Montreal commercial real estate market update – Q1 2023

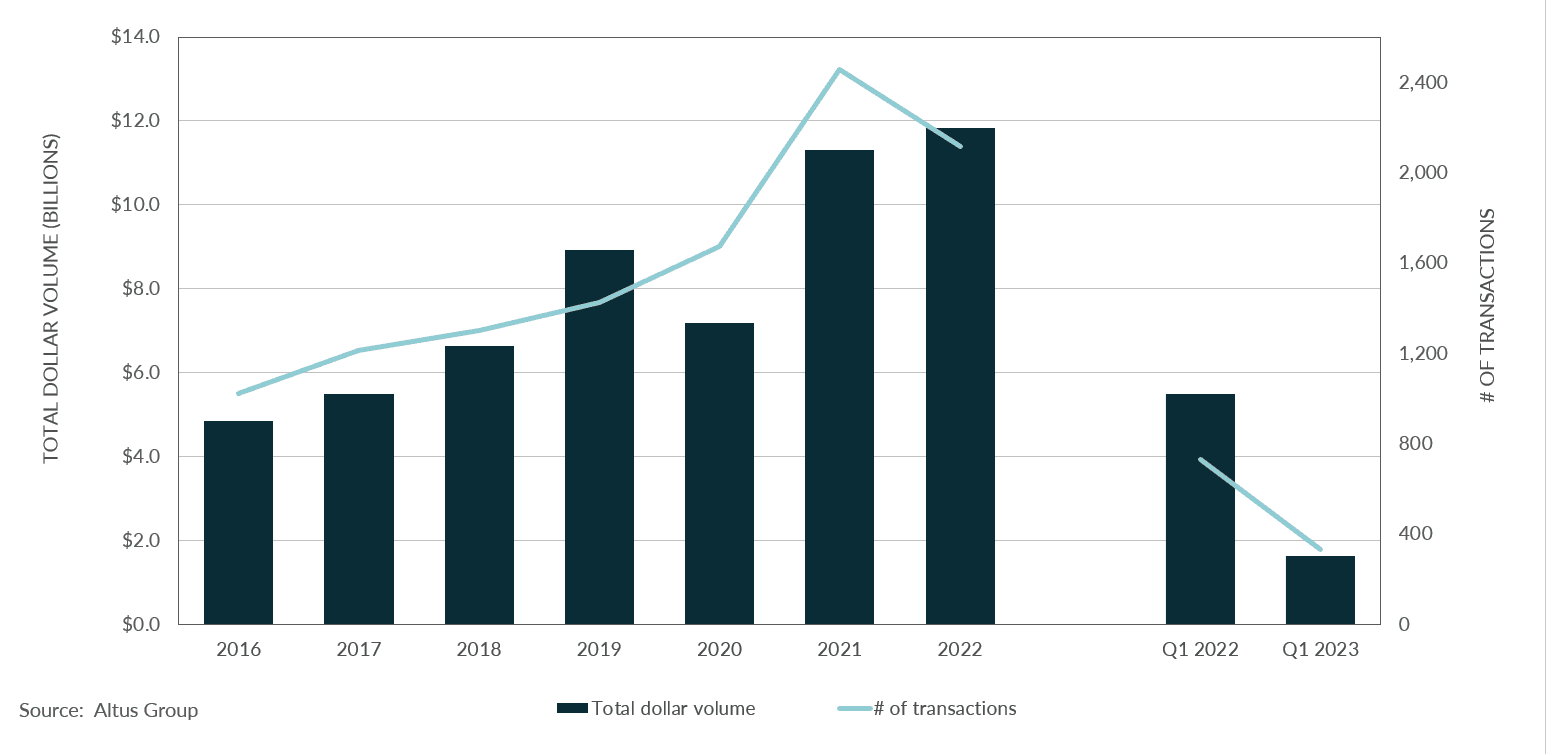

Q1 2023: Montreal market continues slowdown into the first quarter of 2023 with transaction volume slumping 70%.

Following a stark slowing in the last three quarters of 2022, commercial investment activity in the Montreal market area in Q1 2023 totalled $1.6 billion, indicative of a 70% decline when compared to Q1 2022. The rapid onset of interest rate hikes which began in 2022 has made both buyers and sellers tentative to agree on deals. In addition, the time lag between deal finalization and actual closing created the need for many purchasers to renegotiate with their lenders to account for the increased costs of borrowing. The slowdown in transaction activity can also be attributed to the ongoing misalignment of buyer and seller price expectations.

Figure 1 - Montreal Market Area, Property transactions – All sectors by year

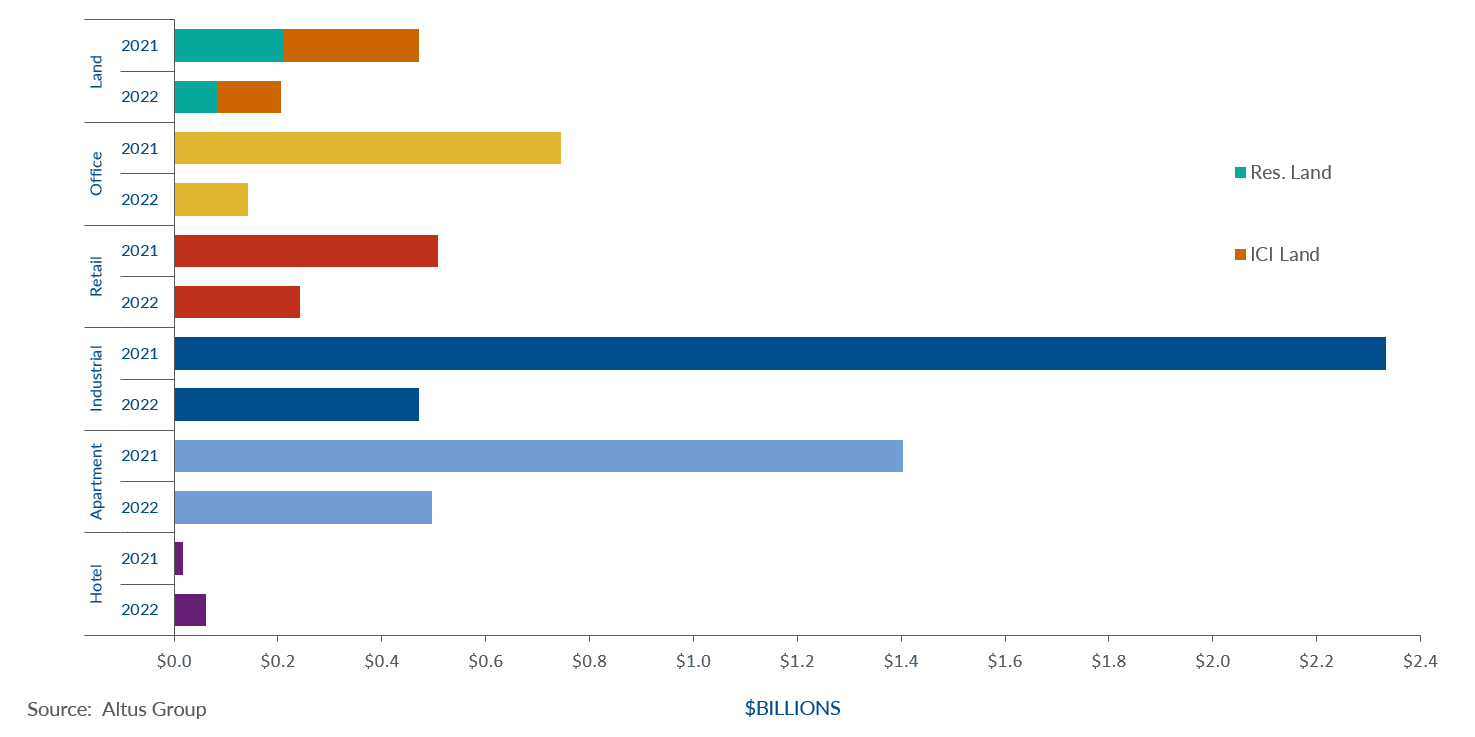

The apartment sector posted the highest volume in Q1 2023 with assets of $497 million transacted, down almost two-thirds from Q1 2022. Industrial properties followed closely with $471 million in total investment, down 80% from Q1 2022. However, the industrial market remained strong with the availability rate at 3% while rental rates continued to rise based on a limited supply of listings.

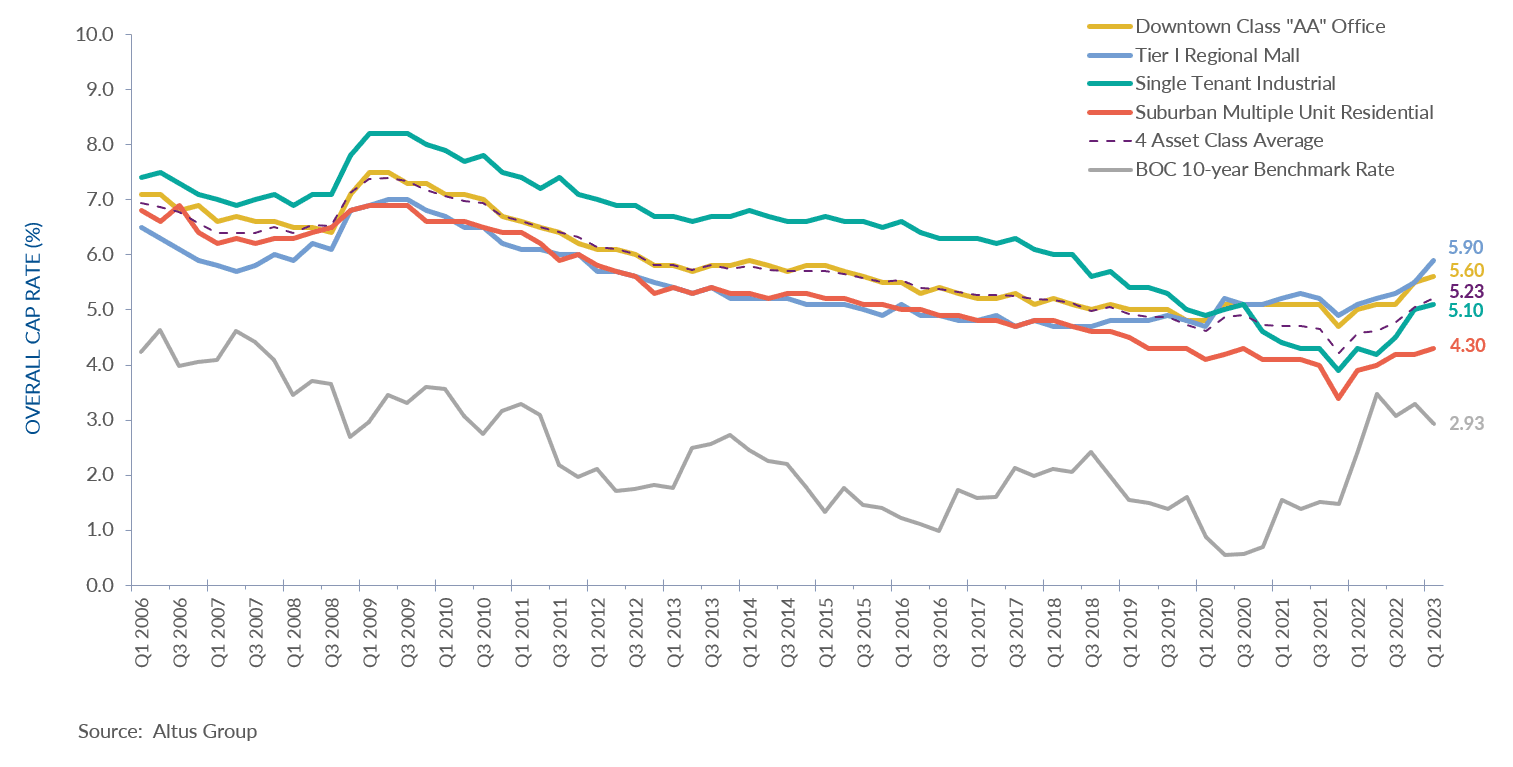

According to Altus' Investment Trend Survey, cap rate expectations continue to trend higher based on higher borrowing costs. Multi-tenant and single tenant industrial property in Montreal were the 2nd and 3rd most preferred product/market combination, respectively.

Figure 2 - Montreal Market Area, Property transactions by asset class (Q1 2022 vs. Q1 2023)

Office investment transactions dropped to $142 million in Q1 2023, down about 80% from Q1 2022. The ability of businesses to bring employees back into the office continues to weigh on this asset class.

Figure 3 - Montreal Market Area, OCR trends – 4 benchmark asset classes

Notable Q1 2023 transactions

3400 Raymond-Lasnier Street- Industrial

The most significant industrial transaction of the first quarter of 2023 was the purchase of 3400 Raymond-Lasnier Street by a joint venture between Montoni Groupe and Aimco. The industrial facility built in 2005 is comprised of 402,951 square feet of distribution space and 71,512 square feet of office space and showrooms.

The property is serviced by 27 truck bays and 303 parking spaces. At the time of the sale, the entire building was leased to Sport Maska Inc. The lease started in 2008 and expires in December 2023. The tenant has two renewal options for two further terms spanning five years each. The same joint partnership acquired 4 million square feet of industrial land in Saint-Bruno-de-Montarville in 2021.

9900 Irénée Vachon Street – Industrial

BTB REIT captured the sale leaseback of the new industrial facility of Lion Electric in Mirabel. The 176,819 square foot battery factory was completed in 2022 and has a clear height of 32 feet. Lion Electric signed a lease of twenty years with three (10) years renewal options.

8401, 8625, 8801, 8885 Trans-Canada Road - Office

In the office sector, Groupe Mach purchased four properties in Saint-Laurent in the western part of the island. The portfolio was purchased for $84,000,000 and contains a gross leasable area of approximately 379,285 square feet, representing an aggregate price per square foot of $221.50. This is the third acquisition of the year, after the InterContinental Montreal hotel and 8500 Place Marien.

1355 Le Corbusier Boulevard - Apartment

The most notable transaction for the apartment sector was the sale of 1355 Le Corbusier Boulevard in Laval by Centurion Apartment REIT. The complex built in 2021 counts for 240 units and was traded for close to $83 million. Centurion Apartment REIT is an active purchaser with several assets on and off the island of Montreal, however this is the first purchase in Laval. Overall, the tighter borrowing requirements and return expectations have been casting a pall over commercial transactions with investment activity expected to remain muted in the near term.

Authors

Edward Jegg

Research Manager

Diana Pricop

Team Lead

Authors

Edward Jegg

Research Manager

Diana Pricop

Team Lead

Resources

Latest insights