Key highlights

In Q1 2024, the write-down of European commercial property values showed a notable moderation, down just 0.5% sequentially over Q4 2023. This represents a significant improvement from the 3.4% drop recorded in Q4 2023 over Q3 2023. Property values within this dataset have now been written down for seven consecutive quarters during which values have now fallen by a total of 16.5%.

Against the backdrop of a higher for longer interest rate environment, valuation yields continued to rise putting further downward pressure on the market but less so than at the back end of last year. Q1 2024 marked the eighth consecutive quarter of rising yields but the -1.4% negative impact on values, compared with a more acute -4.4% offset in the final three months of 2023.

Market participants currently expect major European central banks to begin cutting interest rates in the second half of this year. Once interest rates start to fall, yields are expected to stop rising, reducing the downward pressure on valuations they have exerted over the last seven quarters. The increase in yields in Q1 2024 was in part counterbalanced by improving market fundamentals, as reflected in the positive cashflow and cap expenditures metrics.

The level of value decline eased off notably in each of the four main sectors of the market. Industrial and residential retained nearly all their value from last quarter, and the decline in office valuations notably decelerated.

Retail consumer spending is expected to increase across the region as inflation subsides and overall economic conditions improve. However, in Q1 2024 retail values did fall the most out of any of the sectors as operating expenses increased and incidences of leases being renegotiated below market rent levels tempered the level of cash flow gains for the sector.

Residential property valuations were the one sector where yields levelled out in Q1 2024, marking an end to seven consecutive quarterly yield increases.

Values rose by 3.3% for properties outside of the main four property sectors. Most of the upside can be attributed to student housing accommodation assets where valuation yields began to compress during Q1 2024. The ongoing shortage of high-quality student accommodation in European cities, coupled with strong demand for study abroad, is expected to support the attractiveness of this subsector.

To read latest update on the Pan European Valuation Analysis Headline Trends update, click here.

For further in-depth observations read: Pan-European Dataset: Expert Analysis – Q1 2024

All Property - Q1 Valuations post smallest decline of the last seven quarters

Each quarter, Altus Group analyses the performance of an aggregate dataset of core Pan-European open-ended diversified funds, representing €29 billion in assets under management. The funds cover 17 countries and span the industrial, office, retail and residential property sectors.

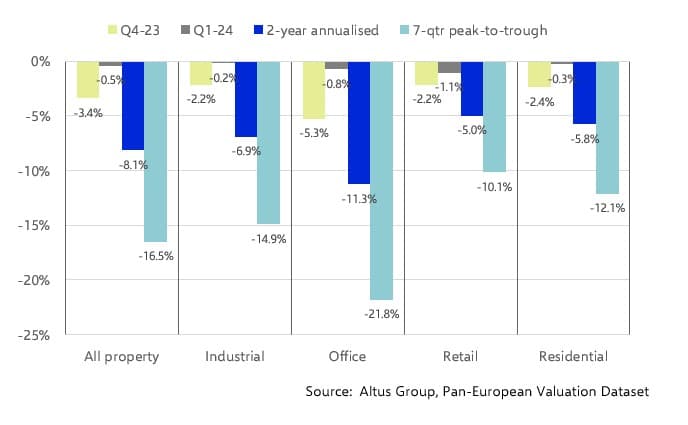

Figure 1 illustrates the historical performance, by sector in the last two quarters, as well as the two-year annualised and peak-to-trough results.

In the opening three months of 2024, the write-down in European commercial property values moderated significantly across all the sectors. In terms of all property, the decline of just 0.5% was a marked improvement on the 3.4% drop registered in Q4 2023 and was also the smallest decrease posted since property valuations began declining in Q3 2022

Figure 1 - Historical valuation performance by sector

Through peak to trough, the office sector has experienced the worst write-downs by far, reflecting the drop in demand for space caused by increased remote working. Industrial continued its yield correction off the sector’s post-pandemic performance. The retail sector continues to adjust to competition from online selling. Nevertheless, this sector has produced the best relative performance over the past two years.

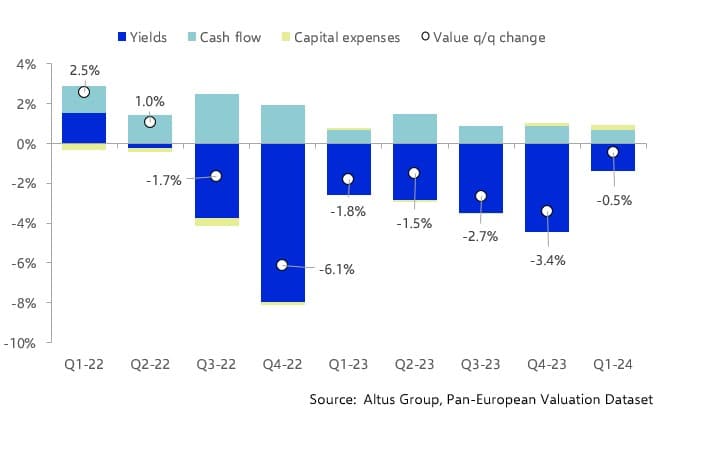

Figure 2 shows the total change in value in Q1 2024 versus Q4 2023, as well as the contribution from the underlying factors driving valuation.

Figure 2 - Contribution to the q/q change in value of European commercial property

Q1 2024 marked the 8th consecutive quarter of rising yields, although the contribution this quarter is the smallest since valuations began declining. The -1.4% negative impact on values was nearly offset by positive contributions from cash flow (+0.7%) and capital expenses. (+0.3%), indicating how market fundamentals are continuing to improve at the aggregate level.

The Altus aggregated valuation data shows how the upward pressure on yields is subsiding and this could well continue. Headline inflation is nearing central bank targets while the overall European economy remains challenged by weak demand for its exports, slowing growth in labour markets and constrained household spending. Market participants currently expect major European central banks to begin cutting interest rates in the second half of this year. Once interest rates start to fall, yields should stop rising, reducing the downward pressure on valuations they have exerted over the last seven quarters.

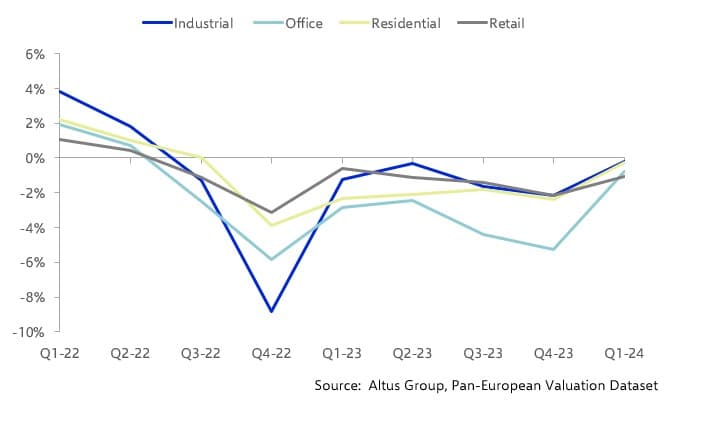

Figure 3 - Quarterly change in valuation by sector

Figure 3 indicates that, relative to Q4 2023, all sectors had smaller write-downs in the first quarter of 2024. Industrial and residential came very close to retaining their value from last quarter. Declines in office sector valuations decelerated, with Q1’s decrease of 0.8% being far better than Q4’s drop of 5.3%. Valuations in the retail sector fell the furthest over the quarter at 1.1%, but this was less acute than the setback experience in the closing quarter of 2023.

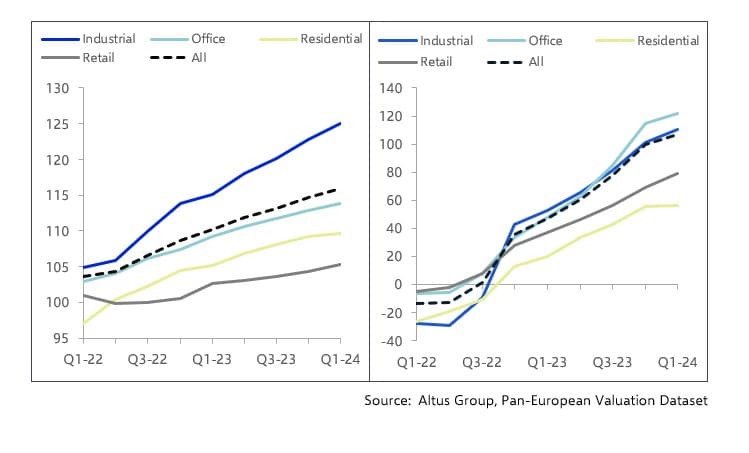

Figures 4 and 5 show the growth in rents and quarterly yield movements by sector over the last four quarters. Industrial property has seen strong rental growth, comparatively, but the yield impact has also been outsized. Offices, which have been facing very weak occupier demand, had the highest impact from yields but were in the middle of the pack in rent growth. Residential saw no impact from yield in Q1 and rent growth flattened. Retail has seen the least growth in rents while yield impacts are still climbing.

Figures 4 & 5 - Quarterly rent growth (Q4 2021=1.00) & Quarterly yield movement

Table 6 focuses on the contributors to all sector valuations during Q1 2024. Numbers in red represent results that underperform the “All sectors” value on the first line of the table while figures in green indicate results that compare favourably with the “All sectors” metrics.

Table 6 - Contributions to sector valuation in Q1 2024

Value change | Yield impact | Cash flow impact | Capital expenses | |

|---|---|---|---|---|

All sectors - Average | -0.5% | -1.4% | 0.7% | 0.3% |

Industrial | -0.2% | -1.7% | 1.4% | 0.1% |

Office | -0.8% | -1.5% | 0.5% | 0.3% |

Residential | -0.3% | 0.0% | -0.5% | 0.3% |

Retail | -1.1% | -1.7% | 0.3% | 0.3% |

Other | 3.3% | 0.5% | 1.1% | 1.7% |

Source: Altus Group, Pan European Valuation Dataset

Table 6 indicates that in Q1, yields had a negative contribution to valuations in industrial, office and retail, but had no impact on residential valuations. Cash flow contributions were strongly positive in the industrial sector, skewing the all-property average higher, but also had marginally positive contributions to both retail and office. A negative impact from cash flow was the reason why residential valuations fell in Q1.

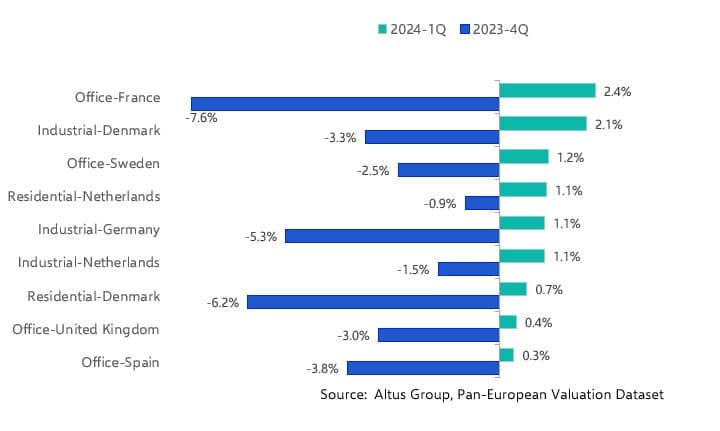

Looking at results for particular countries and sectors, Figure 7 illustrates cases where the Q1 valuation posted an increase, reversing a decline in Q4 2023.

Figure 7 - Sector/country reversals in valuation

These reversals partly reflect an improvement in economic growth in Q1. The euro-zone economy exited the brief recession it experienced during the last two quarters of 2023, driven by growth in its largest economies. The euro-zone as a whole expanded by 0.3% quarter-on-quarter (q/q), the strongest gain since Q3 2022. Both Germany’s and France’s GDP rose by 0.2% in Q1. Italy’s GDP increased by 0.3% and Spain advanced by 0.7%, driven mainly by tourism.

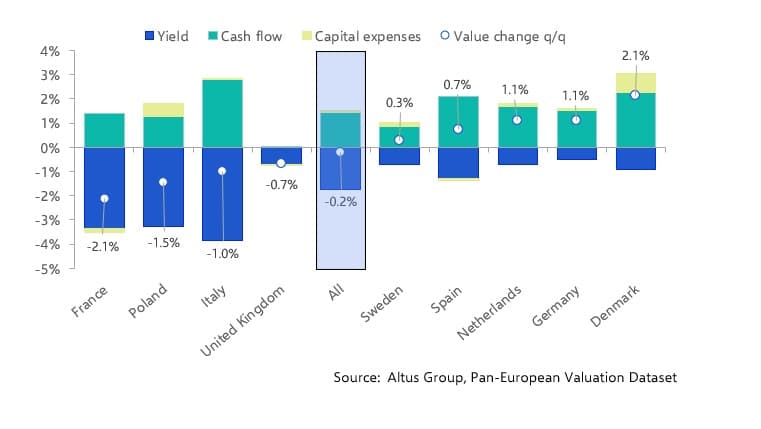

Industrial property benefits from higher rents and gains in projected cashflow

Values in the industrial sector declined by just 0.2% in the first three months of the year. While industrial assets continued to experience an outsized negative impact from rising yields, a 1.9% increase in market rents was behind the positive contribution from forward-projected cash flow. On the flipside, the larger-than-average yield correction experienced by the sector dates back to their yields having dropped further than any other sector in the post pandemic growth period.

More countries saw valuations decline than increase during Q1 due to the continuing drag from those higher yields. It is worth noting that rents picked up in all countries except Poland, where rents fell by 1.9% q/q. Also of note was Denmark where a gain of 2.9% reversed a fall of 1.6% in Q4 2023.

Though absorption has been somewhat constrained due to weak economic activity, occupancy for industrial property overall is relatively high in most countries. The e-commerce sector has been supported by increased consumer outlays thanks to recent wage growth and falling inflation which have supported online purchases.

Figure 8 - Contributions to country valuations of industrial property in Q1 2024

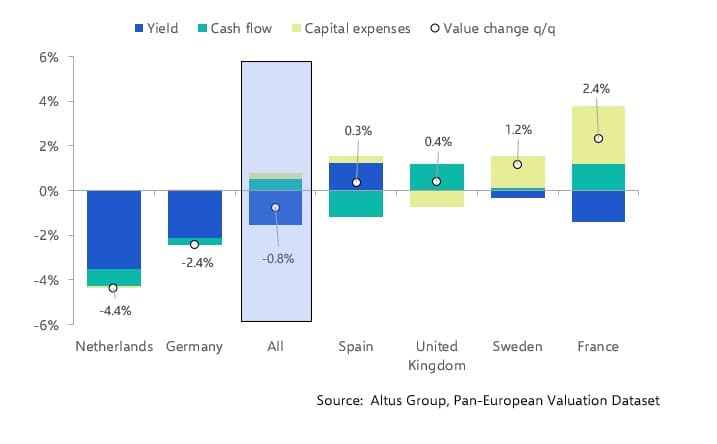

Offices: Yields still a significant drag but capital expenses help preserve value

Valuations for offices have suffered the largest correction of all property over the last two years and were down nearly 22% at the trough. In Q1, office values were down just 0.8% on average, a more encouraging result than the 5.3% drop in Q4 2023.

Demand for space in the office sector continues to be depressed due to the ongoing impact of greater remote working. Firms have absorbed new staff into their existing space and continue to try to do more with what they currently have, or even downsize.

Figure 9 indicates yields were largely responsible for ongoing write-downs in both Germany and the Netherlands. Both countries posted employment growth in Q4 2023 that was below the euro-zone average, expecting to limit the demand for office space in Q1. Office employment in Germany, in particular, is being squeezed not only by expanded remote working, but also exposure to the tech sector where jobs are being shed so the worst may not be over for German offices.

Figure 9 - Contributions to country valuations of offices in Q1 2024

Several markets saw valuations rise in Q1. Of note was the strong 2.4% q/q increase in France which resulted from capital that had been previously modelled in valuations now being invested in the assets. This expenditure, in turn, is expected to boost market rents, providing better future cash flow to offset any further negative yield impacts. Spain was the one market where the yield impact was positive for office valuations.

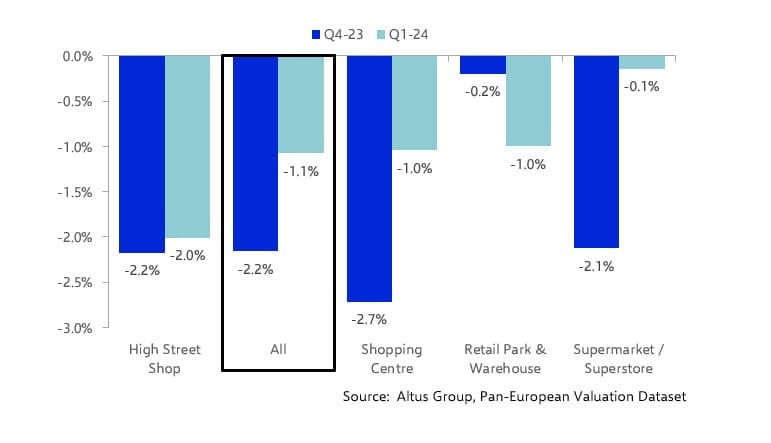

Retail: Deterioration in valuations has subsided

In Q1, the retail sector posted the worst performance among the major property sectors, with values down 1.1% q/q. However, this was only half the decline posted in Q4 2023.

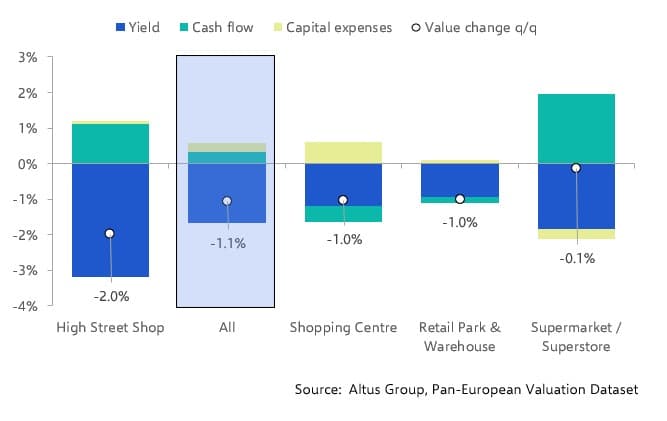

Altus Group’s retail sector dataset focuses on the type of establishment, rather than geographical location. As can be seen in Figure 10, valuations were down in all the subgroupings. Yet, all categories – except Retail Park & Warehouse – showed material improvement relative to the last three months of 2023.

Figure 10 - Change in quarterly valuations in retail sub-sectors

Figure 11 illustrates that cash flow, except in the case of Supermarket/Superstore contributed very little to the valuations in the sector and were lowered among retail warehouses and shopping centres. The negative effect of yields, was, by far, the determinant of the declines in value in Q1.

Figure 11 - Contributions to retail subsector valuations in Q1 2024

Residential: Yields have started to level out

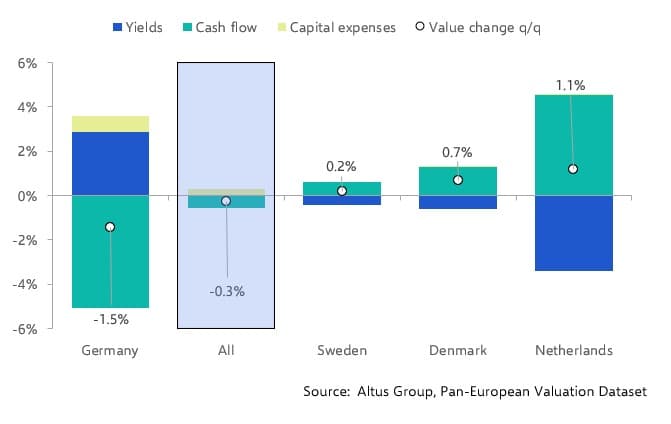

Residential property experienced a minor decline in value of 0.3% in the first quarter of the year, a much better outturn than the -2.3% decline posted in Q4 2023. The aggregate decline for the first three months of the year is deceiving because the drop of -1.5% in the German market outweighed increased valuations in Sweden, Denmark and the Netherlands. In those three countries, cash flow contributions exceeded the negative impetus from yields.

Figure 12 - Contributions to country residential property valuations in Q1 2024

There has been a long boom in investment in residential property, with increased home working during the pandemic the most recent impetus for the sector. Income from residential property is tied to underlying demographics which, across Europe, are relatively stable in the aggregate. Generally, residential rents are closely correlated to inflation, but over the last year, the costs of upkeep have risen faster than rents, and have potentially reined in the cash flow impact on valuations. As inflation decelerates across the region, capital expense costs should move back into line, allowing rent increases to feed through into stronger cash flow gains. With interest rate cuts on the horizon, as in the case of the other property sectors, negative yield pressure is expected to diminish.

Other property: Gains in student population is expected to spur expansion in accommodation

Values in the “other” property grouping rose by 3.3% in Q1 2024. Most of the gain resulted from student accommodation assets where valuation yields began to compress again during the opening three months of the year, after having moved out continually in 2023.

In the Purpose-Built-Student-Accommodation (PBSA) there is a distinct undersupply in most European cities. With the interest in studying abroad continuing to increase, in part due to the willingness of universities to hold classes in English, near-term supply plans are likely to continue to fall short of demand. Rent growth prospects are therefore favourable given the tight supply conditions and are further supported by the ability of international students to afford living in this type of housing.

Conclusions

Taken in aggregate, valuations had their best relative performance quarter in nearly two years. Economic activity in Europe generally improved in Q1, supporting market fundamentals but there continues to be a good deal of variation among the property sectors as well as within them. If interest rate cuts come to fruition later this year, pressure from yields should subside further.

Disclaimer

This article is being provided for informational purposes only. No information included in this article constitutes, nor can it be relied upon as, legal, tax, investment, or other advice. Recipients should consult their independent advisors. The views and opinions expressed in this article are those of the authors themselves and do not necessarily reflect the views or positions of Altus Group Limited or its subsidiaries or affiliates (collectively, “Altus Group”).

The article, the information contained therein, and any links to other sites are provided “as is” without any representations, warranties, or conditions of any kind, express or implied, including, without limitation, implied warranties, or conditions of fitness for a particular purpose or use, non-infringement or that any information is accurate, current, or complete. Altus Group has not independently verified any third-party information and makes no representation as to the accuracy or completeness of any such information.

Altus Group and its advisors, directors, officers, and employees (collectively, its “Representatives”) are not liable or responsible to any person for any injury, loss, or damage of any nature whatsoever arising from or incurred by the use of, reliance on or interpretation of the information contained in the article or sites that are linked in the article.

The foregoing limitation shall apply even if Altus Group or its Representatives have been advised or should have known of the possibility of such injury, loss, or damage. Any unauthorized use of the information is strictly prohibited. A user is not authorized to copy, circulate, disclose, disseminate, or distribute the information, either whole, or in part, to any third party unless first explicitly agreed by Altus Group.

Author

Altus Group

Author