Greater Golden Horseshoe commercial real estate market update – Q4 2023

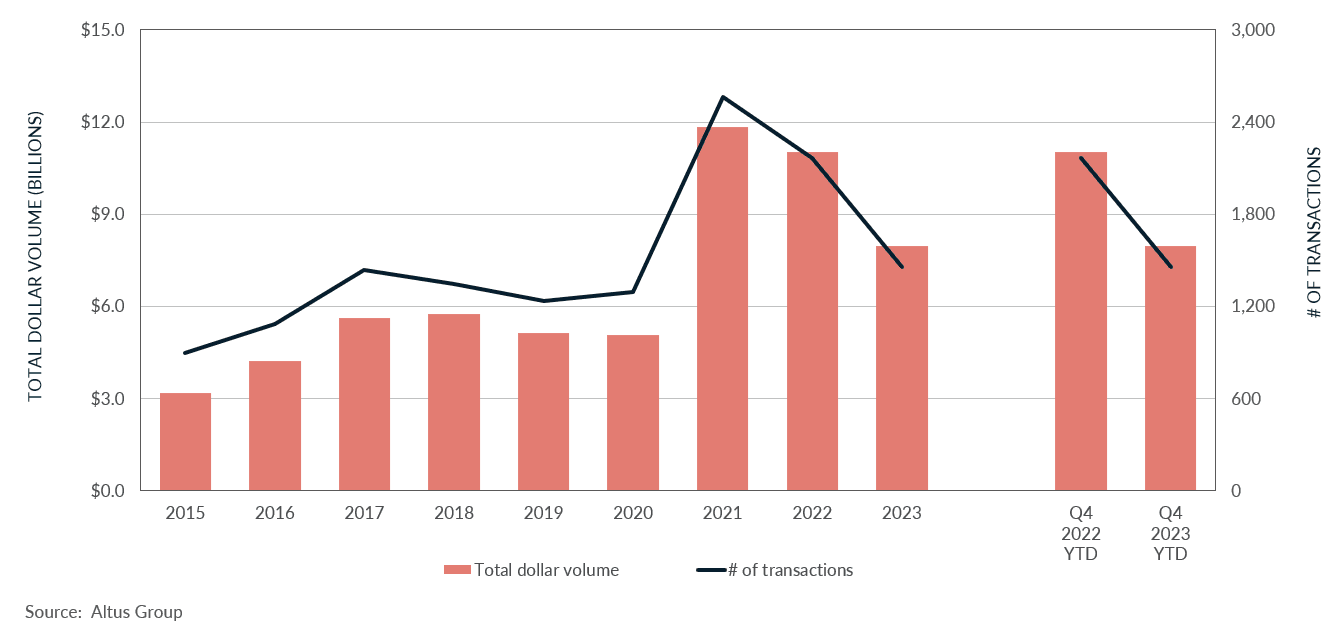

Q4 2023: The Greater Golden Horseshoe market reported nearly $8 billion transacted in 2023, a 28% decrease compared to 2022.

Key highlights

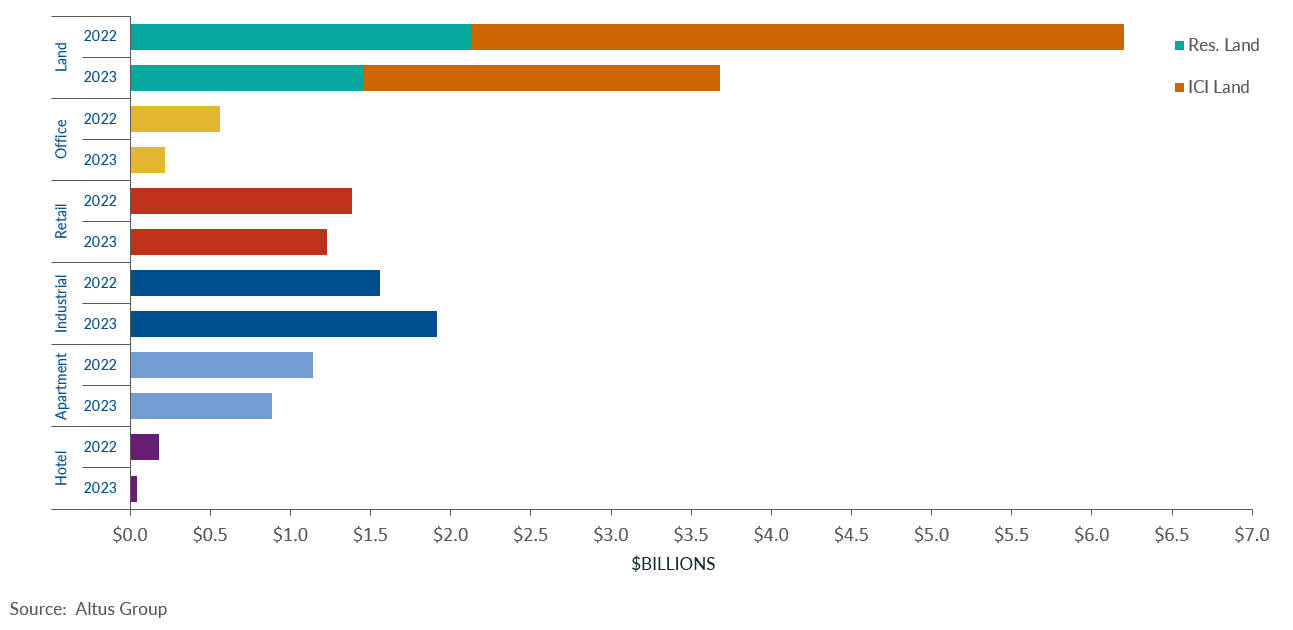

All sectors in the Greater Golden Horseshoe (GGH) observed a decline in transaction volume

The Waterloo Region and Wellington County were the only markets to report positive year-over-year (YoY) growth, at nearly $2.2 million and $1.1 million in dollar volume transacted, respectively

The industrial sector reported $1.9 billion in dollar volume transacted, a 23% increase YoY

The GGH market posted $887 million in multi-family dollar volume transacted, a 22% decrease YoY

The retail sector reported $1.2 billion in dollar volume transacted, an 11% decrease YoY

The residential and ICI land sales have slowed, with $3.7 million in dollar volume transacted, a 41% decrease YoY

Transaction activity in the Greater Golden Horseshoe market declined by nearly a third compared to the previous year

Climbing interest rates and inflationary pressures in the first half of 2023 largely contributed to the slowdown in market activity across the Greater Golden Horseshoe (GGH). All sectors observed a decline in transaction volume. However, the GGH’s industrial sector remained active despite the difficulties stemming from the macroeconomic headwinds. The Waterloo region and Wellington County were the only markets to report positive year-over-year (YoY) growth, at nearly $2.2 million and $1.1 million in dollar volume transacted, respectively.

Figure 1 - Property transactions – All sectors by year

The industrial sector reported $1.9 billion in dollar volume transacted, a 23% increase YoY. According to Altus Group’s most recent Canadian industrial market update, Southwestern Ontario, located in the South GGH market, the industrial availability rate increased by 2.1% to 5.1%. The market reported 2.5 million square feet of industrial completions, with over 80% pre-leased, and 5.4 million square feet of new supply under construction, with 30% pre-leased. Furthermore, demand for industrial products has not waned in the GGH as tenants compete for suitable spaces. The record-breaking delivery of industrial completions in 2023 has assisted in gradually shifting the GGH to a more balanced market. Wellington County reported the highest YoY percentage change, with $533 million in dollar volume transacted in 2023.

The GGH market posted $887 million in multi-family dollar volume transacted (a 22% decrease YoY), as higher interest rates, inflationary pressures, labour shortages, increased construction and material costs, and price expectations between buyers and sellers contributed to the decline in activity. However, as housing affordability continued to deteriorate across major urban markets, municipalities located in the outer urban fringes have become attractive destinations for those seeking more favourable economic conditions. At the same time, the GGH’s growing tech sector has contributed to a dramatic population increase, adding pressure to the tight market.

The retail sector reported $1.2 billion in dollar volume transacted, an 11% decrease YoY. In a region rich with employment opportunities and an abundance of post-secondary institutions, the shift to a hybrid work model and the return to in-person learning has aided in the recovery of the retail sector, especially food-anchored retail strips, as Canadians have pivoted their spending towards essential goods and services.

The residential and ICI land sales have slowed, with $3.7 million in dollar volume transacted, a 41% decrease YoY. The residential land sector posted $1.5 million, while the ICI land sector posted $2.2 million, a 32% decrease and a 45% decrease YoY, respectively. The decline in land investment can be attributed to difficulties securing financing amidst a high-interest rate environment.

Figure 2 - Property transactions by asset class (2022 vs. 2023)

Notable Q4 2023 transactions:

The following are notable transactions for the Q4 2023 Greater Golden Horseshoe commercial real estate market update:

49 Queen Street East, Cambridge – Apartment

This 10-storey, 153-unit high-rise apartment in Cambridge was the largest multi-family transaction registered in the GGH market for 2023. The building was purchased by Skyline Apartment REIT for $81.3 million, representing a price per unit of $531,373. The vendor on this transaction was Starlight Investments, who originally acquired this property in February 2018 for a purchase price of nearly $53 million.

271 Reidel Drive, Kitchener – Residential Land

With a land area of just over 204 acres and a purchase price of $155 million, this acquisition by Activa represented the largest residential land transaction in the 2023 year. Many current and upcoming residential developments surround the unimproved site. At the time of sale, no applications have been submitted to the City of Kitchener, but this future development is part of the growth plan for the Great Golden Horseshoe, which aims to create more housing based on the population’s growth and needs.

500 Pinebush Road, Cambridge – Industrial

Acquired by Dream from BentallGreenOak, this 122,394 square feet industrial building was purchased for nearly $27.2 million, representing a price per square foot of $222. The property is ideally located within minutes of Highway 401, providing easy access to the GGH & GTA markets.

This acquisition by Dream capped off a busy year, which also included a joint venture with GIC. Together, they acquired Summit Industrial Income REIT for $5.9 billion in February. This deal included 158 properties across four provinces, totaling nearly 22 million square feet of industrial space.

In 2023, higher interest rates and inflationary pressures slowed investment activity across all major markets in Canada; however, investor interest in the GGH market area has grown considerably in the last decade. As the region experienced an influx of in-migration from surrounding urban centres for its affordability and employment opportunities, the market is poised for many growth opportunities.

Authors

Jennifer Nhieu

Senior Research Analyst

Yusra Sarfraz

Market Analyst

Authors

Jennifer Nhieu

Senior Research Analyst

Yusra Sarfraz

Market Analyst

Resources

Latest insights