Key highlights

Australia’s construction industry is struggling with near-record rates of insolvencies. After years of cashflow management challenges in an overheated market, construction companies are struggling to source capital as the market cools, and some projects no longer stack up.

How long does the industry have to deal with current headwinds? How can developers manage their risk to play their best hands?

Altus Group’s Niall McSweeney and Barry McBeth turn a spotlight on insolvencies to help clients manage and mitigate risk.

As construction industry insolvencies hit a nine-year high, the consequence of an industry reliant on cashflow is clear to all.

The years of record rates of investment, high incentives and low borrowing costs are over, and Australia’s construction industry is now being squeezed from all sides. Fixed-price contracts, signed and sealed in the pre-pandemic days, must now be delivered in a slowing market as costs continue to escalate and interest rates rise.

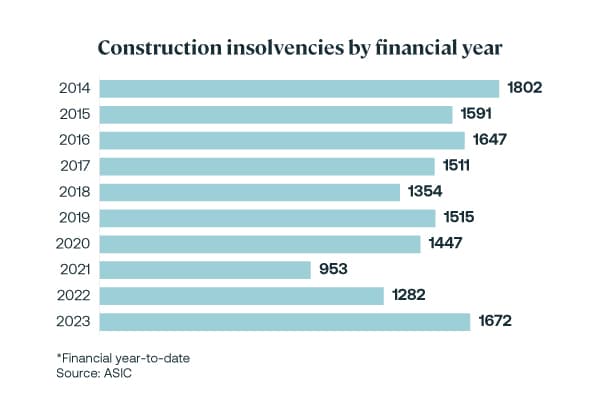

The number of construction industry insolvencies grows by the day. By mid-May 2023, a massive 1,709 construction companies had called in external administrators over the financial year, according to the corporate regulatory, the Australian Securities Investment Commission.

Figure 1 - Construction insolvencies by financial year

To put this in perspective, we haven't seen higher failure rates –1,802 to be precise – since 2014.

Tougher economic conditions and tighter liquidity means banks and other creditors are less willing to extend debt and equity funding. At the same time, the Australian Tax Office is actively seeking the repayment of around $45 billion in uncollected tax debt.

But many construction companies are operating on a very risky business model. New cash inflows have always paid down old debts. But eventually the losses pile up and the liquidators are called in.

Poor financial management is a key issue for many industry players. Stable construction firms with strong balance sheets will prevail and may pick up distressed projects left behind by those companies less able to navigate the volatile market.

Fair contracts, finance and feasibility

Data published in The Australian in January shows some of the nation’s largest builders are operating on increasingly thin margins. One builder generated $803 million in the 2022 financial year, only to bank $1.3 million in profit. Another made just $7.1 million in profit despite pulling in $1.34 billion in revenue over the financial year.

Some of these numbers are a hiccup away from zero, and poor financial management for construction firms has become a key issue. The more stable construction firms will see their way through the current environment and potentially pick up distressed projects left. The best firms / those with strong balance sheets being the ones available to deliver.

Some companies have fallen foul of a broken contracting model that unfairly allocates risk. Consult Australia’s ‘model client’ behaviours includes ‘collaborative contracting’ principles which maintain proportionate liability, balance rights and obligations, and fairly allocate risk. Unfortunately, many construction contracts are drafted to pass risk down the supply chain, often to the party least able to manage that risk. The consequences are there for all to see.

Banks are now looking less favourably on ‘rise and fall’ clauses in contracts – which share the risk of fluctuating building costs, for instance – and fewer projects are securing funding without a clearly defined outcome. Financiers want to fix costs as much as possible, and this is acceptable among companies with large cash reserves. But smaller companies may now be required to find tens of millions in additional equity – and this can have a colossal impact on the feasibility of projects.

There is, though, another less acknowledged reason why businesses are going under. In some cases, fatter margins would only mean bigger houses and faster cars.

Construction firms go under due to their own financial management, not low margins. Fair and reasonable risk allocation, with the right builder at the right price and a sensible contract, will help the industry move forward. For larger projects, market sounding at the early stages of procurement can help alleviate potential issues later down the line.

Rolling the dice on replacement costs

Insolvencies add to the cost burden because someone must pay to complete the job.

Developers must tread carefully – millions in the bank is not an effective safety net. If a contractor falls over, developers should expect to pay the last progress payment and then an additional 10% to 20% to finish a job if a contractor falls over.

Why is this? For starters, subcontractors who are waiting on previous progress payments are unlikely to recommence work under a new builder until they receive the money they are owed in full. Usually there is a massive gap – around two months of payments – that must be squared away to get the project moving again.

The replacement contractor can expect to be saddled with a swag of extra costs. These include retendering costs, fees for assessment of work completed by the failed contractor, premiums to warrant works completed by original contractor, redocumentation and redesign fees, legal, repricing, currency, as well as escalations due to delay.

Fewer Tier 2 contractors are willing to take on the risk, and that is compelling some developers to consider Tier 1 contractors. But Tier 1 contractors usually come with bigger overheads – and this can be cost prohibitive when you are already struggling to balance the budget. It is becoming more common that the replacement contractor will not take the risk on the previous works, which means the developer is exposed for the works to date and any associated re-work required.

Talking about tiers

There are three tiers of construction company in Australia:

Tier 1 contractors can undertake most of the required work with their own employees providing all managerial and supervisory roles. These contractors usually have a large balance sheet, can assume the project risk and major procurement functions.

Tier 2 contractors generally rely on subcontractors to perform much of the work but limited to one or two major projects at a particular time.

Tier 3 contractors are dependent on subcontractors and usually only perform minor work.

End to end accountability

Quality contractors won’t run away from their obligations. But it is reasonable for them to question when their obligations end. NSW Building Commissioner David Chandler OAM recently on LinkedIn noted that regulation now requires “end to end accountability”. To meet this requirement, building certifiers must confirm the “whole of the works” have been completed in accordance with the building's declared design. “Demonstrating that declaration continuity is properly engaged is providing a new pipeline of work for specialist auditors and lawyers who have been first to see this opening market,” the Building Commissioner has said. Those “stepping in” to manage completion but who do not demonstrate compliance will find regulatory hurdles that “have not previously existed”.

Watch out for the warning signs

The construction industry is at an inflection point. With the current rate of failures, developers must be clear on the progress of their projects and where the costs lie. Without that clarity, there is a real risk of overexposure.

Understanding why a project has failed or is faltering is easier with the benefit of hindsight.

But the early warning signs that a development is in distress are often in plain sight, onsite. These include slowing progress, missed milestones, unexpected delays, materials, or equipment removed from site ahead of schedule, a messy site or falling standards of quality.

Altus Group suggests subcontractors should be alert to high turnover rates on site or rumours of late, reduced or non-payments. A head contractor overly focused on variations and extensions, requesting shorter payment cycles or irregular prepayments for materials do not bode well.

In an industry where cashflow is king, a slowing rate of sales, underachieving leasing, discounted stock or high level of incentives are also symptoms of stress.

Familiarise yourself with the signs to get ahead of risk. When you do spot risks, don’t wait. Take immediate action to investigate and seek solutions. Altus Group’s team of experts, backed by decades of experience and data-driven insights, can help you play a strong hand in a risky market.

Authors

Niall McSweeney

Head of Development Advisory, Asia-Pacific

Barry McBeth

Director, Cost Management

Authors

Niall McSweeney

Head of Development Advisory, Asia-Pacific

Barry McBeth

Director, Cost Management

Resources

Latest insights

Jan 9, 2025

Building the future - Key trends shaping Australia’s construction industry in 2025