Canadian CRE valuation analysis – Q1 2025

Altus Group’s Q1 analysis shows Canadian property values holding firm.

Key highlights

Across the four main property types, valuation movement was relatively muted with retail outperforming other sectors, up 4.08% compared to a year ago, followed by residential at 1.13%

Industrial values were largely flat on a 12-month basis, moving up 0.40%

Office valuations have shown signs of stabilizing over the past year with Q1 values that dipped a slight 0.48% over the prior quarter and -4.02% on a year-over-year basis

The outcome of trade policy could set the direction of valuations for certain property sectors and create more bifurcation in the market between stronger and weaker assets

Overall, investment sales volume has slowed this year, dropping from $8.5 billion in Q1 2025 compared to $10.2 billion in Q1 2024 and $12.3 billion in Q1 2023

Read the latest Canadian CRE valuation analysis.

Navigating trade tensions: Impact on CRE valuations and market stability

Will tariffs and the US versus Canada trade war change the trajectory of commercial real estate and multifamily valuations? Although overall fundamentals remain relatively stable, uncertainty is clouding the near-term outlook for valuations across property sectors.

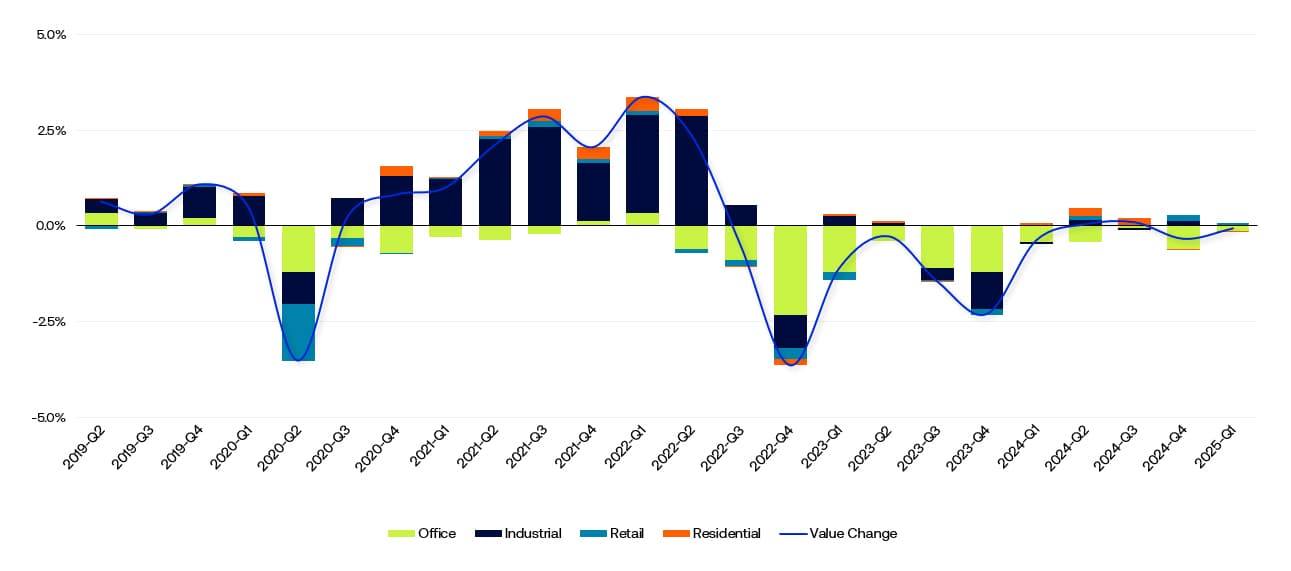

Altus Group’s latest valuation data shows that Canadian commercial and multifamily values stayed the course in the first quarter. Across the four main property types, valuation movement was relatively muted with retail outperforming other sectors, up 4.08% compared to a year ago, followed by residential at 1.13%. Industrial values were largely flat on a 12-month basis, moving up 0.40% and office was the only sector that saw a year-over-year decline of 4.02%.

The broader trendline shows less volatility and more stability in values over the past five consecutive quarters. Even office, although still choppy, is experiencing more modest valuation moves compared to the bigger declines that occurred in 2022 and 2023.

Figure 1 – Canada, all sector valuation change

Source: Altus Group

At the end of 2024, the expectation was that interest rates would move lower and values for real estate would trend higher as investors bid up the price of real estate. However, US President Trump’s trade tariffs have sparked widespread uncertainty and volatility in global markets. “Absent this trade war, I think we would see greater strength in pricing for real estate,” says Robert Santilli, Altus Group’s Director of Valuation Advisory for Canada. The market is now in a holding pattern, and the outcome of trade policy could set the direction of valuations for certain property sectors and create more bifurcation in the market between stronger and weaker assets.

At this stage, there are still different outcomes playing out. “If we go into a recession, then we're going to see the fundamentals deteriorate more rapidly, and you'll see the pricing or the multiples that are paid for income come down,” says Santilli. “If this trade war is resolved, and there's not too much damage done, then I think we resume the course of easing monetary policy. Interest rates come down, and deal activity increases from what we've seen in the last two years.”

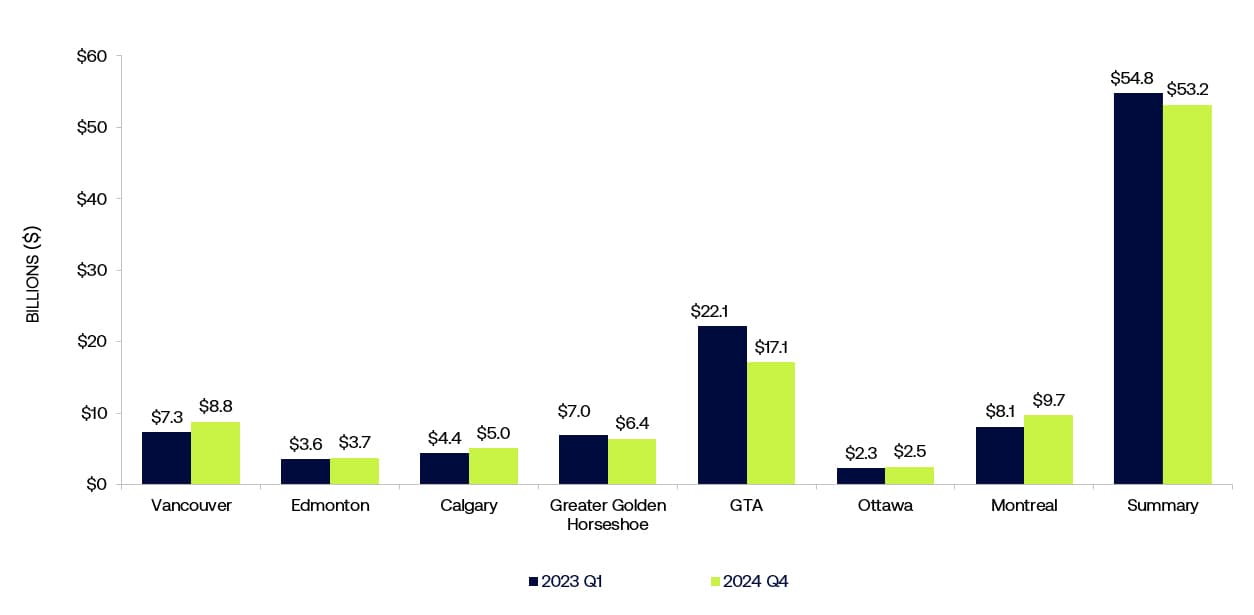

Slower pace of investment sales

Overall, investment sales volume has slowed this year, dropping from $8.5 billion in Q1 2025 compared to $10.2 billion in Q1 2024 and $12.3 billion in Q1 2023.

“The challenge we’re having with the current climate is that there is a bit of a pause in the market. Deals are still happening, but transaction activity is focused on core deals where people feel confident in going forward, while there is some hesitation on certain other transactions,” says Ray Wong, Altus Group’s Vice President of Data Solutions.

Investors have dry powder and they want to invest. “They haven't pulled the trigger because of the uncertainty right now. We don’t know what tariffs will be in place and for how long, and we don’t know the potential economic impact from those tariffs,” says Wong. The hope is that if tariff issues are settled relatively quickly, people will get back in the market on both the commercial and residential side, and transaction activity will pick up as the year progresses.

Figure 2 – Total year-over-year investment activity (2023 versus 2024)

Source: Altus Group

Analyzing CRE valuation trends across property types

Supply-demand dynamics, along with uncertainty surrounding the outlook for macroeconomic conditions, are influencing transaction activity and near-term trends in property valuations. Although food-anchored retail centres have proved to be resilient during cyclical downturns, certain segments of retail could be impacted if consumer spending slows related to new tariffs. Values in both industrial and multifamily appear to be flattening, while office is showing positive signs of stabilizing values.

Retail

Although retail values are still down 9.3% compared to pre-pandemic levels (1Q 2020), the sector has seen positive momentum over the past year with Q1 values that rose 0.74% compared to Q4 and 4.1% compared to Q1 2024.

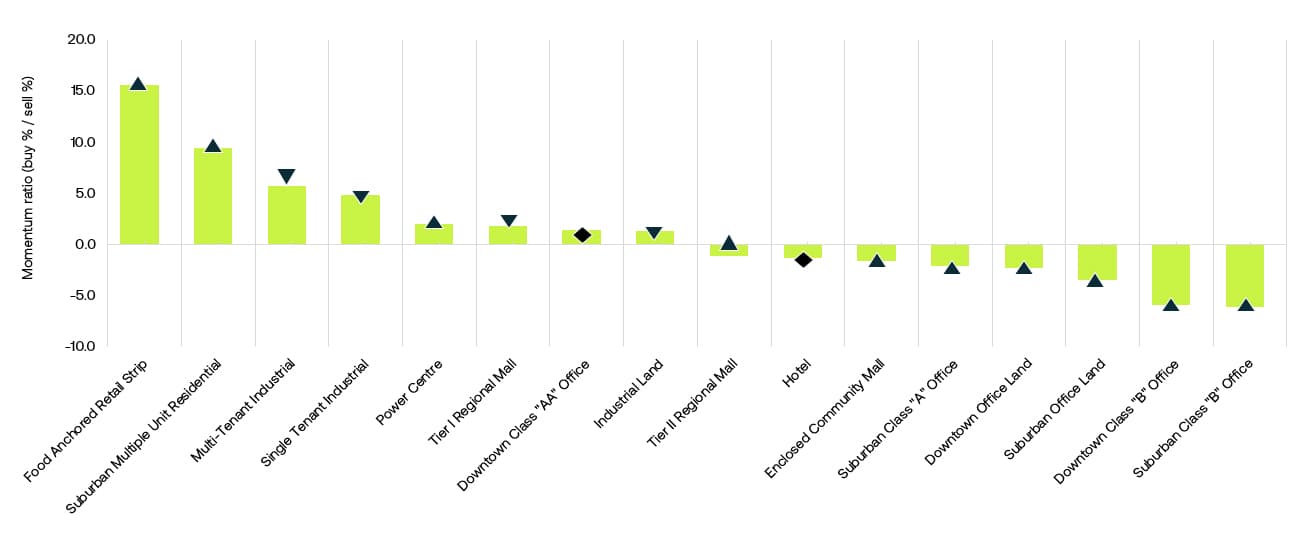

The most sought-after sector across all property types is food-anchored retail. Figure 3 shows the property type barometer from Altus Group’s Investment Trends Survey Q1 2025 results. The food-anchored retail strip remains the preferred investment by a wide margin. Investors like the stability in foot traffic and sales. The obstacle to investment is the limited inventory of those assets for sale. Owners are choosing to hold onto those assets because they are performing well. First quarter retail sales across all types of retail assets reached $1.37 billion, which was well ahead of office but trailed sales volume in both industrial at $1.85 billion and multifamily residential at $1.60 billion.

“The challenge for retail is the health of the consumer going forward. If we go into a recession, what does that mean for the fundamentals in the retail space?” says Santilli. Those concerns are another reason driving demand for more resilient food-anchored retail.

Figure 3 – Property type barometer – All available products (Q1 2025)

Source: Altus Group

Figure 4 – Retail value change

Source: Altus Group

Industrial

Following a strong run in soaring property values over the past few years, industrial values appear to be flattening out. Although industrial values are more than 60% higher compared to pre-pandemic levels, values were virtually unchanged in Q1 on a quarter-over-quarter basis and rose only a slight 0.40% year-over-year.

“Investors still like the fundamentals of industrial, but they’re a little more cautious because they’re also thinking about the potential impact of tariffs,” says Wong. Industrial also has experienced some flattening in rent growth due to market uncertainty and increased availability.

The industrial market has gone through a transition of “just in time” inventory to “just in case” where companies stockpiled more inventory due to the pandemic supply chain disruption. Last year, companies started disposing of some of their excess space, which resulted in a slight increase in vacancy. “We're hearing now that companies may be moving back into a “just in case” inventory management system and getting as much inventory as possible before the tariffs hit,” says Wong.

Figure 5 – Industrial value change

Source: Altus Group

Multifamily

Multifamily property values have flattened over the past 12 months along with softening rent growth. Although values are still 12.3% higher compared to pre-pandemic levels, values have moved only nominally over the past year, dipping 0.03% compared to Q4 and up 1.13% year-over-year.

Residential tends to be a perennial favourite among investors due to rising rental rates and strong occupancies. However, investors are starting to be more cautious due to softening fundamentals, including slowing rent growth and the increasing prevalence of rental incentives. Notwithstanding these concerns, pricing has remained relatively strong.

Figure 6 – Residential value change

Source: Altus Group

Office

Not surprisingly, the office sector has experienced the biggest decline in valuation with property values that are down 20.1% compared to pre-pandemic levels. On a positive note, office has shown signs of stabilizing over the past year with Q1 values that dipped a slight 0.48% over the prior quarter and -4.02% on a year-over-year basis.

Despite more momentum from people returning to the office, due in part to increased company mandates, office has room for values to drop further. Those declines are likely to be concentrated in lower quality B space, whereas the demand for AA space remains very strong. “Office valuations are seeing a separation between well-leased assets in good locations, versus B assets that are going to remain challenged in the near and immediate future,” says Wong.

Figure 7 – Office value change

Source: Altus Group

Property valuation outlook

Historically, real estate valuations lag shifts occurring in economic and market conditions. “The numbers we’re seeing in first quarter are closings based on activity that occurred during the fourth quarter. That’s why the numbers are still robust,” says Wong. “We won’t see the real impact from investor hesitation in the market until the second or third quarter.”

Some fundamentals are starting to soften but not enough to call out a trend. The real estate market remains in a bit of a holding pattern as participants look for more clarity on tariffs and more data that will offer insights into how property fundamentals and pricing are moving. “It is a wait-and-see mindset right now. Well leased retail should perform well, and we might see a light at the end of the tunnel for office. Residential and industrial have some headwinds with rents rolling backwards in some cases and concessions increasing, but there are buyers out there for good product. says Santilli. “If the specter of tariffs goes away and monetary policy continues to ease, then transaction activity will be spurred.”

Going forward, Altus Group will continue to monitor key market and economic factors that influence valuations.

Want to be notified of our new and relevant CRE content, articles and events?

Authors

Ray Wong

Vice President, Data Solutions

Robert Santilli

Director, Valuation Advisory - Canada

Authors

Ray Wong

Vice President, Data Solutions

Robert Santilli

Director, Valuation Advisory - Canada

Resources

Latest insights