Calgary commercial real estate market update - Q2 2025

Calgary’s CRE market saw $2.6B in Q2 2025 deals, with industrial and office strengthening while retail, multifamily, and land cooled from last year’s spike.

Key highlights:

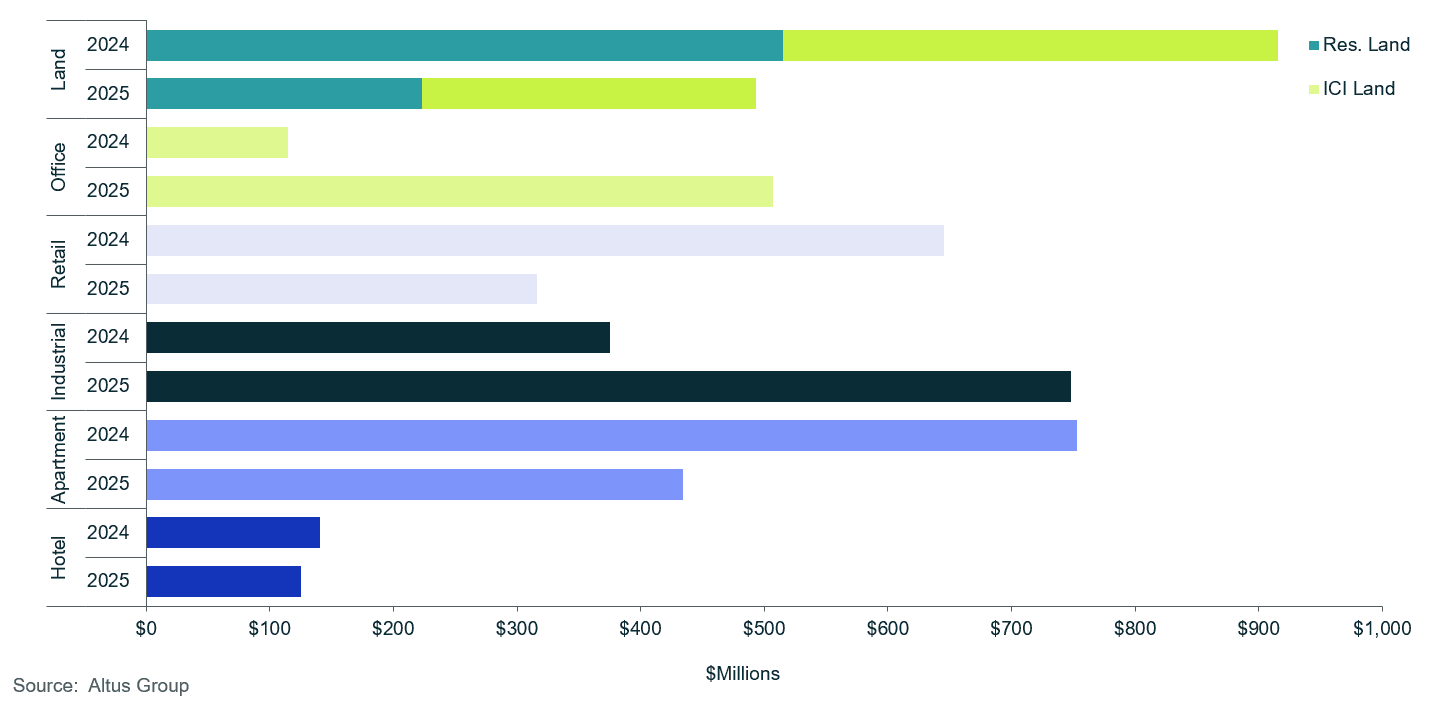

In the first half of 2025, Calgary reported a contraction in investment activity, with $2.6 billion in dollar volume transacted, an 11% year-over-year decrease

Despite a 51% year-over-year decrease, the retail sector remained strong by historical standards, with $316 million in dollar volume transacted

The industrial sector saw a nearly doubled year-over-year increase, recording $748 million in dollar volume transacted

Although the multifamily sector faced a 42% year-over-year decrease, multifamily remained robust by historical standards, with $435 million in dollar volume transacted

The office sector experienced a significant 344% year-over-year increase, with $507 million in dollar volume transacted

The land sector recorded $493 million in dollar volume transacted, down 46% year-over-year.

The residential land sub-sector recorded $223 million in dollar volume transacted, while the ICI land sub-sector recorded $270 million, down 57% and 33% year-over-year, respectively

In the first half of 2025, Calgary saw a contraction in commercial investment, marking an 11% decrease year-over-year

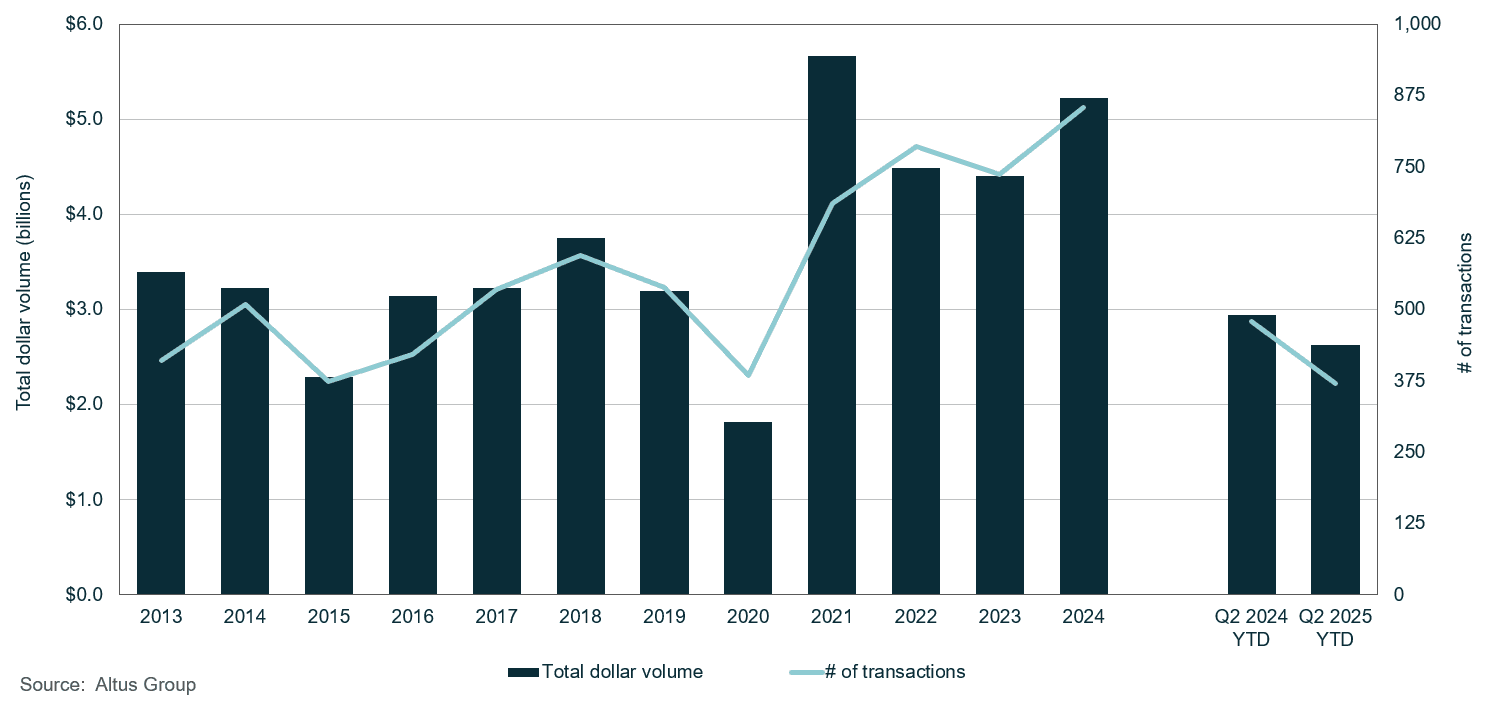

The Calgary commercial real estate market experienced a modest decrease in investment activity during the first half of 2025. This downturn was primarily attributable to heightened geopolitical trade tensions and prevailing weakness in domestic economic conditions. The total dollar volume transacted for the period reached $2.6 billion, representing a 11% decline year-over-year (Figure 1).

Figure 1: Calgary property transactions - All sectors by year

A significant factor contributing to the year-over-year decline was an anomalous pull-forward of investment activity that had occurred in the second quarter of 2024. Anticipation of a proposed, and subsequently cancelled, increase in the capital gains inclusion rate motivated investors to expedite the finalization of transactions. This reactive surge created an unusually high spike in volume in the preceding year, which in turn caused the first half of 2025 to appear disproportionately subdued in comparison. The earlier volume, therefore, was not reflective of underlying, sustainable market strength.

The market also contended with geopolitical uncertainties, particularly regarding potential tariffs from the US, which further constrained economic activity and potentially exacerbated domestic inflationary pressures within Canada. Consequently, the Bank of Canada (BoC) maintained its key interest rate at 2.75%. These cumulative economic and political factors collectively led investors to adopt a more risk-averse posture regarding capital deployment, delaying significant investment decisions until greater clarity emerged.

While investment volume was impacted, Calgary was less affected when compared to higher-priced, larger markets, such as Toronto and Vancouver, which encountered greater volatility and steeper decreases in investment activity. Alberta’s sustained population growth and its comparative affordability for business operations effectively buffered the economic headwinds. The market recorded $1.1 billion in dollar volume transacted during the second quarter of 2025, a figure that represented a higher-than-average second-quarter volume when compared to equivalent periods in 2023 and 2022. This performance highlighted the underlying demographic foundation that provided a crucial basis for commercial real estate stability.

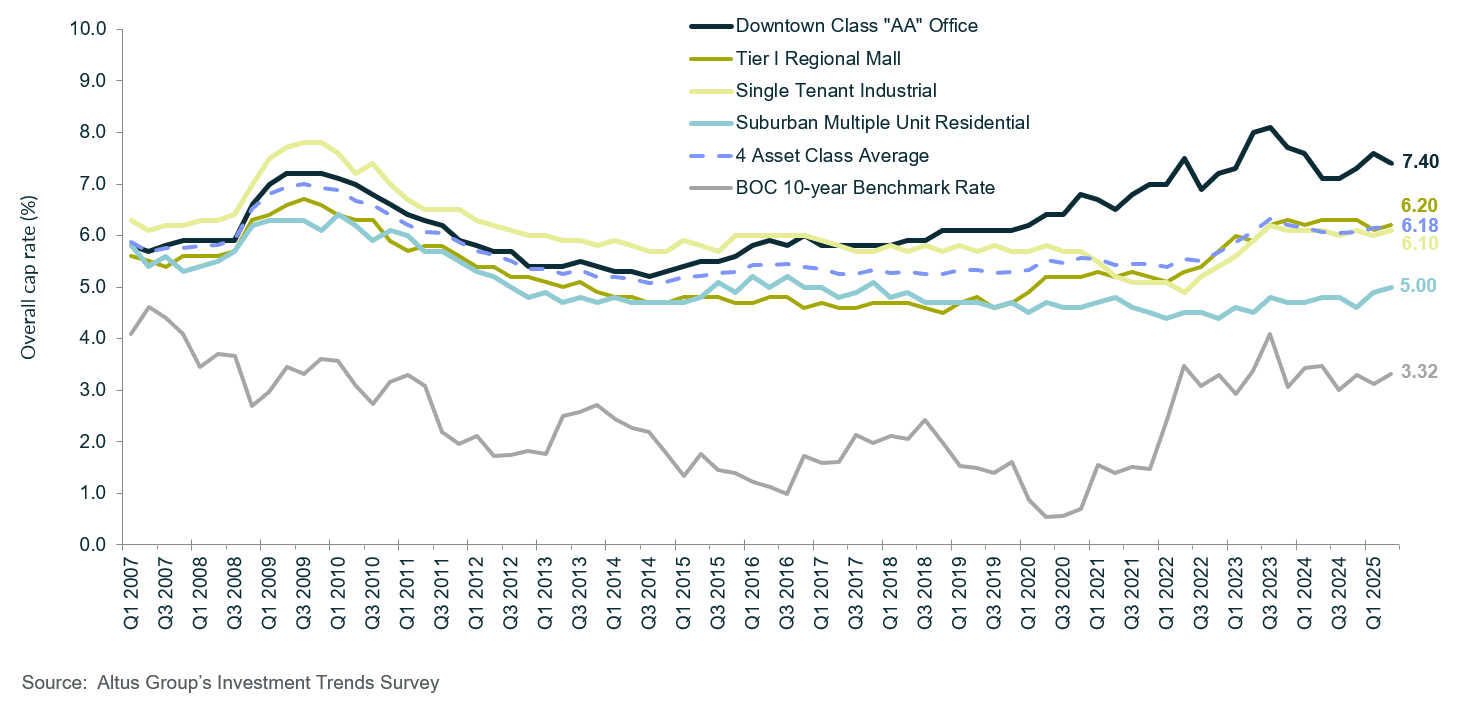

Investors continued to exhibit a pronounced preference for high-quality, well-located industrial and office assets. Calgary has garnered substantial attention as a strategic hub for affordable logistical operations and for its efforts in spearheading office-to-residential conversions through its Downtown Calgary Development Incentive program. This increased scrutiny contributed to an upward trajectory in industrial and office investment volume during the first half of 2025. Calgary maintained its fourth-place ranking in investor preference, according to Altus Group’s Q2 2025 Canadian Investment Trends Survey (ITS), attesting to the market’s enduring attractiveness. Strategically, investors favoured food-anchored retail strips as the top preferred product type. This preference reflected a clear appetite for stable assets with robust income-generating potential, which were often underpinned by essential services and resilient demographic demand.

Retail

The retail sector recorded approximately $316 million in dollar volume transacted, a notable 51% decrease year-over-year. However, this seemingly subdued transaction activity was misleading when considered in its historical context. Although Calgary’s retail sector experienced a record-high investment volume in the second quarter of 2024, when compared against historical benchmarks, the investment volume in 2025 appeared robust and consistent with national trends.

Altus Group’s Q2 2025 Canadian ITS highlighted that food-anchored retail strips were the top choice for investors in the Calgary market. The popularity of these assets stemmed from their inherent stability, fuelled by steady consumer demand for essential goods and services. This consistent demand ensured reliable cash flow, enabling these investments to withstand broader economic downturns and mitigate the disruptive impacts caused by e-commerce. Their steady performance over recent years has established them as a staple in many investment portfolios.

Despite this increasing investor demand for defensive, income-generating assets, Calgary’s retail market remained exceptionally tight, particularly regarding food-anchored retail strips. This scarcity limited acquisition opportunities for investors seeking to deploy capital into this high-demand segment.

Industrial

Despite the pervasive economic headwinds influencing the broader market, Calgary’s industrial sector successfully countered the national trend of waning investment activity. The sector recorded nearly $748 million in dollar volume transacted, representing a substantial 99% increase year-over-year, underscoring the city’s enduring appeal as a strategic hub for industrial operations.

On the development front, only one fully leased building, totalling 660,000 square feet, reached completion during the period. Concurrently, only six industrial spaces, totalling nearly 1.8 million square feet, remained under construction. Of this future supply, 55% of the space remained available for lease, signalling weaker pre-leasing activity and suggesting that prospective occupiers were adopting a more cautious approach to new commitments.

This shift in activity supported a rebalancing of the market’s supply and demand equilibrium. According to Altus Group’s Q2 2025 Canadian industrial market update, Calgary’s industrial availability rate increased by 50 basis points year-over-year to 6.5%. This increase contributed to more stable market conditions after several years of substantial speculative development, reflecting a necessary adjustment as new space came online.

Multifamily

The multifamily sector experienced a notable slowdown, with nearly $435 million in dollar volume transacted, a 42% decrease year-over-year. As was the case in other sectors, this figure was potentially misleading when compared directly to the exceptional activity of the prior year, which was distorted by the now-cancelled capital gains inclusion rate increase. However, when assessed against historical benchmarks, the activity was more consistent with long-term trends, supported by Calgary’s robust and unique market fundamentals.

Despite the easing in transaction activity, Calgary’s strong demographic fundamentals continued to exert powerful upward pressure on housing demand. The city’s continued population growth sustained an increased pace of new development. The need for more affordable housing options drove the appeal of multiple-unit suburban residential buildings, which became a popular product category for both developers and investors.

This shift was especially important given the market tightness for affordable housing, particularly in neighbourhoods in and surrounding the downtown core, where existing supply remained constrained. The high volume of units under construction, many of them purpose-built rentals, underscored the market’s pivot toward smaller, more affordable, higher-density products. This focus was a direct response to the ongoing affordability challenges and served to stabilize the long-term outlook for cash-flow-oriented multifamily investments.

Office

Calgary’s office sector recorded a significant 344% year-over-year increase in investment volume, with $507 million in dollar volume transacted. This sustained growth reflected the ongoing “flight to quality” phenomenon, where investors capitalized on tenants' increasing preference for prime, well-located assets.

Reflective of this trend, Oxford Properties had acquired full ownership of seven office properties in Vancouver and Calgary, buying out the stakes held by CPP Investments. Three of these key properties were located in Calgary, and the transactions were among the most significant of the period. Specifically, the acquisition of Eau Claire Tower and 400 Third represented the top two office transactions in the second quarter, valued at $91 million and $57 million, respectively. These high-value transactions highlighted renewed investor confidence in Calgary’s premium office assets and the future growth potential of the downtown core.

Ongoing efforts to convert underutilized office spaces into residential units or other productive, high-value alternative uses have helped remove obsolete inventory from the market and improve overall market health. According to the City of Calgary, six conversion projects have been completed under its Downtown Development Incentive program, adding much-needed affordable residential units, a new post-secondary institution, and hotel units to the city.

With obsolete space removed from the market’s inventory, Calgary’s overall office availability rate experienced a significant correction. According to Altus Group’s Q2 2025 Canadian office market update, Calgary’s availability rate recorded a sharp decrease of 220 basis points year-over-year, settling at 21.1%. This improvement reflected a healthier balance between supply and demand in a market that has struggled with historically high vacancy.

The limited development pipeline further reinforced this trend by preventing an influx of new supply that could otherwise exacerbate vacancy challenges. In terms of new development, the first half of 2025 saw no new office completions, indicating a disciplined approach by developers to new construction. Looking ahead, only one office building, the Westwind Business Campus III, totalling just over 72,000 square feet, remains under construction. Notably, 100% of this future space is still available for lease, pointing to cautious tenant behaviour and a preference for existing, proven assets or those that can be readily convertible to other uses.

Land

The land sector, including both residential and ICI land, experienced a contraction in the first half of 2025. Total investment volume reached $493 million, marking a 46% decrease year-over-year. This decline was visible across both sub-sectors. The residential land sub-sector recorded nearly $223 million in dollar volume transacted, a 57% year-over-year decrease. Similarly, the ICI land sub-sector recorded a 33% year-over-year decrease with $270 million in dollar volume transacted.

Underlying demand for residential and ICI land remained robust, supported by strong demographic growth, but macroeconomic conditions weighed on transaction activity. Specifically, stagnant interest rates, global trade policy uncertainty, and broader economic volatility collectively contributed to developers and investors adopting a more cautious approach to land acquisition and new launches. Higher capital costs and construction risk, including cost pressures linked to trade tariffs, prompted developers to pause or defer major new land commitments.

The temporary easing in land acquisitions was also tied to current market supply dynamics. Specifically, the concurrent completion of a growing inventory of multifamily housing provided a momentary lift in available housing stock, allowing residential developers to pause and assess absorption rates before committing to new land acquisitions. At the same time, the pullback in speculative industrial development, marked by an increased industrial availability rate, relieved the intense demand for ICI land, supporting a needed reset after the earlier industrial construction surge.

Figure 2: Calgary property transactions by asset class (Q2 2024 vs. Q2 2025)

Notable Calgary property transactions for Q2 2025

The following are the notable transactions for the Q2 2025 Calgary commercial real estate market update:

79 Castleridge Drive NE (Castleview Park Apartments) - Apartment

The Castleview Park Apartments at 79 Castleridge Drive NE have reportedly traded hands for $25 million, signalling strong institutional appetite for Calgary’s multifamily market. The 10-building, 120-unit complex, characterized by its well-maintained one and two-bed units, private balconies, and in-suite storage, is already operating at stabilized occupancy. Positioned in Calgary’s northeast, the property offers reliable cash flow and long-term growth potential. This sale adds momentum to the expanding trend of investor capital flowing into purpose-built rental housing in Alberta.

200 High Plains Trail (Building 13 High Plains Industrial Park) - Industrial

The sale of the property at 200 High Plains Trail in Balzac, Alberta, within the expansive High Plains Industrial Park, marked the most significant investment in the region since 2023. It reflects the continued strength of investor interest in Calgary’s logistics real estate. The recently completed Class A facility, which spanned approximately 200,860 square feet, was fully leased on a long-term basis at the time of the transaction. The property was acquired by the Toronto-based CanFirst Capital Management and its partner for $38 million. Its strategic positioning, just minutes away from Highway 2, the CrossIron Mills mall, Stoney Trail ring road, and the Calgary International Airport, coupled with a lower tax regime in Rocky View Country, provided a clear competitive advantage within Western Canada’s distribution network.

216 Grande Boulevard (Grande Plaza) - Retail

The Grande Plaza Retail Centre in Cochrane, Alberta, a fully leased property spanning nearly 22,000 square feet of gross leasable area, was acquired by West Oak Investments for $10.1 million in early April 2025. West Oak Investments, based in Regina and founded in 1989, manages a portfolio of residential and retail assets across Saskatchewan. The Cochrane retail centre was originally part of a four-property portfolio, highlighting West Oak’s continued expansion into Alberta’s retail market.

388 Country Hills Boulevard NE (NorthPointe at Country Hills) - Retail

The retail plaza at 388 Country Hills Boulevard NE, known as NorthPointe at Country Hills, represented the largest retail transaction in Calgary this year, exchanging hands for $54.5 million. This sale highlighted continued investor confidence in well-located suburban retail assets. The property was acquired by CT REIT, a Toronto-based real estate investment trust anchored by Canadian Tire Corporation, with a national portfolio focused on stable, income-producing retail properties. The centre featured a strong tenant mix, including Canadian Tire, CIBC, Landmark Cinemas, and Shell, with high traffic exposure and convenient access along Country Hills Boulevard in the fast-growing northeast trade area. This transaction underscored the ongoing appeal of community-oriented, service-based retail centres within Calgary’s evolving commercial landscape.

Figure 3: Overall Capitalization Rate trends - 4 benchmark asset classes, Calgary

Looking ahead

The investment trends observed during the first half of 2025 painted a picture of Calgary’s commercial real estate market defined by selective resilience and strategic transformation. Geopolitical uncertainty and macroeconomic caution, compounded by distortions from last year’s tax-driven surge in activity, contributed to a decline in overall transaction volume. At the same time, the city’s strong underlying demographic growth and policy-driven initiatives served as powerful and important stabilizing forces.

Looking ahead, Calgary is well-positioned for continued strength and is increasingly viewed as a leading Canadian market for future investment. The momentum is expected to be sustained by several factors. Continued strong population growth will underpin long-term demand across all asset classes, particularly in the multifamily and retail sectors, where essential service-anchored assets will remain a primary investment strategy. The successful rebalancing of office supply through conversions is anticipated to drive further improvements in removing obsolete inventory, transforming spaces to other productive, high value uses. While the industrial sector may stabilize after its expansion, the region’s strategic location and affordability are expected to maintain strong investor appetite.

Given the persistent market uncertainty, investor caution is expected to continue in the near term. Capital deployment will likely remain selective until greater clarity emerges regarding national interest rate policies and the future impact of trade tariffs. Therefore, the second half of 2025 is anticipated to see major investment decisions prioritizing risk mitigation and stable income generation over opportunistic growth, reflecting a cautious approach to market participation.

Want to be notified of our new and relevant CRE content, articles and events?

Disclaimer

This publication has been prepared for general guidance on matters of interest only and does not constitute professional advice or services of Altus Group, its affiliates and its related entities (collectively “Altus Group”). You should not act upon the information contained in this publication without obtaining specific professional advice.

A number of factors may influence the performance of the commercial real estate market, including regulatory conditions and economic factors such as interest rate fluctuations, inflation, changing investor sentiment, and shifts in tenant demand or occupancy trends. We strongly recommend that you consult with a qualified professional to assess how these and other market dynamics may impact your investment strategy, underwriting assumptions, asset valuations, and overall portfolio performance.

No representation or warranty (express or implied) is given as to the accuracy, completeness or reliability of the information contained in this publication, or the suitability of the information for a particular purpose. To the extent permitted by law, Altus Group does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. The distribution of this publication to you does not create, extend or revive a client relationship between Altus Group and you or any other person or entity. This publication, or any part thereof, may not be reproduced or distributed in any form for any purpose without the express written consent of Altus Group.

Authors

Jennifer Nhieu

Senior Research Analyst

Nhu Pham

Market Analyst

Authors

Jennifer Nhieu

Senior Research Analyst

Nhu Pham

Market Analyst

Resources

Latest insights