Ottawa market area commercial real estate market update - Q4 2023

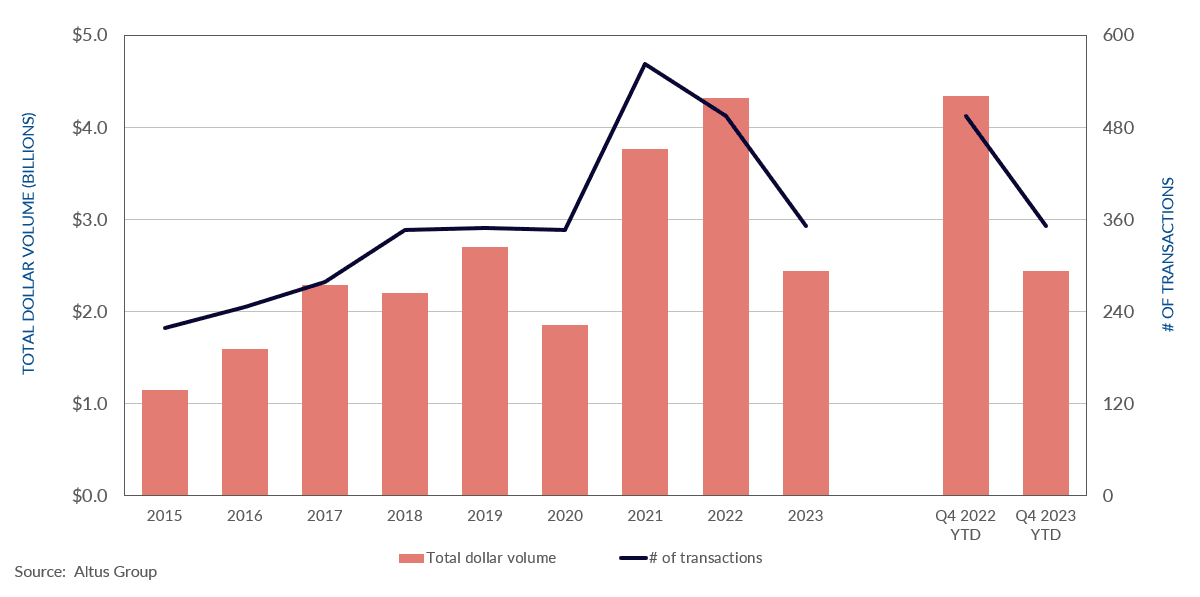

The Ottawa and Gatineau market aw $2.4 billion in dollar volume transacted in 2023, a 44% decline compared to 2022.

Key highlights

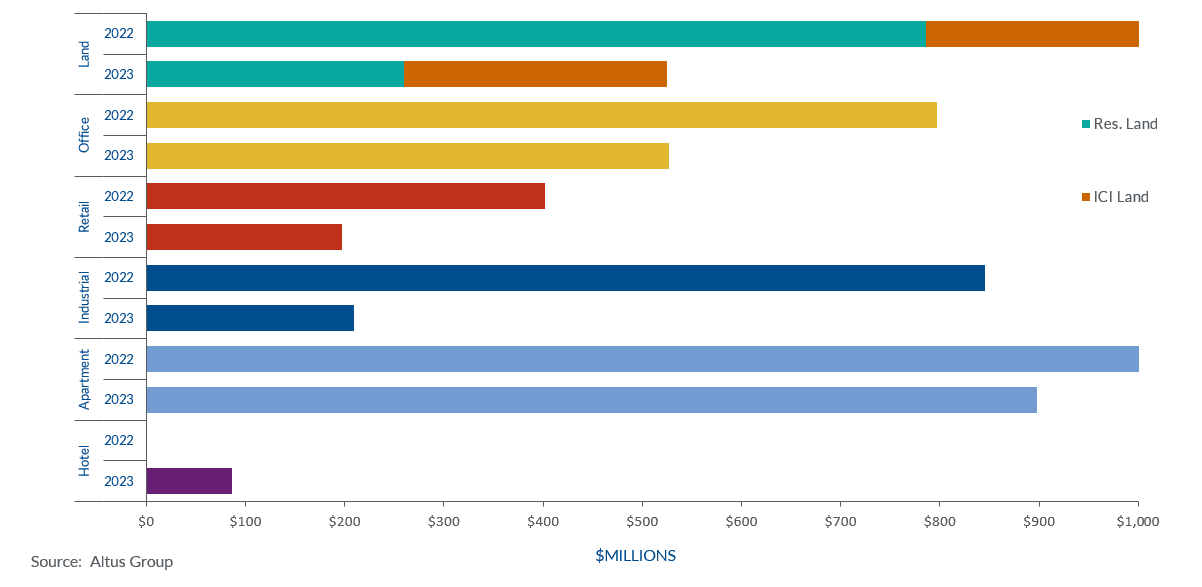

The multi-family sector reported $898 million in dollar volume transacted, a minimal decrease of 15% year-over-year (YoY)

The office sector posted $527 million in dollar volume transacted, a 34% decrease YoY

The retail sector recorded $197 million in dollar volume transacted, a 51% decrease YoY

Ottawa’s industrial sector sustained a heavy hit, with only $210 million in dollar volume transacted, a 75% decrease YoY

Residential and ICI land sales have slowed, given the current economic conditions and the surge in land prices, with $525 million in dollar volume transacted, a 58% decrease YoY

Transaction activity in the Ottawa market remained muted, with transaction volume down by nearly half compared to the previous year

A year marked by higher interest rates, inflationary pressures, and heightened economic uncertainty has led to a slowdown in major markets across Canada. The Ottawa and Gatineau market was no exception, with $2.4 billion in dollar volume transacted in 2023, a 44% decline compared to 2022. According to Altus Group’s most recent Canadian commercial real estate investment trends survey, as investors exercised a higher degree of caution navigating the volatile macroeconomic environment, Ottawa remained a preferred market, following Vancouver and Toronto, respectively.

Figure 1 - Property transactions - All sectors by year

The multi-family sector reported $898 million in dollar volume transacted, a minimal decrease of 15% year-over-year (YoY). This slowdown was a byproduct of the shifting economic conditions. As investors continued to navigate the price discovery phase, multi-family remained a preferred asset class as a result of its strong underlying demographic and economic fundamentals. Steady population growth from the market’s employment stability and a large university presence have provided the market with a steady demand for rentals despite the turbulent year.

The office sector posted $527 million in dollar volume transacted, a 34% decrease YoY. This comes as no surprise, as office space requirements have greatly diminished, and return-to-office has lagged due to the popularity of the hybrid work model and continued rightsizing efforts by landlords and businesses. Altus Group’s most recent Canadian office market update indicates that the Canadian office availability rate has decreased by 1.3 percentage points to 13.4%, YoY. The market has been steadily addressing its office vacancies through office-to-residential conversions, with three downtown buildings slated for conversion in 2023.

The retail sector recorded $197 million in dollar volume transacted, a 51% decrease YoY. With credit to the hybrid work model, neighbourhood to community-level retail centres have recovered as workers spend more time at home and in their local neighbourhood. To this effect, Altus Group’s most recent Canadian commercial real estate investment trends survey found that food-anchored retail strips remained a preferred real estate asset due to their resilience in the face of economic uncertainty, their potential for redevelopment, and changing consumer needs.

Ottawa’s industrial sector sustained a heavy hit, with only $210 million in dollar volume transacted, a 75% decline YoY. Altus Group’s most recent Canadian industrial market update revealed that the industrial availability rate has increased by 0.3 percentage points to 3.3%, YoY. However, Ottawa’s availability rate was the second lowest among all major Canadian markets, after Vancouver at 3.1%. Despite the delivery of new supply in 2023, market conditions remained tight with the shortage of projects in the development pipeline. In addition, the decrease in activity can be attributed to the lack of industrial listings for sale in the market, rather than the lack of demand.

Residential and ICI land sales have slowed, given the current economic conditions and the surge in land prices, with $525 million in dollar volume transacted, a 58% decrease YoY. The residential land posted $260 million, while the ICI land posted $265 million, a 67% decrease and a 42% decrease YoY, respectively.

Figure 2 - Ottawa property transactions by asset class (2022 vs. 2023)

Notable Q4 2023 transactions:

The following are the notable transactions for the Q4 2023 Ottawa and Gatineau commercial real estate market update:

NOX Apartment Portfolio Phase III, Ville de Gatineau – Apartment

The final phase of Junic’s NOX portfolio was sold to Centurion Apartment REIT, completing the portfolio’s acquisition. The portfolio comprises seven newly built, five-storey residential apartment buildings in Gatineau’s Plateau neighbourhood. Each building contains a mix of one- and two-bedroom units, including some with dens and mezzanines. The portfolio sold for just under $195 million at an aggregate price per unit of $364,827. This transaction underscores the strong investor confidence in the Gatineau multi-family residential market. Centurion had also previously acquired Junic’s Le Central development upon completion in 2022, which included 345 units for a consideration of $115 million.

Morguard – Crown Realty Portfolio, Ottawa – Industrial

With a total purchase price of $39.8 million, Crown Realty Partners acquired five small bay, multi-tenant flex industrial buildings from Morguard. Located on Lancaster Road and Newmarket Street, the portfolio contains a total gross floor area of approximately 205,641 square feet, representing an aggregate price per square foot of $193. Among these, three buildings were acquired through a joint venture partnership with Ripple Developments, totaling approximately 115,000 square feet.

Van Leeuwen Centre, Kanata – Retail

Strategically located adjacent to Kanata’s Hazeldean Mall, this fully occupied 63,159 square foot neighbourhood shopping centre was purchased by a local investor for $23.8 million. The plaza is anchored by a Shoppers Drug Mart and was constructed circa 1988. A freestanding Bank of Montreal branch was added to the property in 2019. Although the purchaser has not indicated an intention to add further density to the property, the plaza sits on a 4.4-acre lot with a coverage ratio of approximately 33%, indicating that future development is possible.

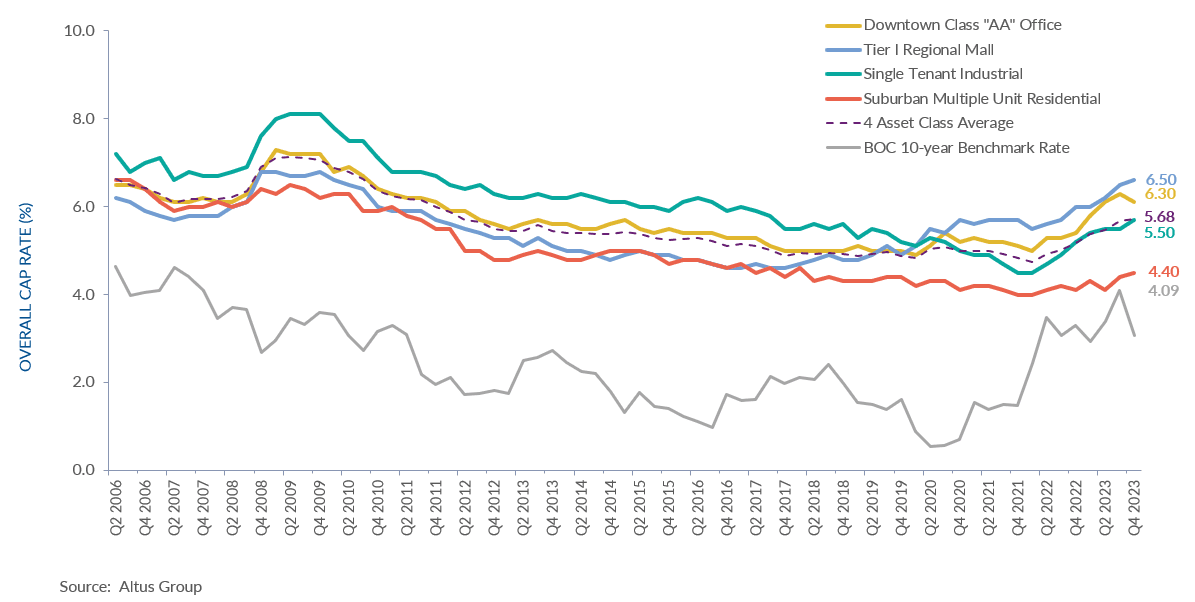

Figure 3 - OCR trends across 4 benchmark asset classes

With the macroeconomic challenges introduced by higher interest rates and inflationary pressures, transaction activity in the Ottawa and Gatineau market area gradually decelerated throughout 2023. In addition, with the lingering effects of 2023’s market dynamics carrying onto 2024, investor sentiment has remained cautiously optimistic with the anticipation of lower interest rates.

Want to be notified of our new and relevant CRE content, articles and events?

Authors

Jennifer Nhieu

Senior Research Analyst

Stephen Robinson

Market Analyst

Authors

Jennifer Nhieu

Senior Research Analyst

Stephen Robinson

Market Analyst

Resources

Latest insights