Key highlights

US CRE professionals' concerns about a recession faded in the first quarter of 2024, with only 37% of respondents expecting a near-term recession, down from 77% in the prior quarter

Respondents expect the next recession to be shallow, with 89% predicting this outcome, and 59% of Q1 2024 respondents anticipating the next recession to be short-lived

While the data suggests market participants are more optimistic about the economic outlook, there remains a level of uncertainty surrounding future economic conditions, especially with the potential impact of high-interest rates and the evolving sentiments of CRE industry

Likelihood of recession

As 2024 unfolds, concerns about a recession quickly faded among US CRE professionals. In our Q1 2024 CRE Industry Conditions and Sentiments survey, we asked market participants how likely they thought a recession was within the next six months. And regardless of that timing, what they thought the length and depth of the next one would be.

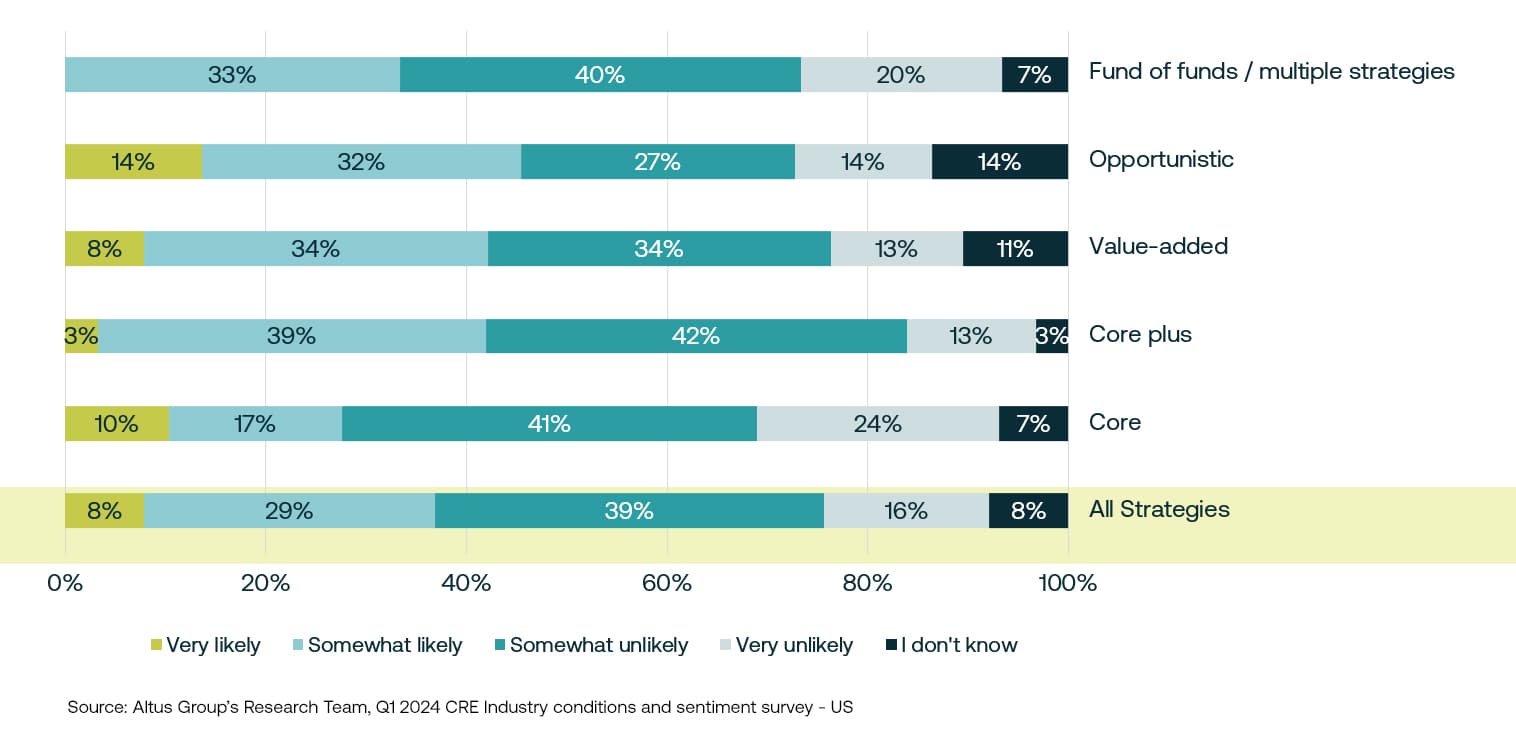

Only 37% of respondents told us the recession was “very likely”, or “somewhat likely”, within six months – or by late summer 2024. This was a significant decrease from the prior quarter when 77% thought a near-term recession was in the cards. This is possibly one of the most significant shifts in the survey from the last quarter, despite not being a CRE-specific question.

While the shift is reflective of overall improved sentiment with the near-term macro backdrop, there was a notable increase in the number of “I don't know” responses. In Q4 2023, “I don’t know” responses accounted for only 1% of total responses, however, this moved up to 8% in the Q1 2024 results. This shift could be reflective of overall uncertainty about how to interpret the macro climate. Interestingly, the highest percentages of “I don't know” responses were from the “value-added” and “opportunistic” strategies, which are often the fund strategies that would most likely benefit during market corrections and downturns.

Figure 1 - How likely is an economic recession within the next six months?

Expected length and depth of next recession

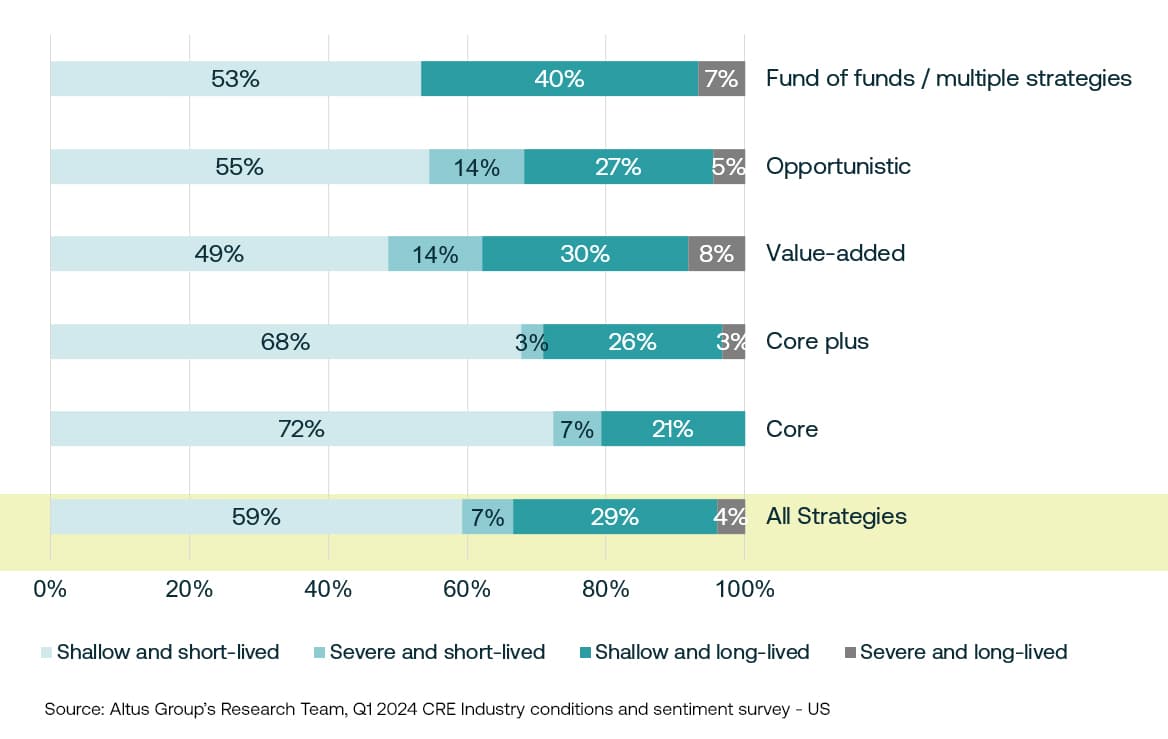

Interestingly, respondents expect the shape of the next recession to be shallow, regardless of timing. Nearly all respondents, 89% in total, expect the next recession to be shallow, similar to the results from last quarter, but significantly more respondents have migrated into the short-lived camp, with 59% of Q1 2024 respondents predicting this outcome, as opposed to just 37% in Q4 2023.

Figure 2 - What will be the depth and length of the next economic recession?

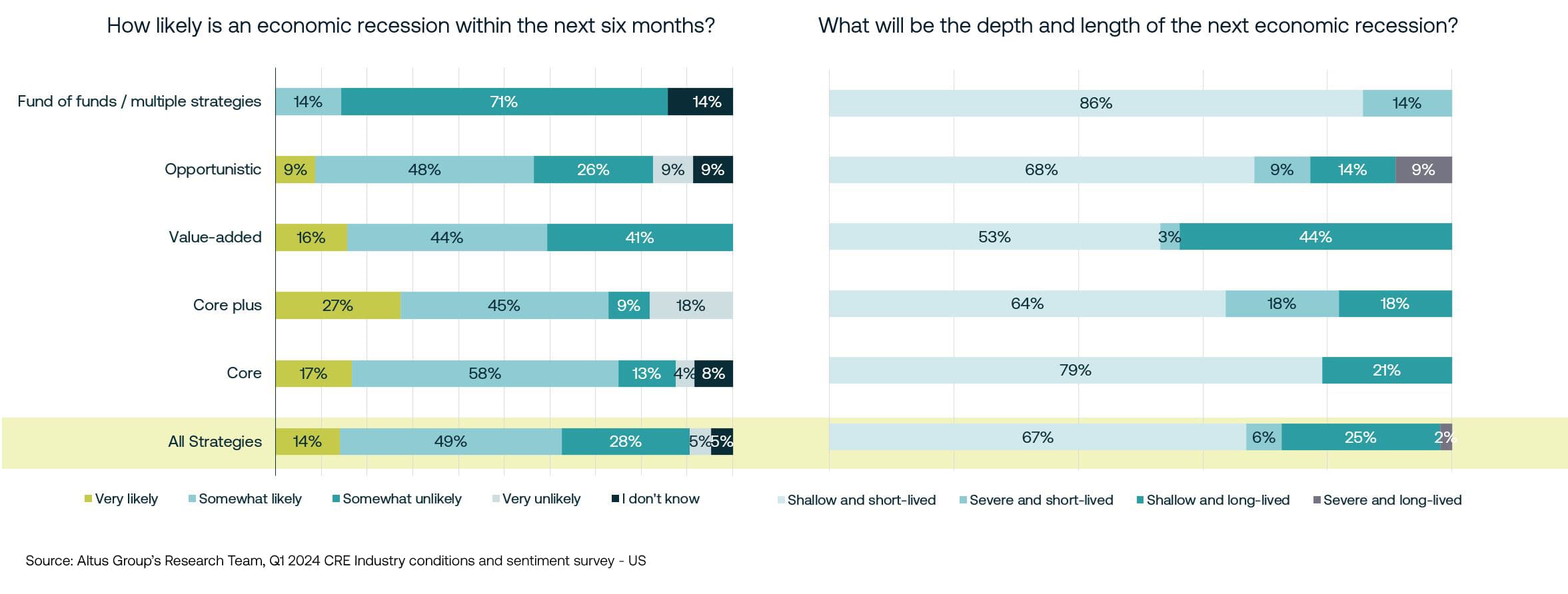

Recession sentiment results from Canada

We also track sentiment separately for Canada, and there was a 15-percentage point decline in the near-term recession expectations, however, it was a much smaller decline than was seen in the US. Ultimately, this left a majority (63%) of the Canadian respondents still expecting a recession in the short term. In terms of expectations around the next recession, 92% of respondents predicted that the recession would be shallow, and this indicator is up 6 percentage points from Q4 2023.

Figure 3 - Recession sentiment from Canada commercial real estate industry

Impact on the real estate industry

Overall, it appears that confidence in the possibility of a recession occurring within the next six months has significantly diminished among US CRE professionals. The data suggests that market participants are more optimistic about the economic outlook and anticipate a less severe downturn than was previously anticipated. However, there remains a level of uncertainty surrounding future economic conditions. Taking into consideration some of the more recent comments from the Federal Reserve Bank around the likelihood of any relief from high-interest rates in 2024, it will be interesting to see how sentiments from the CRE community evolve in the coming quarters, and how they will impact the real estate industry.

Author

Omar Eltorai

Director of Research

Author

Omar Eltorai

Director of Research

Resources

Latest insights

Jun 19, 2025

EP66 - From uncertainty to stability: How CRE is adapting to the latest mix of volatility