Vancouver commercial real estate market update - Q1 2024

Our quarterly update of Vancouver's commercial real estate market, including overall cap rates and notable property transactions across asset classes.

Key highlights

Vancouver reported $1.7 billion in dollar volume transacted in the first quarter of 2024, down 16% year-over-year (YoY)

Despite the slowdown, Vancouver was Canada’s most preferred market by investors in the first quarter of 2024, with Toronto and Ottawa following, respectively

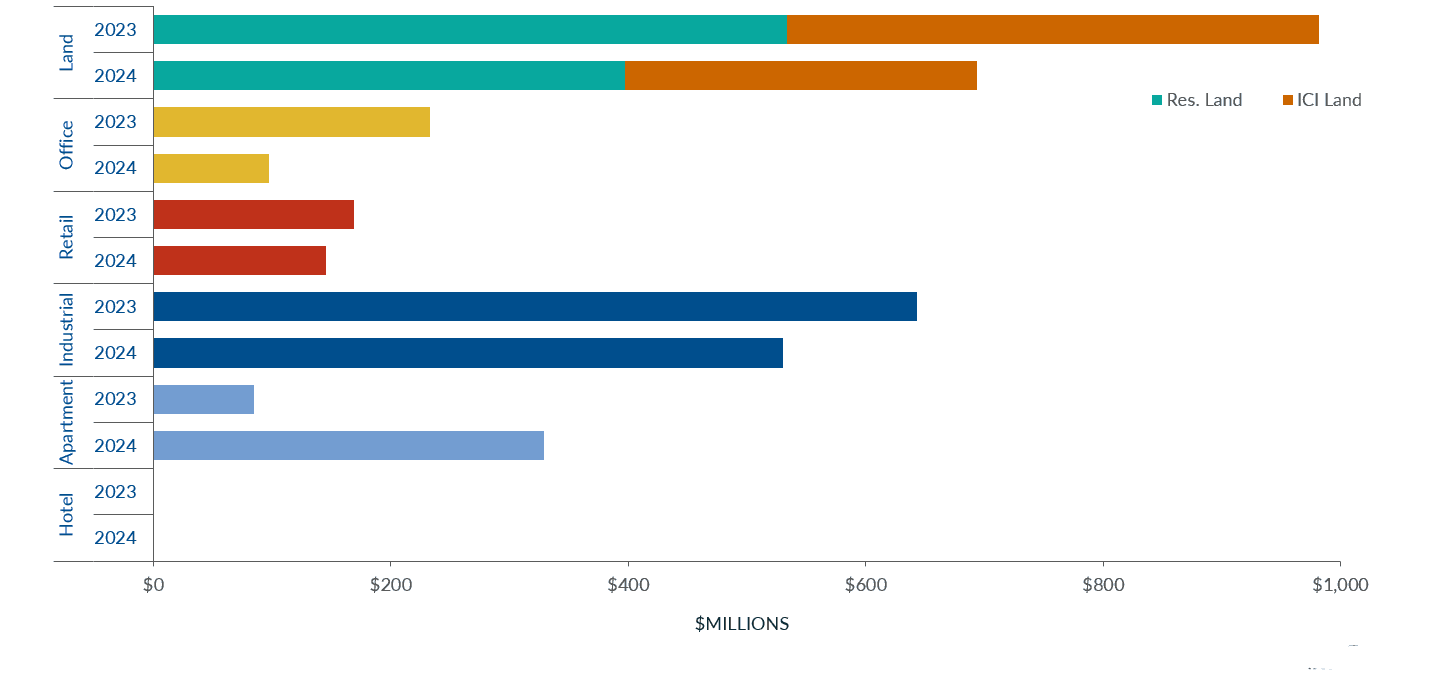

The industrial sector reported $531 million in dollar volume transacted, a decrease of 17% YoY

Investment in residential and ICI land has declined from the levels observed in the past three years, with $694 million in dollar volume transacted, a 29% decrease YoY

The multi-family sector recorded $329 million in dollar volume transacted, a whopping 206% increase YoY

Vancouver’s office sector transacted $97 million, a 58% decrease YoY

The retail sector reported $146 million in dollar volume transacted, a 14% decrease YoY

For the latest update on the Vancouver CRE Market Update, click here.

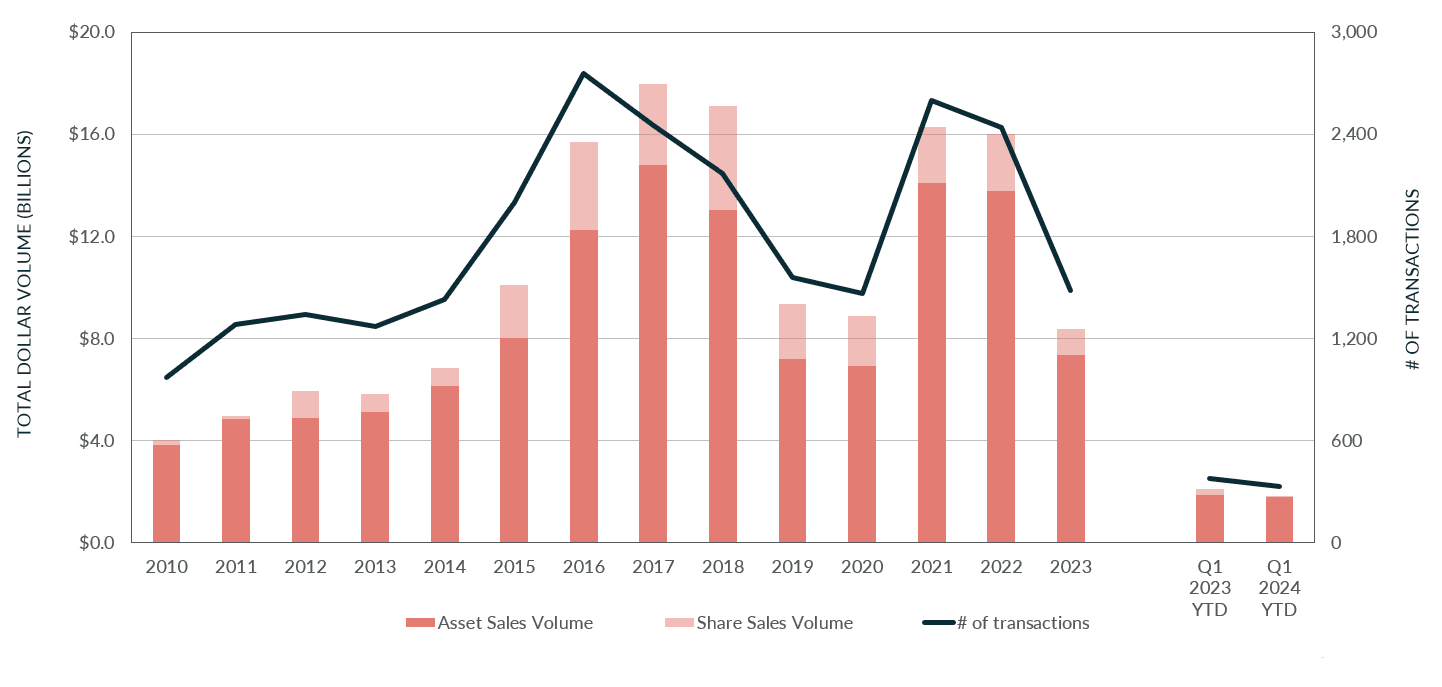

Investment activity in the Vancouver market continued to slow, a decrease of 16% year-over-year

In the first quarter of 2024, restrictive monetary policy from the Bank of Canada hampered investment transaction activity in the Vancouver area as investors remained cautious. Vancouver reported $1.7 billion in dollar volume transacted, down 16% year-over-year (YoY). Despite the slowdown, Vancouver was Canada’s most preferred market by investors in the first quarter of 2024 according to Altus Group’s most recent Canadian CRE Investment Trends Survey, with Toronto and Ottawa following, respectively. This order remained unchanged from the fourth quarter of 2023.

Figure 1 - Property transactions – All sectors by year

The industrial sector reported $531 million in dollar volume transacted, a decrease of 17% YoY. Investment activity in Vancouver moderated as challenges associated with elevated interest rates, surging land costs, labour shortages, and increased construction and material costs persisted. However, Canada’s population growth and the continued expansion of the e-commerce market have pushed the demand for modern distribution and warehousing facilities and kept market conditions tight. Altus Group’s most recent Canadian industrial market update revealed that Vancouver’s industrial availability rate increased by 1.1 percentage points from the previous quarter to 4.2% in Q1 2024. Moreover, the first quarter introduced 519,646 square feet of new supply, 12% of which is pre-leased. In addition, 4.2 million square feet of industrial space are under construction, with over half of the space pre-leased.

Investment in residential land and ICI land has declined from the levels observed in the past three years, given current economic conditions and the surge in land prices, with $694 million in dollar volume transacted, a 29% decrease YoY. Residential land posted $397 million transacted , while the ICI land posted $297 million, a 26% decrease and a 34% decrease YoY, respectively. Despite the challenges, the residential land sector saw the most investment volume (22%), followed by industrial, as developers are confident prospective buyers and renters can bear the brunt of higher housing costs.

The multi-family sector recorded $329 million in dollar volume transacted, a whopping 206% increase YoY. Despite the financing challenges impacting the delivery of new housing supply, persistent demand for rental housing continued to drive construction activity in Vancouver. Furthermore, elevated mortgage rates and increased population growth continued to put pressure on the Vancouver rental market and, in turn, exacerbated the issue of housing affordability.

Vancouver’s office sector transacted $97 million, a 58% decrease YoY. According to Altus Group’s most recent Canadian office market update, Vancouver’s office availability rate has increased 0.2 percentage points from the previous quarter to 12.4% in Q1 2024. The office sector's narrative has remained unchanged, with landlords and businesses focused on rightsizing efforts in response to diminishing demand to diminishing demand. The market saw 154,766 square feet of office completions, fully leased. Additionally, nearly 3.2 million square feet of office space is under construction, with nearly half pre-leased. Vancouver and Toronto were the only major markets to report construction activity as the flight-for-quality trend offered stability to Class A office products.

The retail sector reported $146 million in dollar volume transacted, a 14% decrease YoY. Altus Group’s most recent Canadian CRE Investment Trends Survey indicated that Vancouver’s second-ranked property type remained food-anchored retail strips as consumers continued exercising non-discretionary spending with the growing cost of living.

Figure 2 - Property transactions by asset class (Q1 2023 vs. Q1 2024)

Notable Q1 2024 transactions

The following are the notable transactions for the Q1 2024 Vancouver commercial real estate market update:

2860, 2865, 2880 & 2885 Packard Avenue (Garden Court Co-op & Tri-Branch Co-op) – Apartment

In February 2024, the Garden Court Co-op and the Tri-Branch Co-op were acquired by the Community Land Trust of B.C. for a total consideration of $87 million. The properties represent the first acquisitions under B.C.’s Rental Protection Fund. The two self-managing co-ops represent 290 homes at below-market rents purchased for a combined $300,000 per unit. The two properties are located near Coquitlam Centre Shopping Mall, Coquitlam Central, and Lincoln Skytrain Stations. The Rental Protection Fund has approved funding to preserve additional homes throughout the province, notably The Brighton & Claymore Apartments (5374 203rd Street & 5375 204th Street) in Langley, and currently has thousands of additional homes under funding consideration.

165 West 6th Street (Ocean View Apartments) – Apartment

Purchased by the Hiy̓ám̓ ta Sḵwx̱wú7mesh Housing Society for $13 million, this Lower Lonsdale apartment building containing 35 units represents an important acquisition with long-term development potential by the housing society which has multiple projects across North Vancouver, Burrard Inlet and Squamish Valley. Founded in 2019, Hiy̓ám̓ Housing’s mandate is to build safe, equitable and affordable housing and deliver 1,000 new homes for the Squamish people, contributing to the Nation’s goal of housing every member within a generation.

1960 & 2175 West 7th Avenue – Residential land

Located north of West Broadway along West 7th Avenue in Kitsilano, the two non-adjacent sites were acquired between January and March 2024 for a total of $49 million. Three-storey apartment buildings currently occupy both sites steps away from the future Arbutus Skytrain Station. Gracorp has submitted two separate rezoning applications proposing a 20-storey building on each site with floor space ratios of 6.5. These projects are part of a recent wave of higher-density development projects along the Broadway Corridor following the approval of the Broadway Plan in 2022.

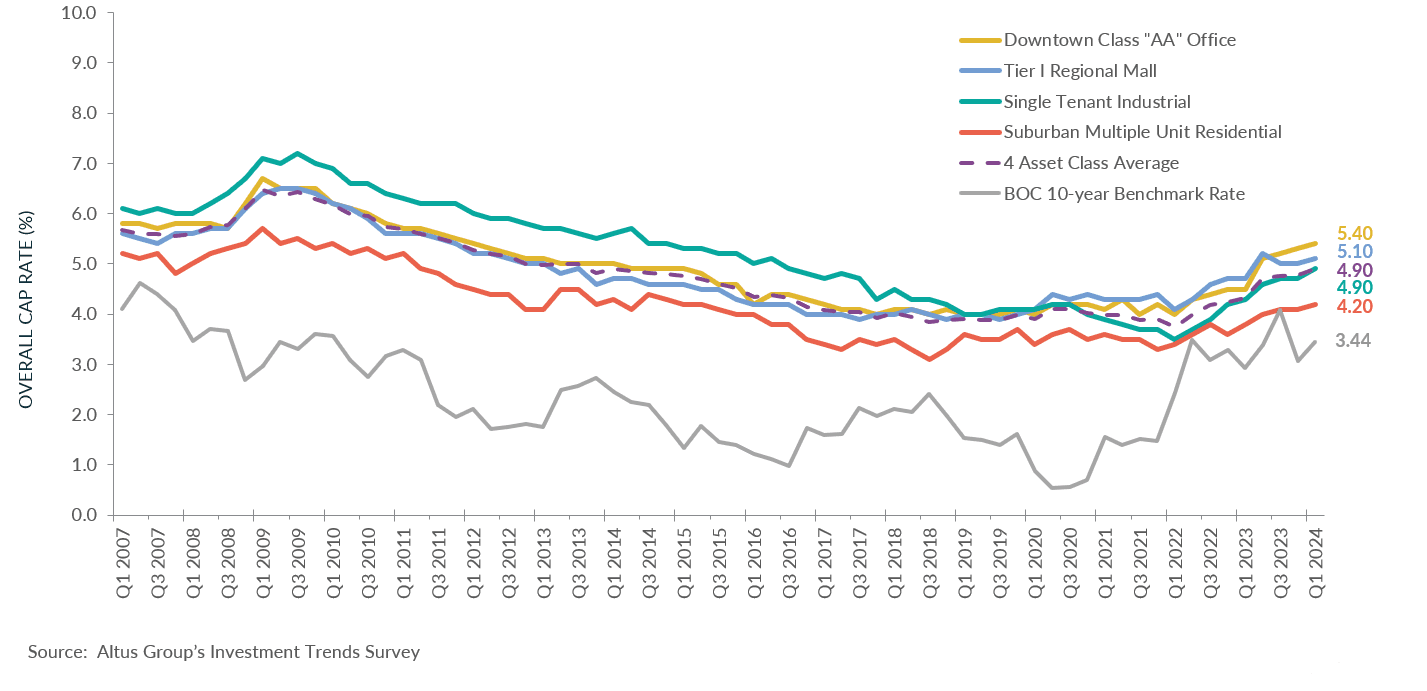

Figure 3 - OCR trends across 4 benchmark asset classes

Conclusion

The first quarter of 2024 was off to a slow start in Vancouver as investors continued to navigate through a tricky operating environment. Industrial accounted for most of the investment dollar volume as the asset class benefitted from the support of strong underlying demographic and economic fundamentals. Looking ahead, investors remained optimistic as the anticipated interest rate cuts will gradually unfurl pent-up demand.

Want to be notified of our new and relevant CRE content, articles and events?

Authors

Jennifer Nhieu

Senior Research Analyst

Phil Racine

Team Lead

Authors

Jennifer Nhieu

Senior Research Analyst

Phil Racine

Team Lead