Key highlights

Altus Group is forecasting flat economic growth in 2024, with momentum expected to pick up in the latter half of the year

Year-to-date property sales in 2023 are down 37% compared to 2022

Interest rates remain a top concern and interest rates could move higher before they start to improve, likely in late 2024

Overall, industrial availability rates have increased over the past four quarters by 100 basis points from 2.6% to 3.6%

Office occupancy is increasing as some companies mandate the return to office; the average weekly occupancy is around 54%, and higher at 69% for the peak days

A surge in population growth will continue to put pressure on housing availability and affordability

Increased operating expenses will drive the need for improved operating efficiency

2023 year in review and outlook for 2024

As we approach the end of 2023, real estate markets are feeling the pressure of higher interest rates and are bracing for more challenges ahead in the coming year. “A lot of the discussion last year was, hang on until 2024. Now we're saying hang on until 2025 or 2025-plus,” says Raymond Wong, Vice President, Data Solutions Delivery at Altus Group. “It's going to be a bit of a challenge going forward, because we’re still going to see continued strain finding capital sources, especially for office and land, and continued seller and buyer price discovery.”

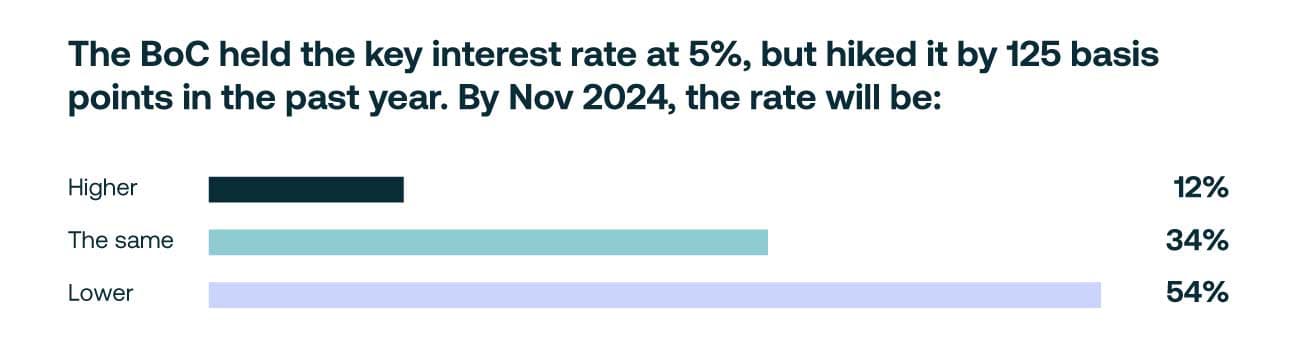

Figure 1 - Looking ahead to November 2024, webinar attendees were asked if they expect key interest rates to be higher, the same, or lower.

Altus Group’s economic growth forecast paints the picture of virtually flat economic growth in 2024, with momentum possibly picking up later in the year. However, the economy isn’t likely to normalize to a better growth rate until 2025. “As we scan across the country, all provinces – except for Atlantic Canada – are seeing sharply lower growth this year and further slowdowns or moderation in economic growth next year, but perhaps less so in Alberta than most of the rest of the provinces,” says Peter Norman, Vice President and Chief Economist at Altus Group.

On the positive side, data does show some improvement in the return to office numbers. Buyer demand for multi-unit residential and industrial remains strong, although buyers are using caution to avoid negative leverage. However, the near-term landscape is likely to remain a challenging one for both real estate investors and operators. “We’re going to see increased operational costs challenges, and we need to find efficiencies via AI or other areas,” adds Wong.

A number of disruptive factors are impacting both the Canadian economy and the commercial real estate market at large, with the issue of population growth topping that list. Canada’s population grew by more than 1 million people over the 12 months leading up to the middle of 2023; this growth is double the pace of the prior year, and three times the normal pace. In addition, 98% of that new population is coming from international newcomers, including new residents, foreign workers, and international students.

“Population growth is very important in the end for the real estate sector and very important for the Canadian economy, but when it changes so rapidly it’s creating a lot of waves and challenges” says Norman. That growth is having significant implications on things such as demand for housing, how much housing should be built, and where, adds Norman. Data also shows that Ontario is attracting the biggest share of that population growth at 38%, followed more distantly by Quebec at 18% and both BC and Alberta at 15%.

Economic headwinds

Despite relatively flat economic growth, employment numbers have been holding up reasonably well. Canada is expected to add close to 325,000 net new jobs in 2023, which is well above pre-pandemic norms. However, the unemployment rate is simultaneously rising as a result of the strong population growth, as more immigrants are now participating in the labour force.

The Bank of Canada has also made it clear that inflation, although improving, is not coming down fast enough. “I think we have increased our chances of an interest rate increase, either later this year or early next year, and that the hold period will be longer,” says Norman. “The odds now are that rates will be the same or potentially even higher a year from now and that's having a lengthening influence on a lot of the issues that we’re facing.

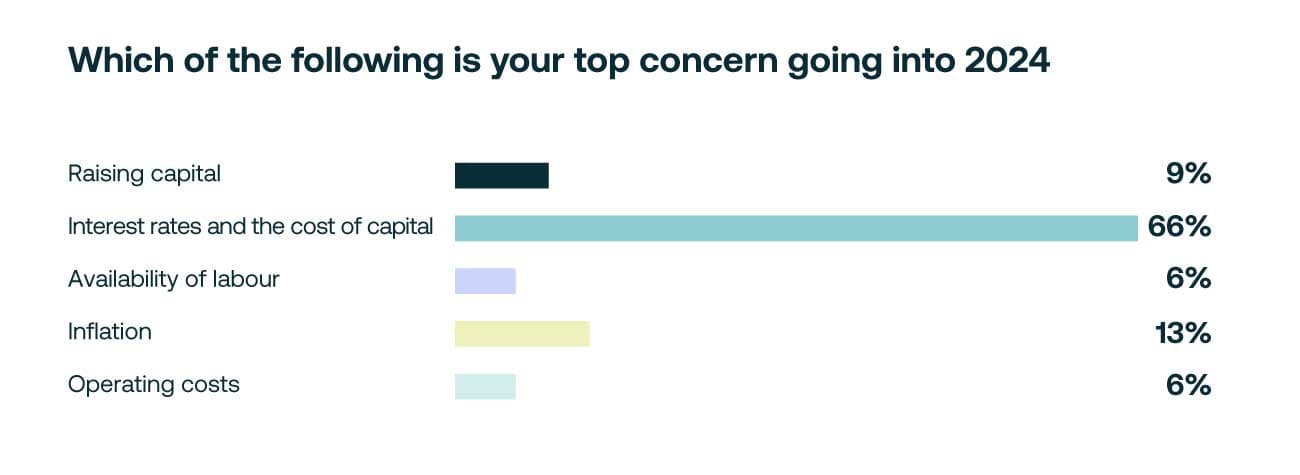

Figure 2 - According to our audience poll, interest rates and cost of capital are the top concern going into 2024

Another top concern involves debt service ratios that are shooting up very quickly. “Our expectations for 2024 are for even higher debt service ratios, particularly as interest rates continue to go up, and more mortgage holders race renewals” says Norman. The debt service ratio is a concern for households in terms of their ability to participate in the rest of the economy.

Transaction volume declines

Higher interest rates and ongoing price discovery are slowing transaction volume. Year-to-date sales activity in 2023 is down 37% compared to 2022. “Overall investment activity is not as bad as we thought it was going to be,” notes Wong.

Excluding land, industrial generated the highest volume of sales at more than $12 billion, followed by multi-family at close to $8 billion. The biggest challenge is finding capital sources for financing. Industrial and apartments continue to be the most popular in terms of demand but finding product – and the process of price discovery – remain obstacles to transactions.

CRE investor preferences have remained fairly consistent, with a greater focus on food-anchored retail strip centres, suburban multi-unit residential and both single and multi-tenant industrial, while demand for all types of office is down considerably. “There are a number of different strong headwinds ahead of us, the biggest challenge is the ability to secure some of the financing. But there's no weakness in wanting to purchase, it’s just from a timing perspective and the lack of deals,” says Wong.

Industrial performance remains solid

Overall, industrial availability rates have increased over the past four quarters by 100 basis points from 2.6% to 3.6%. According to Wong, there is some softening due to the economy, in addition to the impact from higher rental rates. It’s not much of a concern because the availability rate remains low and there are still strong increases in rental rates. However, the availability rate will be something to watch going forward into next year, particularly from a construction perspective, he adds.

The availability rate of buildings under construction appears elevated, but most of those spaces are being committed just prior to completion. “I think we're still undersupplied especially for some of the newer buildings and higher ceiling heights,” says Wong. The average gross rents continue to push higher. Vancouver and Toronto rents have increased by about 40%, while Montreal rents have increased about 63% since 2020. Vancouver remains the highest cost market, with gross rents averaging $27.24 per square foot (psf).

Buyer demand for industrial has kept cap rates low at around 4.5%. However, financing costs are between 5% and 8% depending on the type of debt. “What we have seen is the return of occupiers that want to purchase rather than rent, especially with the rapid increase in rents over the last few years. And occupiers tend to be a little bit more aggressive with some of the purchases, especially if the space is vacant and it is still challenging from a financing perspective,” says Wong.

Workers return to the office

The occupancy levels of people returning to the office in the Toronto market is increasing. The average weekly occupancy now sits around 54%, and higher at 69% for the peak days, which are typically Wednesdays or Thursday. Mondays and Fridays tend to be low occupancy days at around 28%. “The good news is that the numbers are increasing, in part because of increased mandates from companies to have their employees back in because of certain productivity challenges,” says Wong. However, companies are still facing some difficulties in effectively enforcing these mandates.

National office vacancies appear to be flattening at 17.6%. Calgary continues to post the highest vacancy rate at 23.9%, although levels have improved from 25.7% in the first quarter. “The overall availability rate is starting to flatten a bit based on the shrinkage in the overall office sublet side,” says Wong. Some of the sublets have been on the market for two or three years. So there are some sublets that are burning off, while there also are still some extensions occurring from tenants that want to remain in their space but are perhaps cutting back on their space requirement.

Canadian office leasing activity is slower than it was a year ago at 9.9 million square feet (sf), but not dramatically slower. Last year, leasing activity through the third quarter was at 12.3 million sf. It also is no surprise that data shows more demand for Class A space compared to B and C space. “We do know that demand for office is going to be impacted from the growth of AI in the tech sector,” says Wong. In the more challenging environment, office owners will need to be more proactive to integrate multiple layers of data and insights to identify opportunities to really shore up their performance in the face of flat or declining rents, by looking at overall efficiencies, reducing costs, and maximizing the technology, he adds.

Growing concerns for housing

The resale market is a leading indicator of what's happening in terms of housing demand. Year-to-date home sales through September stood at 356,912 compared to 412,910 for the same period in 2022. Although there is some cooling in home sales, the seasonal pattern seems to be reverting back to pre-pandemic trends. “That may seem odd given that we’ve got high-interest rates that are having an impact, and I think they will have more of an impact as we go forward,” says Norman.

There are plenty of issues ahead in the housing resale market that impact both supply and demand. Airbnb is one area of interest, as more of the property purchases that were initially intended for short-term rental are now coming back into the for-sale market. This can be attributed, at least in part, to interest rates; however, it is also a softer market for those short-term rentals. Property owners facing modest mortgage distress as they have to renew at higher rates are also likely to contribute to new supply coming into the market.

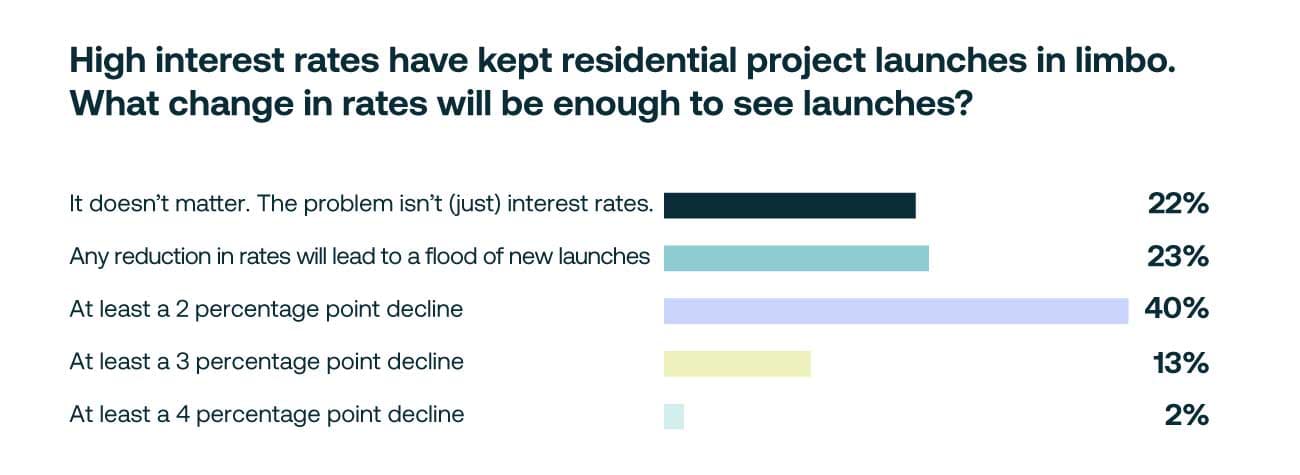

Figure 3 - According to our audience poll, a 2 percent decline in interest rates is needed to encourage more residential project launches

On the price front, there have been some notable price adjustments due to the changes in interest rates. “For most markets now, the price adjustment has mostly played its course, and we're starting to see prices leveling off and even some upward pressure on prices in key markets,” says Norman. If Bank of Canada raises rates again and mortgage rates follow suit, pricing could level off again, but there doesn’t appear to be any major declines in housing prices going forward. Data on newly constructed home sales is more of a mixed bag. For example, new home sales in Edmonton and Montreal are dramatically lower, while suburban markets such as Hamilton have seen a fair increase in sales.

Slowing growth for multi-unit residential

Condominium apartment sales are down about 30 to 40% in most markets across the country. There are two forces at play here. “One is, we've got less product available because we've got launches that have paused and there’s less inventory available to buy. Secondly, one of the major components of condominium apartment sales is the investor market, which also has dried up in a lot of markets,” says Norman.

There continues to be strong demand for new rental housing in Canada. Rental households accounted for almost half of all household growth in Canada in recent years but is now moderating slightly to about 40%, based on changing demographics. Growth in rental households should be good for condominium investors, but there is also increasingly more competition from purpose-built rentals, with some 56,000 new units constructed per year over the last couple of years. “This is getting a lot closer to the underlying need for rental and so opportunities in those investor markets will probably be a lot softer going forward,” says Norman.

Although the inventory of new high-rise product has increased from very low levels during the pandemic, new development is slowing. As an example, developers in Toronto were bringing around 30 new projects per quarter to the market and those launches have dropped by almost half in the last 18 months to 17 new launches per quarter. "It's taking longer to sell out each project,” says Norman. The result is that lower housing starts will begin showing up in 2024 and 2025, and this is a similar trend that is playing out elsewhere in Canada.

Developers are also still struggling with high construction costs, “We're still seeing construction costs rising, and that continues to be a challenge for developers, regardless of the interest rate environment,” he says. In addition, there is a fairly dramatic decline in land sales, which will likely be a harbinger for weaker construction activity going forward, adds Norman. Altus is projecting that new housing starts will drop to 188,000 in 2024 and 171,000 in 2025. That slowdown comes at the same time the country is experiencing significant population growth. “So, the need for housing is strong but the supply of housing will lag significantly, at least for the next couple of years,” says Norman, “and that’s a recipe for further problems with housing affordability.”

Authors

Ray Wong

Vice President, Data Solutions

Peter Norman

Vice President and Economic Strategist

Authors

Ray Wong

Vice President, Data Solutions

Peter Norman

Vice President and Economic Strategist

Resources

Latest insights