This article was first featured in the Institutional Real Estate Inc.’s Niche properties in the spotlight report in September 2021.

Investment in single-family rentals was thought of as a growth strategy for investors looking to buy low-priced properties after the global financial crisis. Today, the SFR market has matured into a legitimate asset class because of predictable cash flows, stable returns and solid rent growth. These characteristics are attractive to a wide range of investors and lenders, and SFRs have quickly become a desirable addition to a well-rounded investment portfolio.

Historically, investors looked at core properties — office, retail, industrial and multifamily — for their investments. Some also include hotels in that category. During the past decade, as more money flowed into these property types, the purchase prices were bid up, and their returns decreased.

This price increase (and reduced return) has led to investors seeking higher returns in alternative (noncore) assets such as single-family rental, medical office, data centers, manufactured housing (mobile home), assisted living, student housing, senior housing, self-storage, net-leased (retail, industrial, office), urban core (street-level) retail, life sciences and healthcare.

The case for SFRs

Residential is considered a relatively safe investment because people will always need a place to live. Over the past 10 years, the increased prices (and lower returns) for apartment properties have led residential investors to SFRs, where they can get higher returns.

Currently, the SFR market is highly fragmented, and many homes and/or portfolios are owned by “mom and pop” operators. SFR ownership is attractive because it can be easily scaled up by adding hundreds of homes quickly by focusing on select markets. Another advantage is that tenants tend to renew their leases, which results in lower turnover costs. SFRs have a 75 percent retention rate, compared to 50 percent to 53 percent for multifamily from 2013 through 2018.

According to the Urban Institute, most SFR units are owned by individual investors. Approximately 45 percent belong to landlords who own just one unit (mom and pops), and 87 percent of investors own 10 or fewer units. SFRs are a relatively new asset class for institutional investors. Despite rapid growth, it is estimated that institutional ownership (portfolios with more than 2,000 properties) is between 2.8 percent and 3.1 percent of the total SFR units, representing 450,000 to 500,000 homes. This contrasts with other income-producing product types including multifamily rental (MFR) housing, where institutions own 50 percent to 55 percent of the units.

Without SFR units, there is not enough supply in multifamily properties to meet the demand of renters. According to the U.S. Census Bureau, from 2007 through 2016 the number of SFRs increased by 31 percent, compared with 14 percent for MFRs. In net numbers, SFRs added 3.6 million units, compared with 3.2 million MFR units.

Although applicable to both SFRs and MFRs, several factors are responsible for the demand of rental units, including job growth and migration, changes in demographics, relatively flat wage growth, the large population size of the millennial generation, higher student debt, more restrictive single-family lending standards, and the cost of purchasing and maintaining a single-family home. Combined, these factors have resulted in a change in the homeownership rate.

Since 2010, the number of homes occupied by renters has increased at a faster rate than homes occupied by owners. Despite the improved economic conditions following the global financial crisis (GFC), the homeownership rate is well below the peak of 69.2 percent reached in 2014.

Evolution

The GFC was a major inflection point for SFR ownership, accelerating the institutionalization of this asset class. The GFC resulted in a single-family mortgage default rate of more than 8 percent, and 4 million homes went into foreclosure. Many were purchased by investors at foreclosure auctions.

In 2012, the Federal Housing Finance Agency (FHFA) created the Real Estate Owned (REO) Initiative. This allowed private investors to buy properties in bulk as real estate investment trusts (REITs) if they rented the homes for a certain number of years.

Several large firms — Invitation Homes, American Homes 4 Rent, Colony, American Residential Properties, Waypoint, Amherst, Progress Residential, Silver Bay and others — entered the market at an attractive entry point. They spent billions on tens of thousands of homes, and their initial strategy was to sell some or all of them once the market recovered. Meanwhile, the properties generated a steady cash flow.

As the economy began its gradual recovery, several firms went public and allowed investors to get liquidity and access to the sector. Eventually, as is typical in a maturing market, consolidation occurred, which allows firms to attain economies of scale more quickly and take advantage of specific opportunities.

For example, in 2015, Colony American Homes merged with Starwood Waypoint Residential Trust to form Starwood Waypoint Homes. In 2017, Starwood Waypoint merged with Invitation Homes to form the largest SFR company. Also in 2017, Tricon Capital acquired Silver Bay Realty Trust.

However, the attractiveness of SFRs has led to a cap rate compression over the past five years. Overall capitalization rates reached a high of 11 percent in 2012 and decreased by 510 basis points to 5.9 percent at the end of 2020. This 46 percent reduction in yield results from property prices accelerating more quickly than property-level incomes.

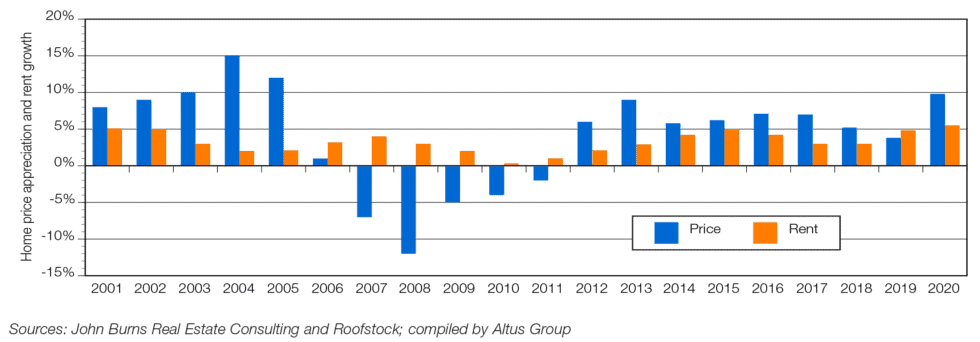

Home price appreciation and rent growth

Figure 1 - Home price appreciation and rent growth

Current trends

Vacancy

Since the GFC, the national vacancy rate experienced a steady decrease despite additions to the SFR supply. Vacancy peaked at 10.6 percent in 2009 and generally declined over the past 10 years to 6.5 percent as of year-end 2020.

Rent growth potential

Rent is usually stable, even during a financial crisis. During the GFC when home prices decreased, SFR rent growth diminished but never went negative. As rent increases, so should cash flow. Owners can capitalize on this by refinancing or selling and realizing the gain.

Technology and efficiency

Because of the increase in home prices, many SFR companies place a greater emphasis on improving efficiencies and increasing their operating margins. They are doing this by investing in technology and data analytics. Several firms have developed proprietary software for all facets of ownership and management, including property search, bidding, acquisition, due diligence, closing, renovation, leasing, management, repair and disposition.

Markets

Institutional investors prefer geographic diversification and own properties in multiple markets. Typically, they focus on affordable moderate income and home price areas that continue to attract in-migration with employment growth above the national average (see “Representative SFR markets”)

Figure 2 - Representative SFR Markets

Investors & funds

Today, some of the largest established firms in the single-family rental arena include public REITs such as Invitation Homes, American Homes 4 Rent and Tricon American Homes, and private investment firms such as Progress Residential (Pretium), Amherst Residential, Blackstone, J.P. Morgan Asset Management, Nuveen Real Estate, BlackRock, Cerberus Capital Management, RESICAP and Conrex.

Other firms making headlines recently:

Atlas Real Estate and DivcoWest formed an SFR joint venture with plans to acquire $1 billion of single-family homes in Arizona, Colorado, Idaho, Nevada and Utah.

The California State Teachers’ Retirement System teamed with PCCP to invest in purpose built single-family rental communities in primary and secondary markets across the United States. The venture will initially have more than $1 billion in purchasing power.

Rockpoint Group formed a $250 million JV with Atlanta-based owner-operator RESICAP with plans to purchase 4,500–5,000 high-quality single-family rental homes in established suburban neighborhoods in the southeast United States and Texas.

Lennar Corp. formed the Upward America Venture. The business initially will be capitalized with a total equity commitment of $1.25 billion led by Centerbridge alongside Allianz Real Estate and other institutional investors. The venture intends to acquire $4 billion of new single-family homes and townhomes in high-growth markets across the United States.

Invesco Real Estate invested capital into SFR firm Mynd’s business and is also partnering with Mynd as an institutional investor. The partnership plans to invest as much as $5 billion, including debt, purchasing about 20,000 single-family rental homes in the U.S. during the next three years.

It’s obvious the SFR investment strategy is gaining a growing following among institutional investors. With a proven track record and the promise of predictable cash flows, stable returns and solid rent growth, single-family rental homes represent an attractive and emerging asset class.

Author

Michael Carey

Senior Director

Author

Michael Carey

Senior Director

Resources

Latest insights