Greater Golden Horseshoe commercial real estate market update – Q2 2023

Q2 2023: The Greater Golden Horseshoe market experienced a 43% decrease in transaction volume.

Key highlights

Despite market volatility, investors in the Greater Golden horseshoe region remain optimistic, particularly towards residential and industrial properties

While the industrial availability rate increased to 3.7% from 3.1% in Q2 2022, rental rates remained high as supply remains tight relative to demand

The affordability of living in major metropolitan cities continued to be a challenge for many Canadians, mainly due to increased homeownership costs and inflation

The land sector experienced a decline in activity this quarter due to uncertainty around increased construction and financing costs

The long-term outlook for the Greater Golden Horseshoe market continued to be optimistic, with strong population growth, constrained supply, and increasing rental rates supporting strong asset fundamentals

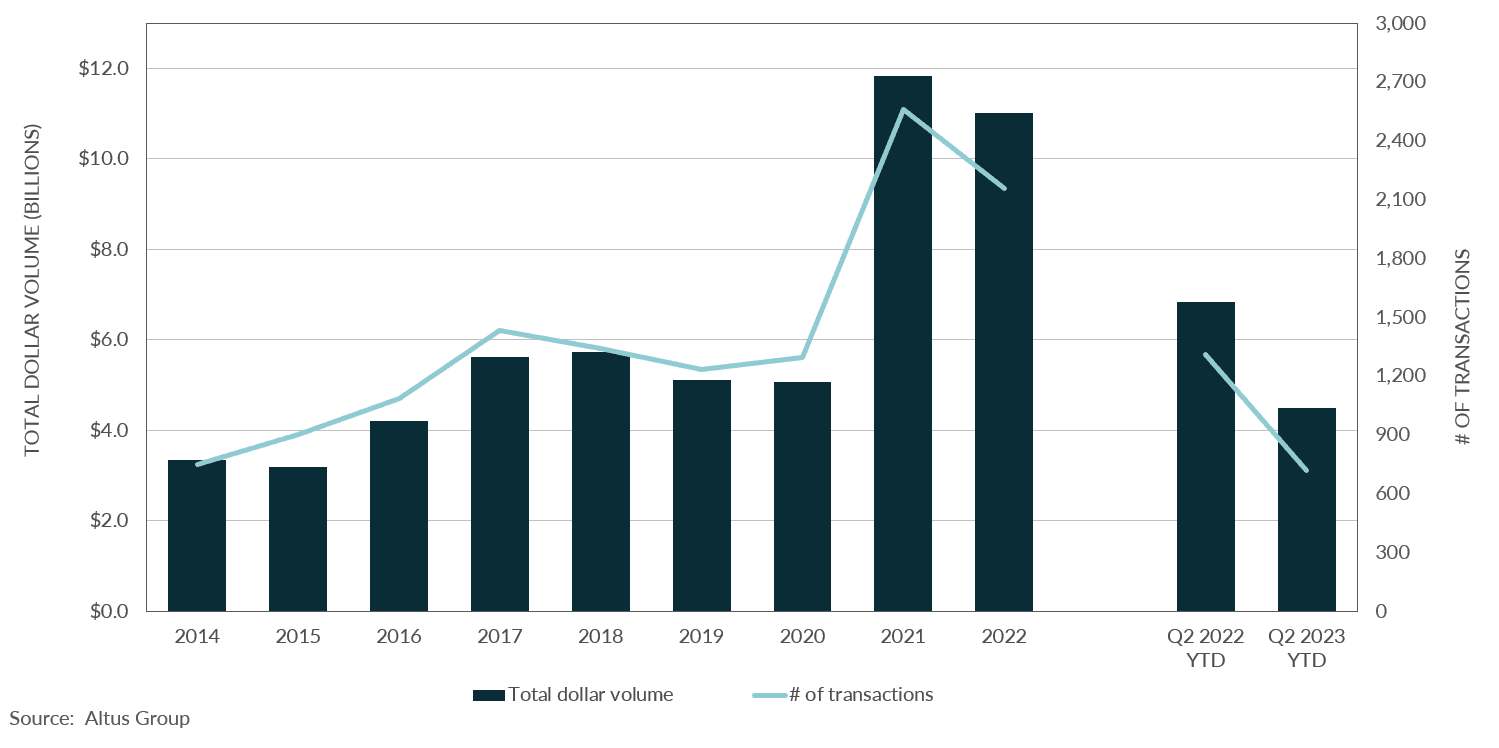

The Greater Golden Horseshoe (GGH) market experienced a 43% decrease in investment dollar volume from 3.8 million in Q2 2022 to 2.2 million in Q2 2023 as the price discovery process continues. However, despite rising interest rates, investors remain optimistic as high population growth, constrained supply, and rising rental rates of residential and industrial properties continue to support asset fundamentals.

Figure 1 - Greater Golden Horseshoe property transactions – All sectors by year

The Greater Golden Horseshoe remains a favourable geographic region for industrial investments. The industrial sector displayed the most resiliency, observing the lowest drop in investment volume (-17%) compared to the other sectors. Brant County reported the highest year-over-year growth, with $100 million in investment volume. However, the Niagara Region and Dufferin County reported the highest growth in industrial investment at $53 million and $20 million, a 190% and 91% increase, respectively. This activity was mainly driven by private investors purchasing multi-tenant and single-tenant industrial assets. Moreover, while the industrial availability rate increased to 3.7% from 3.1% in Q2 2022, rental rates remained high as supply remains tight relative to demand.

The affordability of living in major metropolitan cities continued to be a challenge for many Canadians, mainly due to increased homeownership costs and inflation. As a result, the outer suburban and exurban areas of major urban centers experienced increased migration from those seeking a better economic situation. According to Altus Group’s latest Investment Trends Survey, multi-unit suburban residential remains an investor favourite for Q2 2023. As more Canadians remain in the rental pool, elevated demand and limited supply have resulted in continued investment in the residential sector, regardless of increasing construction costs and interest rates. The Waterloo Region and Wellington County reported the residential investment by dollar volume at $209 million and $65 million, a 102% and 77% increase from Q2 2022, respectively.

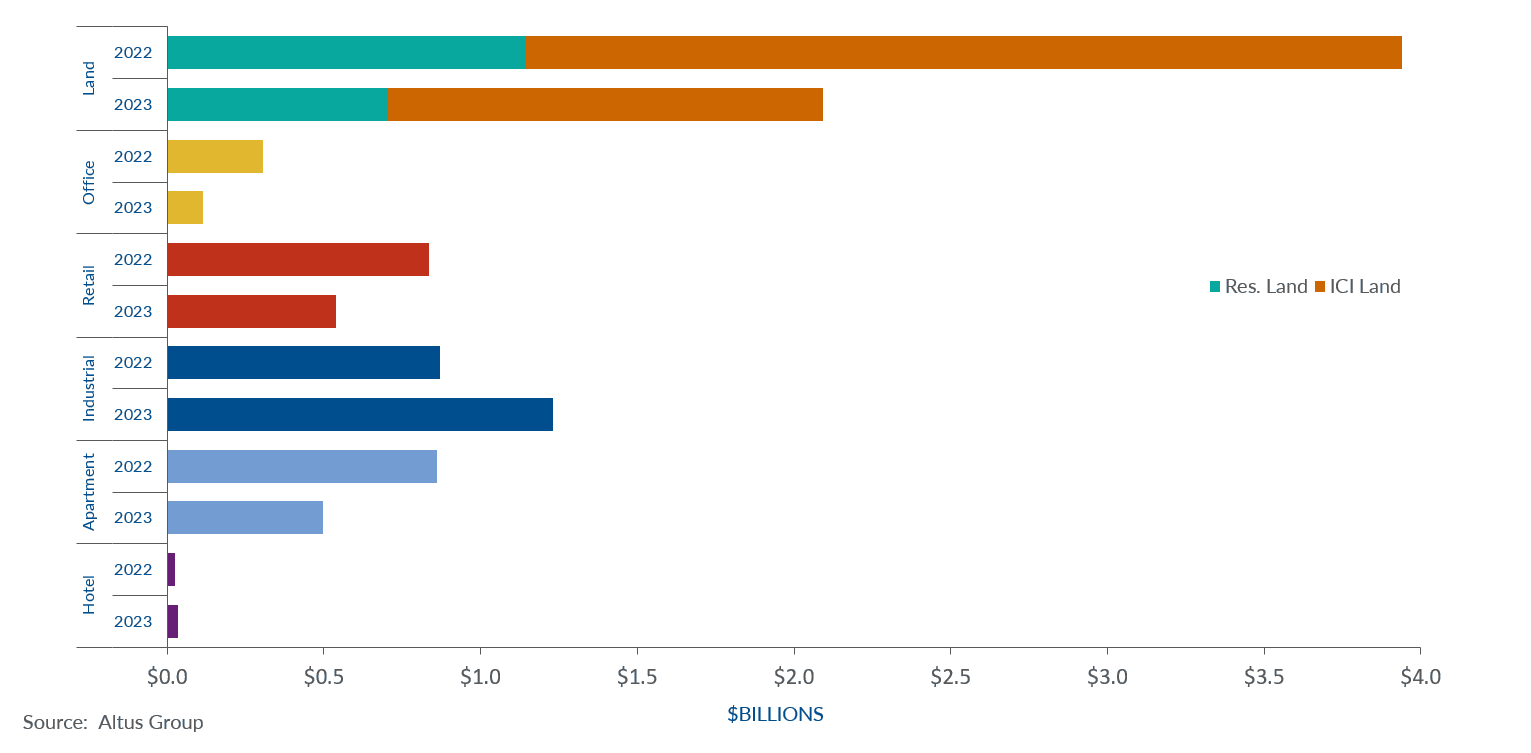

The land sector experienced a decline in activity this quarter due to uncertainty around increased construction and financing costs. Compared to Q2 2022, the residential land sector experienced a slight decrease of 28% in investment volume, while ICI land reported a considerable drop of 57%. The residential sector experienced an upswing in investment, while ICI land is maintaining transaction activity, indicating a potential rebound.

Figure 2 - Property transactions by asset class (YTD Q2 2022 vs YTD Q2 2023)

Activity is expected to remain low as investors adapt to a high-interest-rate environment. However, the long-term outlook for the Greater Golden Horseshoe market continued to be optimistic, with strong population growth, constrained supply, and increasing rental rates supporting strong asset fundamentals. Similar to other Canadian cities, investors have re-balanced their asset portfolio to favour industrial and residential real estate, given the current difficulties in the office and some parts of the retail market.

Notable Q2 2023 transactions

The following are notable transactions for the Q2 2023 Greater Golden Horseshoe commercial real estate market update.

406-526 Fletcher Road, Hamilton – Residential Land

With an acquisition price of $112,500,000, this 152-acre land parcel was acquired by Tribute Communities and represented the largest GGH transaction in the quarter. Before the date of sale, an Official Plan Amendment was submitted and approved by the City of Hamilton. The property is in Elfrida, which is in the City’s Whitebelt area. This area has been identified as an area for urban boundary expansion based on the 2006 City’s Growth-Related Integrated Development Strategy. Essentially, this application for an Official Plan Amendment pertaining to the land in this transaction aligns with the City’s growth plans to deliver a variety of housing types to meet the market-based and affordable housing needs.

30 Hanmer Street West, Barrie – Apartment

Realstar acquired this newly constructed 10-storey apartment building, called the Bayfield Tower, for $53,900,000. Located in the north end of the City of Barrie, the property contains 116 units and sits on approximately 2.3 acres of land. After this acquisition, Realstar also made a second-quarter acquisition in the GTA market, purchasing 1225 York Mills Road for $84,748,231. The purchaser, Realstar Group, currently has $9 billion of assets under management.

130 Mandonell Street- $20,854,080 – Office

This eight-storey office building located in downtown Guelph and currently occupied by The Co-operators Group was acquired by Conestoga College for $26,854,080. The vendor on this sale was Guelph-based Skyline Group of Companies, initially acquiring the building in 2008 in a sale-leaseback transaction. Conestoga College intends to renovate the building for a downtown campus that will accommodate 5,000 students, with an opening planned for 2025.

Authors

Jennifer Nhieu

Senior Research Analyst

Yusra Sarfraz

Market Analyst

Authors

Jennifer Nhieu

Senior Research Analyst

Yusra Sarfraz

Market Analyst

Resources

Latest insights