Key highlights

Capital markets are positively pricing in the end of the rate-hike cycle, pushing stock and bond prices up (and yields down), despite the reemerging political risk, both domestic and foreign

The impressive recent rally in stocks and bonds has raised cross-asset correlations, challenging diversification amidst a credit market has not fully priced in the effect of the 2022-23 rate hikes

The confluence of mixed economic and market indicators likely means that investor selectivity of CRE assets will be critical to capturing return

Even as the Fed does pivot, debt financing for CRE will likely remain less available and still costly, as the bank lenders remain constrained, and the realization or prospect of higher default rates weighs heavy on capital sources’ risk-appetite

Markets pricing in the pause-itive news

As recession risk continues to recede and fixed income markets settle from the prior month’s peaking yields, investors enter the final month of 2023. In the holiday-shortened December month, many are looking ahead to what the next year may bring. Many of the investment and market outlooks that were published through the month, seem to reflect some variation of the “higher-for-longer” (inflation and rates) narrative, coupled with a pushed-out soft-landing. While these seem a bit tame compared to the outlooks written during the same time last year, many of them have noted the reemergence of geopolitical risks.

2024 is bound to be a politically charged year in the US – as the federal budget debate will resurface in Q1 when the second continuing resolution begins to expire, and the 2024 presidential election begins to heat up and raise tensions. Outside the US, the conflict in the Middle East (Israel/Hamas) and Europe (Ukraine/Russia) remains ongoing, and an escalation in either conflict could potentially involve the US or its allies. At the same time, in Asia cross-border tensions remain high within the region (North Korea, Taiwan, South China Sea) and abroad (China/US relationship). While US markets seem to have focused less on these conflicts recently, the media coverage is robust, so rapid deterioration or developments could shake markets.

After the Federal Reserve’s (Fed) decision to hold interest rates steady in the US on November 1, the capital markets are near-definitively pricing in no more rate hikes through 2023 and starting to price in rate cuts through 2024. While the Fed has yet to explicitly confirm that it is done raising rates and is ready to cut, the data released this month (notably core PCE, hourly wage growth) supported the ready-to-cut thesis. US capital markets rallied into the final month of the year, as stocks rose and bond yields fell.

Seeking signals through all the noise

Despite the markets’ optimism about a near-term shift in Fed policy, there is still a lot of noise pertaining to economic and market data. More specifically, concerns are emerging regarding multiple conflicting data, which are either concerning in their own right (rising bankruptcy filings) or illustrations of the rarity of the current market environment. Taken all together, these data suggest that the market might be more fragile heading into 2024 than its recent rally suggests. And while the reemerging and rising political risk might not be entirely concerning on its own, coupled with a fragile market, this political risk could be a potential catalyst for increased volatility at the least.

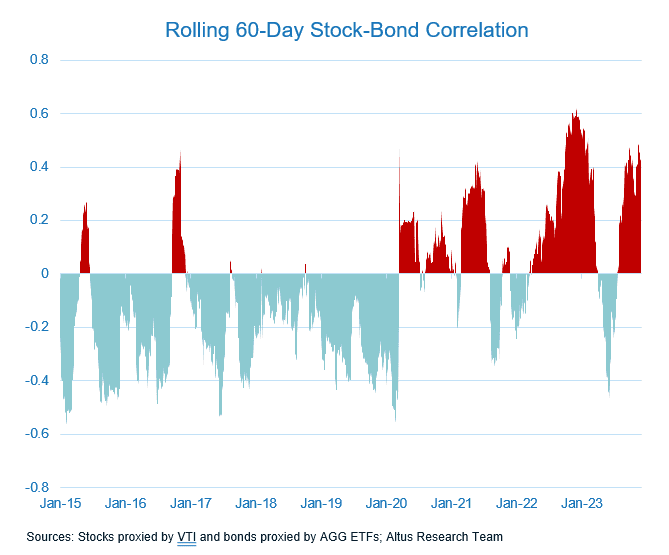

Figure 1 - Concerning correlations emerge

Three of the most concerning signals are coming from the credit markets:

Concerning correlations: Cross-asset correlations remain elevated compared to historical levels, highlighting the rarity of this year’s markets and making diversification difficult for all portfolios.

Yield curve inversion: The yield curve has been inverted for over a year across different maturity pairs (10Y/2Y, 10Y/3M, 10Y/FF). Historically, yield curve inversion occurs approximately 10% of the time, and inversion is one of the strongest predictors of recession. The 10Y/3M pair has been inverted for 277 consecutive market days, the longest period on record dating back to 1982.

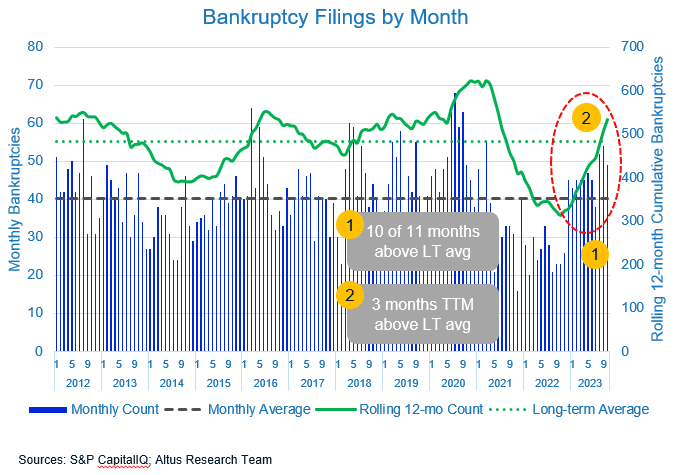

Rising bankruptcy filings: While corporate bankruptcy filings were mostly down since 2021, recent months have seen above long-term trends pick up, as many companies face increasingly difficult financial times. Ten of the last 11 months have witnessed more bankruptcy filings than the long-term monthly average and the trailing twelve-month count has recently moved above its long-term average.

Figure 2 - Bankruptcies on the rise

Groundwork laid for exciting year ahead for 2024, especially for CRE

With the backdrop of a landing economy, pivoting central banks, reemerging (geo)political risk, rallying markets – 2024 is likely going to be an exciting year. As discussed in last month's update, CRE likely still has some catching up to do in terms of pricing in the new cost of capital across the capital stack. While this CRE basis reset may be significant for certain CRE assets and markets, it is much needed to restore overall confidence to the CRE asset class, helping to pull committed capital off the sidelines and into the CRE marketplace.

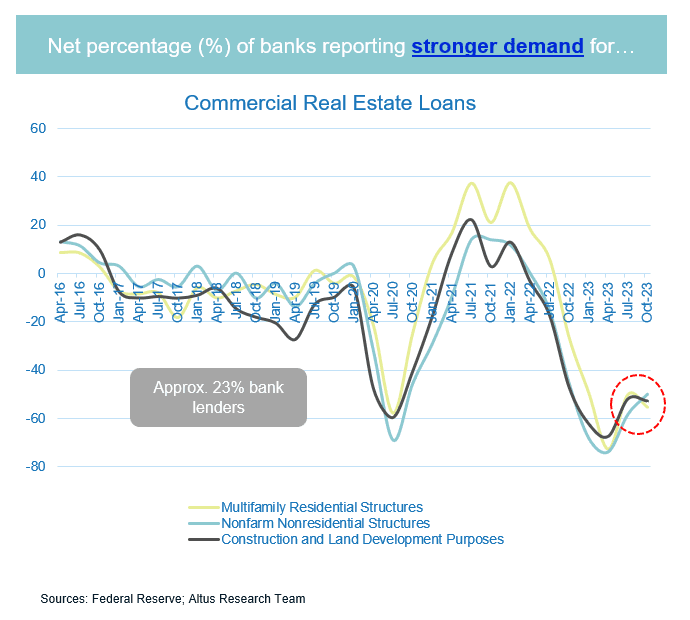

Figure 3 - Demand for loans slips

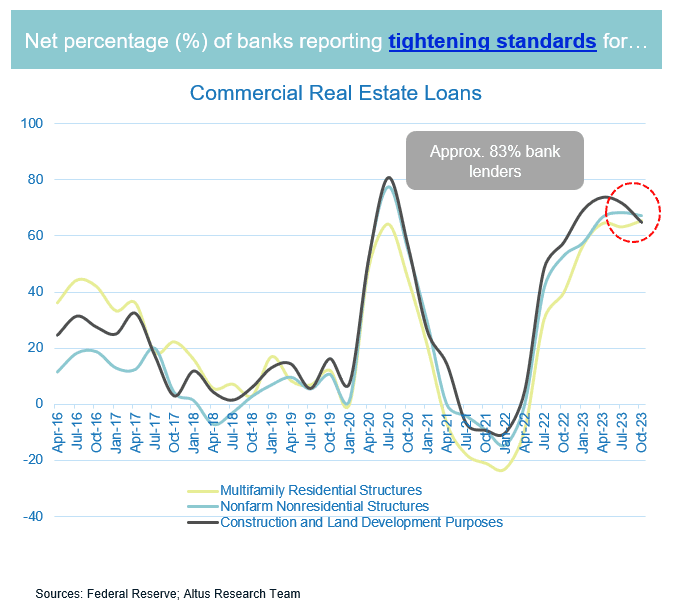

The confluence of mixed economic and market indicators likely mean that investor selectivity of CRE assets will be critical to capturing return. Even as the Fed does pivot, debt financing for CRE will likely remain less available and subsequently costly, as the bank lenders remain constrained, and the realization or prospect of higher default rates weighs heavy on capital sources’ risk-appetite. In the Fed’s recent Senior Loan Officer Opinion Survey, less than a quarter of bank’s noted increased demand for CRE lending and more than 80% indicated that their credit team were tightening lending standards for CRE. While this is not prohibitive to a rapid recovery of investment activity, these measures seem to be improving gradually – supporting the idea that CRE markets may have passed the trough of market activity.

Figure 4 - Lending standards tighten

Economy:

Following the recent Federal Open Market Committee (FOMC) meeting and a softer-than-expected employment report, US bond yields retreated significantly. This prompted Fed Chair Jerome Powell to caution markets against excessively loosening financial conditions. Powell emphasized that the Fed remains prepared to tighten policy if necessary and expressed uncertainty about whether the central bank has achieved the policy stance required to reach its 2% inflation target. The Fed's Senior Loan Officer Opinion Survey indicates that bank lending standards remained restrictive during the third quarter and that credit demand remained weak. While there were pockets of improvement, the survey reports metrics that have historically been associated with recessions. Regarding business and commercial real estate loans, survey respondents reported tighter standards and weaker demand during the quarter.

The New York Fed released September data for its Survey of Consumer Expectations earlier this month which revealed that inflation expectations remained relatively stable. However, households' perceptions and expectations regarding credit conditions deteriorated slightly during the month, suggesting that consumers are becoming more cautious about their borrowing behavior amid concerns about tightening financial conditions. Credit card balances are now $154 billion higher than they were a year ago, the largest annual increase since the Federal Reserve Bank of New York began tracking the data in 1999. The bank also noted that delinquencies have been rising from record-low levels.

The US manufacturing sector lost ground in October as the Institute for Supply Management's (ISM) manufacturing index fell to 46.7 from 49. Europe's manufacturing PMI remained largely unchanged at 43.1, while the UK's index slipped to 44.8 from 45.2. The US services sector also cooled in October, with the ISM non-manufacturing index falling to 51.8 from 53.6.

News of labor market softening was welcomed by markets as it reinforces the notion that the Fed has completed its tightening cycle. Nonfarm payrolls rose 150,000 in October, below the 180,000 consensus forecast. Wage growth slowed, the data show, with average hourly earnings advancing a modest 0.2% month over month. The odds of a further rate hike from the Fed eased after the data, while markets increased bets that the central bank will begin cutting rates in mid-2024. A portion of the 35,000 jobs decline in manufacturing employment is attributed to the temporary impact of the since-settled United Auto Workers strike.

Capital markets:

Market volatility decreased over the month, as the VIX ended the month at 12.92. The rolling 60-day correlation between equities and bonds rose to 0.41, up from a month prior (0.29). The US Dollar was little changed compared to other major global currencies during the month approximately -2.9%.

Stocks ended the month higher, with the US broad market indices ending the month up 9.1% on the month. Performance across sectors was mixed, as Real Estate (+14.8%) and Information Technology (+13.6%) were leading, while Energy (-1.2%) and Consumer Staples (+3.7%) were lagging.

The yield on the 10-year US Treasury security fell 51 bps during the month, settling at 4.37%. The risk-free yield curve remained inverted with the 10-year/3-month US Treasury pair ending the month at -1.08%. Corporate credit spreads tightened during the month, with spreads to US Treasury securities ending the month AAA (55 bps vs 68 bps a month prior) and BBB (155 bps vs 178 bps a month prior). Effective yield on high-yield corporate debt rose to 8.3%.

Commercial real estate:

Shares of US REITs ended the month up (13.6%) beating the US broad market indices, which finished the month up 9.0% from one month prior. Price to FFO multiples for REITs overall expanded during the month, ending at 15.4x (up from 13.8x). Performance across REIT sectors was mixed, and the gap between top performing and bottom performing sectors spanned 15.4%. The best-performing REIT sector for the month was Office (+22.2%), and the worst-performing REIT sector for the month was Health Care (+6.7%).

Author

Omar Eltorai

Director of Research

Author

Omar Eltorai

Director of Research

Resources

Latest insights

Jun 19, 2025

EP66 - From uncertainty to stability: How CRE is adapting to the latest mix of volatility