Montreal commercial real estate market update – Q3 2023

For the latest Montreal commercial real estate market update, click here.

Key highlights

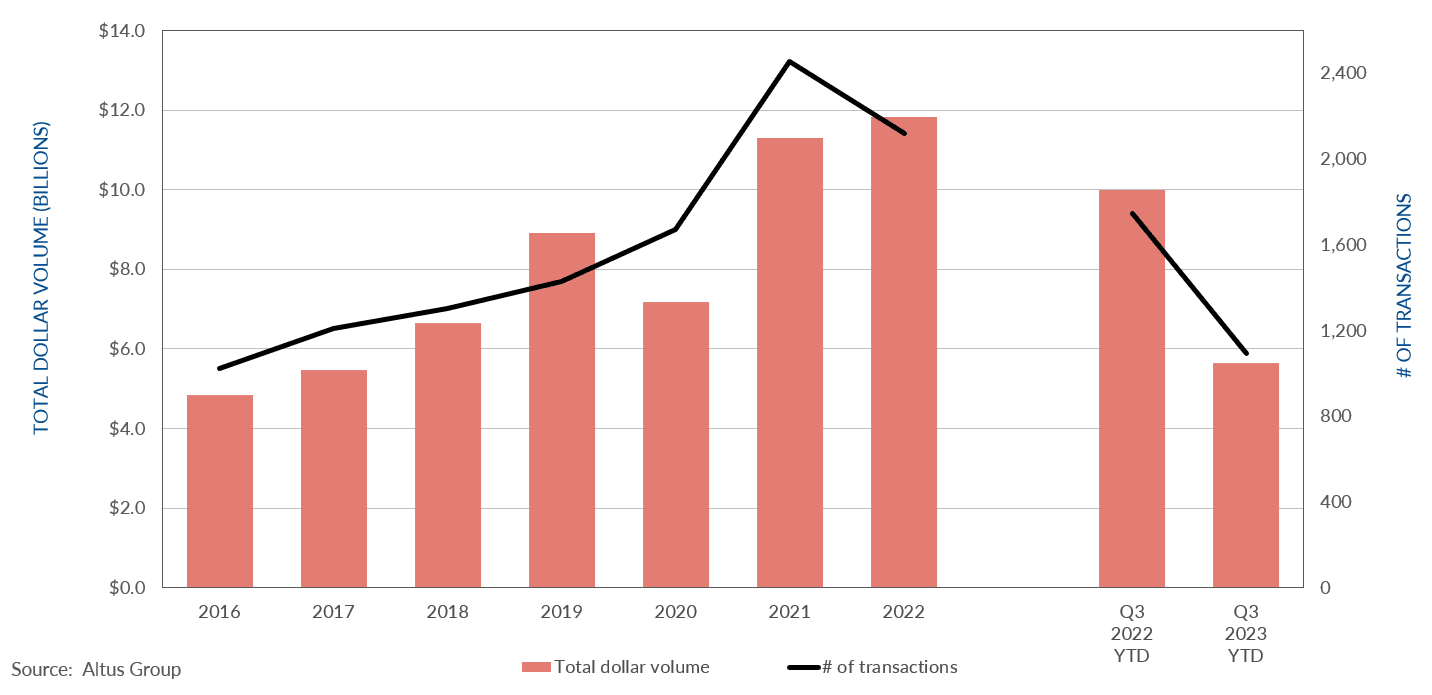

Commercial investment activity in Montreal continued to slow down by the third quarter, with $5.7 billion in dollar volume transacted year-to-date

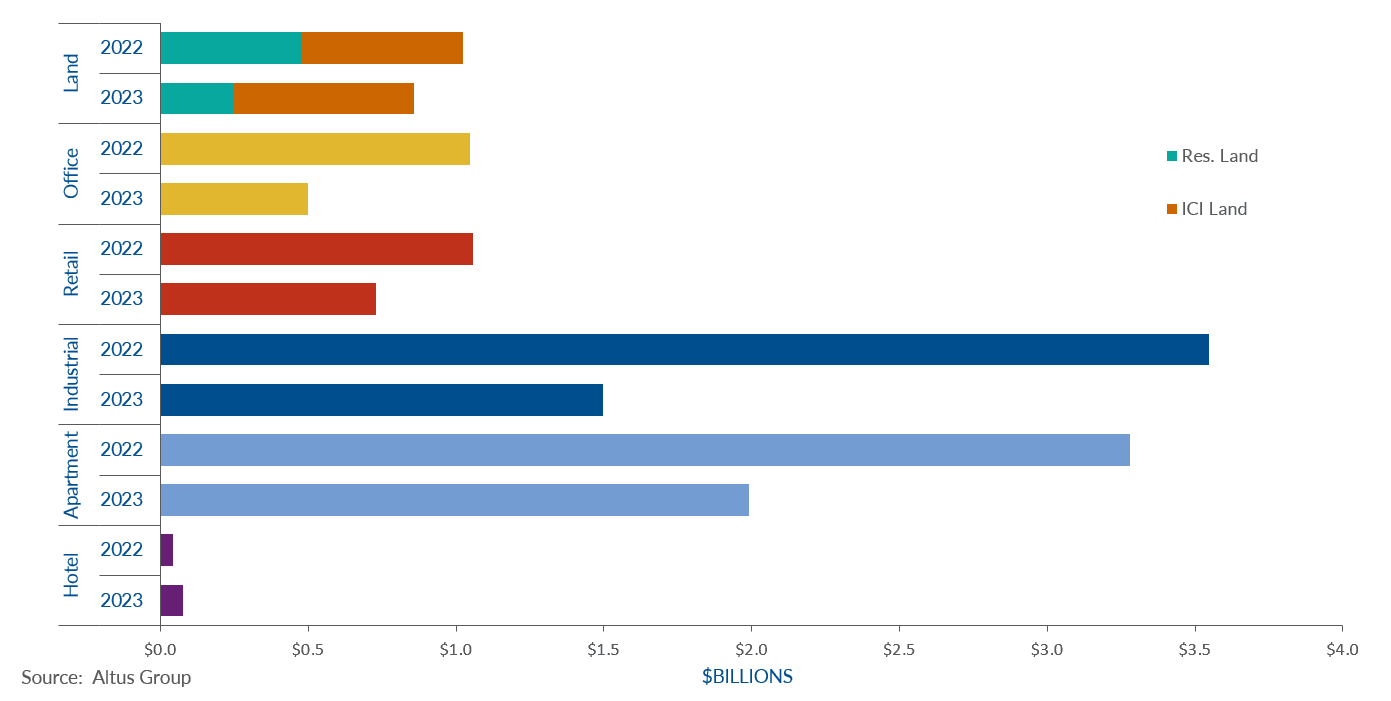

Land investment transactions fell to $858 million, a decrease of 16% year-over-year

The residential land sector continued to soften, with a 49% decrease in investment volume year-over-year

Similar to other Canadian markets, demand in the multi-family sector continued to grow at an aggressive pace, primarily due to a nationwide housing affordability crisis

The office market posted $498 million in dollar volume transacted, a 53% decline year-over-year

The industrial sector reported $1.5 billion in dollar volume transacted, a 58% decrease year-over-year

Retail investment transactions dropped to $728 million, a decline of 31% year-over-year

Montreal market continued to slow down into the third quarter of 2023, with transactions down 44%

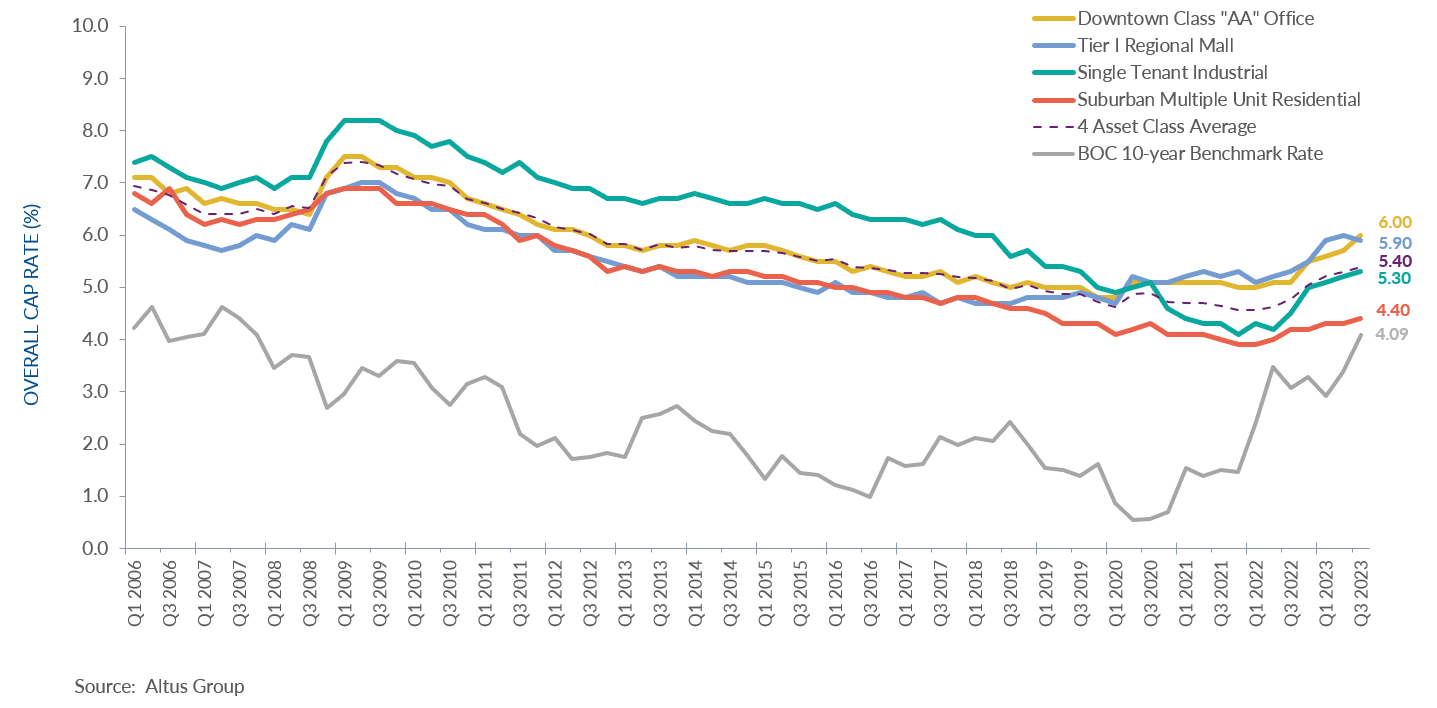

Commercial investment activity in Montreal continued to slow down by the third quarter, with $5.7 billion in dollar volume transacted year-to-date, a 44% decrease year-over-year. High interest rates and inflationary pressures have softened demand as investors continued through the price discovery phase with heightened caution. According to Altus Group’s most recent Investment Trends Survey, Montreal reported a negative momentum ratio, which indicated the market remained favourable to sellers. Moreover, cap rate expectations continued to trend higher for all assets except tier I regional mall.

Figure 1 - Montreal property transactions - All sectors by year

Land investment transactions fell to $858 million, a decrease of 16% year-over-year, as higher interest rates and borrowing costs led to a slowdown in new projects entering the construction pipeline. The residential land sector continued to soften, with a 49% decrease in investment volume year-over-year. In comparison, ICI land saw a 12% increase in investment volume as investors continued to see stability within industrial and some commercial products.

The apartment sector led the pack and recorded nearly $2 billion in dollar volume transacted, though this was down 39% year-over-year. Similar to other Canadian markets, demand in the multi-family sector continued to grow at an aggressive pace, primarily due to a nationwide housing affordability crisis. However, adjustments to higher financing costs have resulted in a pullback in transaction volume in the sector. Investors have opted to hold onto their multi-family products until financial conditions improve.

The office market posted $498 million in dollar volume transacted, a 53% decline year-over-year. This also marks the sector’s third consecutive quarter of negative net absorption. Furthermore, according to Altus Group’s most recent Canadian Office Market Update, the office availability rate rose 0.7 percentage points to 18.2% over the past year. Sublet space was down 1.2 percentage points to 14.0% as tenants continued to rightsize their office space amid economic uncertainty and the increased prevalence of hybrid work arrangements. Moreover, the market saw no office completions for the third quarter. Approximately 1.6 million square feet is currently under construction, with 70% pre-leased.

The industrial sector reported $1.5 billion in dollar volume transacted, a 58% decrease year-over-year. According to Altus Group’s most recent Canadian Industrial Market Update the industrial availability rate rose to 4.6% from 3.6% year-over-year. Furthermore, Montreal saw approximately 275,000 square feet of new supply enter the market with no pre-leasing activity. In addition, 2.7 million square feet of industrial space is currently under construction, with over half pre-leased. The pre-leasing activity demonstrated that the demand for industrial space has begun to moderate.

Retail investment transactions dropped to $728 million, a decline of 31% year-over-year. As the hybrid work model has become a permanent fixture for many Canadian workplaces, people have spent more time at home and in their local neighbourhoods. According to Altus Group’s most recent Investment Trends Survey, food-anchored retail strips in Montreal were the top product/market combination sought by investors. Neighbourhood-level retail centres typically lease to essential businesses and, as a result, have garnered interest from investors for their resilience to economic uncertainty and the impact of e-commerce.

Figure 2 - Montreal property transactions by asset class (YTD Q3 2022 vs. YTD Q3 2023)

Investors have approached the start of the second half of 2023 with cautious optimism, citing higher interest rates, inflationary pressures, and cost of capital remained as their top concerns. As a result, multi-family, industrial, and neighbourhood-level shopping centres continued to make up the majority of investment activity in the market as investors continued to hold onto and rebalance their portfolios with stable, low-risk forms of real estate.

Figure 3 - Montreal OCR trends across 4 benchmark asset classes

Notable Q3 2023 transactions

5400-5750 Thimens Boulevard – Industrial

At the end of September, Manulife sold two industrial asset properties to BentallGreenOak in a deal worth $43.6 million. Anchored by tenants such as Diverse Electronics and Ernest Green & Son, this deal in Saint-Laurent represents a total price per square foot of $185. 5400-5750 Thimens Boulevard contains 236,000 square feet spread across eleven acres of industrial space. This acquisition is BentallGreenOak’s twentieth property in the borough of Saint-Laurent, representing over 40% of its portfolio in the province of Québec.

2532-2534 Michel-Brault Place – Apartment

One of the largest transactions of the quarter saw Hazelview Investments acquire three senior residences known as Sélection Rosemont, totaling 582 units. Located in the borough of Rosemont-La Petite-Patrie, this transaction concluded for approximately $136.1 million, representing a price per unit of $233,826. The Hazelview team also actively manages multiple other multi-family properties around Montreal.

9200-9300 Transcanadienne Highway (A-40) – Industrial

The largest industrial transaction of the quarter saw Equinix REIT acquire the Centre Hypertec building for $121.5 million. With 575,795 square feet of office, industrial, and data centre space, this sale represented a price per square foot of $211. Known as the M1T Montréal IBX Data Center, this facility was originally built around 1974 and is currently home to multiple cloud service providers collocated on the premises. This acquisition added a second property to the purchaser’s portfolio of telecommunication facilities in the province of Québec.

Authors

Jennifer Nhieu

Senior Research Analyst

James Sosner

Senior Market Analyst

Authors

Jennifer Nhieu

Senior Research Analyst

James Sosner

Senior Market Analyst

Resources

Latest insights