Grocery-anchored centers hold an edge on other retail formats

Grocery-anchored centers hold an edge on other retail formats

Key highlights

Consumer spending remains resilient but is occurring in an evolved economy; post-pandemic trends such as the rise in remote work and the popularity of digital entertainment have added elasticity to various in-person spending categories

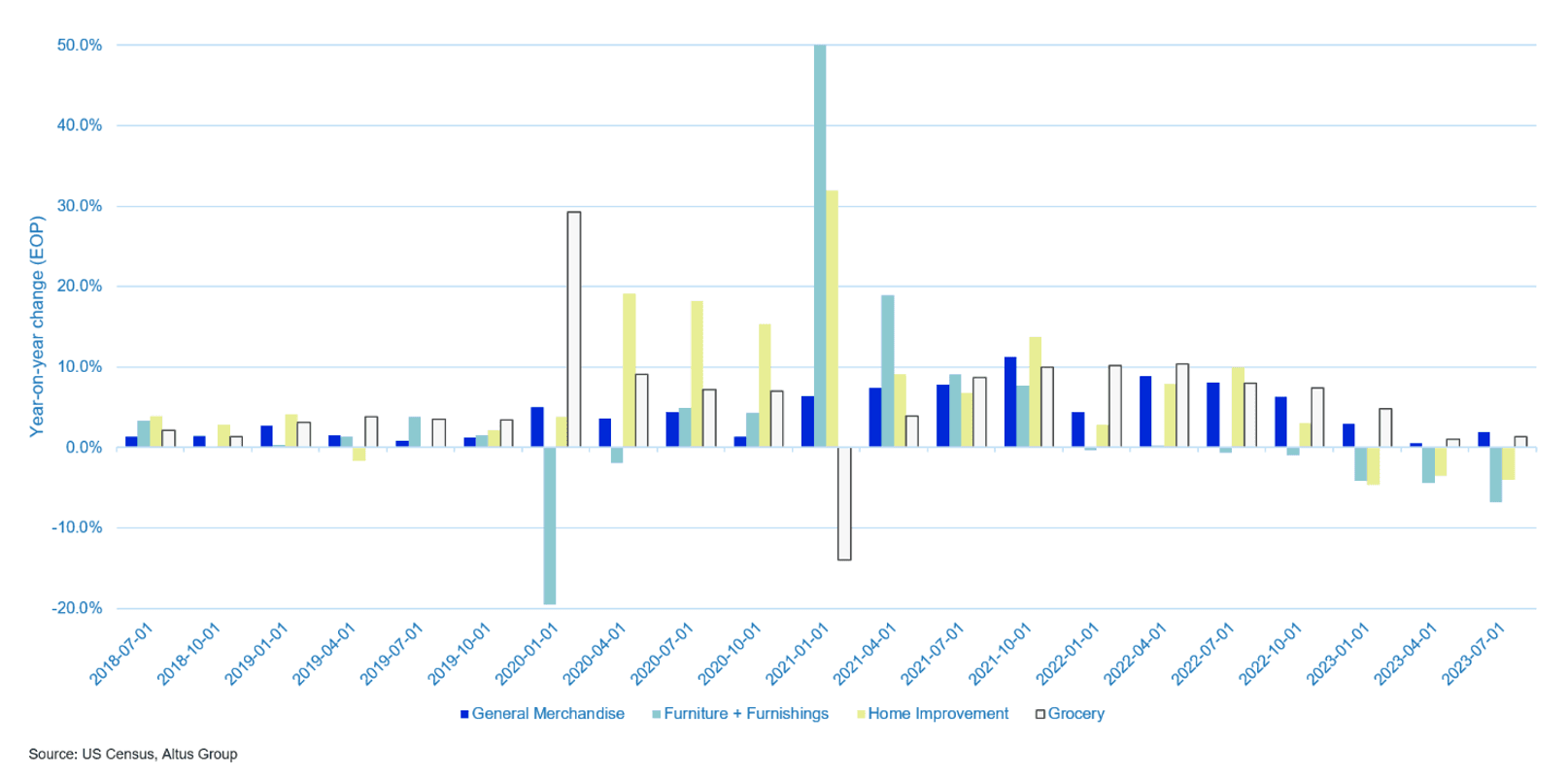

The brick-and-mortar retail sector has enjoyed an unexpected recent rally, though success has varied by tenant type; retail spending in sectors closely tied to housing and construction has seen dramatic year-on-year declines, but the grocery and general merchandise sectors continue to see growth in line with pre-pandemic trends

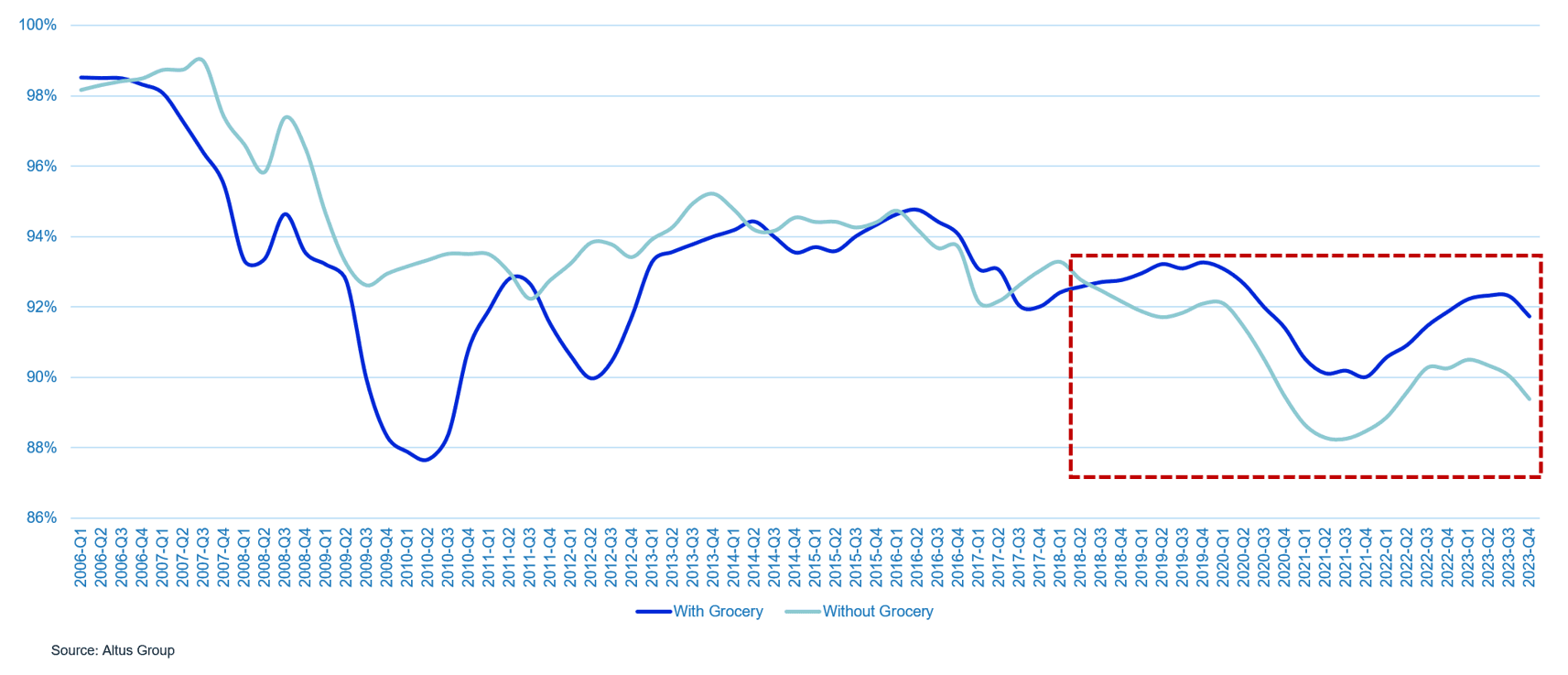

Grocery-anchored retail, seen as a bright spot during the pandemic, continues to hold key performance advantages over other types of strip retail centers, with higher occupancy rates and fewer tenants rolling

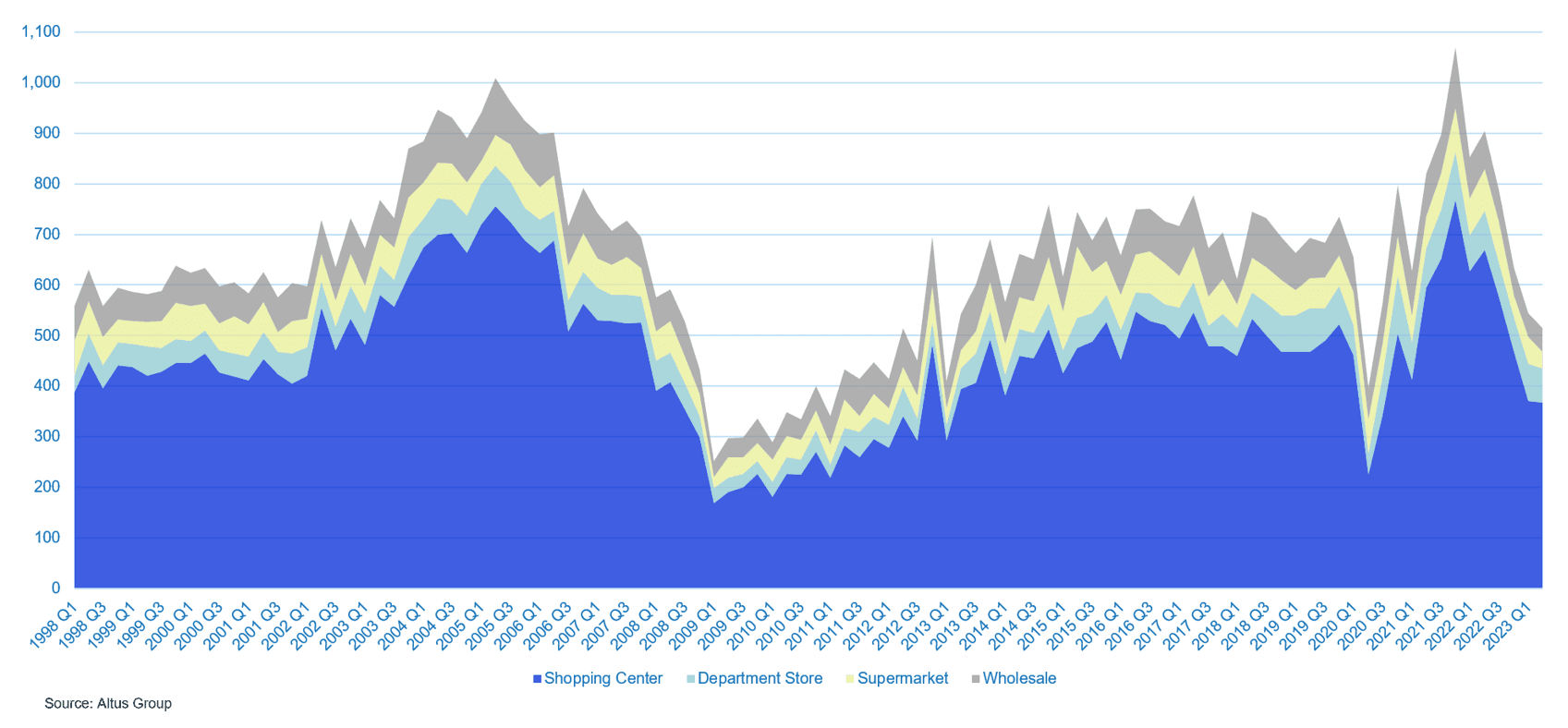

While property transactions across major categories (supermarkets, wholesalers, department stores, and shopping centers) are at their lowest level since 2020, encouraging metrics are still emerging; retail’s quarterly performance exceeded all other sectors in the Q3 NCREIF ODCE Index

Navigating the evolved landscape of retail

Recent data indicates that consumer spending remains hot, with Personal Consumption Expenditures (PCE) growing at an annual rate of 5.4% in November. And while at its lowest growth rate since February 2020, the measure is still well above the pre-pandemic average of 3.9%. This growth, however, is taking place in an evolved economy with changes that might not be apparent in headline spending figures. These underlying shifts are heavily reflected in brick-and-mortar retail. Demand for furniture and home improvement goods wanes while grocery stores and general merchandise stores continue to enjoy growth. Grocery-anchored centers, which emerged as a pandemic-era bright spot for the retail sector, continue to outperform other retail formats, benefitting from higher occupancy and lower tenant rollover. According to the latest release of the NCREIF ODCE index, retail was the top-performing property type. Though fewer retail properties are trading at any point since 2020, elevated in-person spending is working to the advantage of existing institutional owners.

Spending habits diverge

As the holiday season closed out, the US Census's Advance Retail Sales report provides insights into current in-person spending trends at major retailer categories. In the first three quarters of 2023, sectors linked to housing and construction experienced noticeable year-on-year declines. Spending on building materials, garden equipment, and related supplies has decreased by four percentage points compared to the previous year, coinciding with a jump in mortgage rates and a consequent drop in existing home sales. Similarly, sales in furniture and home furnishings categories, items often purchased on credit or with financing, have seen the most substantial decrease, falling by 6.8% from the previous year.

Figure 1: Year-on-year spending changes across major retailer types

Grocery spending growth however, which was steady at nearly 10% from October 2021 to June 2022, remained positive at an estimated 1.3% at the end of Q3. General merchandise retailers, such as discount department store giants Walmart and Target, saw 1.9% year-on-year spending growth at the end of Q3. As consumers hold off on home renovations and other large expenditures, spending on essential goods remains at elevated levels as 2024 begins.

Revisiting a pandemic-era bright spot

With elevated spending levels at supermarkets, grocery-anchored retail, a darling of the sector during the pandemic, has retained many comparative performance advantages. Occupancy at retail strip centers anchored by a grocery store approached 92% by Q4 2023, while their non-grocery-anchored counterparts slipped below 90%. Both, however, have rebounded quickly from pandemic lows. The occupancy rate in retail centers with a grocery anchor has even exceeded that of centers without a grocery anchor in every quarter since Q3 2018. The opposite was true for all but two quarters between 2007 and 2014.

Figure 2: Occupancy by retail strip center type

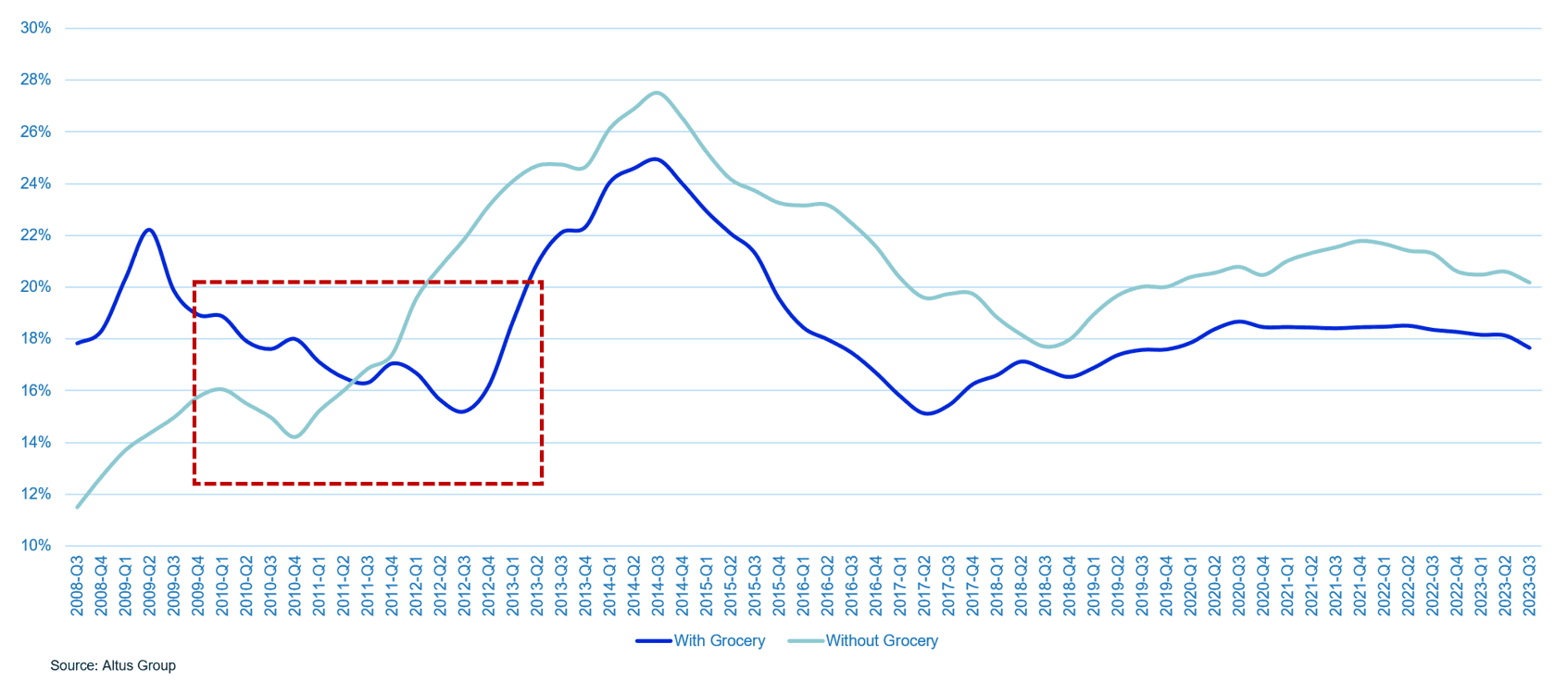

Grocery-anchored centers also maintain a lease-rollover advantage. Centers with a grocery anchor have had less rentable square footage expire within any three-year period since 2011 than their non-grocery-anchored counterparts. Prior to the Global Financial Crisis, non-grocery-anchored centers held this advantage by a multiple-percentage-point margin.

Figure 3: Net rentable area expiring within three years by retail strip center type

The strongest amidst a difficult environment

Transaction volume is down across all major property sectors, but the recent “retail rally” has not exempted the sector from the challenging transaction environment due to higher cost of capital. Transaction volume for shopping centers closely mirrors 2020, one of brick-and-mortar retail’s most difficult operational years on record.

Figure 4: Transaction count by major retail property type

Wholesaler, department store, and even supermarket property transactions remain at similarly low historic levels despite the positive sales growth.

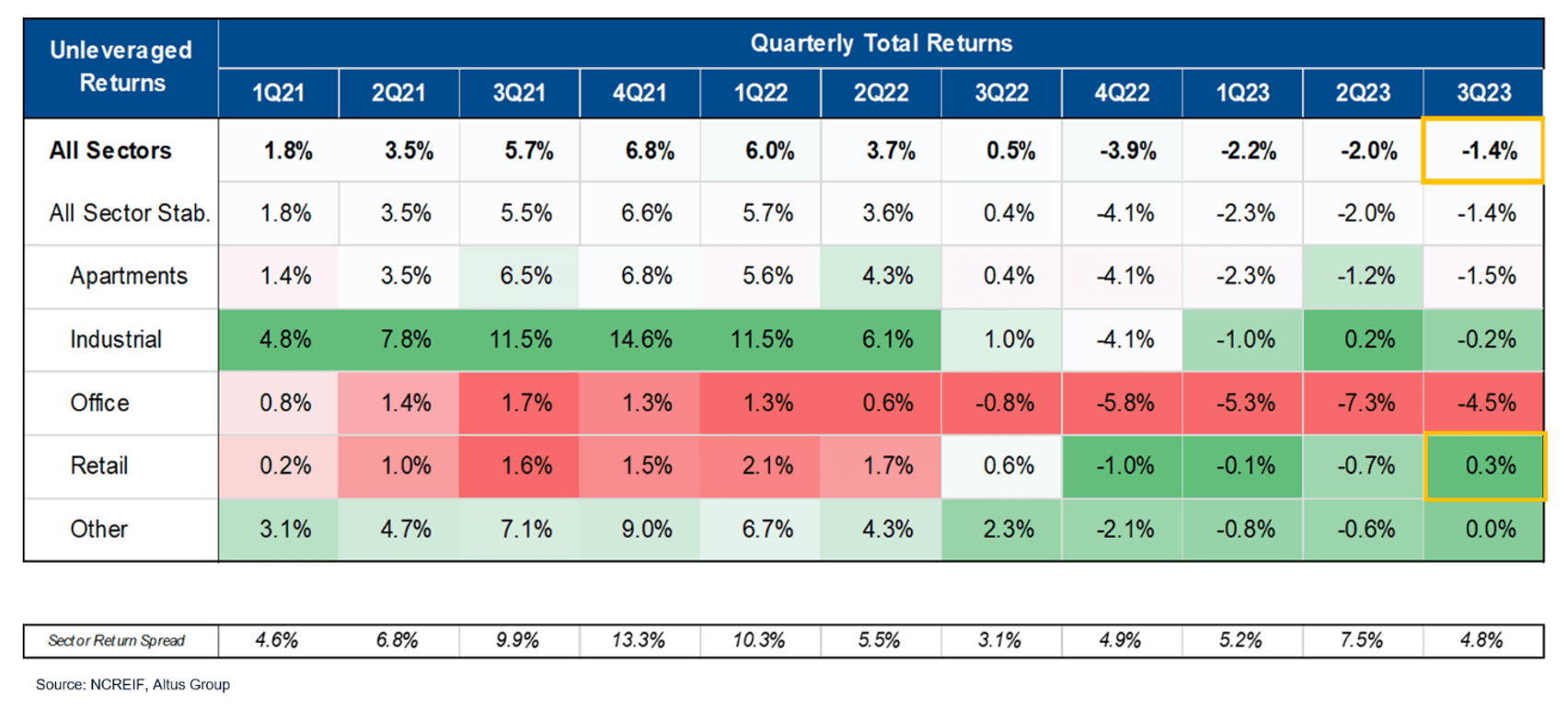

Figure 5: Q3 2023 NCREIF ODCE Index total returns

Retail, however, is showing positive signs. At 0.3%, the sector had its first positive quarter-on-quarter return in the Q3 NCREIF ODCE Index and was the best-performing property sector, as industrial (-0.2%), apartment (-1.5%), and office (-4.5%) all struggled. As broader post-pandemic shifts in spending patterns continue to buoy certain subsets of CRE, a more active transaction marketplace is sure to reveal the real winners and losers in retail.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Cole Perry

Associate Director of Research

Author

Cole Perry

Associate Director of Research

Resources

Latest insights

Jun 19, 2025

EP66 - From uncertainty to stability: How CRE is adapting to the latest mix of volatility