Taking a strategic approach to property maintenance – Unlocking the levers that impact valuations

Maintenance costs can have a significant impact on operating expenses and the ability to strategically address these costs is a lever owners can use to affect value.

Key highlights

A disciplined approach to property maintenance, or lack of one, can have a significant impact on operating expenses and ultimately property valuations

The ability to retain or attract new tenants or charge competitive rents can all be tied to having a well-maintained property

Prioritizing maintenance to create efficiencies and reduce costs can also have a significant impact on net operating income (NOI)

Properties would be well-served to develop a Strategic Asset Management Plan to identify areas of criticality and devise a strategy that aligns with business needs

Maintenance decisions are a critical factor in driving CRE valuations

The value of your CRE property is one of the most important metrics (if not the most important) that any manager/investor/owner needs to know on an ongoing basis. And while valuations are often dictated by market forces, there are a number of “levers” that you can pull to impact valuations.

In an earlier article in our series on “levers” that impact valuations we talked about the importance of property amenities as a competitive advantage to help attract and retain tenants and maintain healthy rents. Property maintenance is much the same in how it can impact NOI and can be argued to be even more critical to the viability of the property and its value.

Property maintenance is often viewed as an inevitable and necessary component of operating expenses, but it is rarely a popular one given the often-high costs. Depending on the property type, maintenance can represent upwards of 30-35% of total annual expenses.

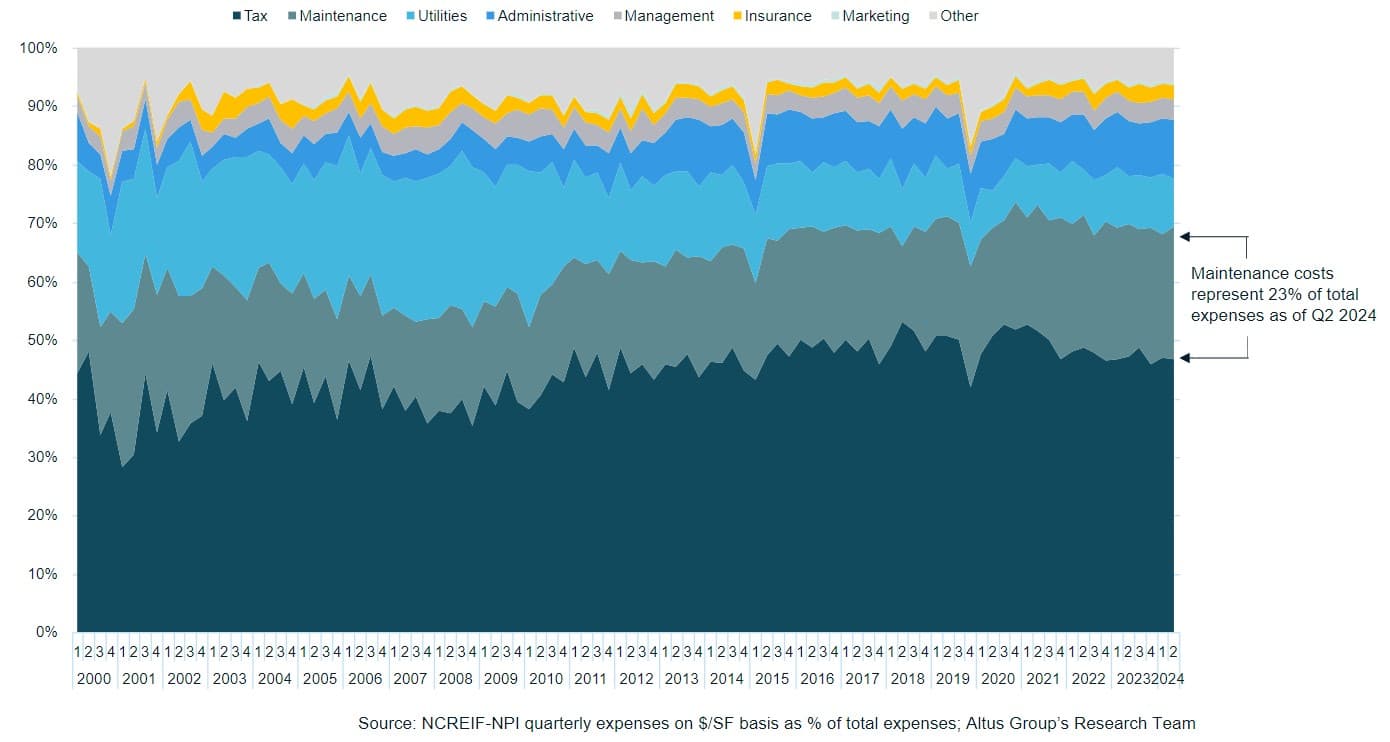

Altus Group research within the New York office sector has shown that maintenance costs typically represent the second largest expense behind property taxes. As Figure 1 shows, as of Q2 2024, taxes represent 47% of total expenses and maintenance costs 23%, and both have been on the rise in the last two decades. Once consuming 25% of total revenues combined, they now consume 32%.

Figure 1 - New York City office sector expenses as a percentage

Finding the “sweet spot” where maintenance becomes a strategic investment

Despite its importance, it’s all too easy to defer maintenance. To patch a leaky roof rather than go to the expense of full replacement. It can be difficult to show a return on investment for maintenance costs, and the impact of deferred or poor maintenance is not always immediately visible. In fact, it can take years, even decades of underfunding before you see that toll on value deterioration. But when it does emerge, the costs can be exponentially higher than they would have been had proper and proactive maintenance been carried out.

Commercial real estate (CRE) owners face questions and risks when it comes to addressing maintenance costs. A ballooning of maintenance expenditures can severely impact a property’s net operating income (NOI) and ultimately its valuation. However, a deferment of those expenditures to save on costs can create its own set of risks:

Building operations can be put into jeopardy, resulting in even higher costs down the line

The ability to attract/maintain tenants and grow rental income becomes much more difficult

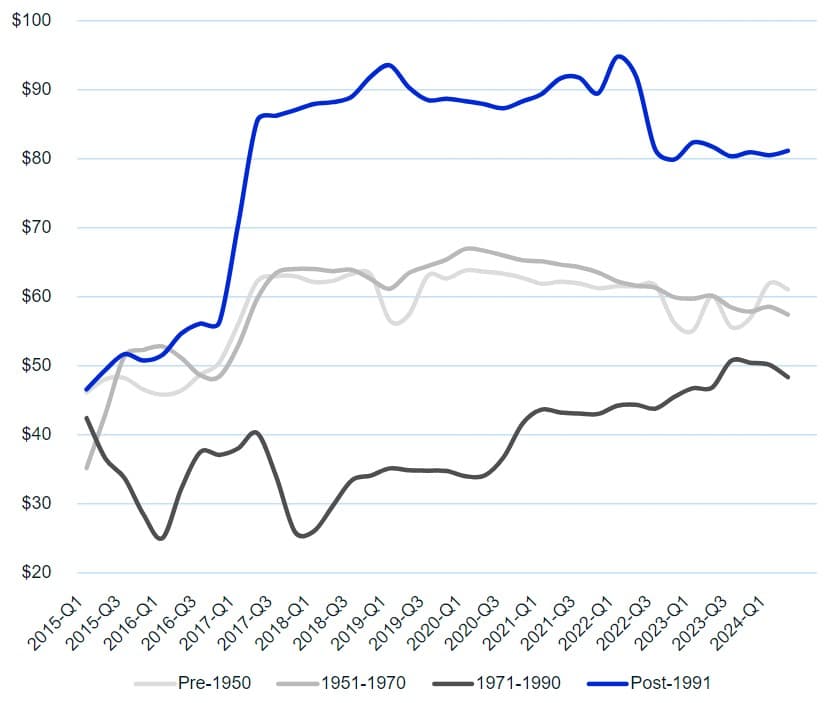

Figure 2 shows the flight to quality that many leasers are making in the office space, preferring newer builds versus the implied complications and costs that are associated with older buildings. Newer, buildings with strong operating programs attract higher quality tenants and are therefore in a better position to grow rents and property values.

Figure 2 - Rents by building age

On the flip side, older buildings need a plan to address maintenance and stay competitive. But where to start? No property has a blank check to turn an old building new. Owners need to find the “sweet spot” where maintenance becomes a strategic investment that protects or even grows property values, and not a crippling overhead cost. This can be built into corporate strategy by developing an Asset Management Strategy, or Strategic Asset Management Plan (SAMP), which is effectively a protocol for the optimization of whole life costs (WLC) or total cost of ownership that aligns with overall corporate or investment strategy.

Financial risks of “run to fail” strategies

Owners have two options when it comes to maintenance. They can establish a SAMP that takes whole life costs into account and budgets for regular maintenance accordingly, or they can operate a “run to fail” strategy that defers maintenance on certain assets that have little to no impact on operations until such time that the asset fails. While "run-to-fail" might minimize day-to-day costs, having to eventually replace a major component in a hurry due to failure will always cost more in capital and result in an interruption to operations. Effectively, you pay more to fix a problem after it occurs rather than prevent it from occurring.

An elevator that is not maintained on a regular basis can cost much more to fix when it does finally break. Added to that is the inconvenience and frustration put on tenants when these issues arise.

Furthermore, trying to sell properties at market price can prove to be a challenge. Any savvy purchaser is going to capture the cost of roof repairs or replacement of outdated HVAC equipment in their due diligence and demand a credit or adjustment upon closing. In extreme cases, deferred maintenance can produce a cascade of problems (e.g. higher costs, tenant departures, need for rent discounts) that all contribute to value depreciation, and in some cases even inoperable real estate.

Establishing a strong SAMP and a proactive approach to maintenance effectively spreads costs out and keeps the property operational.

How to prioritize the maintenance spend to best impact NOI

Align with business goals - Prioritization starts with an asset management strategy that aligns with the business goals and identifies priorities related to the critical areas of the operation. Owners need to ensure minimal impact to their client base, whether they are patients, or travelers, or tenants. From that core focus, you can then create a detailed plan from the strategic level down to the day-to-day operational level that aligns with the goals of the business.

Focus on operational savings opportunities - Prioritize maintenance spend that has the potential to result in long-term savings, such as green and energy efficient technologies or equipment upgrades that improve reliability and also reduce operating costs. One business case example is to put digital sensors on equipment linked to building automation systems. Sensors have the ability to continually monitor a variety of things, from building vibration that could potentially damage equipment to energy and water consumption to identify inefficiencies.

Prioritize statutory requirements – Requirements to health and safety such as regular elevator inspections should be built into the annual operating plan.

Conclusion

When it comes to the impact on property valuations, the decisions owners make on maintenance goes well beyond the cost of that maintenance. A proactive and strategic maintenance plan makes it easier to lease space, easier to attract better tenants and easier to charge premium rents – all factors that have a material impact on net operating income and the bottom-line value of a property.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Paul Saunders

Senior Content Marketing Manager

Author

Paul Saunders

Senior Content Marketing Manager