Key highlights

CRE valuations are going down, but not dropping off a cliff

No sector, not even previously strong ones, are immune

Even as demand for industrial properties moderates, it too has felt the pinch, with yields increasing quarter-over-quarter

Some parts of Canada will see less of an impact on valuations than others, especially those places that receive immigrants, who help support growth

Webinar listeners don't believe valuations have hit rock bottom yet

Around the world, commercial real estate valuations are on their way down – and the Canadian market is seemingly no exception. The question now weighing heavily on the industry is this: how far valuations are likely to fall in the coming months?

Earlier this month, Altus Group’s webinar, 'Valuations in Canada: Where Do Things Stand?' James Harkness, Senior Director, Strategic Client Group at Altus Group, brought together a panel of Altus CRE experts including Vice President of Business Advisory Services, Jonas Locke, Real Estate Market Intelligence Leader, Ray Wong, and Sr. Director, Valuation Advisory, Mike Helm, to discuss the issues currently impacting Canadian CRE valuations.

Valuations are on the way down

Where do Canadian CRE valuations currently stand? According to Altus Group's panelists, and the results of listener surveys taken in real-time during the webinar, valuations are on a downward slope, but they have yet to hit the edge of the cliff.

"We're living in a world that saw downward trending cap rates since about late 2008 in every asset class consistently," said Locke. "But in mid-2020, retail and office started to see weakness tied to the beginning of the pandemic, though multires and industrial held firm."

Since mid-2022, however, cap rates have been rising for all asset classes. “This is the first time that has happened since the great financial crisis,” Locke noted.

The panelists stressed that the current fall doesn't resemble the crashing values of the Great Financial Crisis in many ways, least of all not in its root causes. After the financial market crash in 2008, there was a significant decrease in demand across market sectors. This time, demand is uneven, with office being especially problematic due to the shift in office usage inspired by the pandemic.

All sectors, even industrial, are feeling the impact

“Unsurprisingly, we’ve seen the largest value declines, quarter over quarter and year over year in the office sector. Increased yields are the significant driver of those declines,” said Mike Helm, Director, Valuation Advisory at Altus Group. "Office is the most talked-about recent decline in valuations, but the results of industrial valuations have been the most spectacular. Even on the yield impact to value, we see a greater magnitude than office, but it has been more than offset by tremendous rental growth.” Office valuations dropped 2.77% quarter-over-quarter between Q4 2022 and Q1 2023, with increases to yields causing a decline of 2.36% on their own, according to Altus data. On the other hand, industrial valuations edged up 0.53% over the same period, even with increases to yields dropping values 3.14%, in isolation of any positive cash flow impacts.

Compared with the first quarter of 2022, office valuations are down 11.15%, with the isolated impact of increasing yields resulting in an 8.27% decline. Industrial valuations increased 9.52% year-over-year in Q1 2023, with an isolated negative impact of 12.4% from increasing yields, but a 21.92% offset from positive cash flow impacts in that same period.

Multifamily, another darling property type, has seen its valuations largely flat year-over-year – partly due to the uncertainty surrounding its returns, with increasing yields offset by positive cash flow impacts.

"Multires has much less alignment in the industry when it comes to stabilizing NOI and forecasting cash flows, versus a fully leased, triple-net asset in industrial," Helm said. As for retail, he explains, we have seen larger value declines in enclosed malls, versus grocery-anchored centers that provide necessities in inflationary times.

Valuations follow investment patterns

Data gleaned from Altus' most recent investment trends survey of about 200 investors, fund managers, brokers and other market participants reveals that, on the whole, values are falling as investment sales slow. The survey, Locke said, provides insight into the major asset classes in Canada's eight largest markets.

Following a steep rise in 2021 and 2022, commercial property investment volume dwindled in late '22, with total sales volume at about $15 billion in the third quarter of that year. This is a stark comparison to $24 billion the quarter before, and a recent quarterly peak of around $28 billion.

Although investment volume has slowed down considerably, making valuations harder to determine, it isn't impossible to ascertain valuations – it just takes more work. "What I hear the most is how do you value real estate without transactions?" Locke said. "There are two things I say to that: first, there are transactions, just not as many, and they tend to be messy or complicated." Also, he said, the value of real estate is driven by cash-flow projection and appropriate yield. In some sectors, there is a cash-flow appreciation while yields rates are going up, and in some cases, they can cancel each other out. "It isn't as simple as looking to transactions to establish yield," Locke said. "There's quite a bit more that goes into it."

Different parts of Canada impacted

According to the panelists, Canada is no monolith when it comes to real estate valuations. Some places are seeing sharper declines than others, which have been relatively immune. "High immigration rates mean, for instance, that owners of multires properties stand to do well, especially in the markets that receive most of the influx.," said Raymond Wong, Vice President, Data Solutions Delivery at Altus.

"The good news is that we're going to have a labour force coming in, and they will keep the economy moving with the purchase of goods and rentals," Wong said, but it will also highlight the challenge the country has with a lack of affordable housing.

Still, immigration patterns may be subject to change. Historically, immigration has been focused on major cities like Toronto, Vancouver and Montreal, but as the housing affordability crisis continues to wreak havoc on these areas, immigrants are now considering other destinations. This trend will be good for multires nationwide.

Moreover, sometimes the shift in immigrant patterns can be attributed to a concerted effort on the part of the provinces. For one example, Wong noted that Alberta's recent campaign to attract talent has been working.

Audience polls show nervousness, but not gloom

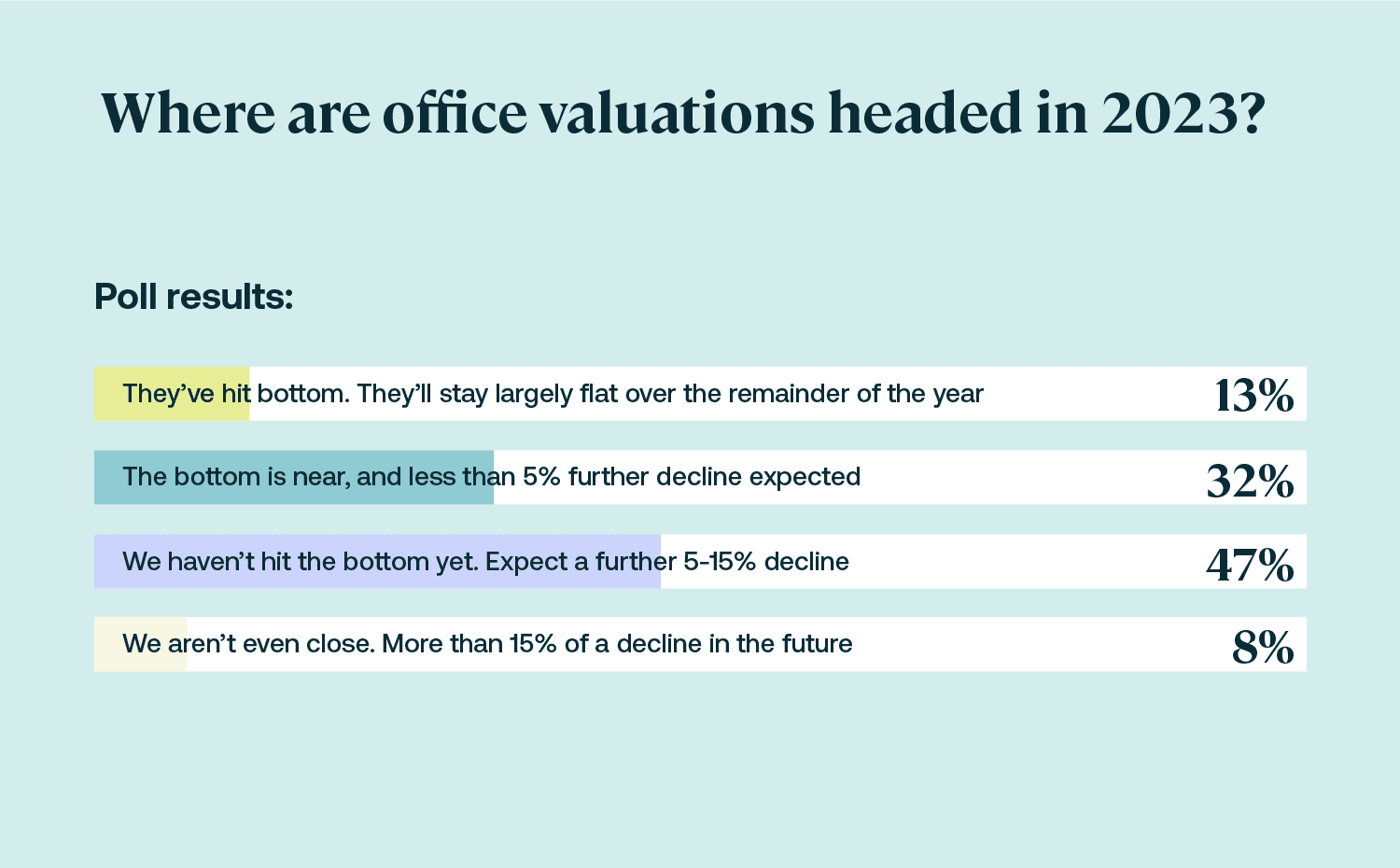

The webinar prompted the audience to engage in two different polls, with the first pertaining to office valuation. The majority of respondents (47%) said that the bottom isn't quite here, with a fall of 5% to 15% more to come, while a smaller but not small number were a little more optimistic. Some 32% said that bottom is near, with only about 5% more to drop. Conversely, a small number (13%) said that the Canadian office market has hit bottom already, and only 8% were pessimistic enough to say that valuations were going to drop 15% more, at a minimum.

Figure 1 - 'Where are office valuations headed in 2023?'

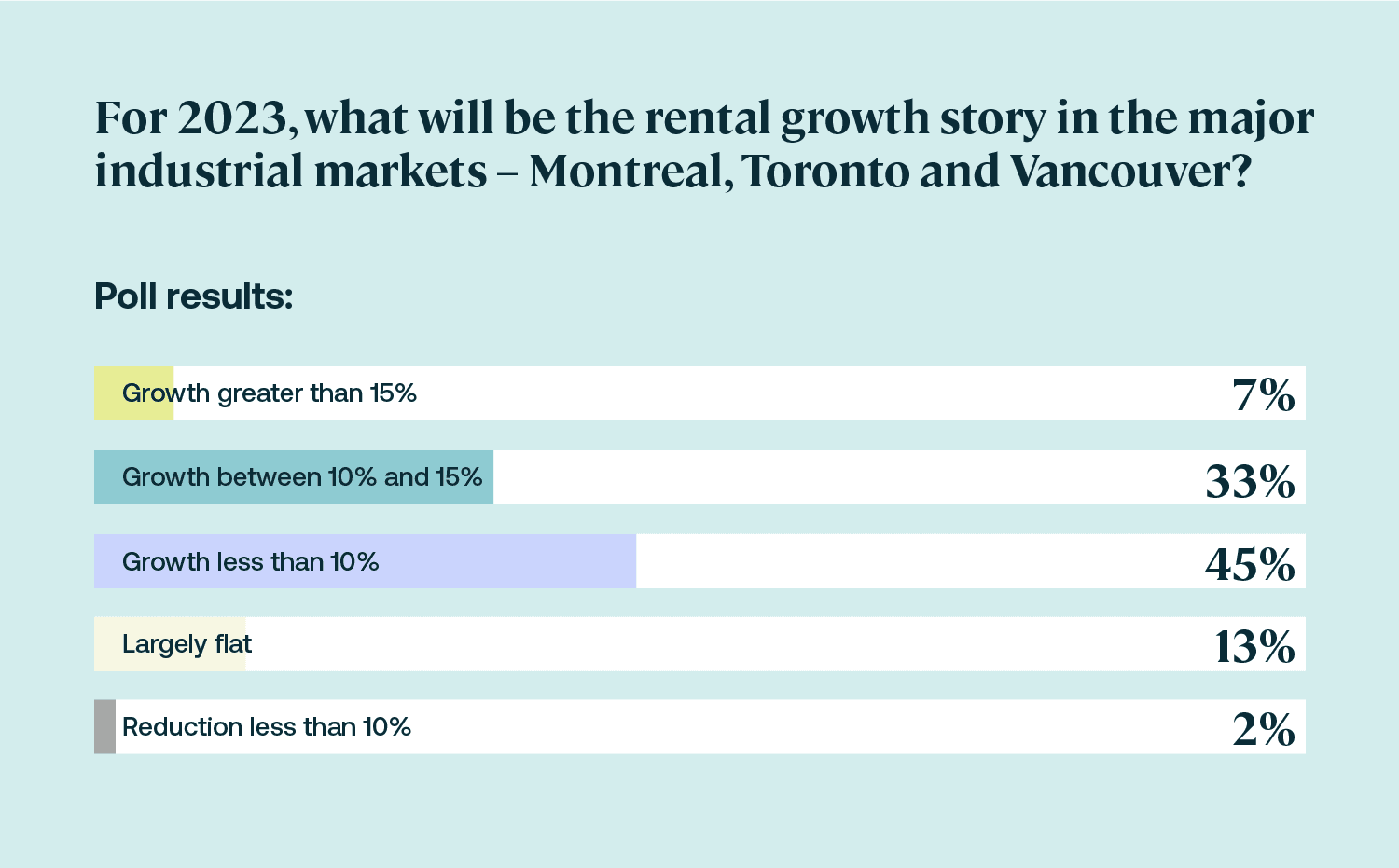

The second poll sought to capture the outlook for the industrial real estate sector in the major Canadian markets. The largest share of respondents (45%) were mildly optimistic, saying that rental growth will be between flat and 10% by the end of 2023. A third (33%) were more optimistic, answering that growth will be between 10% and 15%.

Figure 2 – For 2023, what will be the rental growth story in the major industrial markets: Montreal, Toronto and Vancouver?

Some 13% of the webinar respondents said rents will be flat, and even smaller numbers said rental growth will be negative by as much as 10% or exceed 15% – some 2% and 7% of respondents, respectively.

With their ears to the ground when it comes to Canadian real estate values, webinar listeners affirmed what the panelists and other experts know: Canadian markets are down, but certainly not out.

Authors

Jonas Locke

Vice President, Valuation Advisory

Mike Helm

Sr. Director, Valuation Advisory

Authors

Jonas Locke

Vice President, Valuation Advisory

Mike Helm

Sr. Director, Valuation Advisory

Resources

Latest insights

Jun 24, 2025

The path to properly reflecting decarbonization efforts in Canadian CRE valuations

Jun 19, 2025

EP66 - From uncertainty to stability: How CRE is adapting to the latest mix of volatility

Apr 17, 2025