Calgary commercial real estate market update - Q1 2024

Our quarterly update of Calgary’s commercial real estate market, including the most notable transactions.

Key highlights

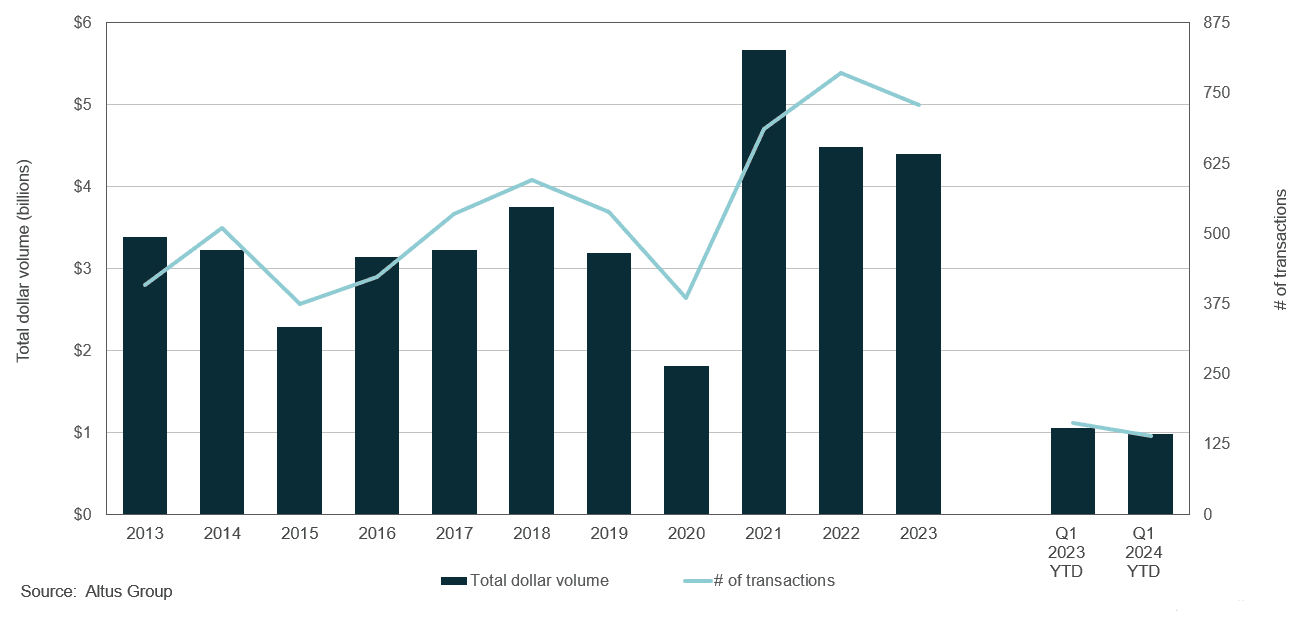

The Calgary market displayed remarkable resilience in the first quarter, with $982 million in dollar volume transacted, down 7% year-over-year (YoY), a minimal decline compared to other major markets across Canada

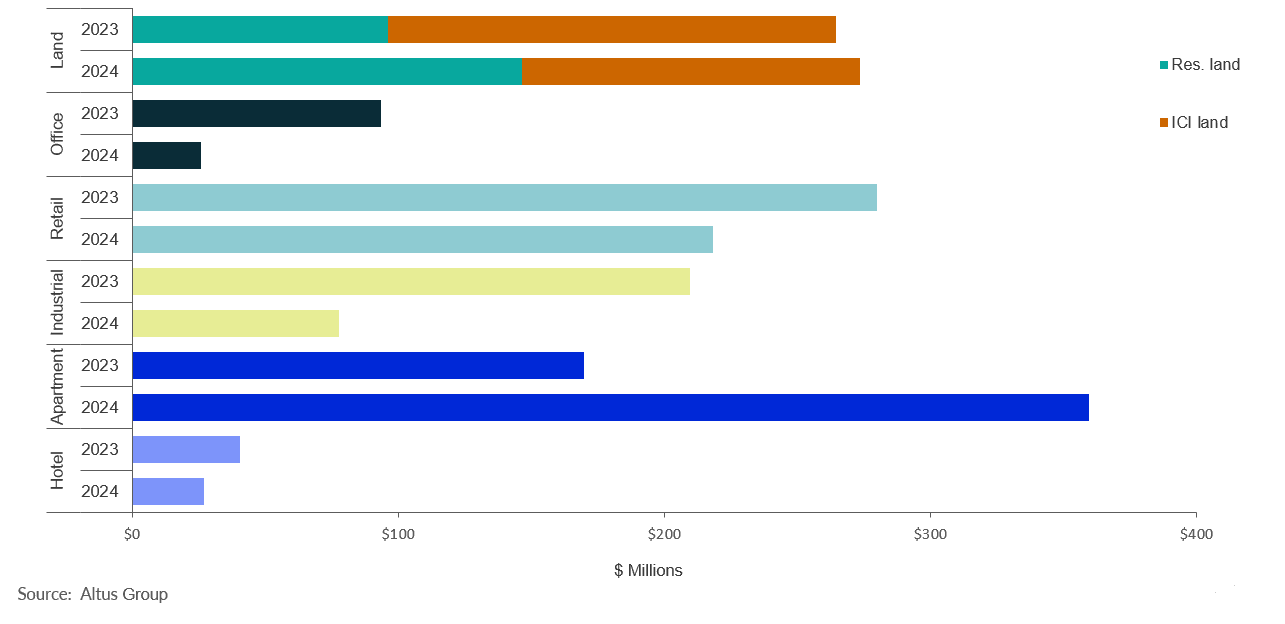

Despite the higher interest rate environment, Calgary reported $360 million in multi-family transaction volume, a 112% increase YoY

Office leasing activity has slowed as demand weakens; to this effect, Calgary’s office sector posted $26 million in dollar volume transacted, a 72% decrease YoY

The demand for industrial products has eased towards more balanced conditions, with $78 million in dollar volume transacted, a 63% decrease YoY

The retail sector experienced a slowdown in the first quarter of 2024, with $218 million in dollar volume transacted, a 22% decrease YoY

Residential land posted $147 million, while the ICI land posted $127 million, a 53% increase and a 25% decrease YoY, respectively

For the latest Calgary commercial real estate market update, click here.

The Calgary market observed a minimal decline of 7% in investment activity as healthy fundamentals sustained demand for multi-family and residential land assets

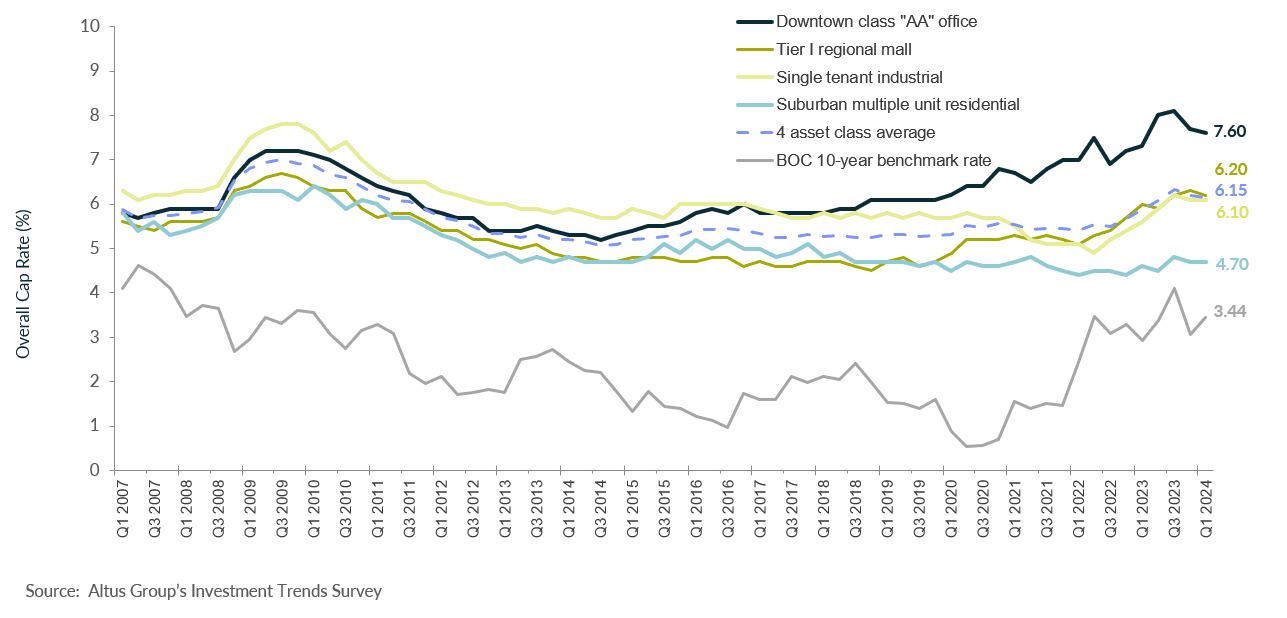

While economic headwinds have remained a challenge, the Calgary market displayed remarkable resilience in the first quarter, with $982 million in dollar volume transacted, down 7% year-over-year (YoY), a minimal decline compared to other major markets across Canada. Demand for multi-family assets remained strong as Alberta smashed population growth records and saw steady employment gains. According to Altus Group’s latest Canadian CRE Investment Trends Survey, Calgary’s top property type was suburban multiple-unit residential. Moreover, Calgary has continued to spearhead office-to-residential conversions, with ‘The Cornerstone’ building completed in the first quarter featuring 112 residential units and both retail and co-working space.

Figure 1 - Property transactions - All sectors by year

Despite the higher interest rate environment, Calgary reported $360 million in multi-family transaction volume, a 112% increase YoY. As previously mentioned, Alberta’s record-breaking population growth has continued to drive demand for multi-family products. This trend was reflective of Canadians seeking better economic conditions as the rising cost of living has driven them away from major urban centres. Rental market conditions are expected to tighten further as multiple-unit residential inventory remains low.

Office leasing activity has slowed as demand weakens; to this effect, Calgary’s office sector posted $26 million in dollar volume transacted, a 72% decrease YoY. Rightsizing efforts persisted in response to the continued popularity of hybrid work arrangements and the preference for Class-A buildings. This trend has resulted in office underutilization, with Class-C and some B buildings becoming functionally obsolete. Calgary has remained proactive in addressing its vacant office space with support from the Downtown Development Incentive Program. Altus Group’s Q1 2024 Canadian office market update indicated that Calgary’s availability rate decreased by 60 basis points to 23.2%.

The demand for industrial products has eased towards more balanced conditions, with $78 million in dollar volume transacted, a 63% decrease YoY. This slowdown in investment volume can be attributed to new supply outpacing transaction activity. However, it is important to note that Calgary remained a favourable destination for industrial investment activity, as the market’s lower land prices, abundant developable land, and streamlined approval processes have resulted in spillover demand from other provinces.

The retail sector experienced a slowdown in the first quarter of 2024, with $218 million in dollar volume transacted, a 22% decrease YoY. This slowdown came after the market reported more than triple the volume in 2023 compared to 2022. Population growth has provided the market with a surge in consumer spending. While the cost of living is more affordable in Calgary compared to other Canadian markets, worsening economic conditions have put pressure on discretionary spending, with investors focused on food-anchored retail properties as they remain resilient amid the unfavourable economic conditions and the negative impact of e-commerce.

Land sales have flattened, with nearly $274 million in dollar volume transacted, a 3% increase YoY. The residential land posted $147 million, while the ICI land posted $127 million, a 53% increase and a 25% decrease YoY, respectively. Positive economic and demographic conditions, as well as low vacancy rates on multiple-unit residential properties, have increased demand for residential land. Meanwhile, ICI land has observed a pullback in activity in response to slowing developments in the industrial and retail sectors.

Figure 2 - Property transactions by asset class (Q1 2023 vs. Q1 2024)

Notable Q1 2024 transactions

15, 20, 50, 55 & 110 Quarry Street East, 11, 30, 31 & 45 Bow Street Common, 80 Bow Street, and 371 Railway Street West (The Quarry) – Retail

Comprised of a 16-building retail complex spread over 33 acres of land, Edmonton-based Springwood Land Corporation divested The Quarry shopping district in January 2024. Situated in the suburbs of Cochrane, Rosedale Developments (headquartered in Edmonton) acquired the approximately 374,000-square-foot power centre for $138,670,638. Constructed in 2014 on brownfield land that once housed a wood treatment facility, the transaction represented the largest Calgary retail transaction in the first quarter of 2024.

141 and 181 Skyview Bay NE (Skyward Living 1 & 2) – Apartment

Acquired in a portfolio transaction at the tail end of the first quarter, Montreal-based private equity firm, Ferrovia Capital purchased the Skyward Living apartment portfolio for $103 million at 141 and 181 Skyview Bay NE (Skyward Living 2 & 1, respectively). Anderson Builders Group, headquartered in Edson, Alberta, sold the two buildings for a price per unit of $271,890. This transaction represented the largest apartment transaction of the quarter and the third largest in the past five years. The deal showcases continued confidence in Alberta as an investor-friendly province amidst a prolonged period of high interest rates and tight bank lending standards.

3111 Shepard Place SE – Industrial

With a sale price of $15.5 million, ATCO Group acquired the five-building facility, located at 3111 Shepard Place SE. Consisting of a main manufacturing building of over 71,000 square feet and four ancillary buildings, GILLFOR Distribution disposed of the nearly 108,000-square-foot industrial facility for a price per square foot of $144 in March 2024. This divestiture represented the largest industrial sale of the first quarter of 2024.

2750 Sunridge Boulevard NE (Emerald Hotel & Suites Calgary Airport) – Hotel

In January 2024, The Emerald Hotel & Suites Calgary Airport transacted for a consideration of $15 million. Constructed in 1982, Walia Hospitality Group disposed of the six-storey, 203-room hotel for a price per room of $73,892. The building is situated about 20 minutes from the Calgary International Airport and represented the largest hotel transaction in the Calgary region in the first quarter of 2024.

Figure 3 - Property transactions by asset class (Q1 2023 vs. Q1 2024)

Conclusion

Elevated interest rates have slowed investment volume in major markets across Canada. However, Calgary weathered macroeconomic headwinds and remained an attractive destination for investors. Multi-family and residential land comprised over half the total dollar volume in the first quarter, as the market continued to be supported by strong underlying demographic and economic fundamentals. Looking ahead, gradual interest rate cuts will likely improve investor sentiment and pick up growth in 2025.

Want to be notified of our new and relevant CRE content, articles and events?

Authors

Jennifer Nhieu

Senior Research Analyst

Garren Sharpe

Senior Market Analyst, Data Solutions

Authors

Jennifer Nhieu

Senior Research Analyst

Garren Sharpe

Senior Market Analyst, Data Solutions

Resources

Latest insights