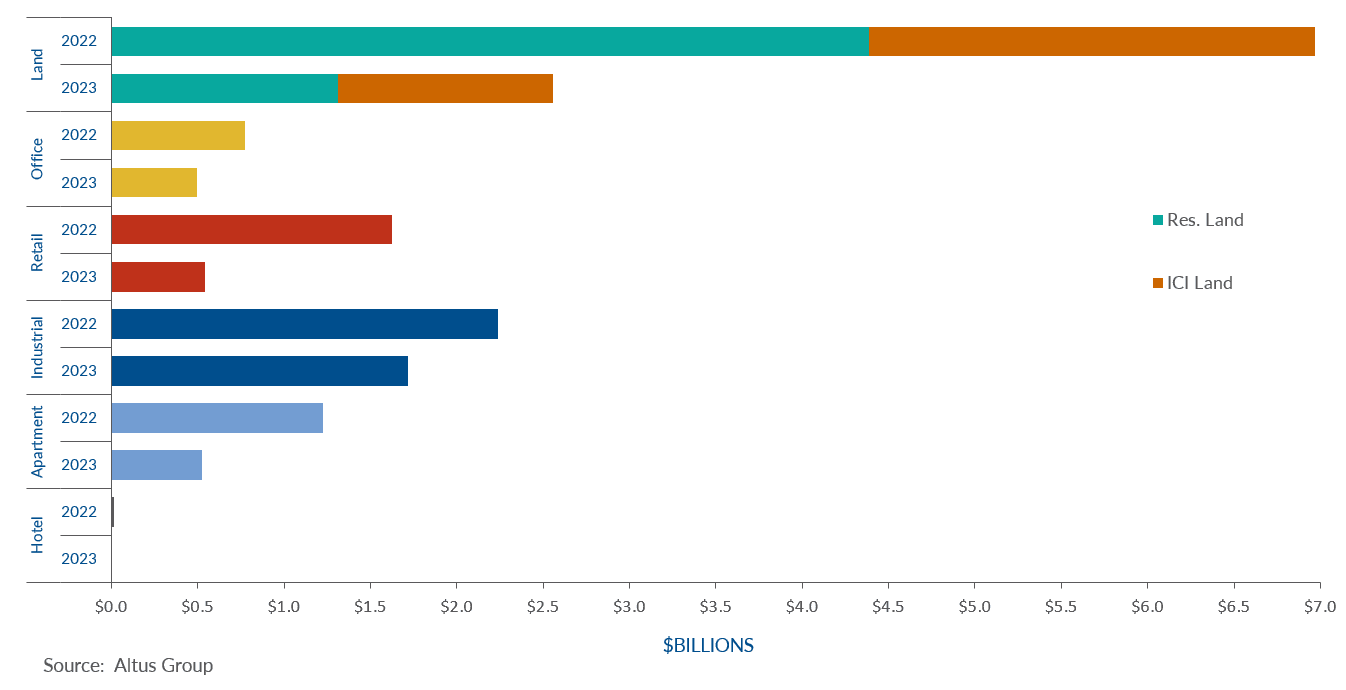

Compared to other asset classes in the Vancouver market, the industrial sector displayed noteworthy resiliency despite the volatility in the market, with $1.7 billion in dollar volume transacted, a 23% decrease year-over-year. Altus Group’s most recent Canadian industrial market update revealed that the industrial availability rate has risen to 2.9%, the highest recorded since Q3 2020. Furthermore, Vancouver saw the completion of one industrial building in the third quarter, representing 65,953 square feet, with no pre-leasing activity. In addition, nearly 4.5 million square feet of industrial buildings are in the construction pipeline, with 60% pre-leased. This pre-leasing activity indicates that the industrial sector demand has begun to taper off from its peak during the first half of 2022 in response to changing market conditions. Despite the increased availability, market conditions have remained tight, as supply could not keep pace with demand.

Residential and ICI land sales have also slumped, with nearly $2.6 billion in dollar volume transacted, a 63% decrease year-over-year. The residential land sector posted $1.3 billion in dollar volume, while the ICI land posted $1.2 million, a decrease of 70% and 52%, respectively. While not unexpected, the continued decline in residential land sales in the Vancouver market suggests less housing supply will be available in the medium term. Furthermore, the shortage of industrial land has also impacted potential employment and business opportunities in the market and the delivery of industrial products.

Vancouver reported $524 million in apartment sales, a 57% decrease year-over-year. Challenges associated with higher interest rates, increased construction costs, and labour shortages have stifled demand and led to sluggish construction and transaction activity. As many Canadians continue to grapple with unaffordable housing while the construction of rental housing fails to keep pace with the market’s growing demand, the British Columbia government has continued introducing a series of proposed legislation to expedite multi-unit housing development approvals.

Similar to other major Canadian markets, demand for office assets has diminished. Vancouver’s office sector posted $493 million, a 36% decline year-over-year. According to Altus Group’s most recent Canadian office market update the office availability rate increased to 12%, an increase of 2.3% year-over-year. Still, Vancouver continued to have the lowest office availability rate across all major markets in Canada. Furthermore, Vancouver recorded no new office completions for the third quarter. In addition, 5.2 million square feet of office space remains under construction, with nearly 55% pre-leased.

The retail sector reported $541 million in dollar volume transacted, a decrease of 67%, primarily due to interest rate hikes and inflationary pressures, which led investors to pivot to more stable, low-risk areas of real estate, such as industrial. However, the gradual return of in-person shopping and interest in physical space has renewed momentum in the retail leasing market. In the Vancouver market, leasing demand for street-front retail space in urban areas and community-level shopping centres in suburban areas continued to be strong. Given the market’s land constraints, the sector has continued to focus on mixed-use redevelopment and densification to introduce new retail space.

Figure 2 - Property transactions by asset class YTD (Q3 2022 vs. Q3 2023)

Notable Q3 2023 transactions

The following are the notable transactions for the Q3 2023 Vancouver commercial real estate market update:

20175 100A Avenue – Industrial

Purchased by Costco Wholesale for roughly $ 31.9 million, this Langley industrial property, located only blocks away from Highway #1, represents a strategic addition to the retailer’s supply chain. The company also acquired the adjacent property (20233 100A Avenue) in April 2021 for $25,000,000. These acquisitions represent the company's first transactions in the Greater Vancouver region since 2005. As of November 2023, the company operated eight warehouses in Vancouver, along with two on Vancouver Island.

2-12 Powell Street & 200 Carrall Street – Retail

Located at the core of Gastown on the corner of Water and Carrall Street, Low Tide Properties purchased this two-storey retail property for $10.2 million. This transaction is part of a series of acquisitions in Gastown in recent years by the company, whose head office is located nearby. Low Tide Properties is committed to growing, strengthening, and reviving neighbourhoods. Other neighbourhoods they have been focusing on include Strathcona, South Flats, and Kitsilano.

8131 & 8151 Bennett Road – Residential Land

Located in Richmond City Centre near Richmond-Brighouse Skytrain Station, this 1.44-acre site was purchased by Unimet Homes for $15 million. A development application has been submitted to the City of Richmond Planning Development proposing to rezone the properties to a Site-Specific Zone to allow for a mixed-use mid-rise development containing a church and approximately 142 purpose-built rental units. This redevelopment follows a trend in the Vancouver area of densifying places of worship, with recent examples being the redevelopment of The Oakridge United Church site located at 305 West 41st Avenue in Vancouver and the St. Andrews United Church site at 2318 St. Johns Street in Port Moody.

Figure 3 - Vancouver market area: OCR trends across 4 benchmark asset classes

While industrial and multi-family products have continued to be in demand, the Vancouver market exhibited signs of a slowdown in investment activities. Higher interest rates and inflationary pressures created challenges associated with higher borrowing costs, delaying or terminating many projects. Similar to other markets nationwide, investment activity is expected to be sluggish for the remainder of 2023 as investors exercise heightened caution amidst unfavourable market conditions.

Authors

Jennifer Nhieu

Senior Research Analyst

Phil Racine

Team Lead

Authors

Jennifer Nhieu

Senior Research Analyst

Phil Racine

Team Lead

Resources

Latest insights