Key highlights

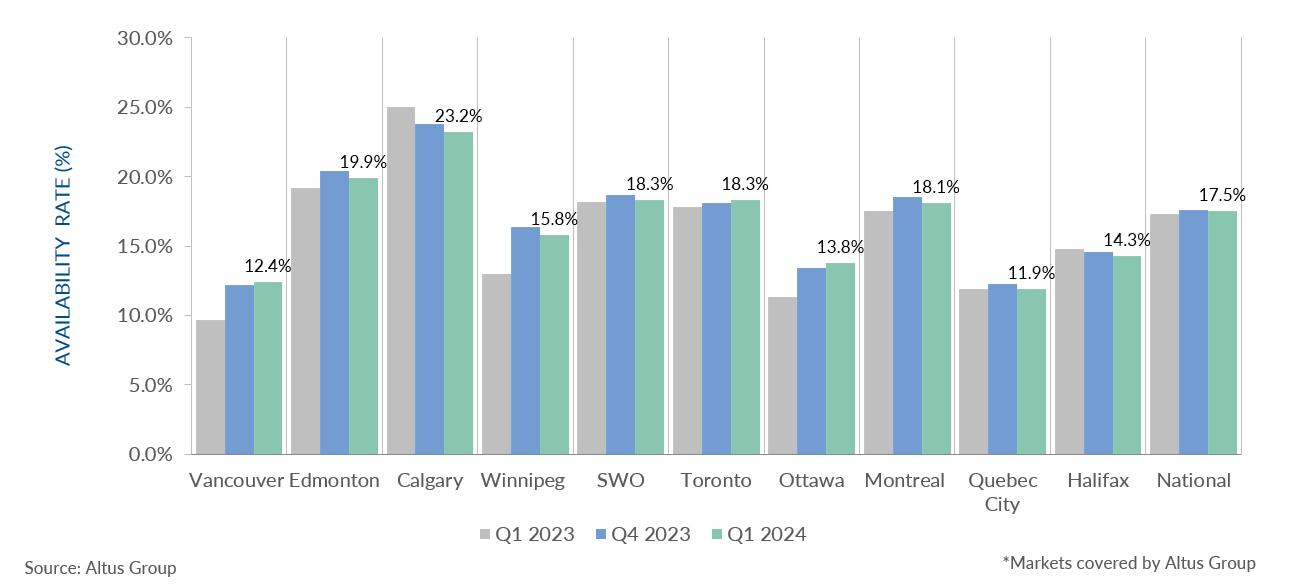

In the first quarter of 2024, the national office availability rate across Canada stabilized at 17.5%

The hybrid work model has cemented itself as a preferred work arrangement, as the share of workers with hybrid arrangements has more than tripled since the start of the pandemic

The Quebec market reported the lowest office availability rate at 11.9%, followed by Vancouver and Ottawa, respectively

The Calgary market continued to record the highest availability at 23.2%

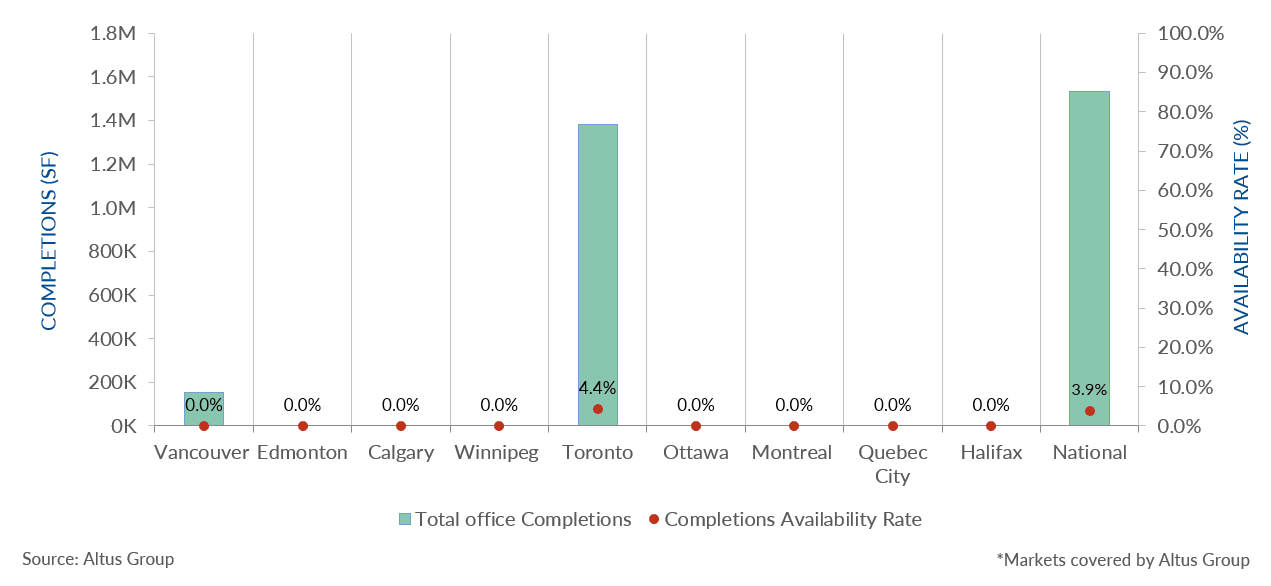

As of the first quarter of 2024, 5 office buildings were completed, with Toronto leading the country in the total completed office buildings

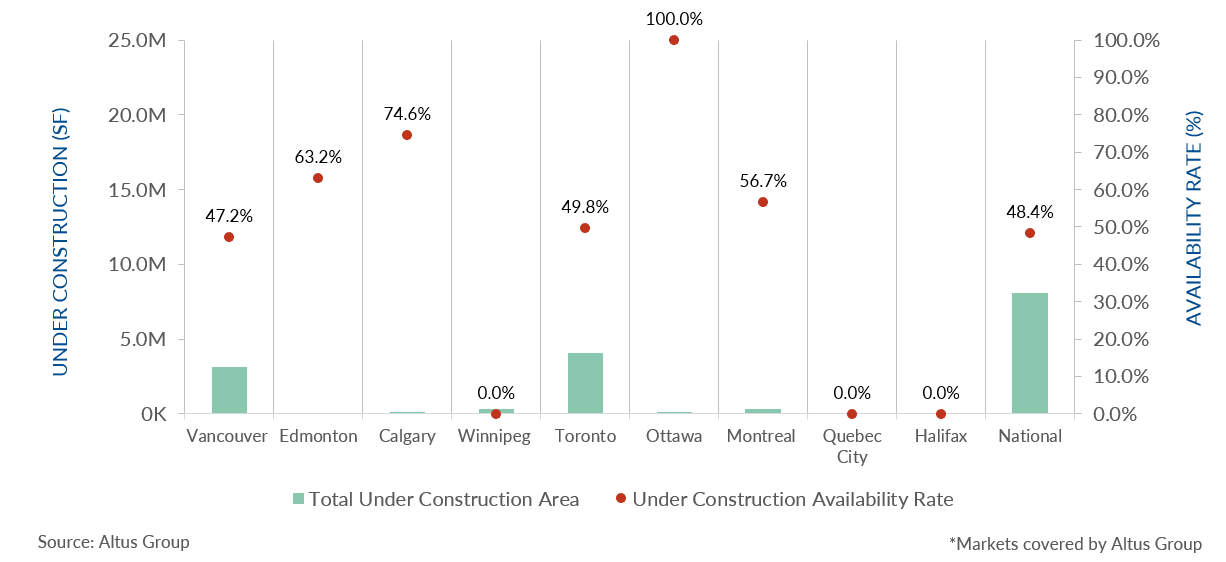

Nationally, 50 office projects were under construction in Q1 2024, totalling 8.1 million square feet, with 52% pre-leased

To read the latest Canadian Office Market update, please click here.

Office availability rates remained flat across Canada

In the first quarter of 2024, the national office availability rate across Canada stabilized at 17.5% for the fourth consecutive quarter (Figure 1), as sublet space steadily decreased. Furthermore, according to Statistics Canada, the hybrid work model has cemented itself as a preferred work arrangement, as the share of workers with hybrid arrangements has more than tripled since the start of the pandemic.

Office leasing transactions continued to be predominately skewed toward Class-A buildings compared to Class-B and C buildings as businesses prioritized high-quality, amenitized spaces located in centralized areas. This phenomenon, which has been dubbed the “flight to quality”, has been a component in the discussion of adaptive reuse, specifically office-to-residential conversion.

According to Statistics Canada’s Labour Force Survey (LFS), as of March 2024, employment remained virtually unchanged (-2,200, -0.0%), as population growth continued to outpace employment growth. In addition, the unemployment rate increased slightly by 0.3 percentage points to 6.1%, due to softening in the accommodation, food services and retail trade. Gains in employment were noted primarily in health care and social assistance. Meanwhile, losses in employment were led by accommodation and food services.

Figure 1 - Office availability (Q1 2023 vs. Q4 2023 vs. Q1 2024)

The Quebec market reported the lowest office availability rate at 11.9%, followed by Vancouver and Ottawa, respectively (Figure 1). The Calgary market continued to record the highest availability at 23.2%; however, at the same time, Calgary has continued to observe declines in its availability rate. This downward trend is primarily due to the city’s Downtown Calgary Development Incentive Program, which has assisted in gradually removing underutilized and vacant spaces from the market’s inventory and increasing leasing activity. Other major markets across Canada have begun to explore the creation of incentive programs to subsidize private office conversions, but current economic conditions have presented numerous challenges to its design.

Figure 2: Office completions and availability (Q1 2024)

As of the first quarter of 2024, 5 office buildings were completed. Toronto leads the country in the total completed office buildings, with 2 office buildings totalling 1.4 million square feet, including the completion of the Cadillac Fairview’s office tower in downtown Toronto (Figure 2).

Figure 3: Office under construction and availability (Q1 2024)

With office vacancies continuing on an upward trend, the demand for office space has diminished and no new significant large office towers have been announced. Nationally, 50 office projects were under construction in the first quarter of 2024, totalling 8.1 million square feet, with 52% pre-leased (Figure 3). Vancouver and Toronto led the country with the highest number of office projects under construction, 23 and 17 projects, totalling 3.1 and 4.1 million square feet, respectively.

Conclusion

As the hybrid work arrangement has observed an upward momentum since 2022, landlords and businesses have responded with the optimization of office space and human resources to reduce expenses. Furthermore, the economic slowdown and rising uncertainty have led to investors and developers adopting a pens-down approach to new office project developments. Demand for office space in Canada is expected to remain strong for newer and well-located office buildings in 2024, while landlords work to secure new and existing tenants.

Authors

Jennifer Nhieu

Senior Research Analyst

Ray Wong

Vice President, Data Solutions

Authors

Jennifer Nhieu

Senior Research Analyst

Ray Wong

Vice President, Data Solutions

Resources

Latest insights