February 2026

TRREB professional newsletter

Altus Group's monthly snapshot of Toronto’s new home and commercial market - giving TRREB professionals the data and trends they need to stay one step ahead.

TRREB members can sign in at OntarioMLP.ca and select MLS® Tools to access Altus Data Studio.

COMMERCIAL

Featured property transactions

Greater Toronto Area: Residential

25 Cosburn Avenue, East York

$40,660,200

$315,195 per unit

Greater Golden Horseshoe: Industrial

10 Washburn Drive, Kitchener

$4,764,500

$224 per sq. ft.

Brokers: Darren Shaw & Austin Randall (Lennard Commercial Realty)

Greater Toronto Area transactions

Sector | Municipality | Address | Price | Unit price | Parameter | Transaction Date | Brokers |

|---|---|---|---|---|---|---|---|

Industrial | Mississauga | 2425 & 2475 Meadowpine Boulevard and 2510 & 2520 Royal Windsor Drive | $195,240,000 | $358 | per sq. ft. | Feb. 11, 2026 | Peter D. Senst, Matthew Brown, Kai Tai Li (CBRE) |

Industrial | Scarborough | 1220 Birchmount Road | $8,225,000 | $298 | per sq. ft. | Feb. 5, 2026 | Hanan Goldfarb(Vanguard Northeast Realty) & Dave Stevens (Cushman & Wakefield) |

Industrial | Oakville | 1550 South Service Road West | $7,850,000 | $595 | per sq. ft. | Feb. 11, 2026 | |

Retail | Aurora | 15117 Yonge Street | $5,495,000 | $780 | per sq. ft. | Jan. 30, 2026 | Alireza Afzaz & Alireza Saberyghomy (Right At Home Realty) |

Greater Golden Horseshoe Area transactions

Sector | Municipality | Address | Price | Unit price | Parameter | Transaction Date |

|---|---|---|---|---|---|---|

Industrial | Hamilton | 70 Unsworth Drive | $6,350,000 | $211 | per sq. ft. | Dec. 30, 2025 |

Apartment | Kitchener | 103 Courtland Avenue East | $2,425,000 | $220,455 | per unit | Jan. 9, 2026 |

Apartment | Hamilton | 17 Cloverdale Avenue | $$1,950,000 | $195 | per sq. ft. | Dec. 29, 2025 |

Office | Hamilton | 7 John Street | $1,100,000 | $579 | per sq. ft. | Jan. 12, 2026 |

Sector spotlight

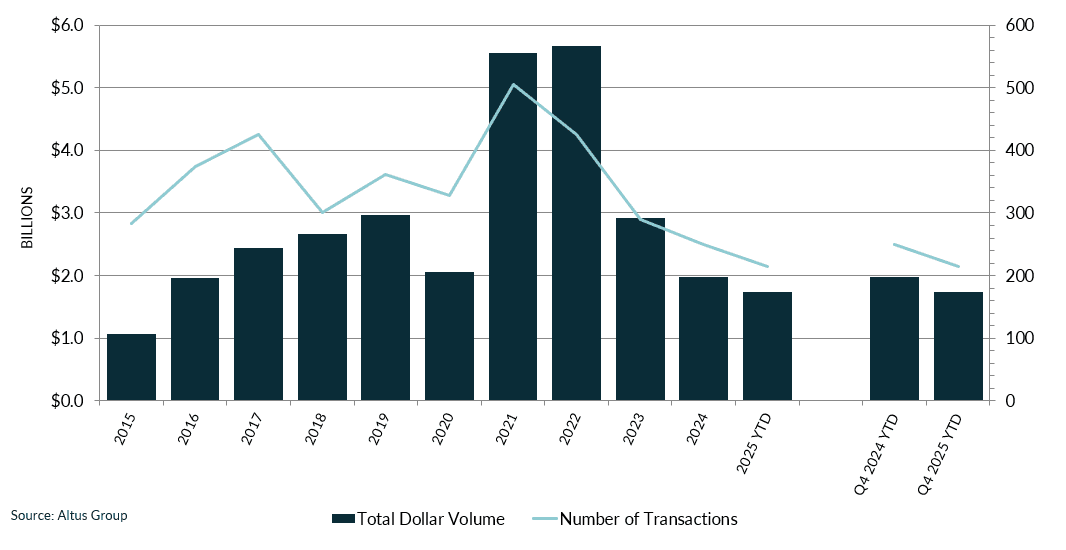

GTA Residential land investment sales activity by year, 2015 - 2025

This chart displays total dollar volume invested by year and the total number of transactions for all Residential Land transactions over $1M in the GTA.

In 2025, investment volume experienced a 24% year-over-year decrease, registering nearly $2.6 billion. This downturn indicated a more cautious investment climate and deceleration in development activity across the region, as stakeholders navigated broader economic uncertainties and elevated borrowing costs that impacted project feasibility.

A total of 223 transactions were recorded in 2025, a 26% decrease when compared to the 301 transactions recorded year-over-year.

GTA residential land investment sales activity by year, 2015-2025

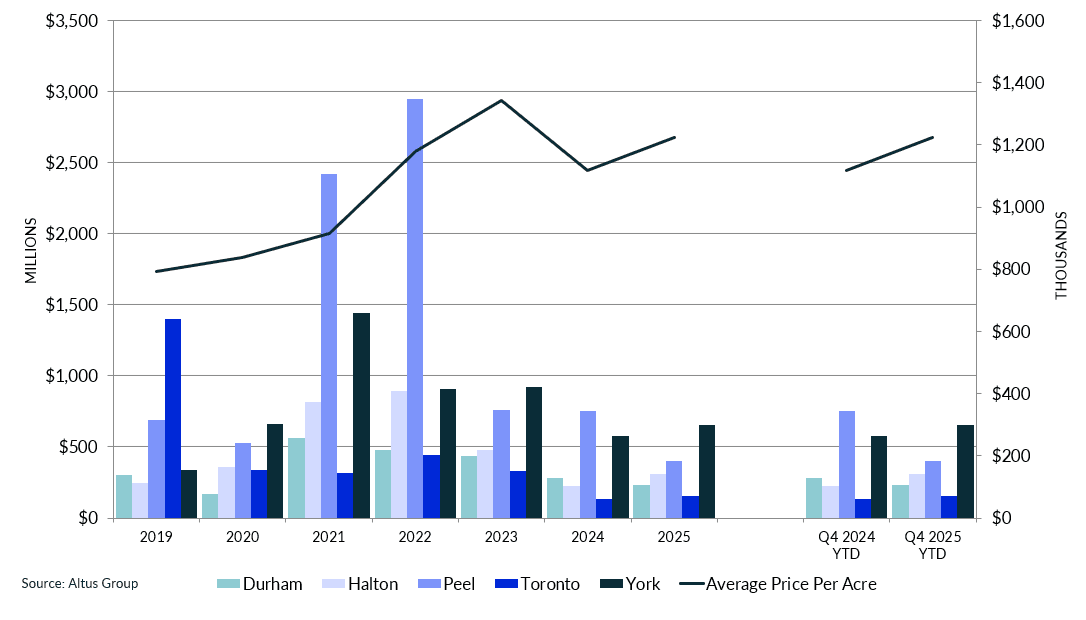

Greater Toronto Area residential land investment sales activity by region, 2019-2025

This chart displays total dollar volume invested by region for all Residential Land transactions over $1M in the GTA.

Four of the five regions saw a year-over-year decrease in investment volume in the residential land and lots sector.

The City of Toronto was the only region to record a year-over-year increase in investment volume, going from nearly $866 in 2024 to $533 in 2025, representing a modest increase of 5%.

Peel region registered the largest year-over-year decrease in investment volume, down 59%. This was followed by Halton, York, and Durham, respectively.

Figure 2: Greater Toronto Area residential land investment sales activity by region, 2019-2025

Coming soon

Enclave

by Cachet Homes

11000 New Dundee Road

Kitchener, ON

Expected opening: Q1 2026

Description:

Coming soon to Kitchener is a collection of 23 ft. traditional and rear lane townhomes by Cachet Homes. This new development will feature 127 townhomes starting from the $700s. The official launch date is anticipated for the end of Q1 2026.

Builder commissions & incentives

North Oak Condos at Oakvillage - Tower 4B

by Minto Developments

4% commission (as of February 10, 2026)

Price range: $648,900 - $1,081,900

Oakville (3075 Trafalgar Road)

Occupancy: December 1, 2025

Westshore

by Minto Developments

3.5% commission (as of February 11, 2026)

Price range: $586,900 - $1,126,900

W6 - Toronto/Etobicoke (3580-3600 Lake Shore Boulevard West)

Occupancy: February 1, 2026

Dupont

by Tridel

4% commission (as of February 9, 2026)

Price range: $580,000 - $1,795,000

W2 - Toronto/York (840 Dupont Street)

Occupancy: May 1, 2026

Queen Church

by Tridel

4% commission (as of February 9, 2026)

Price range: $695,000 - $2,309,000

C8 - Toronto (60 Queen Street East)

Occupancy: June 1, 2027

INSIGHTS Spotlight

Catch the latest research and insights from Altus

Toronto CRE market update - Q4 2025

GTA CRE investment totalled $16.2 billion in 2025, down 8% year-over-year. Retail led all asset classes, up 16% to $2.4 billion, driven by demand for food-anchored properties.

Canadian CRE investment trends - Q4 2025

Our Q4 2025 Investment Trends Survey shows pricing holding steady across most asset classes as uncertainty keeps the market cautious. Read the full report for insights on cap rates, investor preferences, and momentum across Canada.

Disclaimer: The opinions expressed in this newsletter are solely those of the authors and are not endorsed by Altus Group Limited, its affiliates and its related entities (collectively “Altus Group”). This publication has been prepared for general guidance on matters of interest only and does not constitute professional advice or services of Altus Group. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy, completeness or reliability of the information contained in this publication, or the suitability of the information for a particular purpose. To the extent permitted by law, Altus Group does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. The distribution of this publication to you does not create, extend or revive a client relationship between Altus Group and you or any other person or entity. This publication, or any part thereof, may not be reproduced or distributed in any form for any purpose without the express written consent of Altus Group.