Greater Golden Horseshoe commercial real estate market update - Q3 2023

Q3 2023: The Greater Golden Horseshoe market experienced a 33% decrease in transaction volume

Key highlights

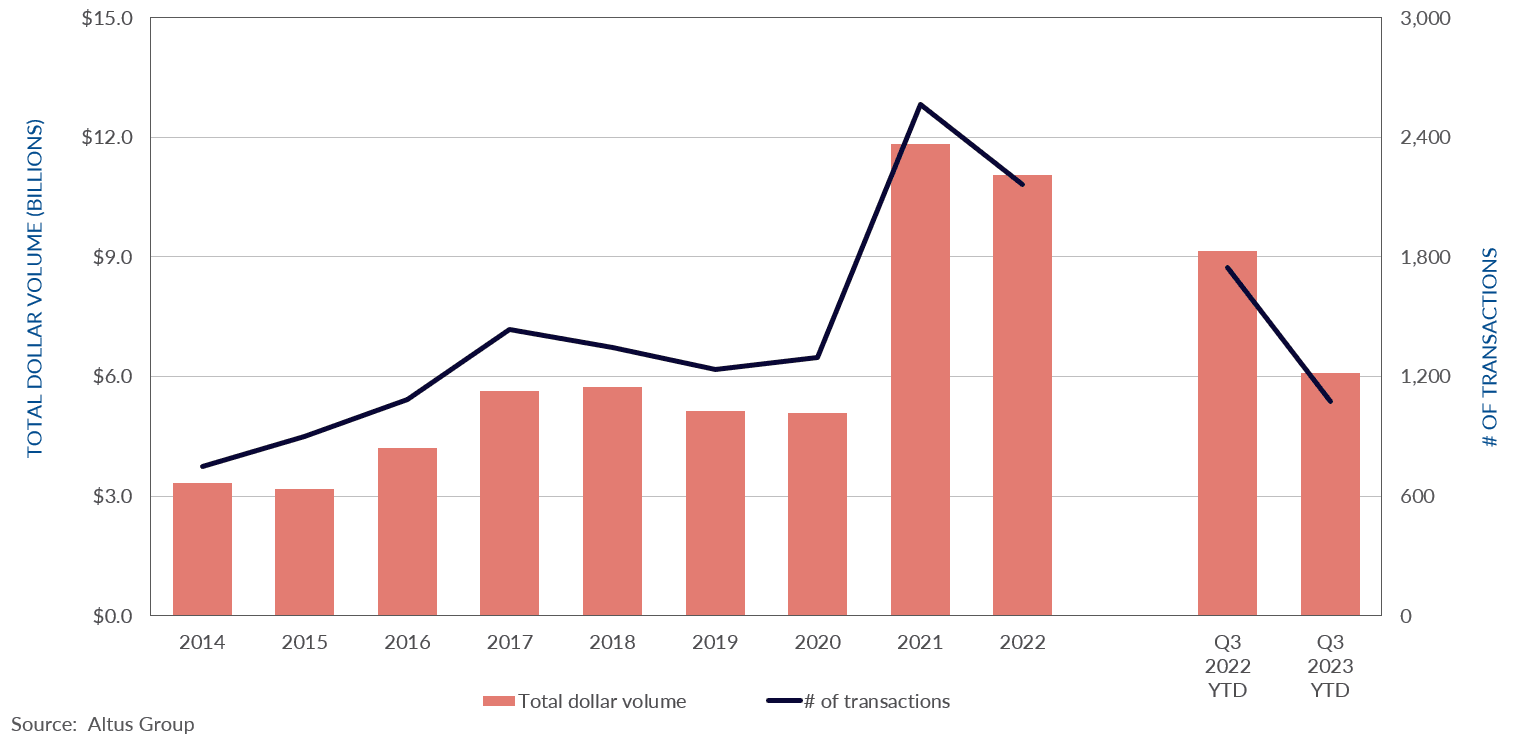

The Greater Golden Horseshoe (GGH) market area reported $6.1 billion transacted through the first three quarters of 2023, a 33% decrease year-over-year

Increased interest in regional and neighbourhood-level shopping centres sparked a promising recovery for the GGH’s retail sector

The market experienced a boom in industrial activity despite higher interest rates and increased cost of borrowing

The market posted $650 million in multi-family dollar volume transacted, a 32% decrease year-over-year, given the difficulties with higher interest rates and the cost of financing housing developments

The retail sector posted $967 million in dollar volume transacted, a 14% decrease year-over-year

Despite a slowdown in transaction volume across the GGH, sales activity in regions such as Waterloo and Wellington County remained strong

The Greater Golden Horseshoe market experienced a 33% decrease in transaction volume

The Greater Golden Horseshoe (GGH) market area reported $6.1 billion transacted through the first three quarters of 2023, a 33% decrease year-over-year. The slowdown in sales activity from the first half of 2023 has persisted into the third quarter. The ICI land sector was the favoured asset class in the market despite a nearly 50 percent decline in transaction volume. Furthermore, increased interest in regional and neighbourhood-level shopping centres sparked a promising recovery for the GGH’s retail sector. The Waterloo Region reported the highest investment volume at $1.5 million, while Wellington County was the only region to report positive growth year-over-year.

Figure 1 - GGH property transactions- All sectors by year

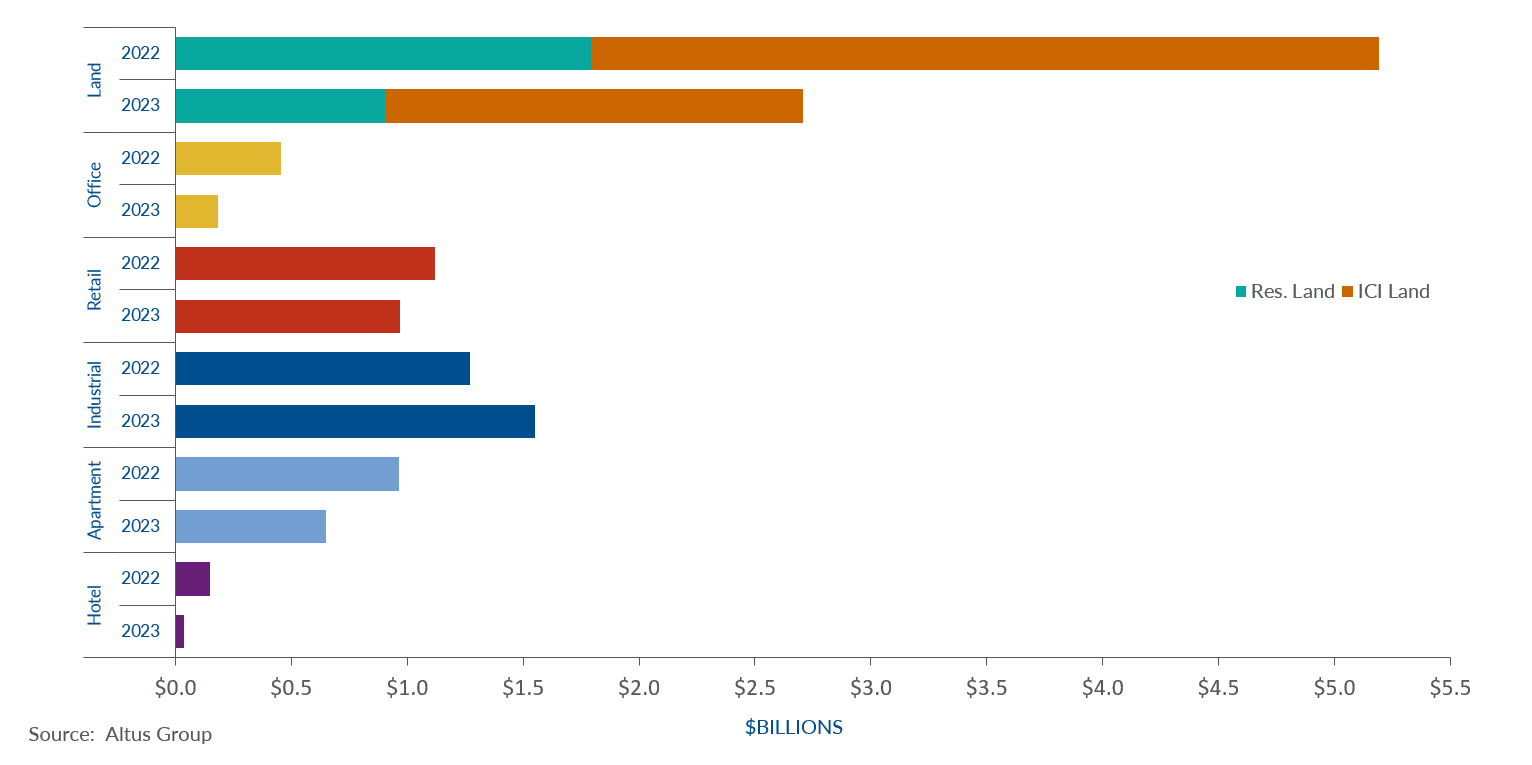

The GGH experienced a boom in industrial activity despite higher interest rates and increased cost of borrowing. The market posted $1.6 billion in dollar volume, a 22% increase year-over-year. According to Altus Group’s Q3 2023 industrial market update, the industrial availability rate for Southwestern Ontario alone increased from 3.4% to 4.9% year-over-year. As demand continued to outstrip supply, over seven million square feet had been added to the construction pipeline, representing 27 industrial projects. Wellington County and Peterborough County reported the highest year-over-year percentage change with industrial investment at $499 million and $83 million, respectively.

With elevated interest rates and inflationary pressures, the issue surrounding housing affordability in major metropolitan cities has arguably worsened for many Canadians. According to Statistics Canada's Canadian Housing Survey, as the cost of homeownership and essential goods increased, renter household growth has outpaced that of owner households. As a result, the outer fringes of urban centres have experienced an increase in immigration from those seeking a better economic situation. The GGH market posted $650 million in multi-family dollar volume transacted, a 32% decrease year-over-year, given the difficulties with higher interest rates and the cost of financing housing developments. The Waterloo Region reported the highest investment volume, at $370 million, an 85% increase year-over-year.

The retail sector posted $967 million in dollar volume transacted, a 14% decrease year-over-year. Compared to other asset classes in the market, the retail sector showed a remarkable recovery as investors responded to changes in consumer spending and focused on resilient types of retail real estate, such as regional and neighbourhood-level shopping centres, specifically centres with grocery anchors.

Figure 2 - GGH property transactions by asset class (YTD Q3 2022 vs. YTD Q3 2023)

Despite a slowdown in transaction volume across the GGH, sales activity in regions such as Waterloo and Wellington County remained strong. Investors have stayed committed to the region's industrial and multi-family sectors as these two sectors continued to be supported by strong underlying demographic and economic fundamentals. Furthermore, while not all types of retail real estate have recovered since the pandemic, shopping centres with grocery anchors and tenants offering essential goods and services have gradually found themselves in more and more investor portfolios for their resilience to economic uncertainty and the impacts of e-commerce.

Notable Q3 2023 transactions

The following are notable transactions for the Q3 2023 Greater Golden Horseshoe commercial real estate market update.

Conestoga Mall, Waterloo – Retail

Representing the largest transaction in the quarter was the sale of Conestoga Mall by Ivanhoe Cambridge to Primaris REIT. With a purchase price of $270 million, the transaction involved $165 million in cash consideration and $105 million of Primaris REIT units and exchangeable units in a newly formed subsidiary. Sitting on nearly 50 acres, the mall recently underwent renovations of nearly $46 million in 2018 and is one of the biggest shopping centres in the Waterloo Region, with over 130 stores and approximately 585,000 square feet. This disposition by Ivanhoe Cambridge is part of its strategy to reduce its exposure to the retail sector.

361 Speedvale Avenue West, Guelph – Industrial

With a sale price of $27 million, representing $166 per square foot, this 162,000 square foot manufacturing building Guelph was the largest GGH industrial transaction seen in the quarter. The transaction involved a sale leaseback with a 10-year triple net lease.

139 University Avenue West, Waterloo – Apartment

The Regional Municipality of Waterloo acquired this 4-storey apartment building in north Waterloo for $11.25 million. With 88 units representing $127,841 per unit, the building formerly accommodated students until 2020. During the pandemic, the owner entered into an agreement with the Municipality of Waterloo to convert the building into a shelter for people in need. The Regional Municipality of Waterloo acquired the property to maintain its current use as a shelter.

73, 89-91 Hunter Street East & 84 Jackson Street East, Hamilton – Residential Land

Located in downtown Hamilton, this 1.4-acre surface parking lot was acquired for $14 million by Toronto-based developer Lamb Development Corp. This property is ideally situated within a three-minute walk to the Hamilton GO Transit Station. This future high-density residential development will add to the numerous high-density developments already proposed in the immediate vicinity. This acquisition represented the third City of Hamilton residential development site Lamb Development Corp. have acquired this year, with the other acquisitions being 102 Park Street North and 117 King William Street.

Authors

Jennifer Nhieu

Senior Research Analyst

Athila Benevenuto

Market Analyst

Authors

Jennifer Nhieu

Senior Research Analyst

Athila Benevenuto

Market Analyst

Resources

Latest insights