Key highlights

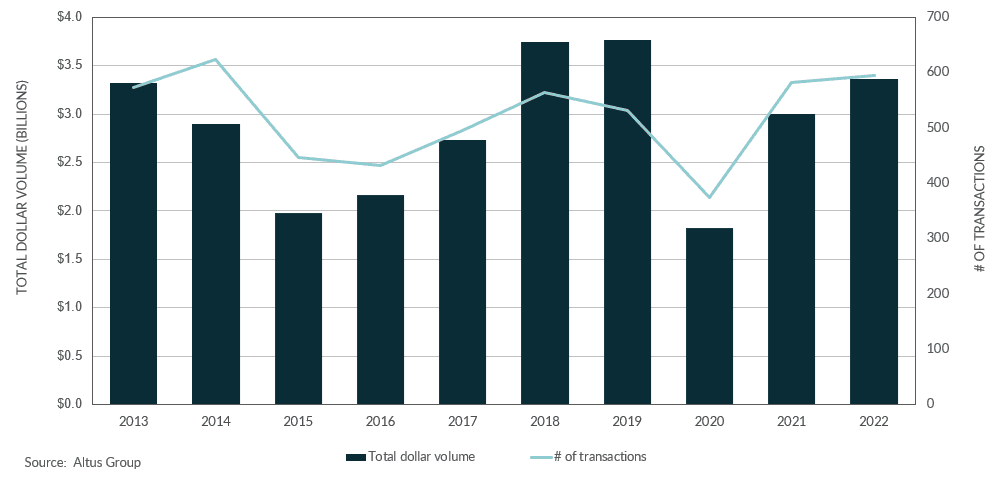

As of December 2022, the Edmonton market reported $3.4 billion in total investment dollar volume, a 12% increase year-over-year

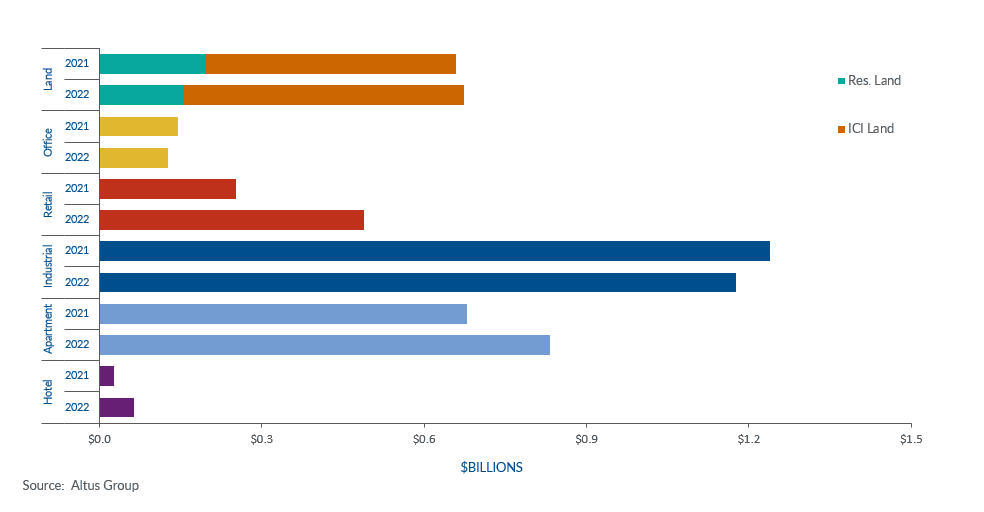

Edmonton’s industrial sector remained robust, with nearly $1.2 billion transacted

Alberta has become an attractive destination for international immigrants and interprovincial migrants seeking a lower cost of living and more affordable housing options compared to other major Canadian cities

The office sector posted $127 million transacted, a 13% decrease year-over-year

The retail sector experienced a successful bounce-back with $489 million transacted, a 94% increase year-over-year

The Edmonton market area remained strong and resilient in 2022 as investors pivoted to industrial and multi-family assets

Note: This is an interim update for the Edmonton commercial real estate market, based on transactions through to the end of December 2022. Altus was only able to tally sales that transacted through December 2022 as part of our year-end 2022 analysis due to processing lags at the Alberta Land Titles registry. Addressing this delay led to a recalculation of the timing of Albertan investment totals in 2022 and 2021. Quarterly updates for 2023 will be available at a later date as title registry data is made available.

Amidst rising interest rates and inflationary pressures, the Edmonton market has remained strong and resilient as investors continued to rebalance their portfolios with reliable, lower-risk forms of real estate, such as multi-family and industrial. As of December 2022, Edmonton reported $3.4 billion in total investment dollar volume, a 12% increase year-over-year. The multi-family and industrial sectors comprised nearly 60% of the total investment volume in Edmonton, at 25% and 35%, respectively. Investors remain optimistic as their favoured asset classes were supported by strong fundamentals tied to record population growth, employment gains and an undersupplied market.

Figure 1 - Property transactions – All sectors by year

Edmonton’s industrial sector remained robust, with nearly $1.2 billion transacted, representing a slight decrease of 2% as a limited and aging inventory continued to drive the demand for modernized industrial assets. While rising interest rates introduced a lot of uncertainty in other areas of real estate, it has not deterred investors in the fight for high-quality class-A industrial spaces. Furthermore, due to the shortage of modern industrial facilities, new projects were added to the construction pipeline to alleviate the strain on the market. Alberta has become an attractive destination for international immigrants and interprovincial migrants seeking a lower cost of living and more affordable housing options compared to other major Canadian cities. According to Statistics Canada, in Q4 2022, the province had the highest population growth recorded since the second quarter of 1957, adding 4.6 million residents, fueling the demand for housing. Edmonton’s multi-family sector recorded $832 million in Q4 2022, a 22% increase year-over-year.

The office sector posted $127 million transacted, a 13% decrease year-over-year. As hybrid work cemented itself as a preferred work arrangement amongst Canadians, office availability rates continued to climb. To address these significant vacancies, the market has continued with rightsizing efforts and halted any significant office projects.

The retail sector experienced a successful bounce-back with $489 million transacted, a 94% increase year-over-year, as pent-up consumer demand and changes in consumer behaviour (e.g., e-commerce boom, experiential retail, etc.) drove the need for food-anchored retail strips, shopping centre redevelopment and last-mile distribution centres in the industrial sector.

Figure 2 - Property transactions by asset class (2022 vs. 2023)

The Edmonton market displayed resilience when challenged by rising interest rates, inflation and increased construction and material costs. The industrial and multi-family sectors comprised the majority of the total investment volume and transactions in Edmonton in 2022. Furthermore, the lack of available supply encouraged new construction and redevelopment of existing buildings. Moreover, unlike some other markets, Edmonton has yet to experience drastic declines in investment volume for any given sector.

Notable Transactions for Q3 2023’s Edmonton commercial real estate market update

2331 66th Street NW (Mill Woods Town Centre) – Retail

Consisting of six two-storey multi-tenant buildings, Maclab Development Group acquired Mill Woods Town Centre, a 455,796-square foot shopping centre in southeast Edmonton. The subject property is located within close proximity of the future Mill Woods LRT Station, and it is slated to undergo intensification with the addition of infill rental housing. Although there is no redevelopment timeline, the property is expected to be a major addition to the Maclab Development Group rental portfolio across the Edmonton Region.

3925 8th Street (41 Business Park) – Industrial

Purchased by the Vestcor – One Properties Joint Venture, this two-building, 635,400-square foot industrial transaction in Nisku marks Vestcor’s entry into the Edmonton market. The site, which operates as Ledcor’s Fabrication and Module Yard, will house two additional industrial warehouse buildings. Completion is expected in Q2 2024, and the acquisition will expand One Properties’ reach in the Edmonton Region.

581 Griesbach Parade NW (Fairfield Inn & Suites Edmonton North) – Hotel

With a sale price of $12.5 million, this four-storey, 102-room acquisition represents Vancouver-based Wanson Group’s first foray into the Edmonton region. With a price per room of $122,912, this hotel is located within a short drive to West Edmonton Mall, the Ice District, and Canadian Forces Base Edmonton in Sturgeon County. Completed in 2017, this transaction illustrates the increasing attractiveness of Alberta’s real estate to Ontario and British Columbia-based investors amidst high prices and rising interest rates.

8401 Southfort Boulevard (Southfort Village) – Apartment

Acquired for a total consideration of $24.3 million, this two-storey, 14-building complex is located in Fort Saskatchewan, just northeast of Edmonton. Situated within a 15-minute drive of Alberta Industrial Heartland, a hydrocarbon-processing region, The 33 Fund’s acquisition is a townhome rental complex comprising 106 three-bedroom units. This transaction represents one of the highest price-per-unit apartment transactions ever sold in Fort Saskatchewan.

The Edmonton market area displayed resilience when challenged by rising interest rates, inflation and increased construction and material costs. The industrial and multi-family sectors comprised the majority of the total investment volume and transactions in the Edmonton market area in 2022. Furthermore, the lack of available supply encouraged new construction and redevelopment of existing buildings. Moreover, unlike some other markets, Edmonton has yet to experience drastic declines in investment volume for any given sector.

Want to be notified of our new and relevant CRE content, articles and events?

Authors

Jennifer Nhieu

Senior Research Analyst

Garren Sharpe

Senior Market Analyst, Data Solutions

Authors

Jennifer Nhieu

Senior Research Analyst

Garren Sharpe

Senior Market Analyst, Data Solutions

Resources

Latest insights