Toronto commercial real estate market update - Q4 2025

The Greater Toronto Area finished the year with nearly $16.2 billion in total commercial real estate volume transacted.

Key highlights:

Source: Altus Data Studio market data and analysis

By the fourth quarter of 2025, the Greater Toronto Area reported a contraction in investment activity, with nearly $16.2 billion in dollar volume transacted, an 8% year-over-year decline

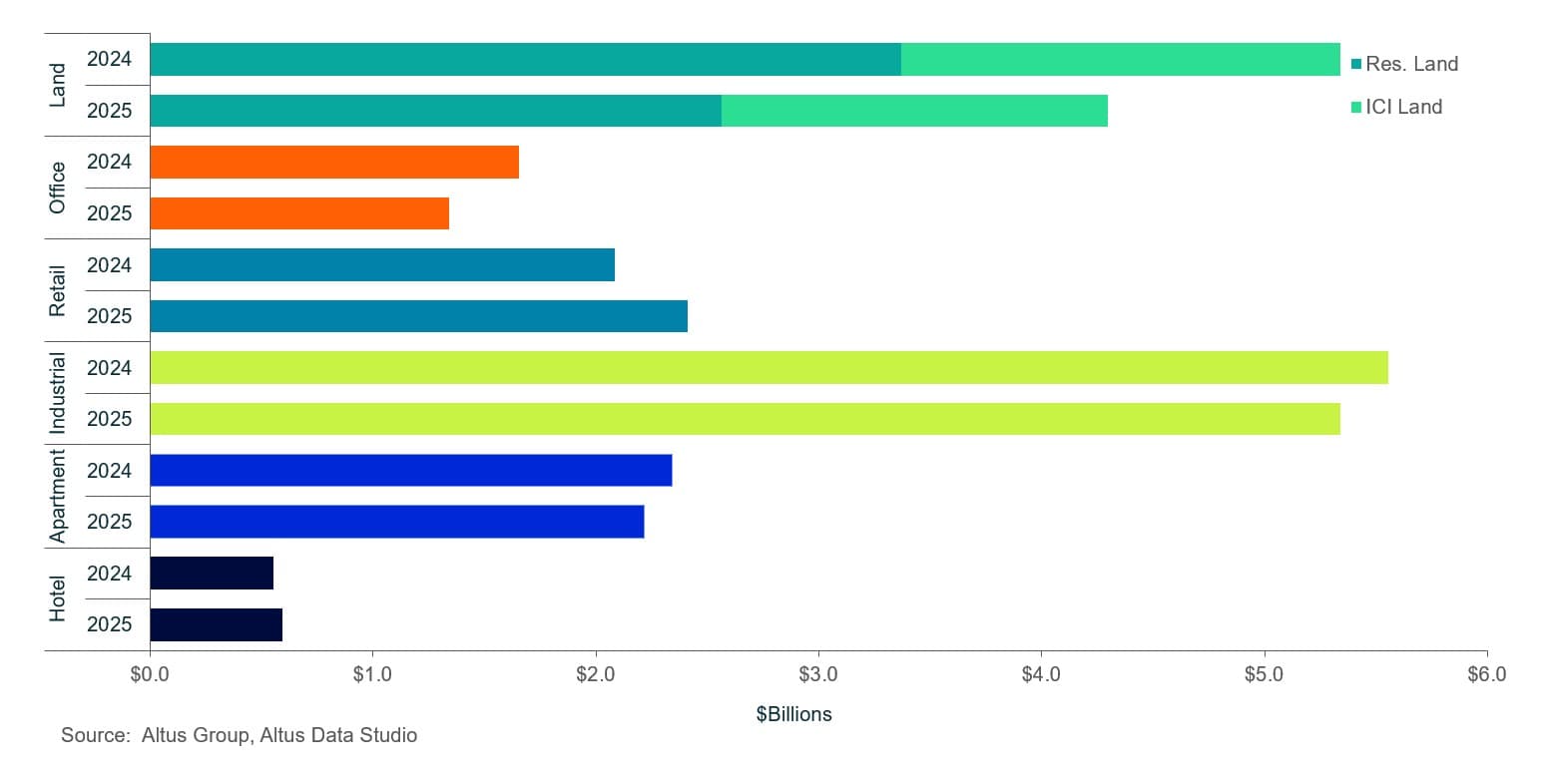

The retail sector demonstrated robust performance, up 16% year-over-year to $2.4 billion in dollar volume transacted, as investors favoured food-anchored retail properties and shopping centres with redevelopment opportunities

The industrial sector recorded $5.3 billion in dollar volume transacted, a modest 4% decline from last year, as global trade tensions impacted investor confidence and delayed capital deployment

The multi-family sector saw $2.2 billion in dollar volume transacted, representing a marginal 5% year-over-year decrease, as investment activity picked up in the second half of 2025

The office sector recorded $1.3 billion in dollar volume transacted, representing a 19% decrease, as limited activity remained skewed towards Class AAA office space

The land sector recorded $4.3 billion in dollar volume transacted, marking a 20% decrease; the residential land and lots sector recorded nearly $2.6 billion in dollar volume transacted, while the ICI land sector recorded $1.7 billion, down 24% and 12% year-over-year, respectively

By the final quarter of 2025, commercial investment in the Greater Toronto Area contracted 8% year-over-year

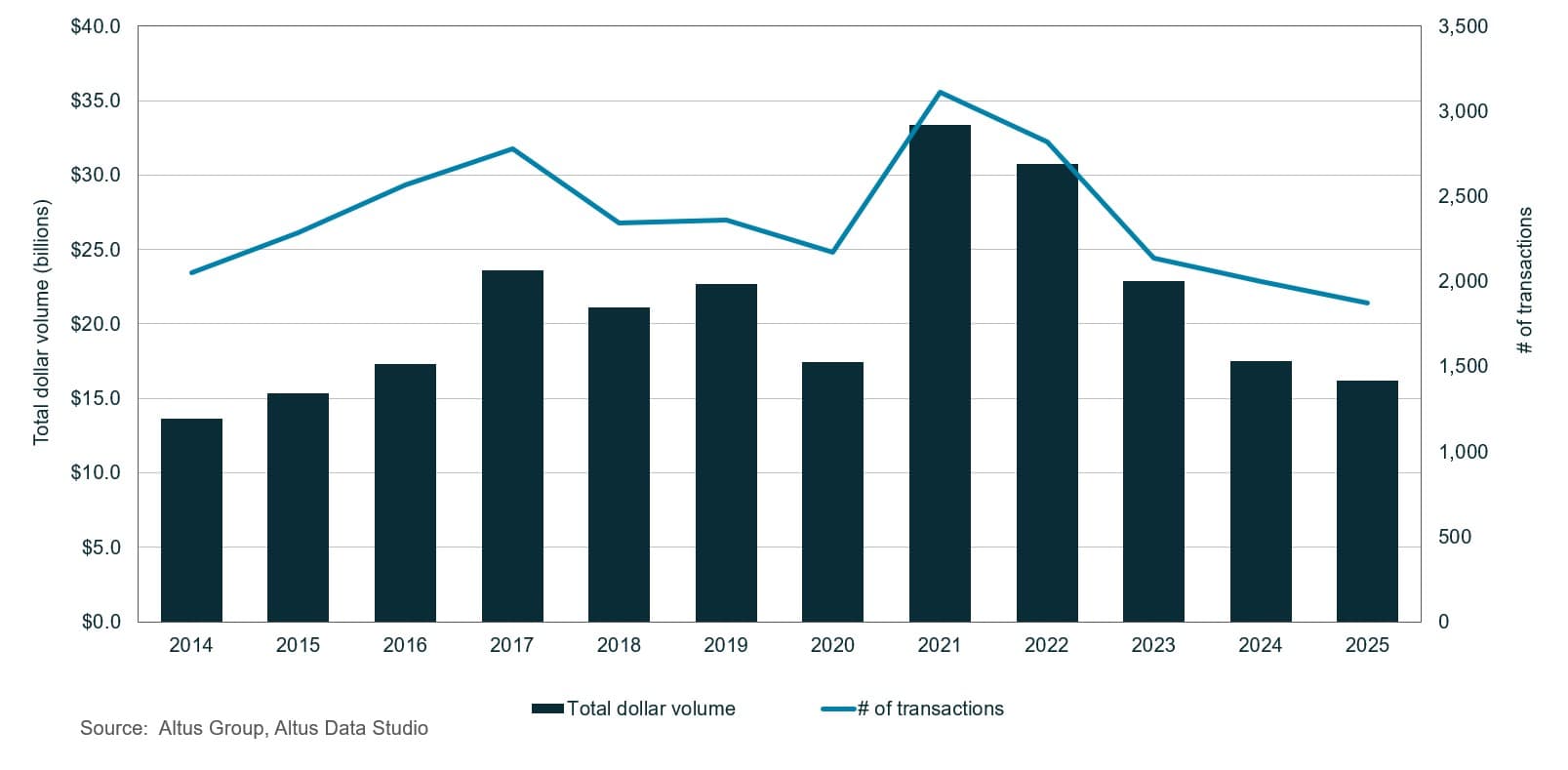

By the final quarter of 2025, the Greater Toronto Area (GTA) commercial real estate market recorded a moderate deceleration in investment activity. Based on data from Altus Data Studio, the total transaction volume for the GTA reached approximately $16.2 billion, representing an 8% year-over-year decrease (Figure 1). This decline was largely attributed to a “pull-forward” of activity in the second quarter of 2024, where investors accelerated deal closures to precede a proposed, and later cancelled, increase in the capital gains inclusion rate. This 2024 surge created an anomalous benchmark, leading to a year-over-year comparison that appeared disproportionately subdued despite stable underlying interest.

Figure 1: Greater Toronto Area property transactions – All sectors by year

Market performance was further influenced by heightened investor uncertainty during the second quarter of 2025, driven by geopolitical tensions and a perceived deterioration in Canada’s economic outlook. While these factors exacerbated the annual decline, they did not indicate a pause in interest. Rather, they prompted a cautious and optimistic shift toward defensive asset classes. Despite these pressures, the Canadian economy demonstrated unexpected resilience in late 2025. This stability was primarily sustained by the legal protections of the Canada-United States-Mexico Agreement (CUSMA), which mitigated the impact of US trade protectionism. Nevertheless, market sentiment remained guarded as the 2026 outlook was impacted by shifting immigration policies and global volatility.

Monetary policy reached a turning point on December 10, 2025, when the Bank of Canada (BoC) maintained the overnight rate at 2.25% after two consecutive reductions. This pause was supported by a 0.6% increase in Real Gross Domestic Product (GDP) during the third quarter (2.6% annualized), rebounding from a 1.8% contraction in the second quarter. However, economists characterized this growth as “fragile,” as it stemmed from a favourable trade balance and increased government defence spending rather than robust domestic activity. Concurrently, the labour market showed signs of stabilization with the unemployment rate easing to 6.8% in December from a peak of 7.1% in September, despite a month-over-month increase in job seekers that points to ongoing economic uncertainty.

In response to the prevailing market environment, many investors deferred major capital commitments, while others rebalanced their portfolios toward defensive asset classes to mitigate volatility. A distinct segment of the market sought diversification by pursuing opportunities in more affordable regions, pivoting away from the high-cost GTA market in search of better value and mitigated risk. Despite these shifts in capital allocation, the latest Altus Group Investment Trends Survey (ITS) confirmed that the GTA remained a primary region for capital deployment, ranking as the third most preferred Canadian market for investment across all property types.

Retail investment activity

The retail sector achieved a remarkable performance in 2025, recording a transaction volume of $2.4 billion. This represented a 16% year-over-year increase, solidifying retail as the top-performing asset class in the GTA. According to Altus Group’s latest ITS, nationally, retail properties with food-anchored retail were at the forefront of investor preference for nine consecutive quarters. Moreover, food-anchored retail strips in Toronto were ranked the most desirable product/market combination in the fourth quarter of 2025. These essential service assets saw intense demand as the properties were highly valued for their defensive qualities, which include higher occupancy rates, lower tenant turnover, e-commerce resistance, and relative immunity to broader economic volatility.

This sustained demand, coupled with the asset class’s efficacy as an inflation hedge, exacerbated an acute inventory shortage. Owners increasingly retained these high-performing, income-producing assets, while restricted lending and the high cost of capital severely limited new development. Consequently, near-term investment activity remained constrained by a lack of available product and elevated financing costs.

Industrial investment activity

The industrial sector recorded nearly $5.3 billion in dollar volume transacted, representing a modest 4% year-over-year decrease. This contraction was primarily driven by the high cost of capital and lingering uncertainty regarding global trade policies, specifically concerning US tariffs. These headwinds necessitated a highly selective acquisition strategy among investors. Simultaneously, the market navigated a rebalancing of supply and demand. The latest Altus Group Canadian industrial market update reported that Toronto’s industrial availability rate decreased by 30 basis points year-over-year to 4.8%, while positive net absorption for two consecutive quarters signalled renewed, albeit cautious, demand for existing space.

A distinct bifurcation in demand emerged as the combination of increased total supply and subdued leasing activity on new inventory shifted leverage towards occupiers. This environment resulted in greater flexibility and more favourable rental rates, often requiring property owners to offer concessions to secure tenancies. Furthermore, the GTA saw an injection of nearly five million square feet of new supply, 70.3% of which remained unleased. This indicated a notable pullback in pre-leasing activity as market demand softened. With 34 projects totalling 8.6 million square feet currently under construction, of which 57.9% remains available, availability rates are expected to remain elevated as these developments reach completion.

Despite these short-term supply-side pressures and a challenging operating environment, the long-term fundamentals of the GTA industrial market remained robust. The region’s strategic location, dense population, and the sustained requirement for e-commerce and logistics infrastructure continued to underpin its underlying strength.

Multi-family investment activity

The multi-family sector recorded $2.2 billion in transaction volume, representing a marginal 5% year-over-year decrease. This contraction was primarily driven by the elevated cost of capital and persistent macroeconomic uncertainty. Simultaneously, the GTA condominium market faced historically low sales volumes as a disconnect between seller pricing and buyer expectations led to a record accumulation of unsold inventory. This surplus exerted downward pressure on both resale values and rental rates for newly completed units, providing a broader range of options for tenants and challenging the performance of traditional multi-family assets.

The sector also contended with a deepening housing affordability crisis. Elevated ownership costs continued to hamper prospective first-time buyers, sustaining high demand for rental accommodations. However, the influx of new condominium supply created a more competitive landscape for property owners, tempering rental income stability and limiting the potential for short-term capital appreciation. These heightened carrying costs and shifting supply dynamics prompted many investors to adopt a defensive posture, deferring new acquisitions in favour of preserving cash flow within existing holdings. Despite these headwinds, private investors remained the primary market participants, focusing on older assets with stable yields while institutional capital remained largely on the sidelines.

Office investment activity

The office sector observed a slowdown in investment volume, with the dollar volume transacted reaching $1.3 billion, representing a 19% year-over-year decrease. Investment activity was primarily concentrated within the Class AAA segment, as investors prioritized premium assets. This focus was driven by rising tenant demand and improving utilization rates, which signalled positive leasing momentum for the coming year.

Return-to-work mandates have had an increasing impact on occupancy shifts, particularly in the downtown core. Several major financial institutions and the Ontario provincial government formally implemented four-day in-office workweeks, with the provincial government scheduled to transition to a full five-day workweek requirement in January 2026.

This renewed focus on physical workspaces led to a tightening of the premium market. The latest Altus Group Canadian office market update reported that Toronto’s office availability rate decreased by 210 basis points to 16.7% year-over-year. Moreover, the downtown Class A availability rate fell by 430 basis points year-over-year to 13.7%. Leasing data further illustrated this flight to quality, with Class A office transactions involving 211 deals, totalling nearly 8.6 million square feet. In stark contrast, Class B office space comprised only 46 transactions, totalling nearly 1.1 million square feet, highlighting a significant bifurcation as aging, functionally obsolete buildings failed to meet modern corporate standards.

No new office completions were recorded during the fourth quarter. However, the development pipeline contained over two million square feet of space under construction, with only 18.2% remaining available for lease. These projects focused on evolving tenant requirements, such as collaborative environments, integrated technology, and wellness amenities. The primary market challenge involved reconciling this incoming supply with broader systemic shifts in office utilization patterns.

Hotel investment activity

The hotel sector recorded $594 million in dollar volume transacted, representing an 8% year-over-year increase. This growth was underpinned by strengthening market fundamentals and a consistent rise in demand. The sector benefited from a revitalized professional landscape and a robust recovery in high-volume tourism, which supported overall asset performance throughout 2025.

This upward trajectory was expected to persist as expanded return-to-office mandates fostered a resurgence in corporate travel and large-scale conventions. Furthermore, leisure tourism showed significant resilience, bolstered by the preliminary economic impact and infrastructure preparations associated with the upcoming 2026 FIFA World Cup and cultural festivals. Investors increasingly viewed the hospitality asset class as a strategic component of a diversified portfolio, favoured for its ability to adjust average daily rates in real-time to reflect shifting market conditions.

Land investment activity

The land sector, encompassing both residential and ICI land, experienced a significant contraction in investment activity. The total transaction volume by the fourth quarter of 2025 reached approximately $4.3 billion, marking a 20% decrease compared to the same period in the previous year. This downturn was particularly acute in the residential land and lots sector, which recorded a volume of $2.6 billion, a 24% year-over-year decline. Similarly, the ICI land sector recorded $1.7 billion in dollar volume transacted, representing a 12% decrease.

This broad-based deceleration reflected a pervasive hesitation among developers to advance both residential and commercial projects within the GTA. Several factors contributed to this cautious environment, including increased borrowing costs, high construction costs, and a complex regulatory landscape. In the residential segment, the slowdown in sales volume and softening rental growth further deterred new land acquisitions, as proponents re-evaluated the financial feasibility of future high-density developments, particularly with condominium apartments. Within the ICI segment, the lack of shovel-ready industrial land and the high cost of servicing existing parcels constrained activity, despite underlying demand for logistics and infrastructure. Collectively, these figures indicated a strategic pivot toward capital preservation as market participants awaited more favourable economic conditions.

Figure 2: Greater Toronto Area property transactions by asset class (2024 vs. 2025)

Notable Toronto property transactions

The following are the notable transactions for the Q4 2025 Toronto commercial real estate market update:

70 York Street, Old Toronto – Office

Representing the highest-value office transaction in 2025, this nearly 21,000 square-foot asset was acquired by a partnership between Desjardins Global Asset Management and the Desjardins Group Pension Fund. Of the $134.6 million total consideration, approximately $27.6 million was allocated to the purchase of a leasehold interest, resolving a previous land lease structure and granting the Desjardins entities 100% freehold ownership. Formerly known as the HSBC Building, the building reached an 80% vacancy rate following HSBC’s lease expiration in 2022. However, after KingSett Capital acquired the site in 2024, occupancy was restored to 92.5%. This transaction occurred as downtown Toronto experienced a resurgence in leasing activity driven by widespread return-to-office mandates throughout 2025.

6 Silver Maple Court, Brampton – Apartment

Lankin Investments purchased this 339-unit apartment complex from GWL Realty Advisors for $115 million. This transaction finalized a three-property portfolio made up of adjacent apartment buildings totalling $247 million in consideration and encompassing nearly 800 units. Situated on approximately six acres, the property offers infill development potential, aligned with Lankin Investments’ established acquisition strategies. At the time of the sale, the firm managed a portfolio exceeding $2 billion across 70 properties, including more than 6,200 apartments and a development pipeline of 2,500 additional units.

Armadale Square, Markham - Retail

BentallGreenOak (BGO) purchased this almost 143,000-square-foot retail property for $407 per square foot, marking the largest retail transaction of the quarter. The asset was fully leased at the time of the sale, anchored by a major Asian grocer and a tenant roster of national retailers, including Shoppers Drug Mart, Mark’s, and Winners. The acquisition followed BGO’s purchase of Rockwood Mall in Mississauga in August 2025, which stood as the second-largest retail transaction of the year. These investments underscored the firm’s strategic expansion into the Canadian retail sector, predicated on the asset class’s resilience against e-commerce growth and post-pandemic volatility.

34-70 Montgomery Avenue, Old Toronto – Residential land

Graywood Developments acquired this 0.75-acre land assembly, comprising 13 parcels, for $42 million. Applications for an Official Plan Amendment, Rezoning, and Site Plan Approval were submitted to the City of Toronto in 2022 and remained under review during the acquisition period. The proposed development envisioned a purpose-built rental project featuring 335 residential units, representing a land cost of approximately $125,373 per buildable unit. This project was supported by the City of Toronto’s Purpose-Built Rental Housing Incentives Stream, launched in November 2024 to accelerate housing supply. As of September 2025, over 44 similar projects were active in the construction phase, promising approximately 7,100 purpose-built rental units.

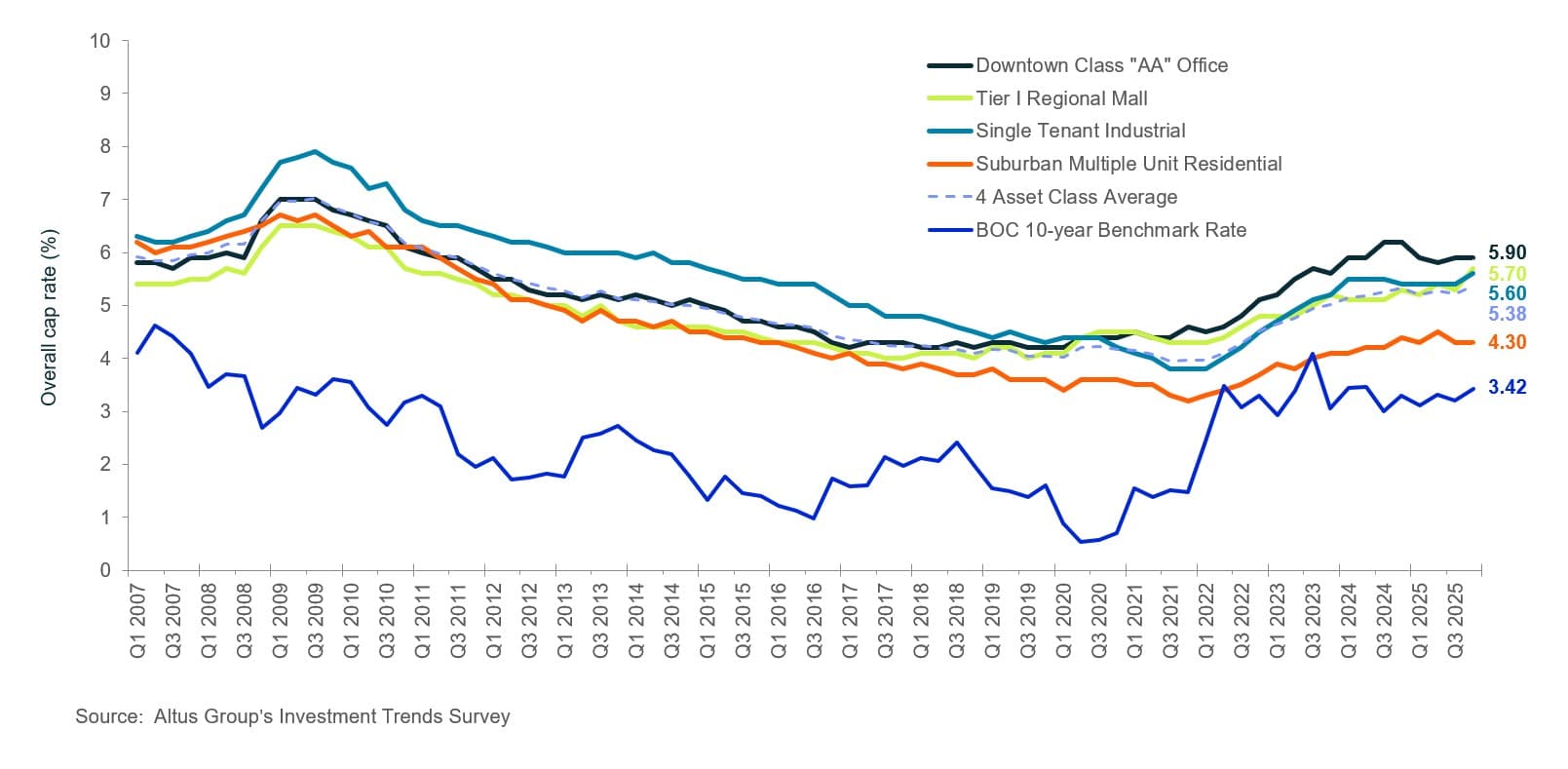

Figure 3: Greater Toronto Area OCR trends across 4 benchmark asset classes

Looking ahead

The GTA commercial real estate market enters 2026 positioned for a phase of disciplined growth. While geopolitical tensions and trade uncertainties remain focal points, Canada’s historical track record in navigating complex cross-border relations through frameworks like CUSMA suggests a capacity for effective risk mitigation. This experience provides a degree of market stability, indicating that while external pressures may persist, they are unlikely to derail the region’s broader economic long-term trajectory.

Investor sentiment is shifting toward a more neutral, balanced posture. The apparent conclusion of the BoC’s easing cycle has improved interest rate predictability, facilitating a gradual narrowing of the bid-ask spread and enabling more consistent underwriting. Consequently, 2026 is expected to see a gradual, albeit highly selective, deployment of capital. Institutional interest will likely remain concentrated in core, defensive sectors such as food-anchored retail and logistics that offer insulation against broader market fluctuations.

Furthermore, the GTA’s long-term fundamentals, including its status as a primary North American financial and technological hub, continue to underpin asset values. Even as domestic immigration policies undergo significant revisions to moderate growth, the region maintains a structural demand for high-quality space across most asset classes. As the market moves past the volatility of 2025, the outlook for 2026 is one of measured re-entry, with investors prioritizing stable yields and capital preservation within a stabilizing yet complex macroeconomic environment.

Want to be notified of our new and relevant CRE content, articles and events?

Disclaimer

This publication has been prepared for general guidance on matters of interest only and does not constitute professional advice or services of Altus Group, its affiliates and its related entities (collectively “Altus Group”). You should not act upon the information contained in this publication without obtaining specific professional advice.

A number of factors may influence the performance of the commercial real estate market, including regulatory conditions and economic factors such as interest rate fluctuations, inflation, changing investor sentiment, and shifts in tenant demand or occupancy trends. We strongly recommend that you consult with a qualified professional to assess how these and other market dynamics may impact your investment strategy, underwriting assumptions, asset valuations, and overall portfolio performance.

No representation or warranty (express or implied) is given as to the accuracy, completeness or reliability of the information contained in this publication, or the suitability of the information for a particular purpose. To the extent permitted by law, Altus Group does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. The distribution of this publication to you does not create, extend or revive a client relationship between Altus Group and you or any other person or entity. This publication, or any part thereof, may not be reproduced or distributed in any form for any purpose without the express written consent of Altus Group.

Authors

Jennifer Nhieu

Senior Research Analyst

Lucy Wu-Yu

Market Analyst

Authors

Jennifer Nhieu

Senior Research Analyst

Lucy Wu-Yu

Market Analyst

Resources

Latest insights