Q4 2024 Results

CRE industry conditions and sentiment survey - Canada

Gain insights into the market sentiment, conditions, metrics, and issues affecting the Canada commercial real estate industry based on our Q4 2024 survey.

Q4 results reveal a stronger appetite to transact, resiliency around multifamily sentiment, and reemerging recession concerns

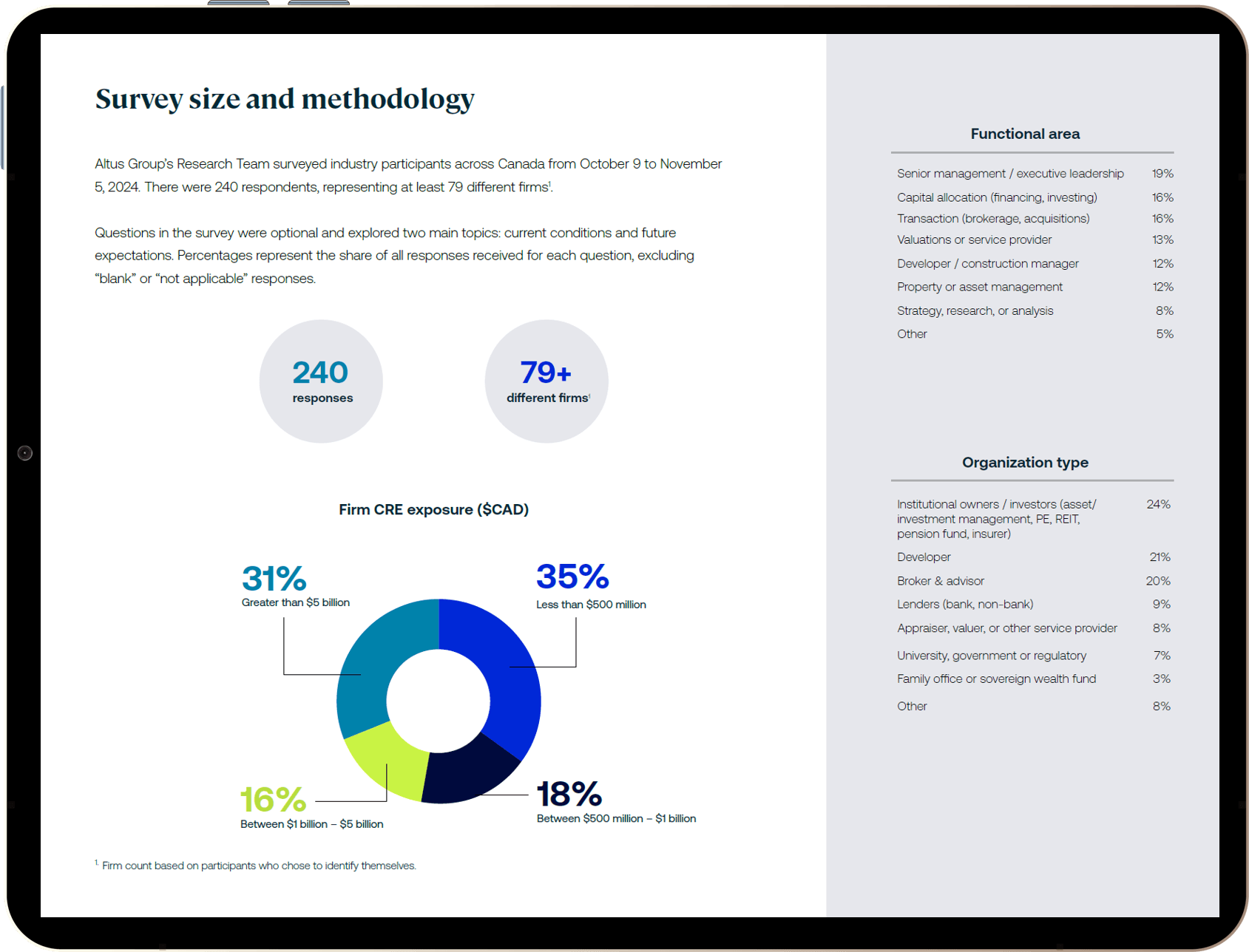

Altus Group conducted a survey across Canada to provide insights into the market sentiment, conditions, metrics, and issues affecting the commercial real estate (CRE) industry.

Key questions include:

How would you characterize current pricing by property type?

What are your expectations for the availability of capital over the next 12 months?

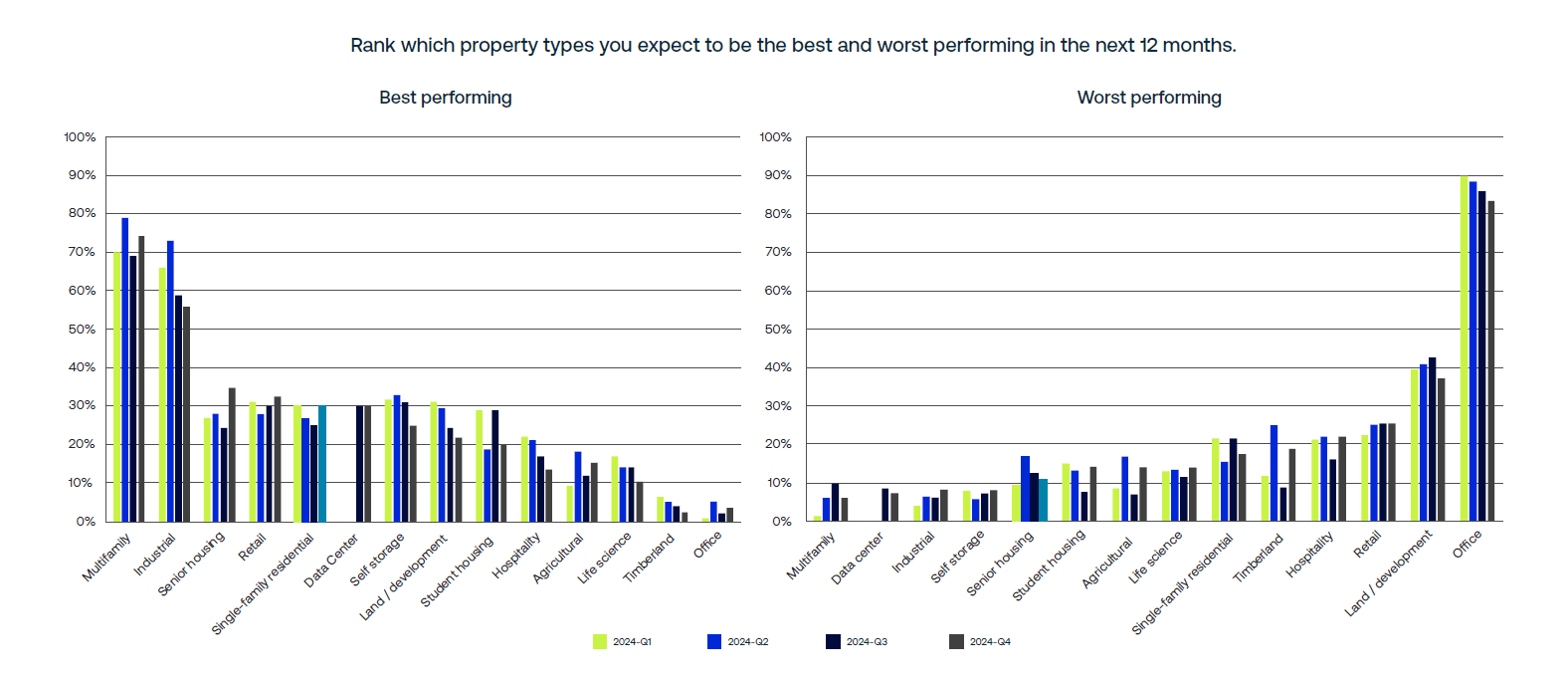

Rank which property types you expect to be the best/worst performing in the next 12 months.

We are happy to announce that the Q4 2024 results for Canada are now available for download.

Key findings

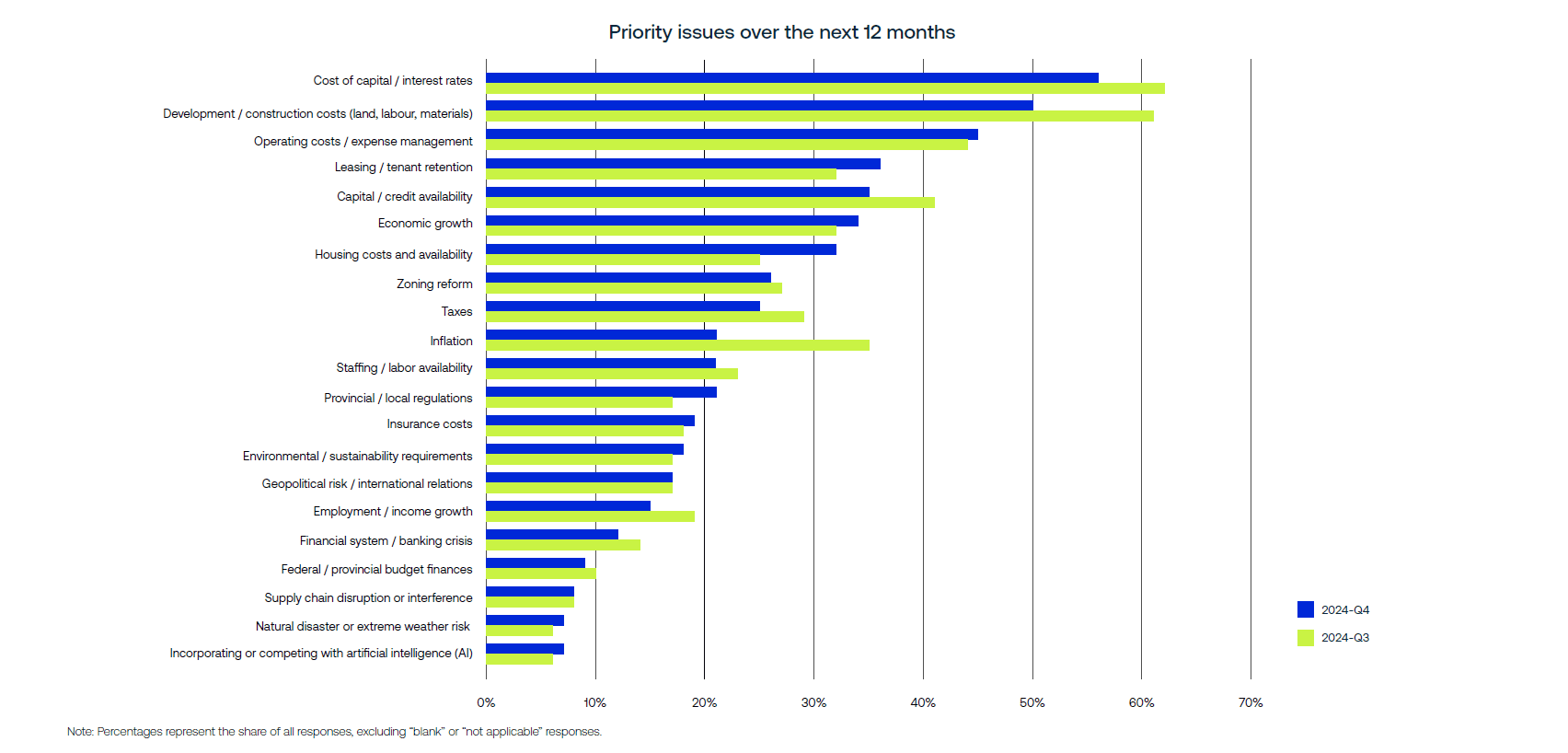

Costs dominated respondents' expected priorities, with majorities identifying the cost of capital (56%) and construction costs (50%) as key issues for the next 12 months.

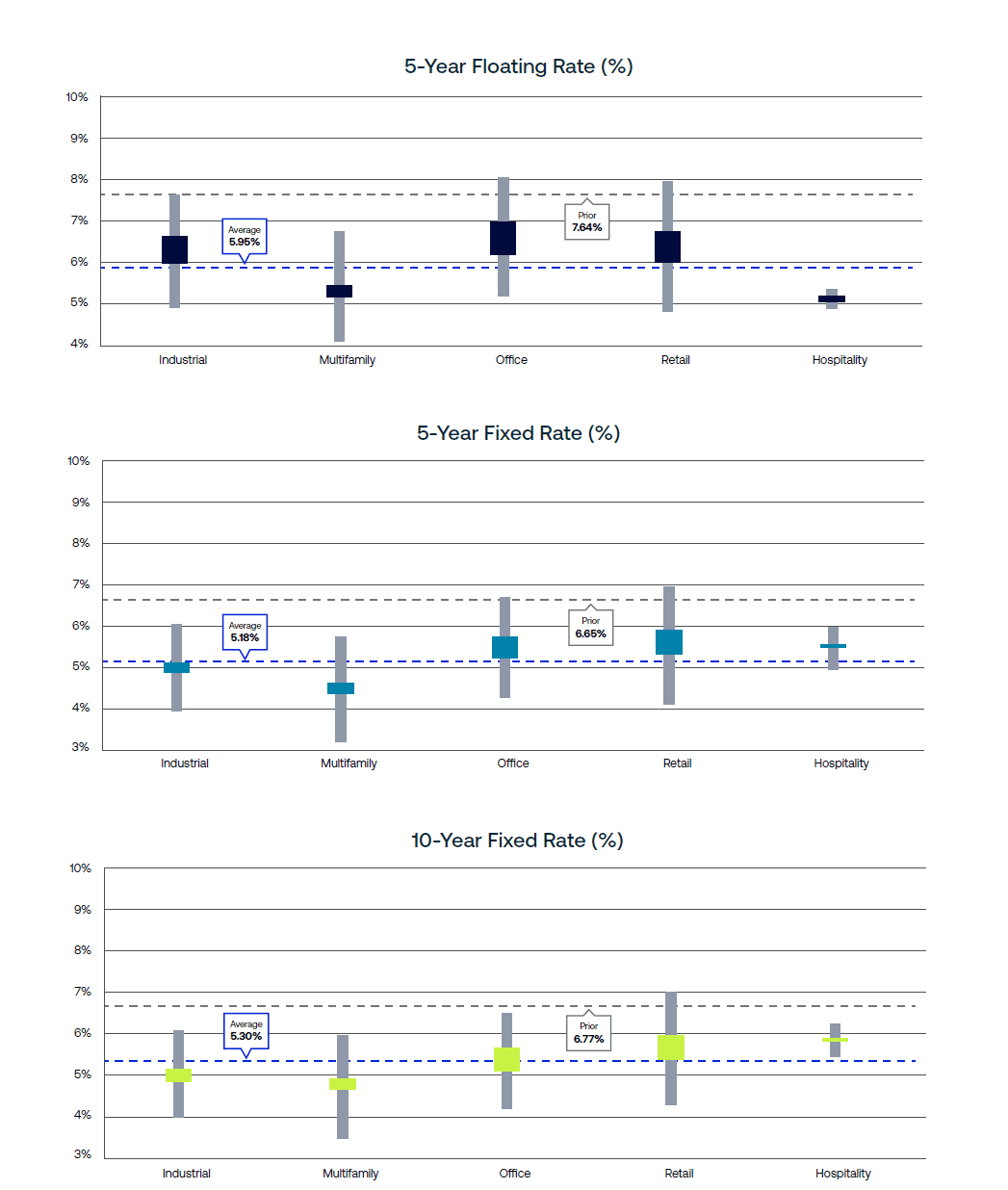

Average all-in interest rates across hospitality, industrial, multifamily, office, and retail fell around 150 bps on the quarter (vs Q3 2024 survey) for both 5-year and 10-year loans.

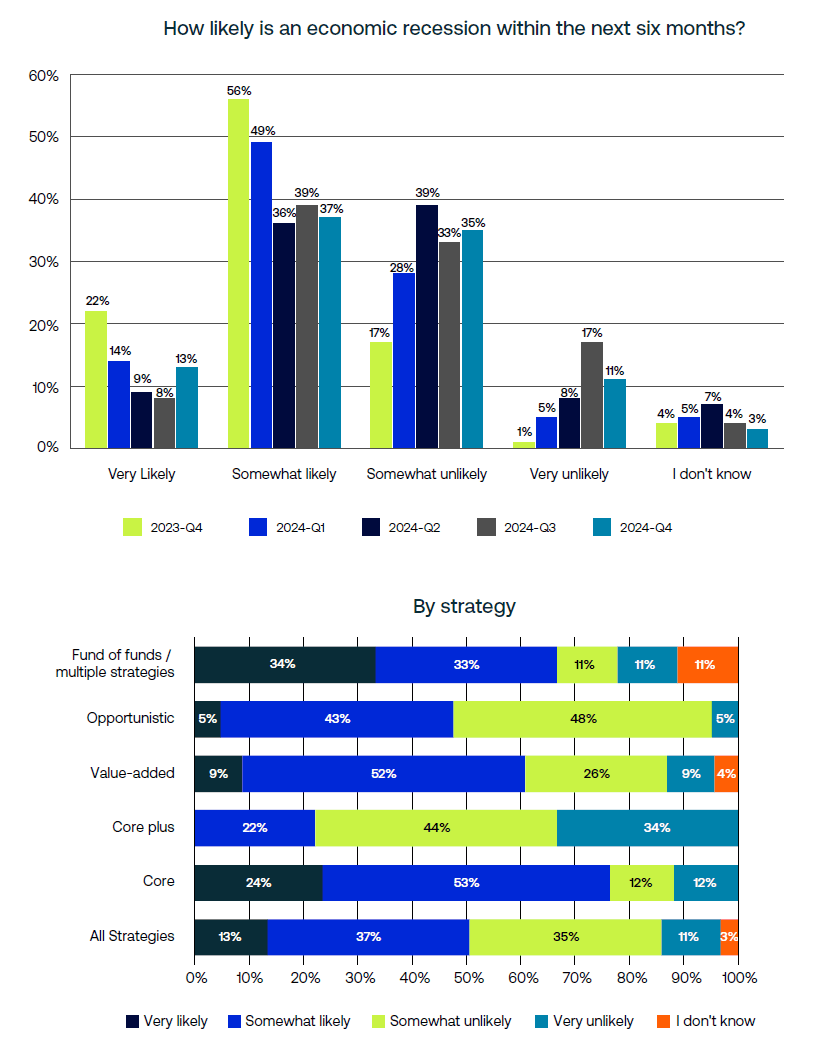

Fifty-one percent of respondents expect a recession to be either “somewhat likely” or "very likely" over the next 6 months, up from 46 percentage points in Q3.

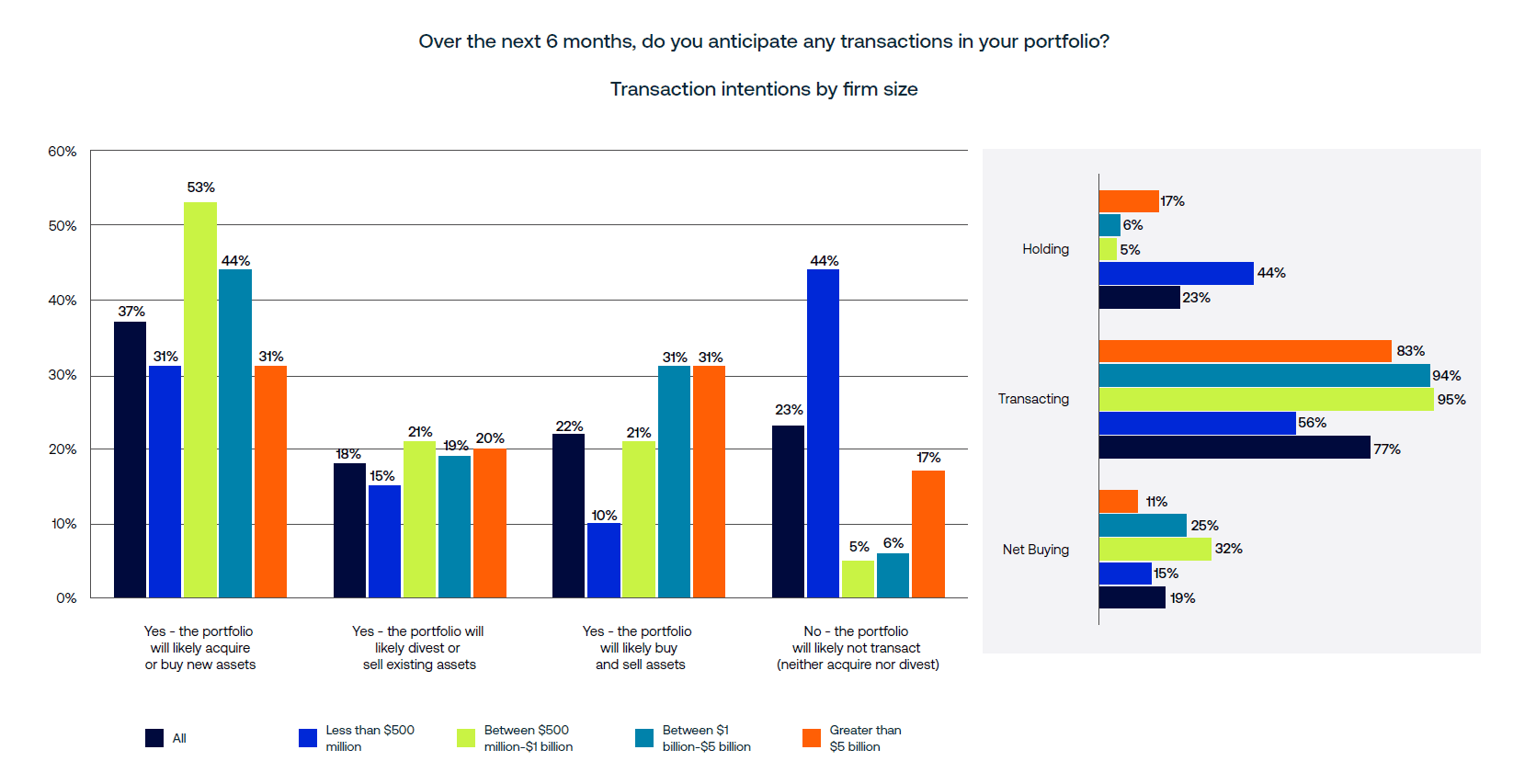

One in five (20%) of respondents at the largest firms (greater than $5 billion CAD) noted that they plan on only selling - up 11 percentage points from Q3 2024.

Sentiment remains resilient for multifamily properties, with 72% of respondents expecting strong performance over the next 12 months, a 3% increase quarter-over-quarter.

About the survey

The Commercial Real Estate Industry Conditions and Sentiment Survey is a quarterly survey providing insights into the market sentiment, conditions, metrics, and issues affecting the Canadian and United States commercial real estate industry.

The Q4 installment of the Canada survey was conducted between October 9th and November 5th, 2024. There were 240 respondents, representing at least 79 different firms.