Key highlights

Altus recently engaged with industry experts on valuation challenges in the Canadian market and the rising importance of benchmarking

Increased volatility driven by interest rates and reduced market transactions have limited traditional market data, creating valuation challenges

This creates a need for cleaner, more data-active valuation models to compensate, especially as ESG and sustainability rise in importance to investors

There is evidence of more valuations being done using discounted cash flow (DCF) and benchmarking in an era of lower transaction volumes

Creating accurate valuations in a low transaction environment

Altus recently hosted a webinar featuring a panel discussion on valuation challenges in the Canadian CRE market and how to ensure accurate, time-effective valuations in a changing environment, as well as the game-changing way benchmarking has affected dealmakers. Joining the panel were industry experts Andrel Wisdom, Manager of Private Investment Valuations at Alberta Investment Management Corp.; Joseph Crescio, Managing Director and Global Head of Real Estate Valuations, Manulife; Eileen Foroglou, CFO at Epic Investment Services; and Altus Group’s own Jonas Locke, VP of Advisory.

In an environment of increased volatility, reduced transactions, and limited market data in some niche sectors, there needs to be alternate ways to create accurate valuations. As part of our ongoing webinar series, we examine some of the biggest valuation issues facing the market.

What is the current state of valuations?

Eileen Foroglou opened by noting, “Interest rate volatility has made it challenging for investors to accurately predict future cash flows and discount rates…we're seeing a larger divide between seller and buyer expectations, (resulting in) a diminished transaction volume market.”

In times of heightened volatility, there needs to be a focus on underlying real estate fundamentals, such as location, property conditions, and asset management, as well as rental potential. Traditional valuation methodologies don’t supply this information easily.

Joseph Crescio highlighted that, in times where there is a lack of transactions, prior pricing can be unreliable. It is important to remember there are data points other than sales available, such as BOVs, failed transactions, public vs. Private REITs, etc.

While office-based assets have seen significant retraction in value, this is part of the broader cyclical market. Industrials, by contrast, have seen a particularly strong performance, so all asset classes have their nuances. Hyper-focusing on one sector can slant discussions inaccurately towards negative headlines around a specific asset class. Andrel Wisdom drew particular attention to how cap rates on the multi-residential side of key markets have spoken to supply/demand fundamentals, for example.

However, it can be frustrating that even in the presence of strong leasing and even some deal-making, values are still flat due to the macro environment and rising risk premiums. Wisdom added that he has noticed an increased focus from external appraisers on cash flow and specific yields, which can also impact valuations negatively. Our experts concluded that, although the general state of the market will always call for broad adjustments and strategizing, there is a need to look at asset- and market-specific factors as well.

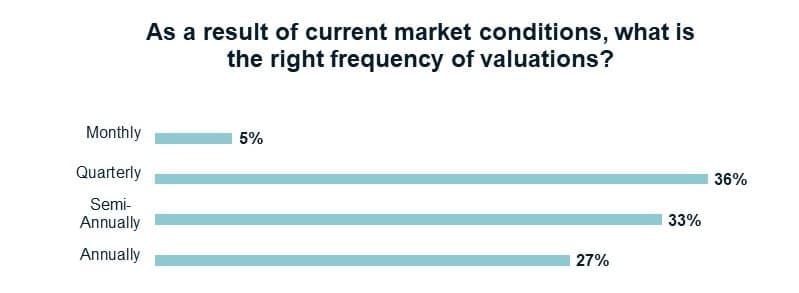

Figure 1 - Poll question: As a result of current market conditions, what do you think is the right frequency of valuations?

As can be seen in the webinar audience poll results, more than two-thirds of our audience felt that semi-annual or quarterly valuations were most appropriate, showing the need to maintain transparency in times of uncertainty.

Our experts’ insight into valuation frequency

Foroglou pointed out that software has helped expand access to analytic data points but mentioned that there is a lack of transparency and information sharing in the Canadian landscape. She would like to see more frameworks for appraisal data, ensuring models accurately mirror the wider market.

Crescio echoed similar sentiments but highlighted that valuation frequency should also be approached individually, based on client needs. For example, certain open-ended funds need more frequent valuation, whereas closed-ended funds could have more flexibility.

Wisdom agreed, noting “I think it's going to be a question of (portfolio composition) by asset class and geography. That's a key impact driver within the volatility equation.” He expects investors to want their assets benchmarked more consistently.

Looking ahead to 2024 market trends

Will 2024 see more valuation predictability? Wisdom believes this will depend on portfolio composition. Future-proofed assets will sustain, where others may experience challenges.

However, much will also depend on the 2024 interest rate environment. This will have a knock-on effect on spread direction and whether cap rates will move up, regardless of individual performance. Specifically for the Canadian market, Wisdom highlighted the current growth in population, with a direct correlation to real estate demand, and Canada’s perception of good market fundamentals. He expects to see both liquidity and cost of capital improve but is less convinced we will see an improvement in deal volumes.

Crescio re-emphasized the need to scrutinize the cost of capital, as much of the market uses debt to transact. Additionally, cash buyers won’t necessarily take a lower yield if the market is commanding higher ones. He also highlighted the interplay between contract rent and limited NOI setups, and the fact that the central bank rate has reduced slightly, as key metrics to watch. While the cost of capital is not always a one-for-one correlation, it is a highly relevant data point in a time where there are limited transactions.

The expansion of DCF analysis

Wisdom touched briefly on how Alberta Investment Management Corp. is now using DCF within its Canadian multifamily portfolio. This has helped investors better understand market factors like tight cap rates and rent run-up. He also highlighted how the ARGUS ValueInsight has helped to boost internal and external collaboration through a simplified platform and the ability to drill down into metrics, extract data, and improve benchmarking capabilities.

Speaking to the multi-residential market, Foroglou noted that they are also shifting to a DCF model, for the ability to see discounted cash flow and what that yields. While direct cap has been the market go-to for perpetual below-market leases, there is value in knowing the wider market and spread. Crescio noted that, “We can compare it across other property types, geographies, and sectors. There is a need to compare apples to apples.” Direct cap then retains value as a check to DCF.

DCF differences in the Canadian and US markets

Comparing his experience within the US and Canadian market spaces, Crescio further noted that the US has more consistent assumptions for underwriting (despite an overall similarity in markets) and a higher volume of transactional data to draw from. Currently, the largest differences are leverage differences between the two markets, with the US using more leverage and IO loans, and the larger size of the US market in general. Additionally, the significant write-downs the US has seen over 2023 have not been seen in Canada. For these reasons the US market is more dynamic and quicker to react to market changes versus the Canadian market.

Canadian models need more deal-specific data, lacking the quick “audit trail” regarding assumptions you can create in the US. Foroglou spoke of the need for more iteration tracking in evaluation models for 2024 to better track these “audit trails”/assumption changes and what drives them. She also spoke of how useful platforms like the Argus ValueInsight platform can be in creating that trail.

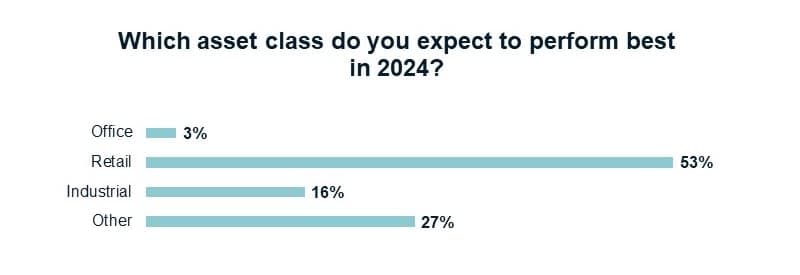

Figure 2 - Poll question: Which asset class do you expect to perform best in 2024?

In the second poll question of the webinar it was not surprising, most believe the office sector will continue to underperform other CRE asset classes (3%). Industrial (53%) is expected to keep its strong performance, with retail (16%) also a slow performer. Multi-residential was purposely not included in the poll but remains another strong category.

Our experts’ insights into asset class performance for 2024

One key thing to note from this poll data is that people are looking away from the three main asset classes. Additionally, with elevated yields, all sectors will be dependent on bank credit rates, especially the industrial sector due to locked-in cash flow. Retail, Crescio believes, may bring pleasant surprises to the table.

The evolution of performance management and valuation

Smart performance management means looking for ways to better understand evolving market conditions. Evaluation strategies must stay aligned with market realities, so improved data analytics is key. DCF, which shows discount rates rather than implying them, can help. In the absence of market data (due to reduced transactions), data points such as cash-on-cash become critical.

Final thoughts

Despite the unstable interest rate environment and reduced market transactions, there are still opportunities for positioning capital to create future opportunities. Currently, there is a focus away from equity capital to more debt instruments. However, looking forward to anticipated shifts — like the rise of ESG — and focusing on growing sectors, can better position investors and funds. Smart investment decisions to navigate uncertain periods start with not only better collaboration and data access, enhanced by better use of technology and automation, but also by the embracing of new valuation models like DCF to better conceptualize these positions.

Authors

Jonas Locke

Vice President, Valuation Advisory

James Harkness

Senior Director

Authors

Jonas Locke

Vice President, Valuation Advisory

James Harkness

Senior Director

Resources

Latest insights

Jun 24, 2025

The path to properly reflecting decarbonization efforts in Canadian CRE valuations

Jun 19, 2025

EP66 - From uncertainty to stability: How CRE is adapting to the latest mix of volatility

Apr 17, 2025