CRE valuation trends – Office insights – Q3 2025

Despite positive indicators, office recovery is uneven across the US, Europe and Canada.

Key highlights

Across all regions, there are clear signs of improving liquidity and renewed investor interest in best-in-class office assets

The recovery is expected to be a K-shaped, in which prime assets in major markets lead any improvement, while commodity stocks continue to struggle or seek alternate uses

Return-to-office mandates from major employers are supporting new leasing activity

In the US, while office values are still on a slight downwards trajectory, the cash flow aspect of appreciation has been positive for the past four quarters with a total one-year gain of 0.9%

In Europe, office appreciation has been trending positive over the past five quarters, with value gains of 0.5% in Q3 and 2.3% year-over-year

Canada’s office metrics are improving, with the magnitude of value declines slowing and the sector overall posting its best quarter in years, with a value decline of 0.26%

Best-in-class assets are attracting both investors and tenants

The hard-hit office sector is beginning to show signs of recovery that bode well for stabilizing values and the return of investor confidence.

Global office markets have faced many of the same challenges and secular shifts resulting from the pandemic. Return-to-office, flight to quality and improving liquidity are common themes across the US, Canada, and Europe. However, those major trends – and their impact on office fundamentals and valuation – are playing out very differently across each region.

The US has experienced the most extreme drop in office values. As of Q3, average values are down 44.8% compared to pre-pandemic levels. By comparison, office values in Europe have proved more resilient with a decline of 15.4%. Canada sits in the middle with values that are down 30% since COVID.

Notably, all three regions are showing signs of improvement in key performance metrics, even if that progress is just a slowing pace of decline. An important shift in the market is that investor confidence and appetite for office assets are returning. Across each region, there are clear signs that liquidity is returning, investors are beginning to re-engage in office transactions, with an increase in bids for better-quality office space in stronger markets, such as New York and San Francisco. However, there are nuances to the performance and near-term outlook when digging into regional markets. Some of the top-line trends include:

In the US, cash flow growth, although muted, is a sign of improving trends for the sector

Data for Europe shows ongoing improvement in revenues, even throughout the recent period of value decline

A bright spot in the Canadian office market is that leasing activity is accelerating, including year-to-date transactions through Q3 that had surpassed 2023 levels

Below, we take a closer look at the performance and outlook for each of the three regions.

US: Signs of recovery are emerging

Office values have dropped sharply in the US and we are still searching for the bottom. Values are down 44.8% since pre-pandemic, including a further 0.9% decline in Q3. To put that into perspective, values across all property types are down just 4.8% from pre-pandemic levels.

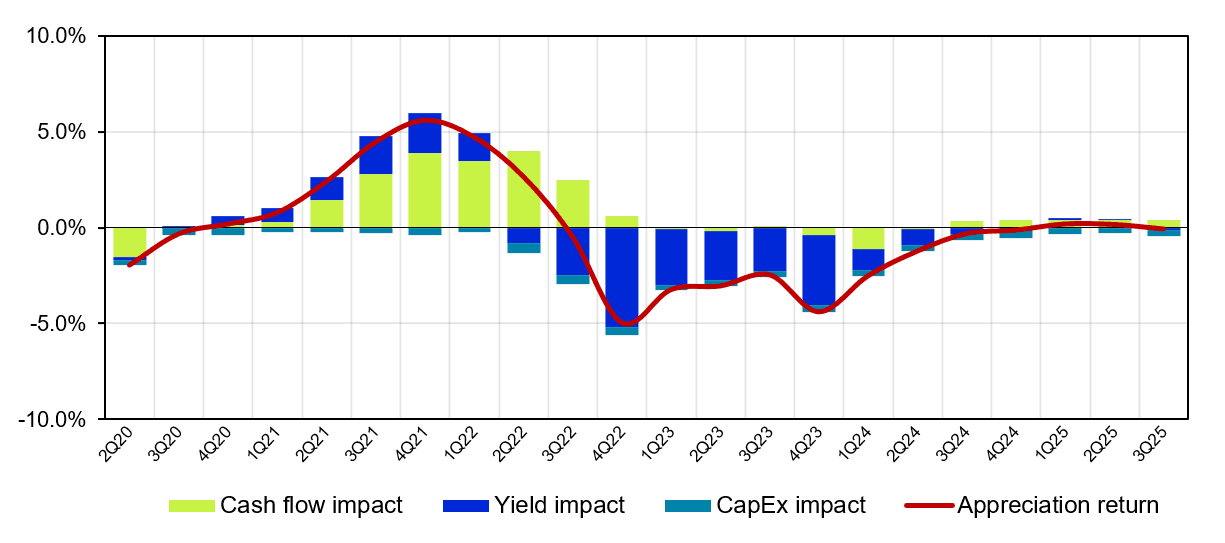

Figure 1: Q3 2025 - Appreciation return - US all sectors

US values have been hit harder for a variety of reasons that include:

High vacancies have taken a toll on cash flows, which have been eroding for the past three years.

The prevalence of non-recourse loans made it easier for borrowers to hand the keys back to the lender once property values fell below the loan amount. Such cases created a ripple effect of value markdowns that have impacted appraisals, as well as liquidity for office assets across the US.

On a positive note, while office continues to lag on most metrics relative to other property types, there are signs of improvement. Cash flows have turned positive for each of the past four quarters with a one-year gain of 0.9%. “Yield impact dipped slightly negative in Q3 at -0.5%, which likely reflects individual property-specific challenges and further caution among investors towards the sector, but cash flow gains, although muted, are a sign that the sector may be starting to stabilize,” says Phil Tily, Altus Group’s Senior Vice President, Performance Analytics.

Office utilization is still down about 30% compared to pre-pandemic levels. However, leasing activity is picking up in many major metros. Employers want the best, newest office space to entice workers back to the office. For example, Deloitte signed an agreement earlier this year to move its North American headquarters into the new 1.1 million sf 70 Hudson Yards office tower, being built in Midtown Manhattan.

The US is also seeing significant improvement in liquidity for office assets. Two years ago, financing for office buildings was SOFR+ 600 or 700 bps. More recently, spreads have come in as low as 200 to 300bps. “As the financing improves, we are seeing increased bids in some of the newer, well-leased office buildings,” says Robby Tandjung, Altus Group’s Executive Vice President, Valuation Advisory. In New York City, for example, 590 Madison Avenue sold earlier this year for $1 billion. “Although it is not true for every market, investors are getting more comfortable with office, especially considering the increase in leasing activity,” he adds.

US outlook

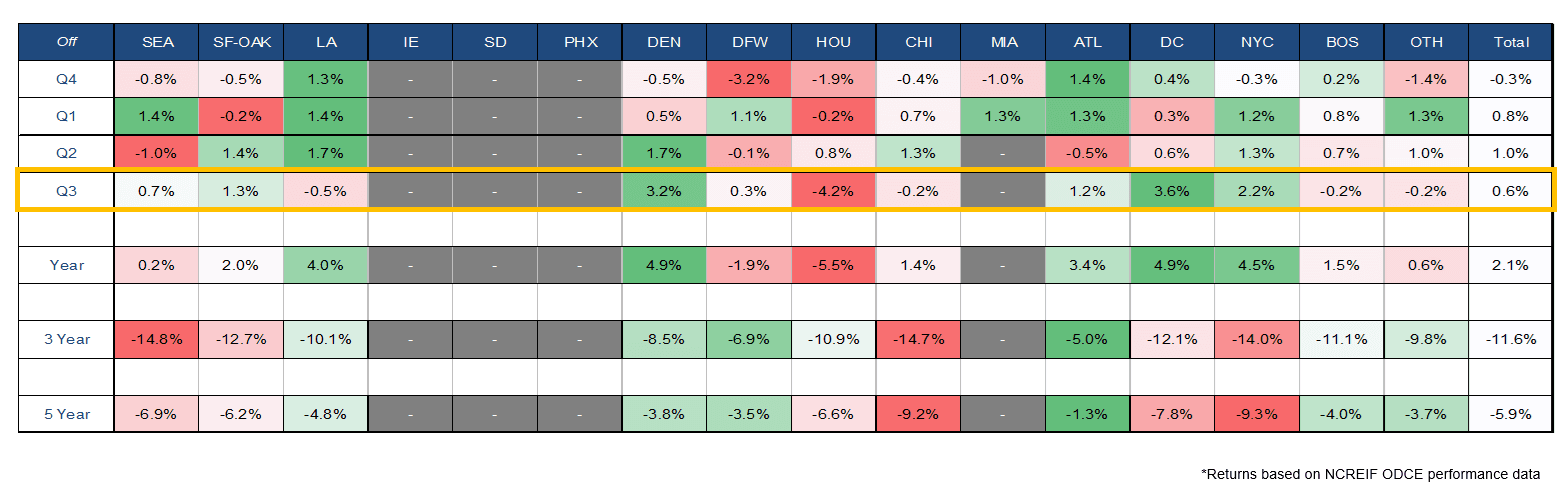

The recovery in the US office market is moving forward, but at an uneven pace with some metros performing better than others. In the last year, markets such as New York City and LA, along with San Francisco in recent quarters, are seeing positive total return momentum, while others such as Houston and Boston are lagging in the recovery.

Figure 2: Total returns by US Metro (CBSA), Q4 2024 – Q3 2025

Commodity office space will continue to face challenges, with significant capex needs and less tenant demand, while leasing activity is picking up in top Class A assets. The US is also facing headwinds from slowing job growth and uncertainty around how AI is going to impact employment. AI could prove to be a headwind for some sectors and a tailwind for others. Investors are continuing to watch how those trends play out across the office sector.

Europe: Cash flows remain resilient under market pressures

Office values in Europe have held up better than in some other regions, and data also shows recent positive momentum. Office values are down 15.4% compared to where they were pre-pandemic compared to an average drop of 4.2% across all property types. Although office is trading at a discount to all property types, the sector didn’t see an outsized decline. In fact, core office saw the same value correction as retail since the onset of the pandemic.

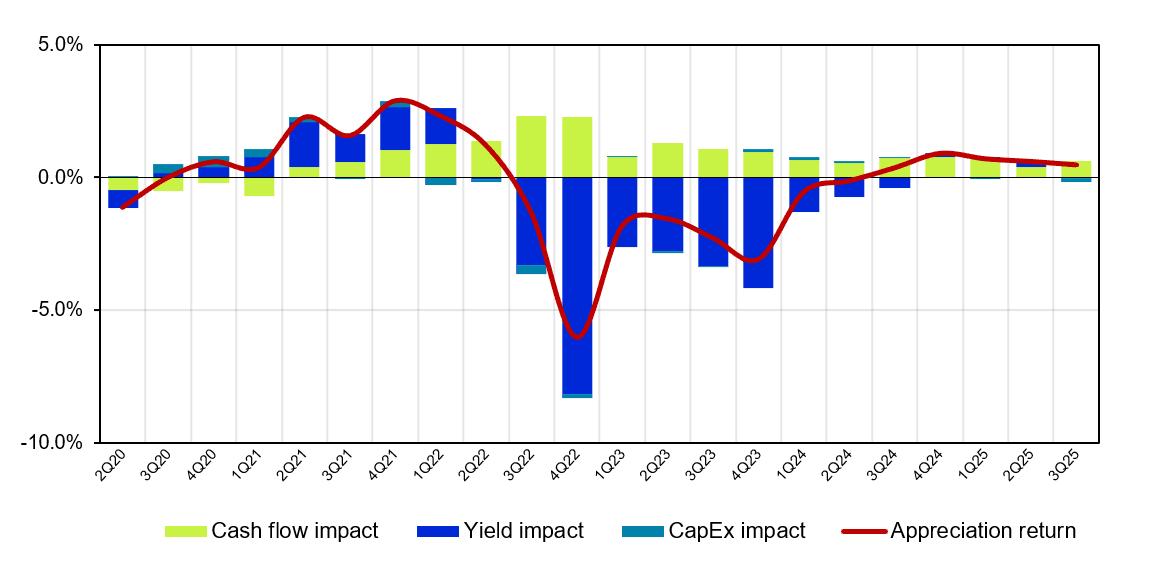

Figure 3: Q3 2025 - Appreciation return - Europe all sectors

Appreciation has also been trending positive over the past five quarters for the sector, with value gains of 0.4% in Q3 and 2.3% on a one-year basis. While there were valid concerns about certain segments of the office market, especially lower-quality assets, the main driver of the European write-down was the higher interest rate environment and associated repricing of yields.

Fundamentals have remained relatively resilient despite market pressures. Data shows ongoing improvement in revenue, even through the recent period of value decline. Cashflows increased by 0.9% during Q3 and are up 2.6% on a 12-month trailing basis, while yield impact remained relatively flat.

Overall appreciation for the sector picked up between Q2 and Q3, with office values in the UK, Germany, France, and the Netherlands all increasing during the latest quarter. “The metrics around the European office market – in terms of both the yield and cashflow aspect of appreciation – are all at the lower end relative to other sectors, but there's more evidence of normalization occurring,” says Le Goff.

One of the reasons for the more modest decline in office values is that Europe had a faster post-pandemic recovery in return-to-office. The Altus European valuation dataset also shows a strong flight-to-quality, which has benefited funds that tend to have newer vintage assets. “There’s continued strong bifurcation between the best and the rest. Demand is highest for super core properties in city center locations in the main capital cities,” says Nicolas Le Goff, Altus Group’s Director, Valuation Advisory - Europe.

France has been the standout performer over the year, where values have risen by an above average 6.3%. French office yields also have tightened over the last year, with values receiving a notable boost from above-average improvements in both contract and market rents.

Europe outlook

The European office market is expected to continue along its current path of normalization. Both investors and tenants are gravitating towards newer “A” properties. Several large office buildings have traded in Europe this year, including the Centre d'Affaires building in the Trocadero district that sold for €700 million (US $819 million).

JP Morgan also has announced plans to build a new state-of-the-art officer tower in London’s Canary Wharf neighborhood. “That demonstrates again the demand that exists for the best quality office buildings,” says Le Goff. On the other side of the market, lower quality buildings are seeing far less momentum.

Canada: Leasing activity is accelerating

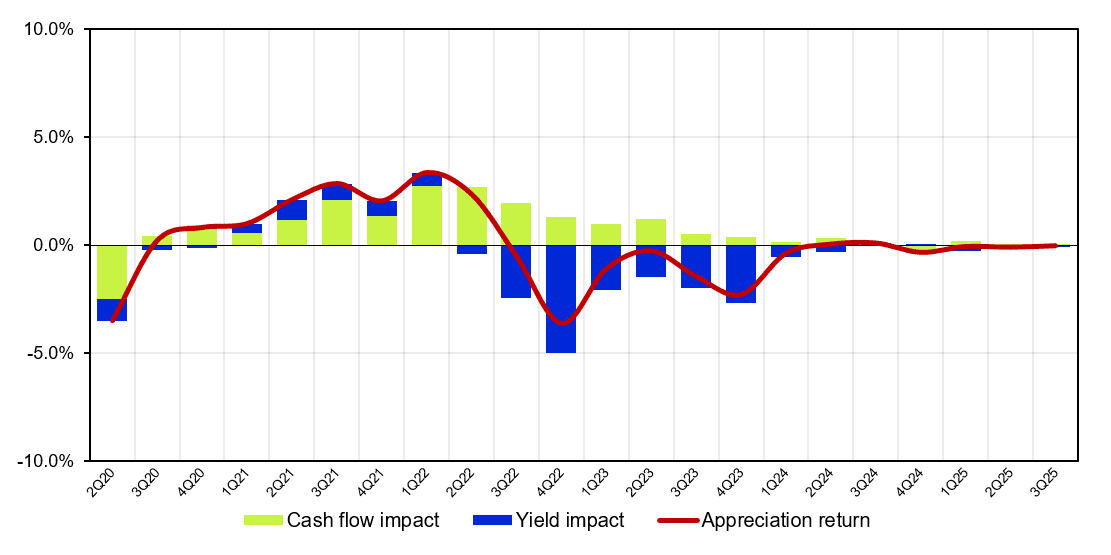

Canadian office values are down 30% on average since pre-pandemic levels. Office valuations saw a further decline in Q3, dipping -0.26% from the prior quarter and -1.3% year-over-year. However, metrics show signs of improvement. Cash flow was relatively flat in Q3 at -0.07%, and the trendline has been positive with a year-to-date gain of 0.4%.

Figure 4: Q3 2025 - Appreciation return - Canada all sectors

Another bright spot in the market is that leasing is accelerating. Leasing activity through the third quarter has already surpassed full year 2023 levels. Demand is being driven by financial services, renewed activity in tech, and return-to-office mandates. However, bifurcation remains a prevalent theme with best-in-class properties leading the recovery.

Vacancies in AAA buildings, especially in Toronto, have dropped below 2%, and tenants are having a more difficult time finding large blocks of contiguous space. As premium space becomes limited, demand is cascading into other Class A buildings. “Appraisers are starting to build in increasing rent escalation forecasts, and in some A buildings, they’re lowering expectations for TI allowances because of strength in the market, although that is very localized to the best, most competitive buildings,” says Robert Santilli, Altus Group’s Director, Valuation Advisory - Canada.

Return-to-office mandates are helping to drive renewed leasing activity. For example, the six large Canadian banks are moving employees back to the office five days a week, and the government of Ontario will require employees to be back in the office five days a week starting in January. “I think that will set a precedent for other municipalities,” says Santilli. Oxford Properties has started pre-leasing a new 1.2 million sf office building in downtown Toronto.

Whereas office was widely viewed as uninvestable 24 months ago, investor appetite for quality assets is returning. “Some recent trades on A+ office assets show that institutional investors are coming back to the table to purchase office assets, and in some cases, at fairly aggressive yields,” says Santilli. The yield impact declined to -0.19% in Q3 and -1.7% on a one-year basis.

Canada outlook

Like the US, weaker job growth could present a speed bump in the recovery. Although Canada's unemployment rate dropped to a 16-month low of 6.5% in November 2025, unemployment remains elevated in the 15-24 cohort at 12.8%. However, the near-term outlook is for an uneven K-shaped recovery. Best-in-class assets are following an upward trend, while lower-quality B and C assets could experience flat metrics or further declines.

Office recovery will be selective

The data across the US, Europe, and Canada points to a sector that is stabilizing, not rebounding in a straight line. Liquidity is returning and cash flows are improving, but value recovery is concentrated in newer, well-located assets with strong tenant demand. Older, capital-intensive buildings with weaker leasing prospects are likely to face ongoing pressure on income, yields and values.

For investors, lenders, and valuers, that means office exposure needs to be managed at the asset level rather than through broad sector calls. Underwriting should reflect higher capex requirements, slower lease-up, and differentiated rent growth assumptions across quality tiers and geographies. Scenario analysis on employment trends, return-to-office policies, and refinancing risk should be built into valuation, portfolio strategy, and loan decisions.

Want to be notified of our new and relevant CRE content, articles and events?

Disclaimer

This publication has been prepared for general guidance on matters of interest only and does not constitute professional advice or services of Altus Group, its affiliates and its related entities (collectively “Altus Group”). You should not act upon the information contained in this publication without obtaining specific professional advice.

A number of factors may influence the performance of the commercial real estate market, including regulatory conditions and economic factors such as interest rate fluctuations, inflation, changing investor sentiment, and shifts in tenant demand or occupancy trends. We strongly recommend that you consult with a qualified professional to assess how these and other market dynamics may impact your investment strategy, underwriting assumptions, asset valuations, and overall portfolio performance.

No representation or warranty (express or implied) is given as to the accuracy, completeness or reliability of the information contained in this publication, or the suitability of the information for a particular purpose. To the extent permitted by law, Altus Group does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. The distribution of this publication to you does not create, extend or revive a client relationship between Altus Group and you or any other person or entity. This publication, or any part thereof, may not be reproduced or distributed in any form for any purpose without the express written consent of Altus Group.

Authors

Robby Tandjung

Executive Vice President, Valuation Advisory

Phil Tily

Senior Vice President, Performance Analytics

Nicolas Le Goff

Director, Valuation Advisory - Europe

Robert Santilli

Director, Valuation Advisory - Canada

Authors

Robby Tandjung

Executive Vice President, Valuation Advisory

Phil Tily

Senior Vice President, Performance Analytics

Nicolas Le Goff

Director, Valuation Advisory - Europe

Robert Santilli

Director, Valuation Advisory - Canada

Resources

Latest insights