Vancouver commercial real estate market update – Q3 2025

Vancouver’s CRE market saw $6.5B in Q3 2025 transactions, down 23% year-over-year, with retail gains offset by softer land, multifamily, and industrial investment.

Key highlights:

By the close of the third quarter, Vancouver reported a 23% year-over-year decrease in overall investment activity, with nearly $6.5 billion in dollar volume transacted

The retail sector reported positive year-over-year growth of 31%, with $1.1 billion in dollar volume transacted

The multifamily sector experienced a year-over-year decrease of 24%, recording $891 million in dollar volume transacted

The industrial sector recorded $1.1 billion in dollar volume transacted, a 27% year-over-year decrease

The office sector saw a modest 4%year-over-year increase in investment volume, recording $1.2 billion in dollar volume transacted, primarily driven by Class-A transaction activity

The land sector recorded nearly $2 billion in dollar volume transacted, marking a substantial 46% decrease

The residential land sub-sector recorded $682 million in dollar volume transacted, while the ICI land sub-sector recorded $1.3 billion, down 61% and 32% year-over-year, respectively

In the third quarter, commercial investment in Vancouver experienced a contraction, down 23% year-over-year

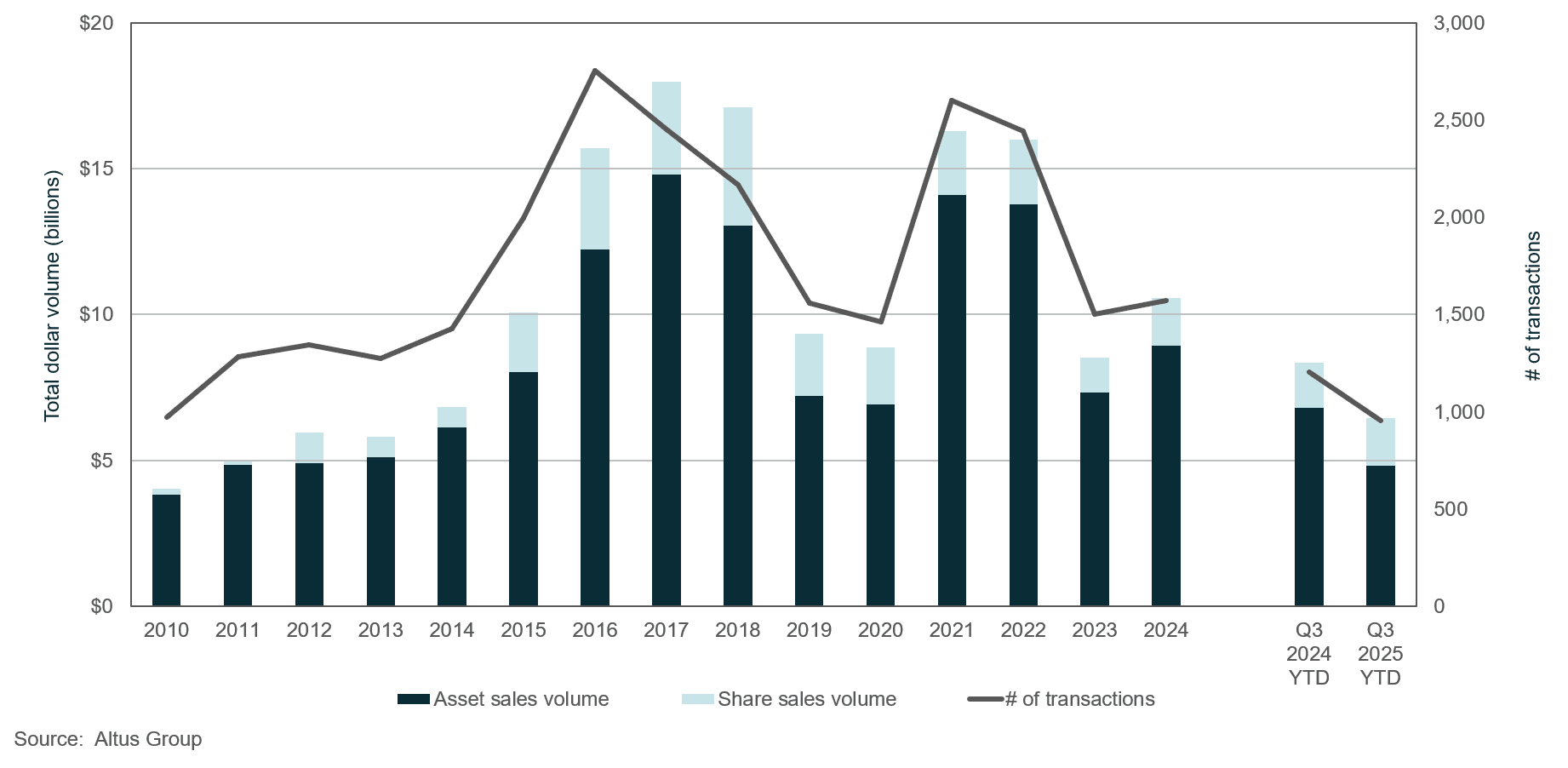

By the end of the third quarter of 2025, Vancouver’s commercial real estate market experienced a significant year-over-year contraction of 23%, with total dollar volume transacted reaching nearly $6.5 billion (Figure 1).

Figure 1: Vancouver property transactions - All sectors by year

A key driver of this decline was the market anomaly created by the pull-forward of investment activity that had occurred during the second quarter of 2024. The proposed increase in the now-cancelled capital gains inclusion rate prompted many investors to finalize deals ahead of its planned implementation on June 25th, 2024. This approach resulted in an anomalous surge in national investment volume during that specific period, despite otherwise subdued market conditions.

Consequently, comparing the first half of 2025 to this artificially inflated period made the year-over-year decline appear more pronounced than usual.

Global trade tensions and weakening economic conditions further weighed on investor sentiment. In response to these challenges, the Bank of Canada (BoC) recommenced its easing cycle, lowering the key interest rate to 2.25% as of October 29th, 2025. Several economic indicators influenced the BoC’s decision:

The national labour unemployment rate held steady at 7.1%, which signalled diminished labour demand across the economy

On a per capita basis, the Gross Domestic Product (GDP) increased by 0.5% in Q3, after contracting by 0.5% in the previous quarter

The Consumer Price Index (CPI) increased to 2.4% in September from 1.9% in August, indicating persistent cost pressures

Against this backdrop, some investors postponed major investment decisions until greater clarity emerged in the political and economic landscape. This pause reflects timing rather than a lack of interest. According to Altus Group’s latest Canadian Investment Trends Survey (ITS), Vancouver reclaimed its first-place ranking as the most preferred market across all asset classes by survey respondents. The market registered a positive momentum ratio, which was a strong indication of a greater intention to buy than sell among survey respondents. However, most investors maintained a defensive posture, an approach that led to a substantial accumulation of institutional capital being held on the sidelines.

Retail

Vancouver’s retail sector mirrored national strength in the third quarter. Total dollar volume transacted surpassed $1.1 billion, a significant 31% increase year-over-year, driven by sustained demand for prime retail locations, especially within core urban areas. Inventory in these desirable areas remained limited, thereby supporting higher pricing.

According to ITS, food-anchored retail strips in Vancouver ranked as the ninth most preferred product-market combination by investors. Their preference for this specific asset class stemmed from its ability to generate dependable cash flow, derived from the reliable, non-discretionary nature of consumer demand for essential goods, particularly groceries and other household products.

This fundamental stability positioned food-anchored retail strips as integral components within many investment portfolios. They provided a comparatively secure refuge in their capacity to endure economic downturns and the structural pressures exerted by the unprecedented growth of e-commerce.

Industrial

The industrial sector recorded $1.1 billion in dollar volume transacted, a 27% decrease year-over-year. This contraction was primarily attributed to three key factors: the anomalous surge in transaction volume observed in 2024, tariff-related disruptions, and shifting demand-supply dynamics.

According to Altus Group’s latest Canadian industrial market update, Vancouver’s industrial availability rate increased by 100 basis points to 5.9% year-over-year, indicating a waning of tenant demand. In response to these conditions, property owners offered incentives to maintain occupancy levels, including rent reductions, shorter lease terms and other inducements to attract and retain tenants.

On the development front, Vancouver added five new industrial buildings, totalling nearly 245,000 square feet. Notably, only 14% of this new space remained available for lease, highlighting the success of built-to-suit projects, which aided in the market’s absorption. The market recorded a net positive absorption of nearly 345,000 square feet in the third quarter. Looking ahead, the development pipeline includes 41 industrial buildings, totalling over 3 million square feet, 46% of which remained available for lease.

Multifamily

The multifamily sector in Vancouver experienced a 24% year-over-year decrease in investment volume, recording $891 million in dollar volume transacted. While the first three quarters of 2024 observed strong performance, primarily due to the anomalous surge of activity, transactions gradually pulled back after the third quarter of 2024 and have since plateaued when compared to historic benchmarks.

This slowdown reflects a combination of softer immigration , labour shortages, high land and construction costs affecting project feasibility, and the surplus of condominium inventory and a lack of overall sales. These factors contributed to flattening rent growth and higher vacancy concentrated in newer builds.

According to ITS, despite prevailing market uncertainty, investors remained cautiously optimistic in Vancouver’s multifamily sector. Suburban multiple-unit residential in Vancouver ranked as the top property type and market combination, supported by sustained rental demand in the region, which was driven by persistently high ownership costs and limited affordable housing options.

While rental supply has increased and rent growth has eased, rental affordability showed no substantive improvement during this period. These persistently tight market conditions maintained long-term support for rental demand, but the simultaneous influx of new supply created a more complex and challenging operating environment for property owners.

This combination of factors contributed to an erosion of consistent rental income stability and diminished near-term prospects of reliable capital appreciation for existing properties. Heightened operational risk for property owners and elevated carrying costs collectively reduced investor confidence, fostering a more cautious and selective approach to new acquisitions.

Office

The office sector recorded nearly $1.2 billion in dollar volume transacted, reflecting a modest 4% increase year-over-year. According to Altus Group’s latest Canadian office market update, Vancouver’s office availability rate decreased by 60 basis points to 12.5% year-over-year, following a peak of 13.1% in the third quarter of 2024. Despite this recent decline, availability rates had stubbornly remained elevated, consistently stabilizing within the 12% range or higher for the preceding three years.

Leasing activity continued to be bifurcated, with a clear skew towards premium space. Both investors and occupiers demonstrated a strong preference for high-quality, amenitized Class-A office space situated in desirable locations:

Class A transactions accounted for most of the leasing activity, with 68 deals encompassing nearly 1.8 million square feet

Class B office space saw considerably less demand, comprising only 18 transactions, totalling approximately 251,000 square feet

This disparity underscored a persistent and accelerating “flight to quality” trend, whereby tenants were actively consolidating space into superior buildings to enhance employee experience and operational efficiency.

On the development front, the third quarter saw the completion of four office buildings, collectively adding 243,000 square feet to the market’s total inventory. Of this newly completed supply, approximately 31% remained available for lease. The future pipeline includes ten office buildings, totalling 1.2 million square feet, with 21% pre-lease availability, suggesting that demand for new, modern office space remained robust. The relatively limited development pipeline is expected to support further tightening of availability rates in the near term, as fewer new projects would be coming online to compete with existing inventory.

Land

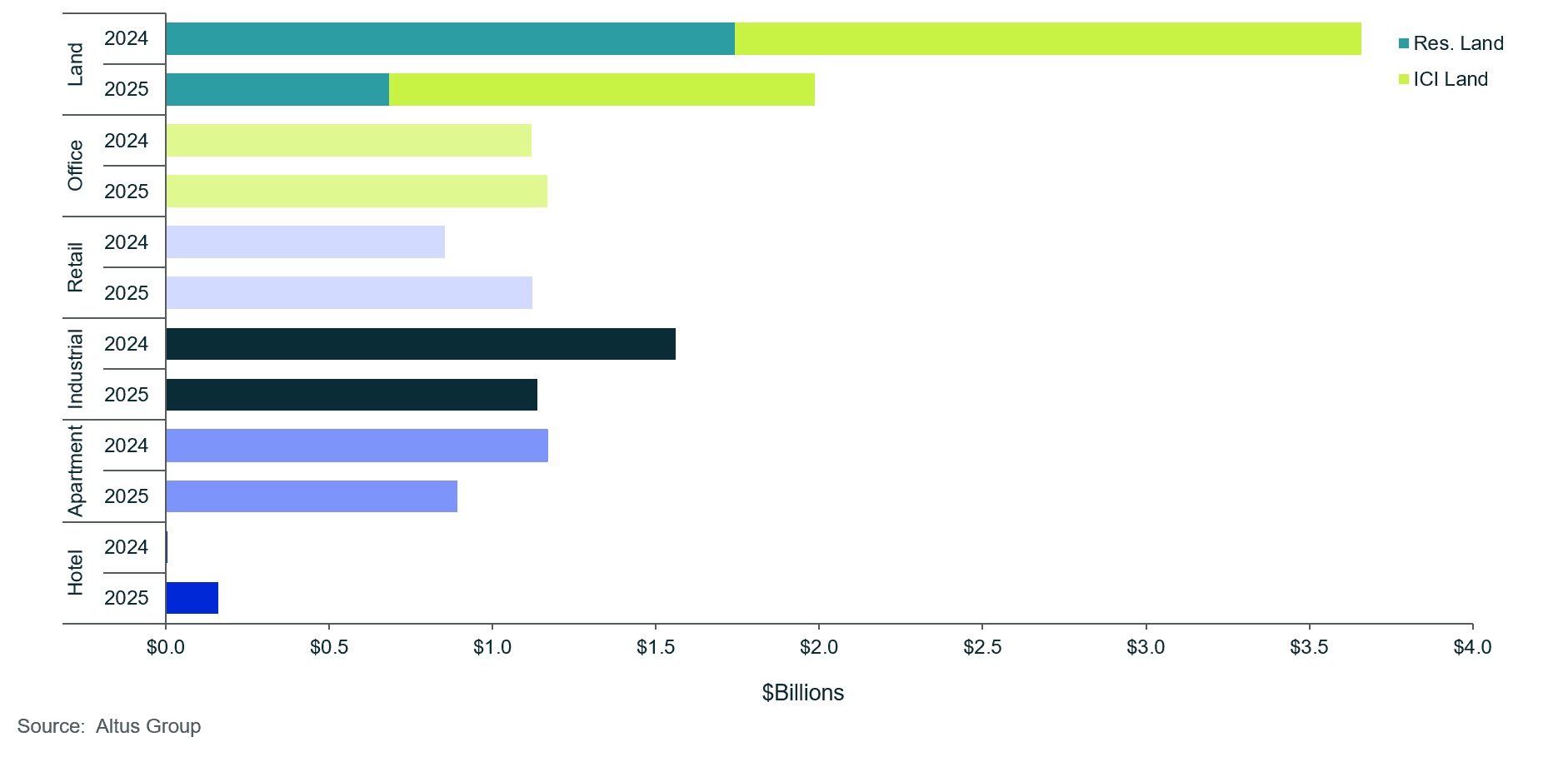

The land sector, encompassing both residential and ICI land, continued on a downward trajectory during the third quarter. Total transaction volume reached nearly $2 billion, marking a substantial 46% decrease year-over-year. This decline signalled a more cautious investment climate and reduced development activity across the region, reflecting [KB1.1]the broader economic uncertainties and higher borrowing costs.

A closer examination revealed that the residential land sub-sector accounted for the largest share of this decline, with transaction volumes totalling $682 million. This represented a significant 61% year-over-year decrease and a gradual slowdown compared to historic benchmarks. Developers were likely to delay new projects due to the softening demand observed in both the condominium and rental sectors. Furthermore, increased construction costs negatively impacted project feasibility, leading to diminished appetite for new residential land acquisitions.

Similarly, the ICI land sub-sector experienced a decline, reporting $1.3 billion in dollar volume transacted, a 32% decrease year-over-year. However, when compared to historic benchmarks, the ICI sector experienced sustained levels of demand by the close of the third quarter. This performance reflected continued confidence in future institutional, commercial and industrial projects, despite the short-term contraction in volume.

Figure 2: Vancouver property transactions by asset class year-to-date

Notable transactions for Q3 2025

The following are the notable transactions for the Q3 2025 Vancouver commercial real estate market update:

4th, 9th, 10th & 11th Floors - 9686 137 Street, Surrey (City Centre 4) - Office

Western Community College (WCC) acquired four strata office floors totalling almost 60,000 square feet in City Centre 4 for $56.1 million, equating to $935 per square foot. WCC intended to occupy the premises for its own institutional use.

The transaction closed on September 29, 2025. City Centre 4 was the newest and largest phase of Surrey’s Health & Technology District, a rapidly expanding hub that comprised over half a million square feet of Class AAA office and retail space, and was home to a mix of health, academic, technology, and professional organizations.

Situated adjacent to Surrey Memorial Hospital and within close proximity to the forthcoming UBC and SFU campuses, the project offered strong transit access, only minutes from King George SkyTrain Station, and a wide range of nearby amenities. The building targeted LEED Gold certification and was scheduled for completion in Q4 2025, reinforcing its appeal to institutional and knowledge-sector occupiers.

20175 Langley Bypass, Langley (Logan Creek Plaza) - Retail

Club16 Trevor Linden Fitness acquired Logan Creek Plaza from Rockcliffe Estates Ltd. for $26.25 million, equating to $553 per square foot across 47,500 square feet of retail space. The transaction closed on August 29, 2025.

The plaza comprised three buildings on 5.36 acres within the established Willowbrook Commercial District, one of Metro Vancouver’s most active retail nodes positioned between Highway 1 and the US border. Club16, the property’s anchor tenant, became the owner-occupier, joining co-tenants Sleep Country and Jordans Flooring.

The surrounding area was poised for further growth with two SkyTrain stations planned less than one kilometre away, enhancing long-term accessibility and value. The acquisition provided the buyer with strategic control of a key location supported by strong tenancy and sustained demand in the Fraser Valley.

904 & 908 Cliveden Avenue, Delta - Industrial

Big Mountain Foods (BMF Farm to Dish Corporation) acquired its leased premises, comprising over 69,000 square feet of production, freezer, cooler and warehouse space on 3.30 acres in the Annacis Island industrial node for $22 million, reflecting $318 per square foot.

The asset was centrally located at the convergence of Delta, Richmond, Burnaby, and Surrey, and offered strong regional connectivity via Highway 91, Highway 99, the South Fraser Perimeter Road, and Highway 1. The facility featured a versatile food-grade manufacturing buildout, including 12,846 square feet of office, 14,329 square feet of freezer, 6,055 square feet of cooler, and 35,907 square feet of production/ warehouse space, supported by clear heights of 18' to 26', eight dock-loading doors and one ramped drive-in. The transaction, which closed on August 29, highlighted continued demand for well-located, specialized industrial assets within Metro Vancouver’s core logistics network.

1390 Sharpewood Drive & Surrounding Lots, Coquitlam - Residential Land

In August 2025, Qualico Group of Companies (Qualico Developments (Vancouver) Inc.) acquired 39 subdivided single-family lots, part of the 3333 Caliente Place land development by Gemex Developments Corp., for $37 million, reflecting approximately $180 per square foot based on the total 206,098 square feet (4.727 acres) of land.

The lots, ranging in individual size from 4,031 to 19,052 square feet, were located north of David Avenue and east of Pipeline Road, spanning addresses along Sharpewood Drive, El Camino Place/Way, and Caliente Place.

The original development was approved in July 2024, including subdivision, rezoning, and OCP amendments to enable low-density residential use. Qualico planned to construct single-family homes on the fully serviced lots, supporting growth within Northeast Coquitlam’s expanding suburban residential market.

4th Floor, 10745 King George Boulevard, Surrey (The Grand) - Office

1534602 B.C. Ltd. acquired the entire 4th floor (19 strata lots), totalling over 16,000 square feet of Class AAA office space in The Grand, for $14.5 million, reflecting $897 per square foot. The transaction closed on September 4, 2025. The Grand was a five-storey commercial podium beneath a 341-home residential tower in Surrey City Centre, offering modern, fully serviced office space in one of Metro Vancouver’s fastest-growing neighbourhoods.

Strategically located just off King George Highway near 108 Avenue, the property was proximate to Surrey’s medical and educational centres, major commercial nodes and surrounding residential developments. The acquisition provided an opportunity for occupiers and investors to establish a presence within a thriving mixed-use hub while benefiting from flexible, high-quality office accommodations.

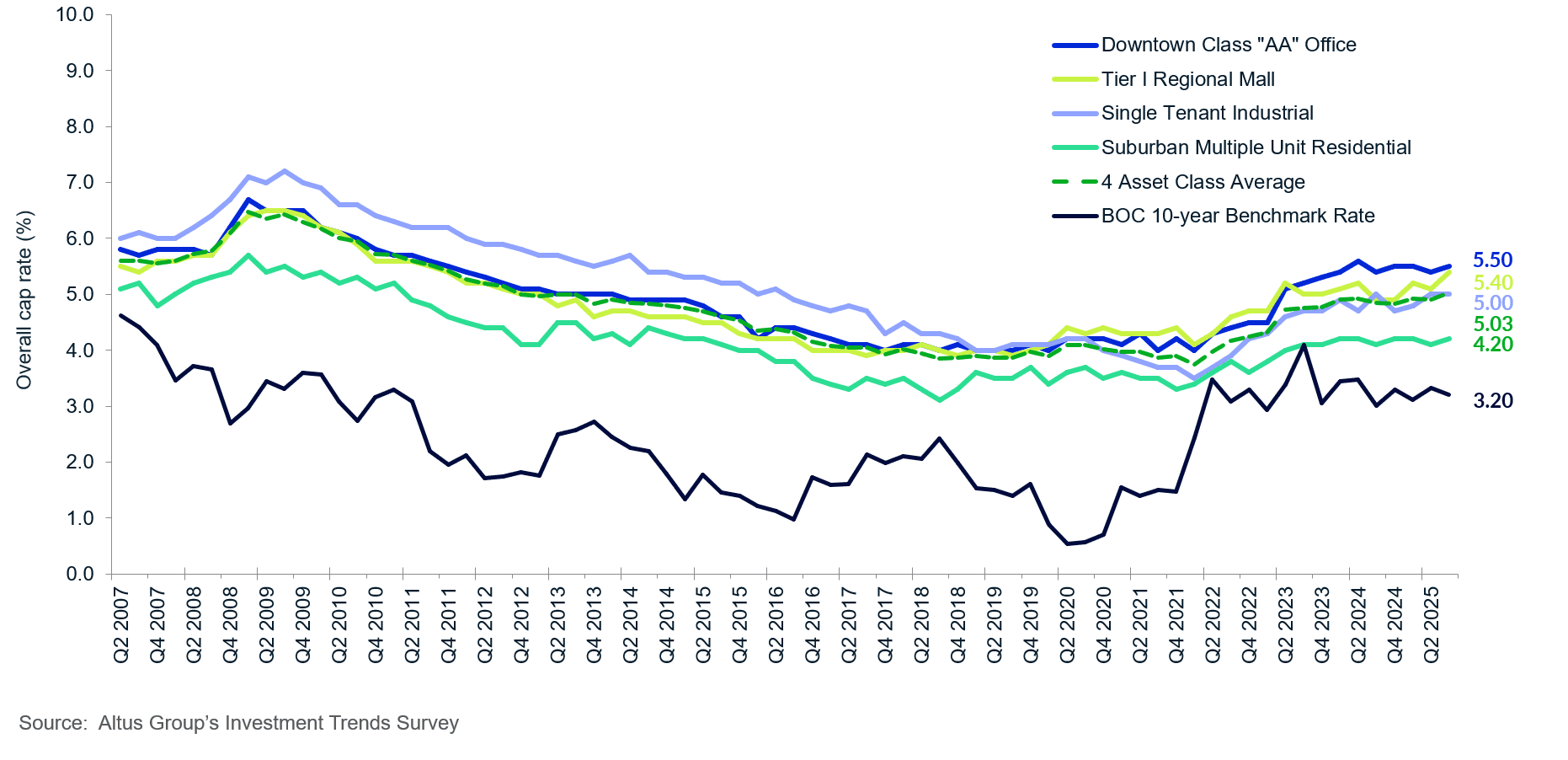

Figure 3: OCR trends across 4 benchmark asset classes, Vancouver

Market outlook

The third quarter of 2025 in Vancouver’s commercial real estate market was defined by heightened investor caution and lower volumes, shaped by macroeconomic headwinds and the distorting effect of prior-year investment anomalies. While the overall dollar volume experienced a significant decline, this aggregated figure masked a pronounced bifurcation in asset class performance and underlying investor sentiment. The retail and multifamily sectors demonstrated resilience and strong long-term appeal, evidenced by their ranking as preferred investment combinations. This preference stemmed from their defensive cash-flow attributes anchored by essential goods demand in retail and non-discretionary rental demand in multifamily, which provided a buffer against volatility. Conversely, the land and industrial sectors experienced substantial investment pullbacks, as developers paused due to high construction costs and the unwinding of prior-year surges.

As the market moves into 2026, Vancouver is expected to enter a phase of gradual recalibration, primarily driven by global trade policy and domestic financing conditions. The BoC’s decision to restart the easing cycle and lower the key interest rate has set a new benchmark for borrowing costs, a level anticipated to persist and foster a more predictable financing environment for developers and investors. The pronounced “flight to quality” is expected to persist in the office and industrial sectors, supporting premiums for new, and amenitized Class-A properties. Furthermore, the limited forward development pipeline in the industrial and office sectors is anticipated to tighten availability rates, leading to improved leasing conditions as the economy stabilizes.

Although institutional capital is building on the sidelines, Vancouver’s sustained ranking as a top market for investor preference suggests that this capital is awaiting greater clarity. A moderation in economic volatility, particularly around international trade, is likely to prompt a phased re-engagement of this sidelined capital, driving transaction volumes closer to historic benchmarks. While the third quarter reflected a cyclical downturn amplified by unique policy effects, Vancouver’s long-term appeal remains intact, with core defensive assets and premium product poised to lead the market’s recovery and stabilization in the year ahead.

Want to be notified of our new and relevant CRE content, articles and events?

Disclaimer

This publication has been prepared for general guidance on matters of interest only and does not constitute professional advice or services of Altus Group, its affiliates and its related entities (collectively “Altus Group”). You should not act upon the information contained in this publication without obtaining specific professional advice.

A number of factors may influence the performance of the commercial real estate market, including regulatory conditions and economic factors such as interest rate fluctuations, inflation, changing investor sentiment, and shifts in tenant demand or occupancy trends. We strongly recommend that you consult with a qualified professional to assess how these and other market dynamics may impact your investment strategy, underwriting assumptions, asset valuations, and overall portfolio performance.

No representation or warranty (express or implied) is given as to the accuracy, completeness or reliability of the information contained in this publication, or the suitability of the information for a particular purpose. To the extent permitted by law, Altus Group does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. The distribution of this publication to you does not create, extend or revive a client relationship between Altus Group and you or any other person or entity. This publication, or any part thereof, may not be reproduced or distributed in any form for any purpose without the express written consent of Altus Group.

Authors

Jennifer Nhieu

Senior Research Analyst

Arthur Tang

Senior Market Analyst

Authors

Jennifer Nhieu

Senior Research Analyst

Arthur Tang

Senior Market Analyst

Resources

Latest insights