Key highlights

Commercial real estate finance industry professionals at CREFC’s annual conference in January noted a widespread expectation for reduced cost of capital in the next 12 months, as the Federal Reserve hints at 3 potential interest rate cuts in 2024, while the market prices in closer to 6

Despite the apparent alignment on interest rate expectations for 2024, panelists and attendees showed little consensus of where values should be, as cooling rent growth and escalating expenses are driving property-level cash flow uncertainty

Rising expenses plague office and multifamily alike, with the latter challenged by 2023’s historic jumps in insurance premiums while the former, experiencing structural demand challenges, requires significantly higher tenant improvements and leasing commission costs

The CRE community comes together for one of the first major trade events of 2024

The Commercial Real Estate Finance Council (CREFC), a CRE industry trade group, kicked off the year with its annual conference, taking place January 8-10, 2024 in Miami. The event brought together CRE debt financing players – lenders, debt investors, and securitization participants – to address the current market and provide outlooks on issues that matter. In addition to financing-specific concerns, panels frequently addressed macro- and property-level concerns.

The following are the Altus Group's Research Team’s key takeaways from the conference.

2024 outlook largely “not negative”, with all eyes on rates

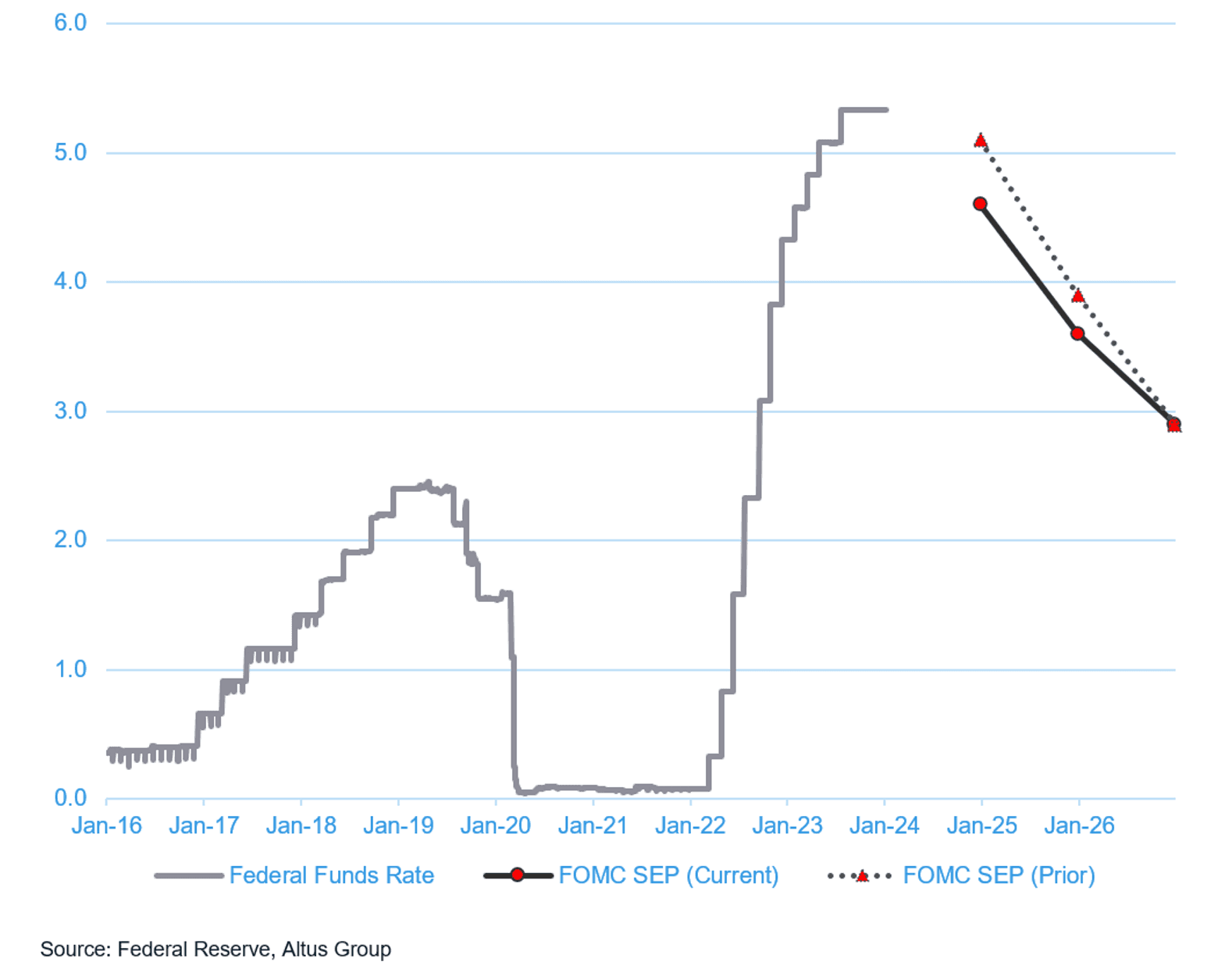

The anticipated downward trajectory of interest rates dominated discussion at the event. And while the Federal Reserve’s interest rate cuts would be beneficial to CRE financing, the number and timing of cuts is still unknown. The Fed has indicated 3 potential rate cuts through 2024, while markets are pricing in closer to 6. Regardless, there was consensus among panelists and attendees alike that cost of capital is all but certain to come down over the next 12 months, leading 2024 to be a year where activity – at the very least – eclipses levels seen in 2023.

Figure 1: Federal funds rate and FOMC summary of projections

Property fundamentals in flux

Despite continued optimism on expected rate cuts through the year, many panelists noted ongoing shifts in CRE fundamentals. Even if the cuts meet expectations, cash flows for many property types remain uncertain. Rent growth in the industrial and multifamily sectors is cooling as expenses across all sectors are increasing. Work-from-home trends continue to take their toll on office utilization, and lease rollover risk becomes apparent. As such, rising tenant improvement and leasing commission costs were mentioned frequently on panels. Each of these complications helps perpetuate the lack of consensus around where values should be. Given stable or declining interest rates, participants uniformly agreed that increased transaction activity should help provide greater clarity on valuations.

Office still property non grata, multifamily falling out of favor

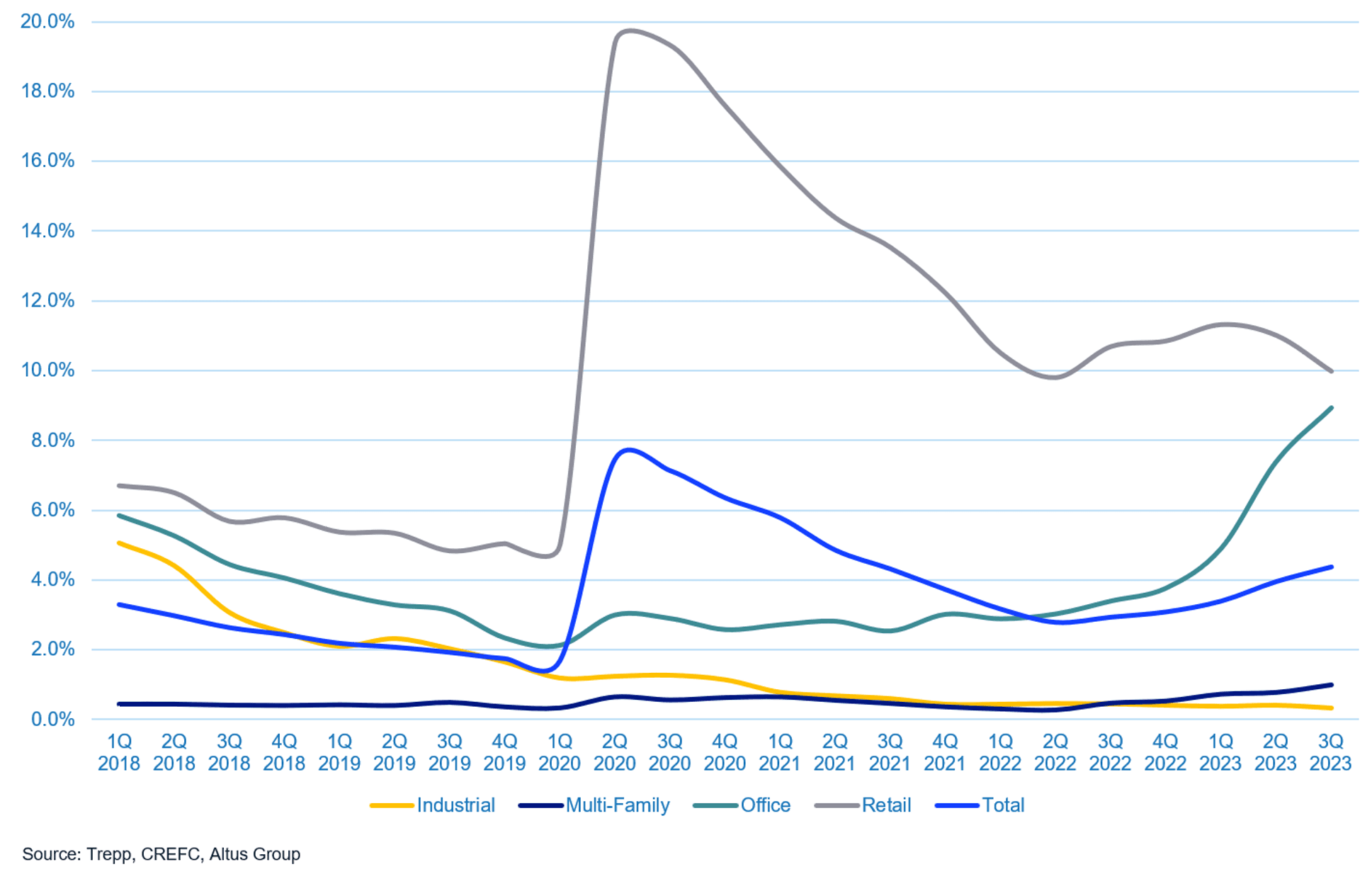

While “office” seemed to be a four-letter word that most panels (purposely?) avoided, many labeled multifamily as possibly the “next shoe to drop”. Some panelists defended the sector by noting that demand remains strong – the persistent US housing shortage was expected to be a tailwind for owners. Others pointed out that expectations for strong rent growth are waning with a wave of new supply across certain markets. Additionally, many multifamily properties took on short-term transitional debt leading up to and during the pandemic. With those loan terms and extensions ending, some now need to refinance in an environment with much higher rates, and the math may no longer work out. Both private and agency lenders alike noted that delinquency rates from multifamily borrowers are already climbing. CMBS delinquency rates for multifamily, while still lower than other sectors, has increased every quarter since Q2 2022.

Figure 2: CMBS delinquent or in special servicing by property type

Insurance is a hot topic... again.

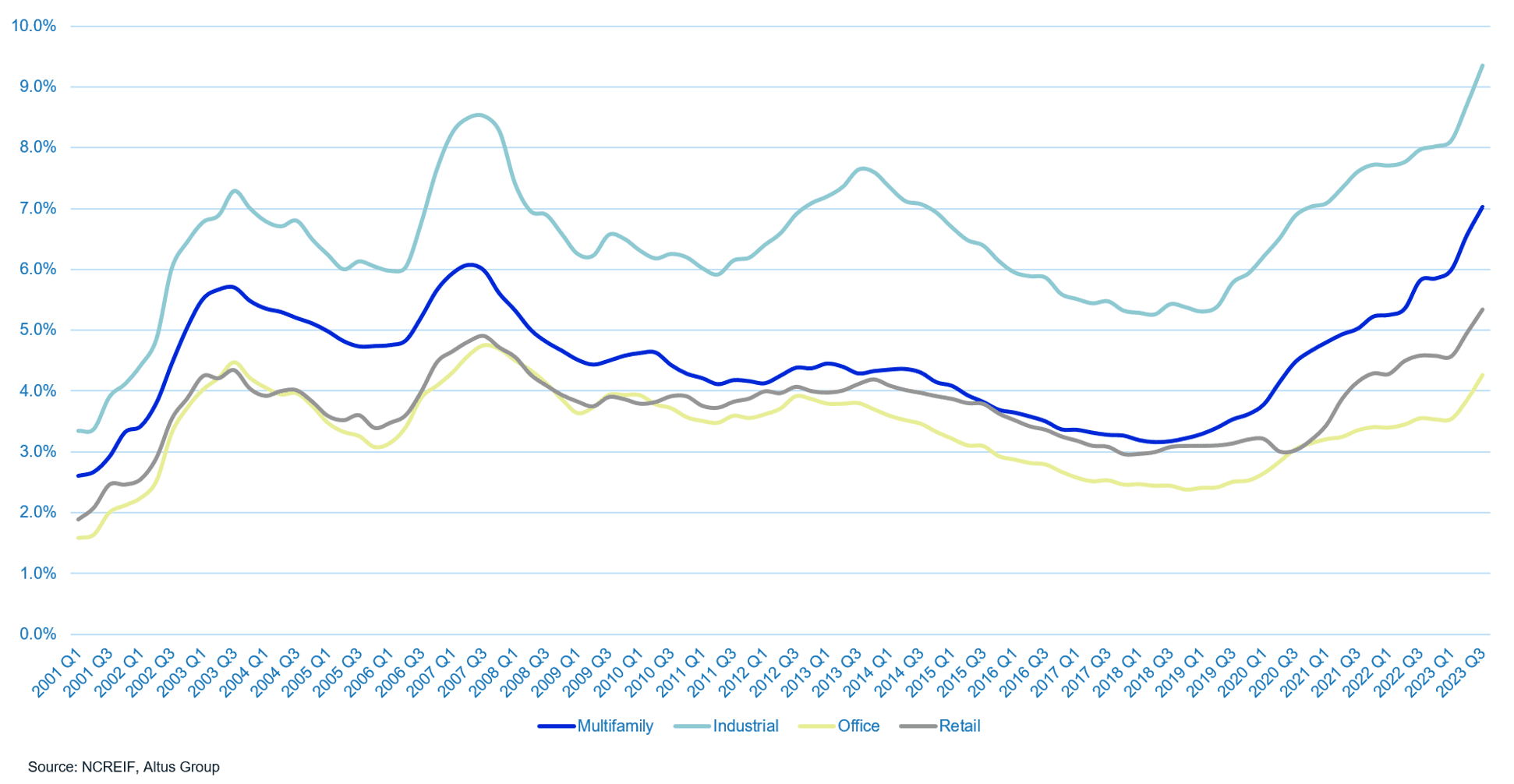

Rising insurance costs were discussed in nearly all panels, and noted as posing a particular danger to the multifamily sector. With the increasing frequency and intensity of weather events, historical catastrophe modeling has proven insufficient. Many insurers are now adjusting their modeled assumptions, repricing the risk, and in more extreme cases discontinuing coverage for certain property types and markets. Data cited on numerous panels stated that while typical annual increases in insurance premiums are +2-3%, they averaged +17% in 2023; in some markets, premiums rose as much as 200%. Insurance as a percentage of total expense is up across all property sectors since 2018, but growth accelerated in 2023.

Figure 3: Insurance as a fraction of total expenses

Looking into 2024

The CREFC annual conference was a showcase of neutrality that veered toward cautious optimism. This was largely influenced by the Federal Reserve’s hint at rate cuts while counterbalanced by property-specific uncertainties surrounding rent growth, expenses, and ultimately valuations. CRE had no shortage of challenges in 2023, and some of these will undoubtedly continue to unravel in 2024. However, the continued thawing of the capital markets may help spur transaction activity and unlock insights necessary to get the wheels moving again for CRE for 2024.

Author

Cole Perry

Associate Director of Research

Author

Cole Perry

Associate Director of Research

Resources

Latest insights

Jun 19, 2025

EP66 - From uncertainty to stability: How CRE is adapting to the latest mix of volatility