Canadian industrial market update – Q3 2024

For the latest Canadian industrial market update, click here.

Key highlights

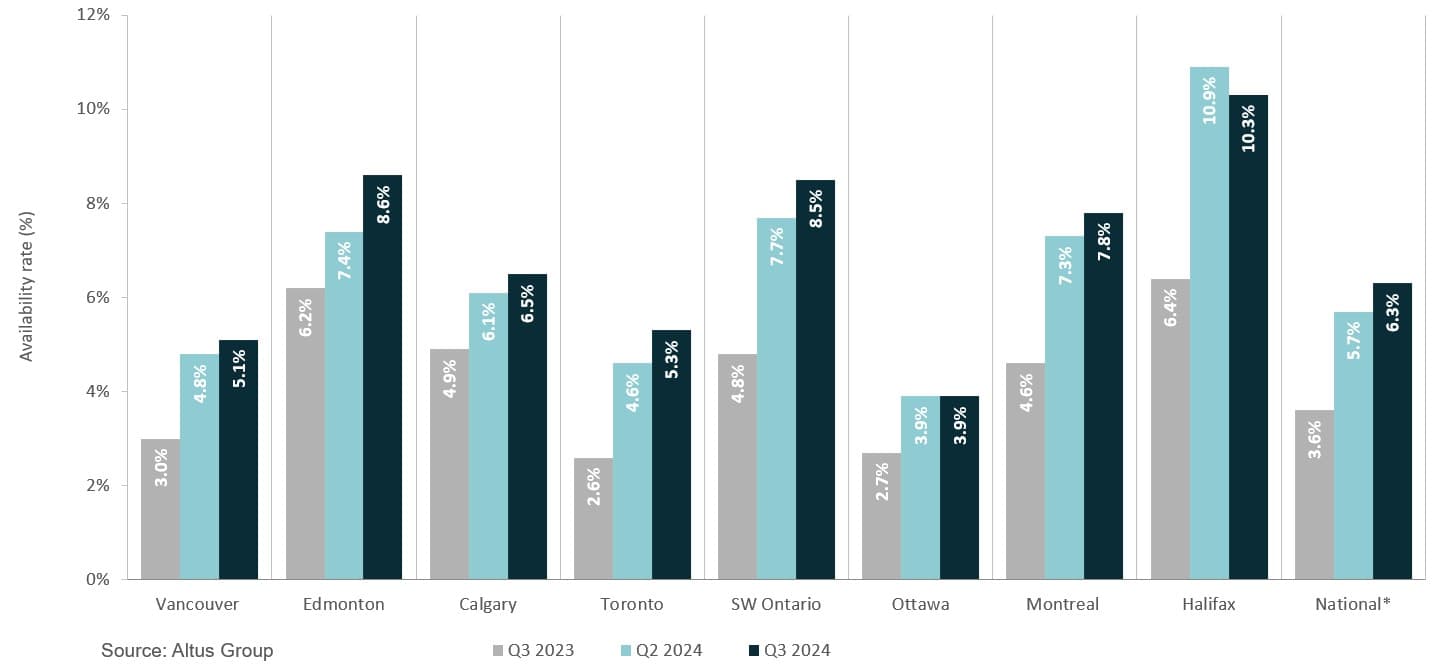

Canada’s national industrial availability rate continued on an upward trajectory, climbing 60 basis points to 6.3% in the third quarter of 2024

Sublet space has gradually increased and contributed to higher national availability, making up 15.6% of the available space, compared to 15.4% a year ago

While industrial rental rates have flattened in the past few quarters, rental rates have continued to experience growth compared to the past ten year

Industrial availability continues to climb across the nation

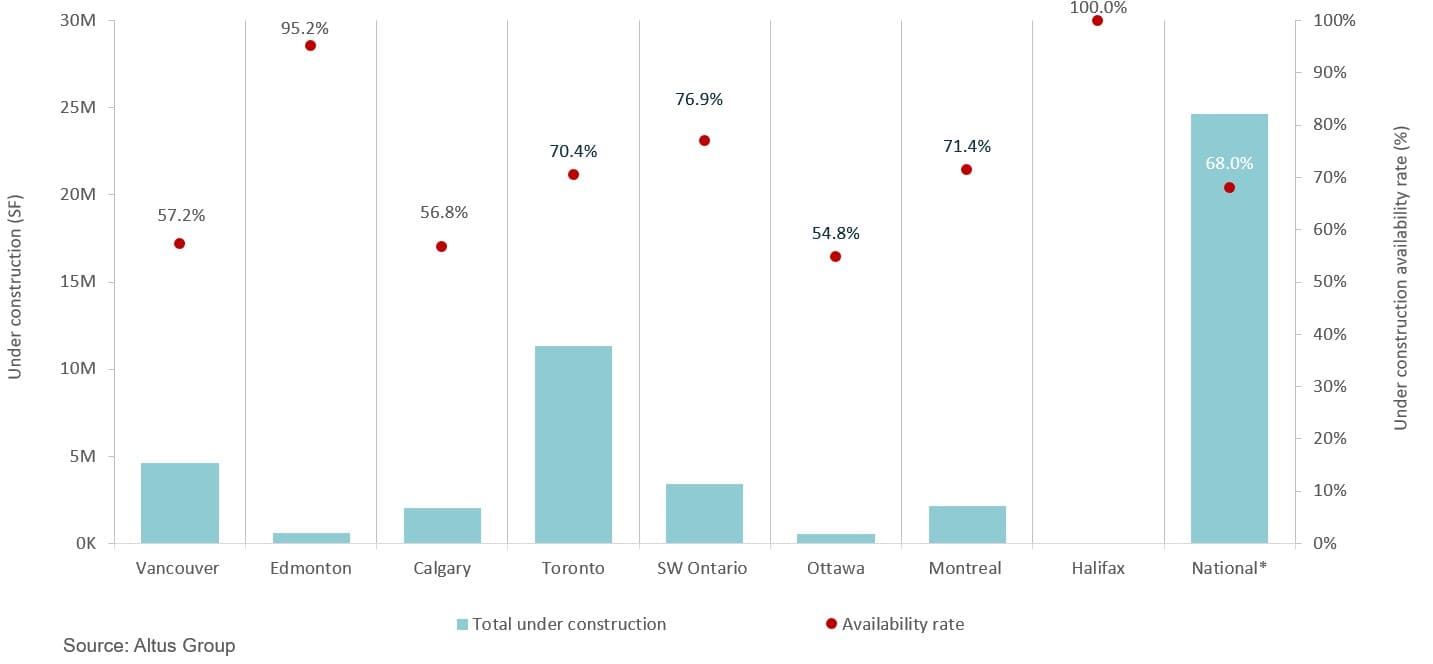

As of the third quarter of 2024, the national construction pipeline has continued to pull back, with a 33% decrease in total space under construction year-over-year. The country registered negative absorption for the third consecutive quarter due to new supply, which had higher vacancy levels upon completion. Market conditions have eased due to a short-term oversupply. However, deal velocity persisted in the Toronto, Vancouver, and Southwestern Ontario markets.

Statistics Canada reports retail sales increased 0.9% to $66.4 billion in July 2024. Seven of the nine subsectors experienced an increase, led by motor vehicle and parts dealers (2.2%). Meanwhile, the largest decreases in retail sales were recorded in building material, and garden equipment and supply dealers (-1.4%). Furthermore, while consumer spending has declined on a per-capita basis, strong population growth has contributed to an increase in core retail sales in categories such as food and beverage retailers (+0.8%) and general merchandise retailers (+0.8%).

Figure 1: Industrial availability Q3 2023 vs. Q2 2024 vs. Q3 2024

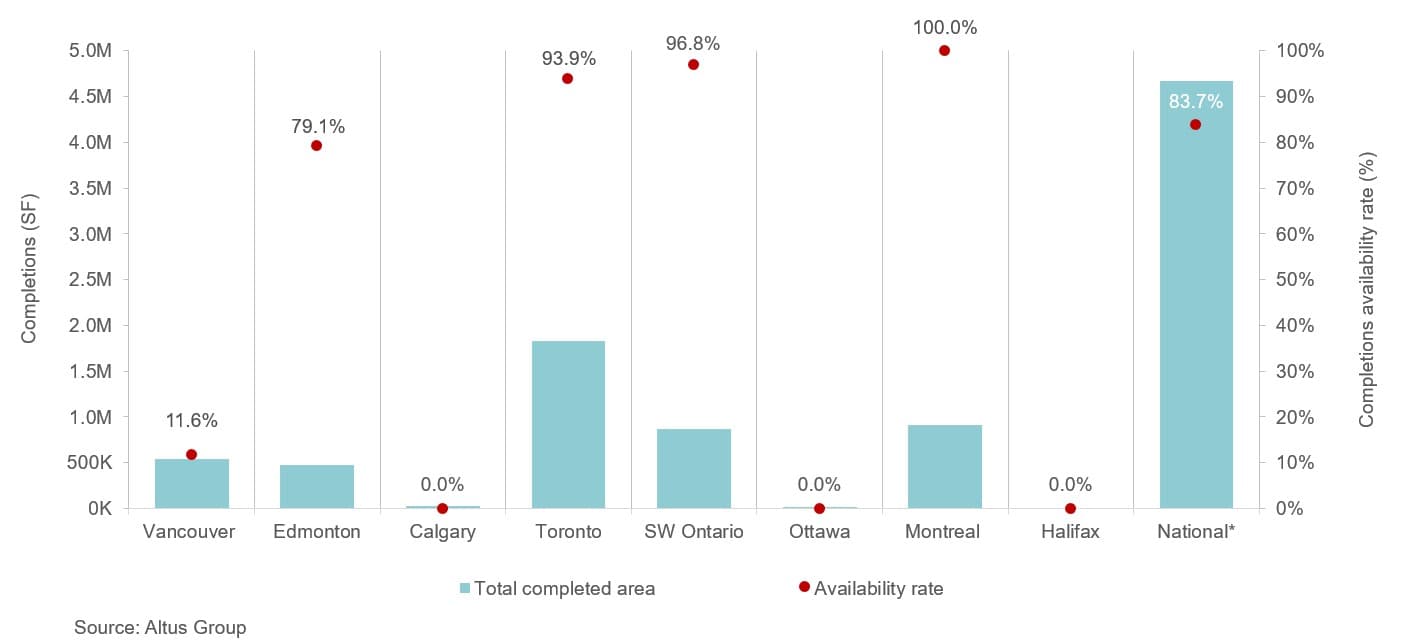

Figure 2: Industrial completion and availability

There were 31 industrial projects completed in the third quarter, totalling nearly 4.7 million square feet, with 84% of the space available. Southwestern Ontario and Montreal comprised the majority of new supply in terms of total square feet, at 1.8 million and 908,000 square feet, with 94% and 100% availability respectively (Figure 2).

Figure 3: Industrial under construction and availability

In the third quarter of 2024, 120 projects were under construction, totalling 25 million square feet, with 69% of the space available (Figure 3). Ottawa recorded the highest pre-leasing activity, with 45% pre-leased, followed by Calgary with 43% pre-leased. Pre-leasing activity in Toronto and Southwestern Ontario has pulled back, with less than 30% of the space pre-leased..

Conclusion

The industrial market is easing towards balanced conditions. According to Altus Group’s latest CRE Industry Conditions and Sentiment Survey, while industrial properties continued to be highly favoured by investors for their strong market fundamentals, the property type, along with multi-family has lost ground as top performers compared to the previous quarter. In the first half of 2024, the industrial asset class comprised the largest share of Canada’s total investment volume, at 25% with $7.2 billion in dollar volume transacted, an 8% decrease year-over-year.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Jennifer Nhieu

Senior Research Analyst

Author

Jennifer Nhieu

Senior Research Analyst

Resources

Latest insights