Canada’s office vacancy rate continues to climb but the pace of the increase has slowed in recent quarters as the market adjusts to the new realities of the workforce. At the same time, the level of sublease space on the market is also dropping. The pandemic over the past two years has perhaps forever changed the office environment in the country.

The hybrid office model is here to stay. So is remote and flexible work. It’s not the same 9 to 5 environment that has existed in Canada, and around the world, for decades. At this point the hybrid model and work for home is working from a productivity standpoint, and until we see a dramatic change, companies will be reluctant to make back to the office a requirement. We also have come to recognize that some employees and departments work better at home.

The office has shifted from a place of productivity to one of collaboration and discussion - a place where people need a purpose to come in. It is also a space to help a company develop its culture and brand for both recruiting people as well as retaining them.

While Canada is increasingly seeing a return to work over the past few months, the big question mark remains: What will the Canadian office sector look like in the future as concepts such as remote work and hybrid work become entrenched as options in how companies operate their businesses?

Even though leasing activity is coming back across the country from Victoria to Halifax, to a certain extent, particularly for newer buildings, there remains an elevated level of uncertainty regarding office space.

The downtowns are definitely getting busier but not to the same level of pre-pandemic. There’s no doubt that an evolution in office space is taking place. And many factors are impacting the office markets in the major cities across the country.

For example, the pandemic has solidified the notion in people’s minds that work can be done outside an actual office space. That has enormous implications for cities like Toronto and Vancouver. Today, people don’t even have to live within those cities to work for companies based in the major metropolitan areas.

Interprovincial migration data indicates the big winners these days are Atlantic Canada and Alberta. In fact, Alberta has an active campaign, trying to lure workers from places like Ontario to experience better affordability when it comes to homeownership and the cost of living.

Companies are also experiencing a shift in thinking by workers. Many people won’t even apply for office jobs today unless there is a hybrid model or some workplace flexibility in place as an option for them.

With a very low unemployment rate these days, employers are being more flexible with employees in providing opportunities that mean less time in the office rather than the traditional five-day-a-week reality that was such a staple of the Canadian workforce for decades.

The demographics and the makeup of the workforce is going to influence and impact office space going forward.

The current situation for office, nationally

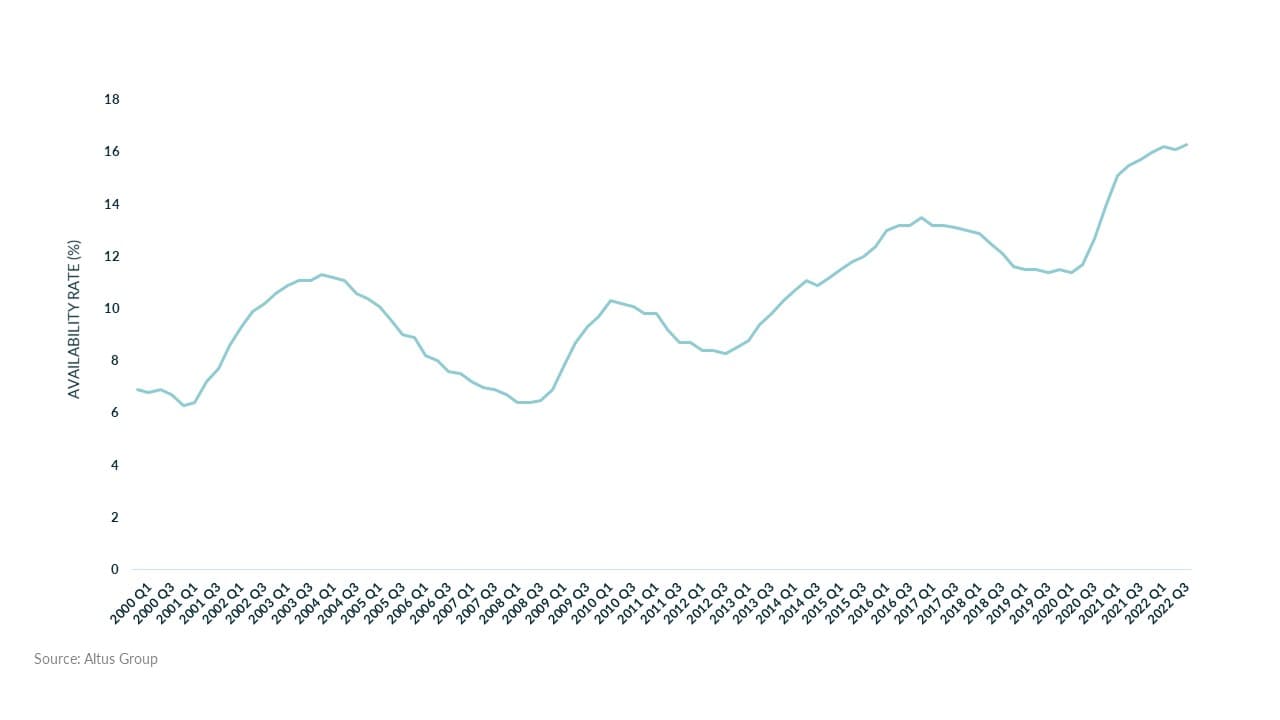

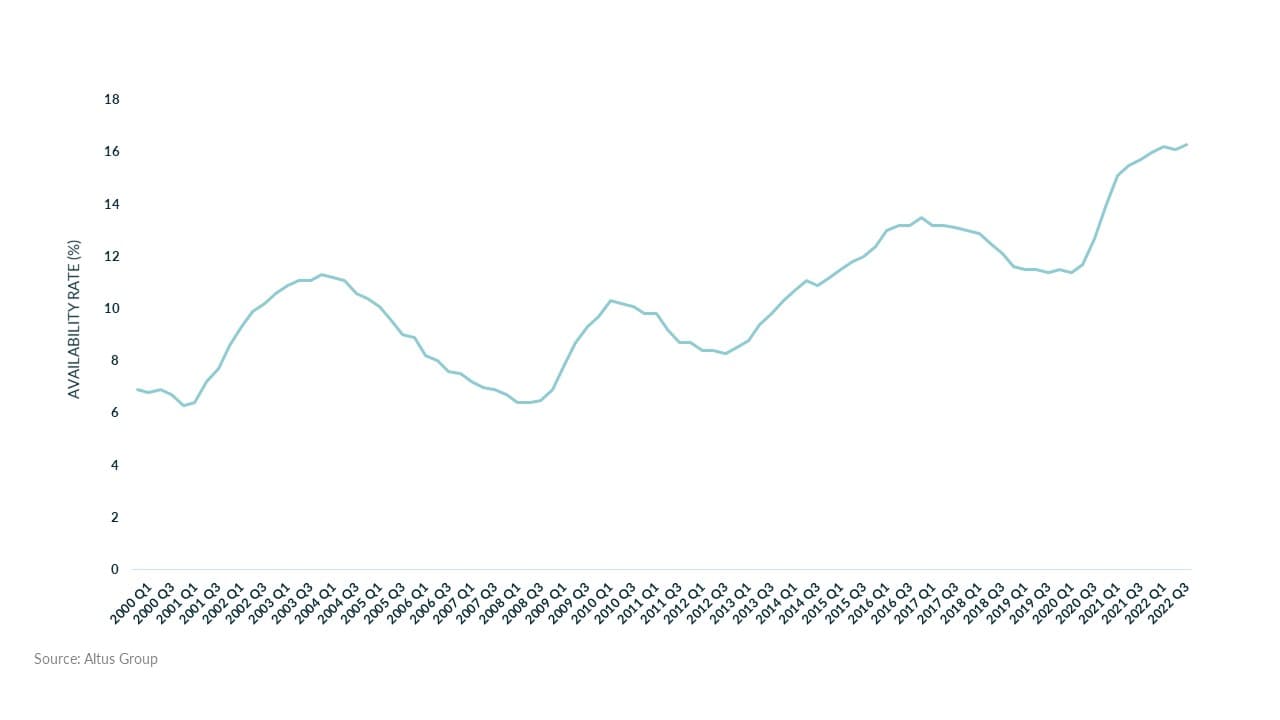

Here’s the current reality in the country. Nationally, in the third quarter of this year, the office availability rate was 16.2 per cent compared with 15.6 per cent in the third quarter of 2021. For the big city markets of Toronto and Vancouver, they too have seen a shift upward.

The Toronto availability rate jumped to 16.0 per cent in Q3, up from 15.0 per cent a year ago, while Vancouver saw the rate increase slightly to 9.7 per cent from 9.4 per cent last year. Leasing activity has definitely increased compared to a year ago, especially for new premises and office space that has already been built out and is ready for immediate occupancy.

Here’s some context on what has been happening. At the end of 2020, the availability rate nationally went from 10.8 per cent in Q3 to 12.6 per cent in Q4. It then moved to 14.4 per cent at the beginning of 2021.

The hikes in availability, though, are getting smaller and smaller which means companies are increasingly absorbing office space. They are doing so but with the mindset that they don’t have to actually have workers in the office for five days a week - at least for the time being.

Some added challenges for office recovery

The challenge is in the fact that companies and owners are spending millions of dollars on building amenities to entice tenants and workers to that office environment.

Landlords are also being more flexible on lease terms to keep tenants, as well as attract new ones as companies are able to utilize more of the building rather than just their own spaces. Lobbies, coffee shops, and rooftops have become gathering places of connection and interaction as well as places for employees to work. And many are adding co-working space, allowing tenants additional office space on an as-needed basis.

There has been an emphasis on environmental design of office space, making them more inclusive and allowing for better social engagement and community-building.

For decades, the argument in the workplace has been that to advance in the world people have to be in the office where they make connections and interact with others. The changing demographics are not seeing that right now.

After two years of the pandemic and experiencing the benefits of remote work, do employees really want to spend a great deal of their time, especially in cities like Toronto and Vancouver, commuting back and forth from their home to their office?

Lots of uncertainty, so we have to wait and see

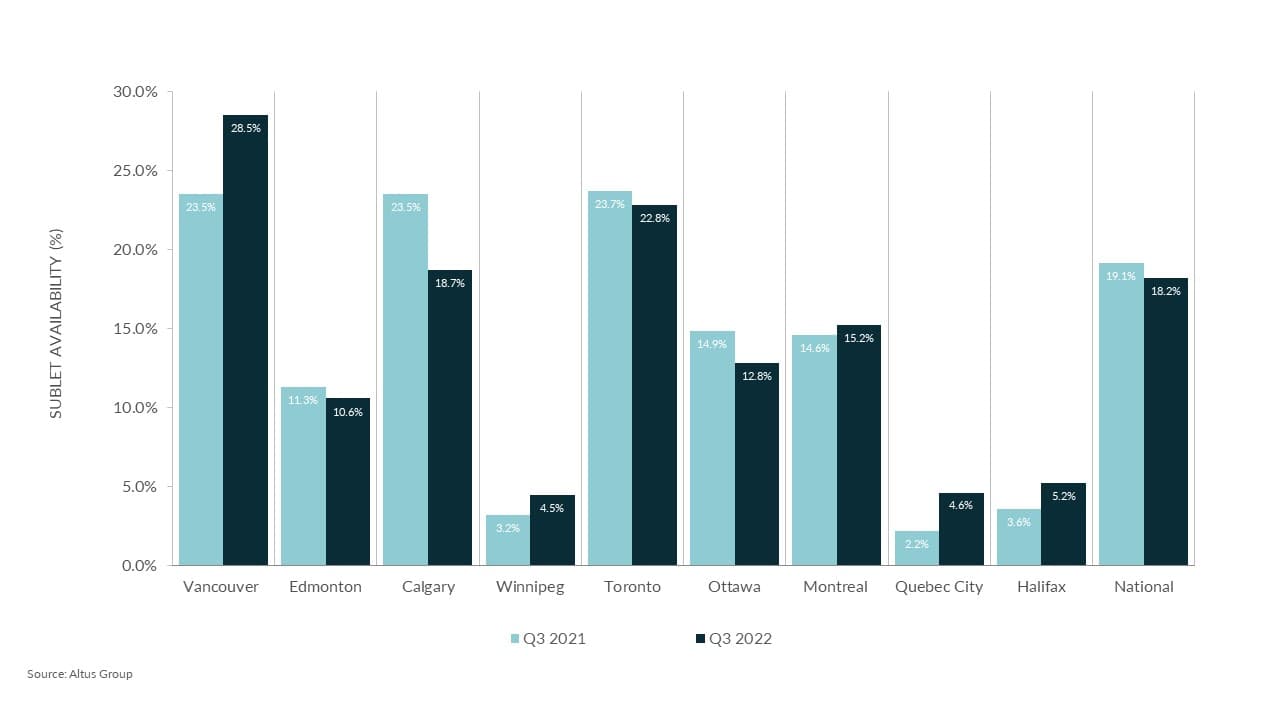

What’s interesting in all this is the percentage of sublet space as a percentage of overall availability. Nationally, that number has dropped to 18.2 per cent in Q3 2022 from 19.1 per cent in Q3 2021.

With companies having one or two years left on their leases, are they just waiting out that time, and when it comes to lease renewal will they take less space or no space at all? It really is the million-dollar question the office sector is anxiously waiting to discover in these uncertain times.

The bottom line is that everyone is still trying to figure out the office market and how it’s going to evolve in this changing work paradigm. Will the shift continue?

And how will that shift itself evolve? In the past, the office was a place where a worker was more productive. Now, because we’ve seen that productivity can be attained remotely, the shift in thinking is to where the office becomes more of a space for collaboration and connection - a place where people come to retain the culture of a company and better understand it, particularly with new hires.

The good news

Despite the level of uncertainty about the office market of the future, there are still buyers looking to invest in this real estate asset, suggesting there remains confidence in the sector going forward and it’s still very much alive and poised to adapt to the ever-shifting real estate landscape.

The bottom line is office space is not going away and will be needed. It will continue to transform to meet the needs of both companies and employees, and as a place to gather, interact and collaborate.

Authors

Mahek Shah

Senior Analyst, National Insights

Ray Wong

Vice President, Data Solutions

Authors

Mahek Shah

Senior Analyst, National Insights

Ray Wong

Vice President, Data Solutions