Key highlights

Altus introduces the Pan-European Valuation Dataset for the European commercial real estate industry. The analysis brings together valuation data from across the region to provide quarterly insight into how and why property values are changing based on a set of core Pan European open-ended diversified core funds representing €33 billion in assets under management

While property values across all sectors declined in Q4 2023 there are varying trends across the different property types

The increase in valuation yields was primarily responsible for the downward pressure in all markets. All sectors have been affected, but the largest corrections were within the office and industrial sectors

Cash flows (part of which includes the linked rent indexations) remained on the rise, providing an element of protection to the values, albeit insufficient against yield expansion

Industrial, retail, and residential sectors held out better than average, for different reasons, with industrial values falling by the least this quarter. The office sector took the largest hit

Ongoing trends to watch in the European market are the impact of high inflation rates and increased cost of capital

For the latest Pan European valuation analysis headline trends update, click here

Headline trends

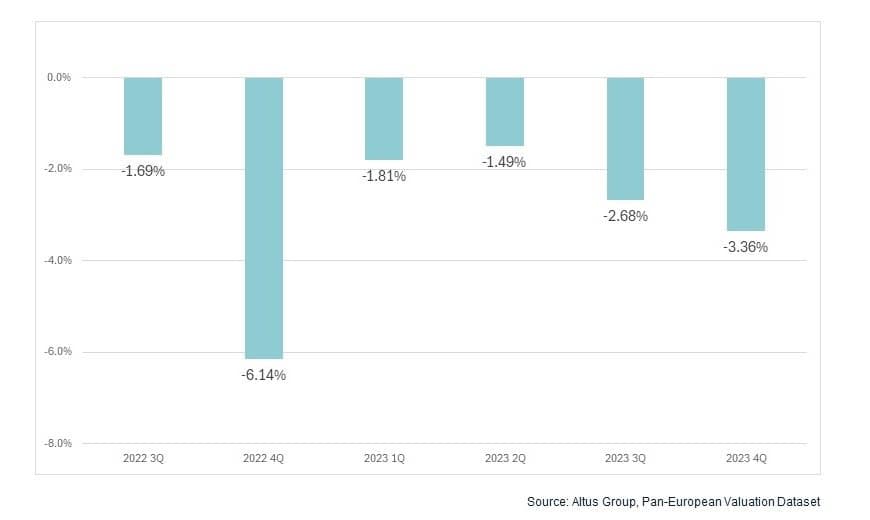

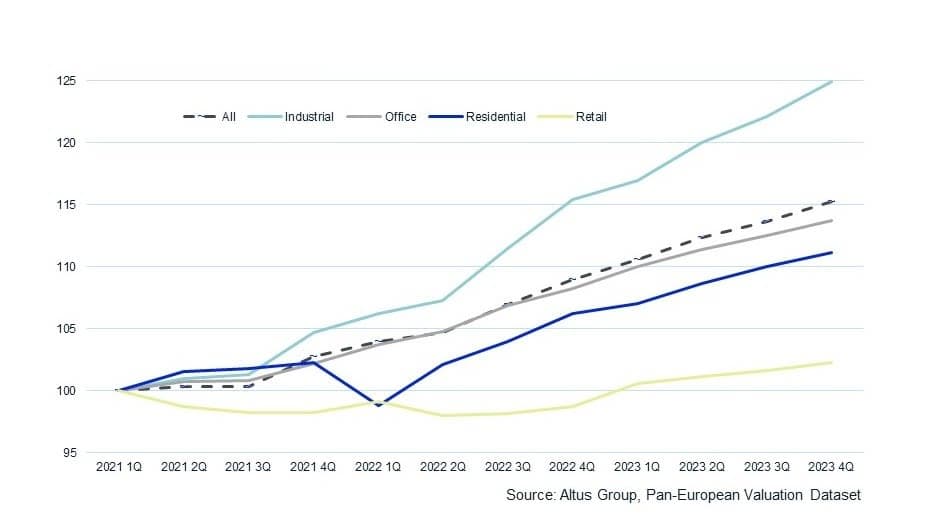

2023 was a year shrouded in uncertainty for the European commercial real estate sector. In the final three months of 2023, property values were written down for the 6th successive quarter. At an overall decline of 3.4%, this was the largest quarterly write-down of the year. In total, values have fallen by 9.0% over the year. Adding in the more pronounced write-downs at the back end of 2022, the current period of correction has seen a total of 16.1% taken off property values over 18 months.

Figure 1 - Q4 shows a continued value depreciation, which worsened in the second half of the year

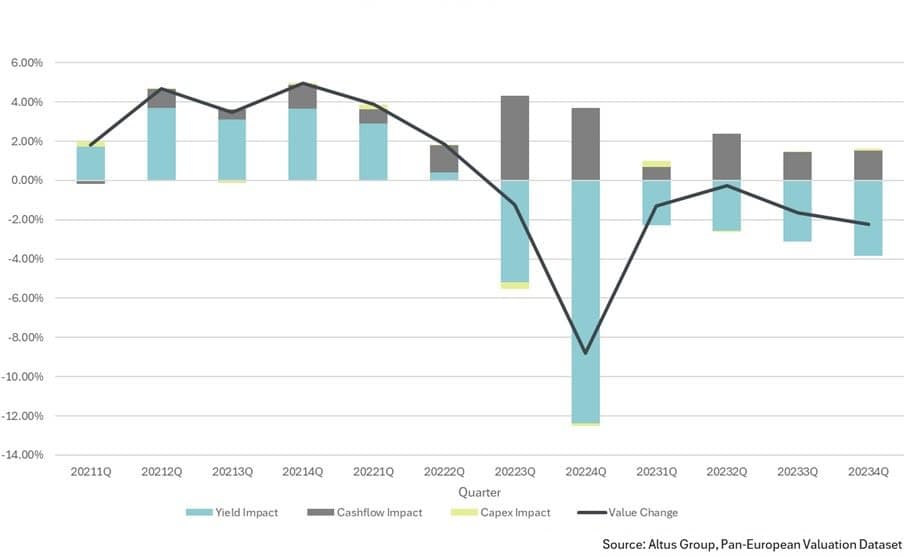

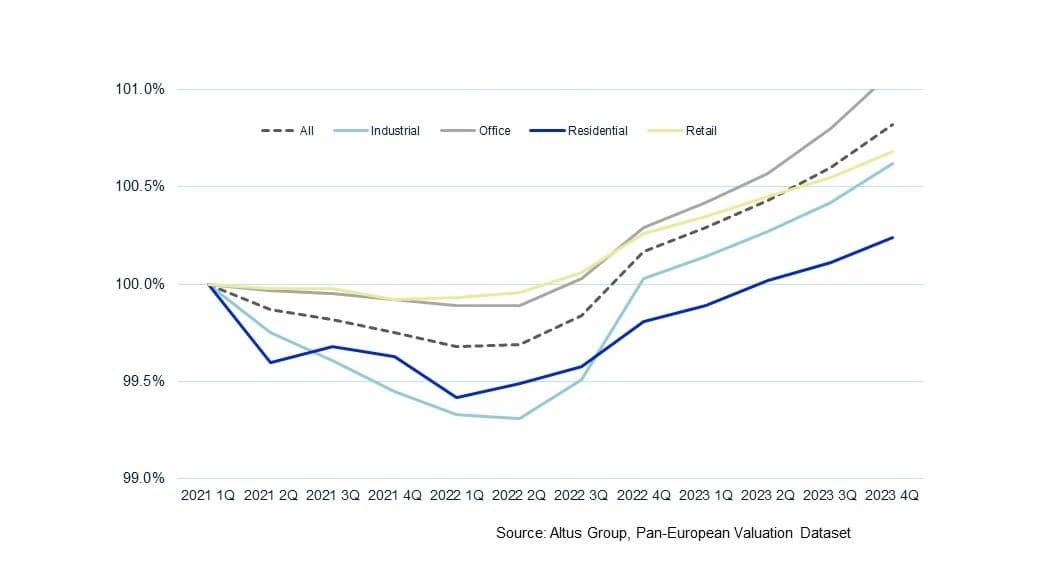

At Altus, we bifurcated the change in values into pure pricing impacts by monitoring the movements in valuation yields versus the underlying economic fundamentals and by monitoring the change in net operating income levels.

This analysis illustrates how the increase in yield levels is primarily responsible for the continued downward pressure on general European property values. This is mostly a response to rising interest rates in the wider European region and the parallel tightening of lending requirements. Both lead to investors underwriting properties at discounted prices to achieve their required returns.

Overall economies had held firm. Expansion slowed, but on the upside, any widespread recession was avoided during 2023. As a result, real estate cash flows remained in the ascendancy throughout 2023. While its impact on value is minimal, it still provides some protection to values. Part of the cushioning we observed from this positive cash flow impact is driven by rent indexations. This is, in turn, triggered by the high levels of inflation throughout the year.

The European market is seeing a rise in the adoption of the discounted cash flow (DCF) valuation methodology against the widespread Traditional valuation methodology. As more and more of our observed samples continue the journey towards DCF valuations, we will also be able to quantify how much of that cash flow growth is driven by the indexations against the quantum driven by rent adjustments.

Figure 2 - Breakdown of valuation drivers Q1 2021 - Q4 2023 for the Pan-European Valuation Dataset

Valuation trends across sectors

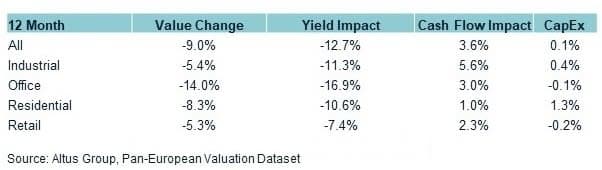

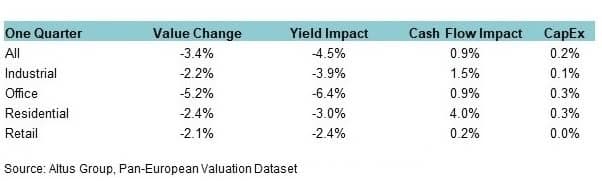

The increased cost of capital in the European market has taken its toll on values in all sectors, but there were mixed results across different property types.

Office

Office, which suffered a massive wake-up call from the pandemic with the change in working practices, have been cast furthest adrift. Values are down 14.0% over the year, with 5.2% of that drop happening in Q4 alone. Office has experienced the largest increase in yields as investors reassess the growth prospects for the sector. In effect, this has taken 16.9% off property values in the last year.

Representing over 40.0% of the dataset, their impact on the overall results is such that office was the only sector where values have fallen by more than average.

Industrial, residential, and retail

There is not a great deal to choose between the other sectors. All three held out better than average but for different reasons. Both over the quarter and the one-year industrials have been afforded more protection due to improved cash flow levels, while retail and residential have experienced a less pure price adjustment.

Retail and residential yields have corrected less than average, both for differing reasons

The limited correction in the retail sector should be considered in light of the prior structural corrections that the sector has gone through in the years before the pandemic

The greater resilience shown by the residential sector during the pandemic has fuelled continued higher demand, and therefore pricing, in contrast to the macroeconomic headwinds affecting the wider economy

Figure 3 - A summary of the key attributes of value change for 12-months (January - December 2023)

Figure 4 - A summary of the key attributes of value change for Q4 2023

Insight into cash flow trends

The stronger industrial cash flow aspect is evident in its underlying market rent trends, and there is no discernible let-up in the gains. In this sector, market rents have risen by a near double-digit 9.5% over the last year, compared with increases of 5.0% and 3.5% in the office and retail sectors respectively. Quarter-on-quarter industrial market rents picked up by 3.4% in the final three months of the year, compared with more tepid gains of 0.5% and 1.4% gains respectively in the retail and office sectors.

If we track back over the last three years to the immediate aftermath of the pandemic, industrial market rents have now risen by a total of 25%. The office sector, while being called into question by the shift in work policies and the wider job environment, has arguably shown its resilience over this period with a 14% improvement in market rents. That said, it is worth bearing in mind that the sample of the market these Pan-European funds are focused on are arguably more prime assets and that there will have been a significant divergence between prime and secondary stock as the office market continues to experience a flight to quality.

The retail sector, in contrast, has made minimal progress regarding market rent. We see only a single-digit 2.0% increase. We are yet to see the more recent impacts of lower inflation and increases in real wages translate into any sizable cashflow gains for the sector, which measured just 0.2% in the closing three months of last year.

Figure 5 - Market rent growth in Q4 2023, averaged by sector

Yield movements to note in the Pan-European market

In terms of the yield impact side of appreciation, the industrial and office sectors have been the worst affected. Before the recent period of interest rate rises, office yields had held relatively steady. Whereas the industrial sector was bolstered by a period of notable yield compression, resulting in a post-pandemic upswing in values for the sector.

The industrial yields, having dropped to historically low levels, recorded the largest movement on the way back up again when the European Central Bank started raising rates mid-way through 2022. Both sectors have endured similar adjustments throughout 2023.

Figure 6 - Tracking the percentage change in value movements

Brief sector-by-sector analysis by market for Q4 2023

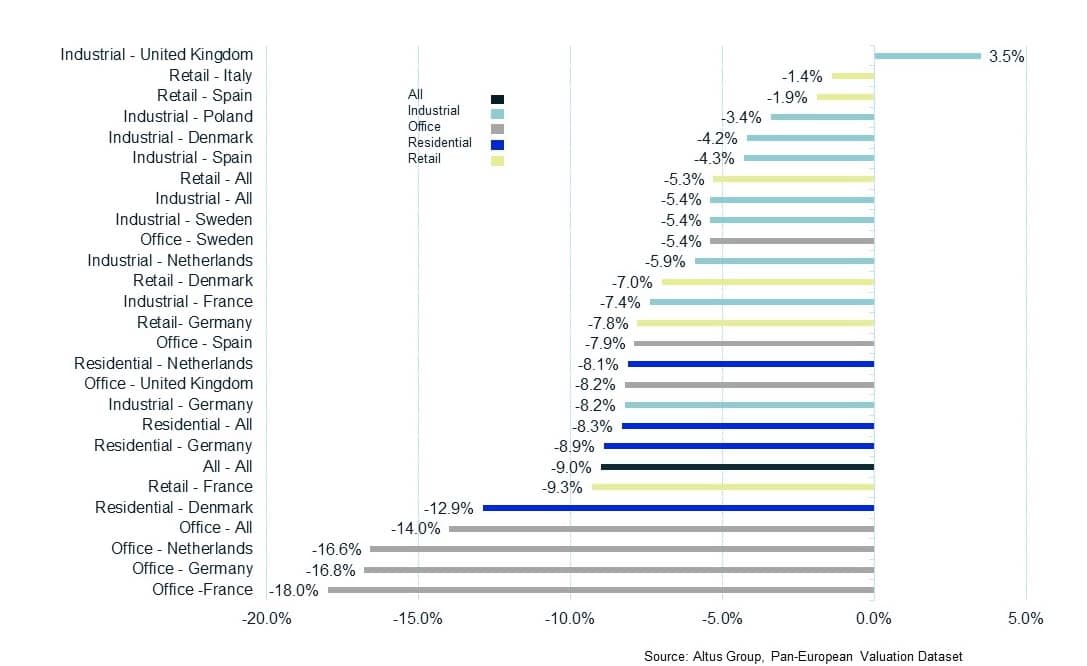

Figure 7 - Sector-by-sector % change in value movements across key markets in 2023

With these broader sector trends summarised, let’s take a brief look at the market trends within the sectors to Q4 2023 for the Pan-European market.

Industrial

In the industrial sector, Germany and France account for a third of the industrial allocation across the Pan-European open-ended core real estate funds in the dataset. In these areas, industrial assets were subject to the largest write-downs over the year. A large proportion of these reductions were taken in the final three months of the year. Value declines in the Netherlands, which is the largest invested market, were more broadly in line with the industrial average, and eased off in the final three months of the year.

The most resilient industrial markets proved to be Spain, Poland, and the UK. Values in the UK, in fact, rose over the year, but that follows on from comparatively larger value declines in the prior year.

Office

In the office sector, it is the central European markets (France, Germany, and the Netherlands) that have experienced the larger value write-downs, with declines in the high teens over the year. Germany and France alone account for over 50.0% of the office exposure across the Pan-European fund dataset.

Values in the surrounding Nordic, Eastern and Southern European markets have proved to be more resilient, with value declines for the year in high single-digit territory. Similarly, UK office values have held up better than average which may be more a reflection of the better-quality assets held by these Pan-European funds which have been investing in the more prime end of the market by design.

Residential

To the extent that we can report on precise trends at country level, the Nordic markets endured some of the larger value declines in 2023. Values in the Netherlands and France were down between 8 - 9%, compared with a near 13% write-down in Denmark.

Retail

In the retail sector, the malls and supermarket sectors held out comparatively well in 2023. Values among the more challenged High Street retail assets experienced the larger value declines. However, much of this perceived resilience in the last year stems from the longer-term sharp adjustments in this sector and the ongoing adaptation to threats from the e-commerce market, which has been in play since before the pandemic accelerated the trend.

About the Pan-European Valuation Dataset

Altus Group’s Pan-European valuation dataset is a centralised, standardized valuation dataset with insights into the factors driving commercial property valuations. A one of its kind for the European market, the Pan-European valuation dataset brings together valuation data from across the region to provide a new level of insight on “how” and “why” property values are changing. In developing the dataset, Altus Group has brought together its market leading technology, its expertise in valuations, data science and analytics, and its relationships with Europe’s most influential real estate funds to gather a critical mass of property data from across the continent. At present, this asset-level dataset is primarily based on Pan-European open-ended diversified core funds but is rapidly expanding to other open-ended strategies (geographic, sector etc.) collectively representing over €40 billion in assets under management*.

* The insights in this Q4 2023 analysis draw on data representing €33 billion in assets under management, as was noted in the Highlights section.

Read the full press release announcing the launch of the Pan-European Valuation Dataset

Authors

Phil Tily

Senior Vice President, Performance Analytics

Nicolas Le Goff

Director, Valuation Advisory

Authors

Phil Tily

Senior Vice President, Performance Analytics

Nicolas Le Goff

Director, Valuation Advisory