Lending for commercial property - Understanding the US borrower's perspective

Stay ahead with access to the debt market perspectives of over 400 US bank and non-bank borrowers.

Better understand the perspectives and respond to the needs of US CRE borrowers

As some US commercial real estate (CRE) borrowers expand their search for lending relationships, they often experience different advantages and challenges based on the type of lender they rely on.

Altus Group’s survey report, Lending for commercial property – The US borrower’s perspective, highlights the differences between bank and non-bank borrowers' lending experiences to help CRE lenders better understand borrowers' needs, challenges, and satisfaction, so they can design more effective lending solutions to build and retain their borrower relationships.

What you'll learn about bank and non-bank CRE borrowers in this report:

CRE loan profiles by borrower type

Perceived benefits, challenges, and satisfaction with lender relationships

Selection criteria for lenders

Assessments and suggestions on the borrowing process

Views on market conditions and outlook

Borrowers' top recommendations for expediting future CRE loan deals

Key findings

Borrower highlights from the report

Perceived improvements

Among CRE borrowers who believe the loan process has become easier and more efficient, at least half cite better technology (57%) and more automation (50%) as driving factors behind these improvements.

Debt market outlook

Borrowers are cautiously optimistic about their ability to access sufficient funding for CRE projects over the next two to three years.

Top lender benefits

CRE borrowers are more likely to cite personalized service, greater timeliness and efficiency, ease of securing financing, and lender stability as the top benefits of working with their respective lenders.

Top loan challenges

Overall deal complexity is the biggest barrier to swift loan completion, although this is a significantly greater challenge for bank borrowers than for those sourcing funding primarily from other lenders.

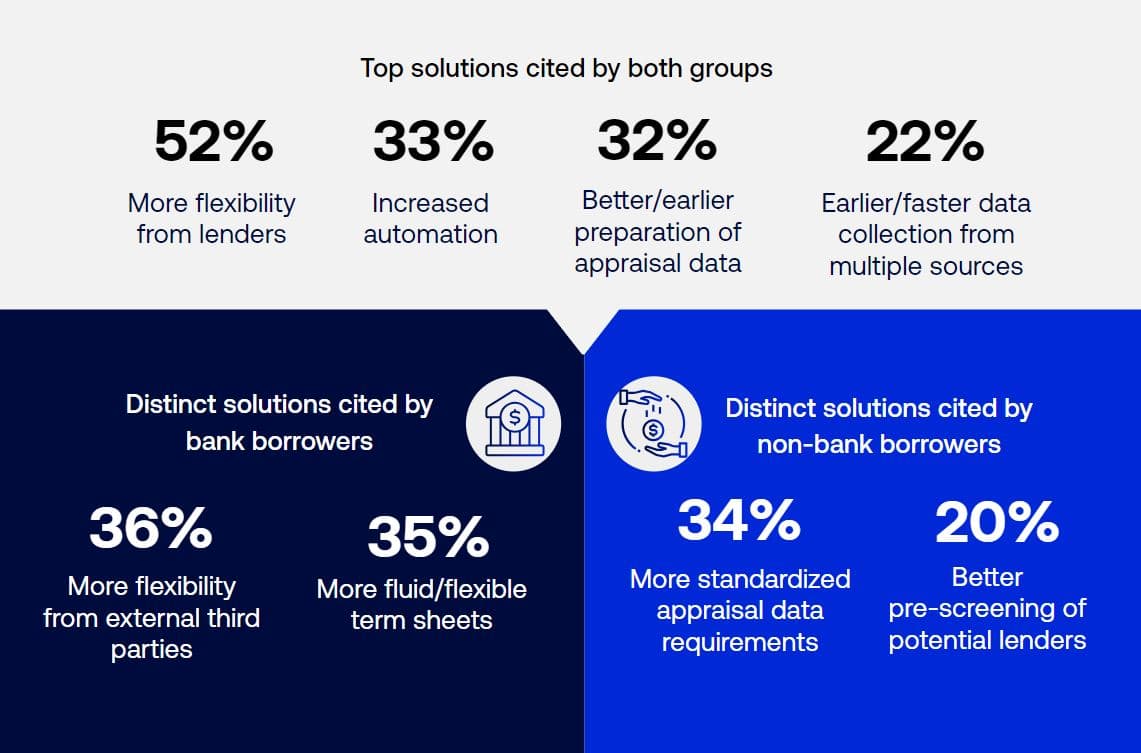

Loan process optimization

One-third of all borrowers cite increased automation as a potential catalyst for future deals, and a similar share point to better or earlier preparation of appraisal data.

About the survey

From Q4 2023 to Q2 2024, primary qualitative and quantitative research was conducted with hundreds of US professionals responsible for making borrowing and lending decisions for commercial real estate projects.

The qualitative research consisted of in-depth, hour-long telephone interviews exploring the current dynamics impacting working relationships between CRE lenders and borrowers. The rich, qualitative insights captured in these interviews were used to inform the development of an online quantitative survey, which was administered to 416 commercial real estate professionals across the US who are responsible for arranging financing for their organizations’ commercial real estate investments.