Commercial real estate industry conditions and sentiment survey - US Q4 2023 results

Key highlights

Altus releases its second installment of the Commercial Real Estate Industry Conditions and Sentiment Survey for the US, a quarterly survey of CRE professionals to gauge perspectives on current and future conditions for the industry

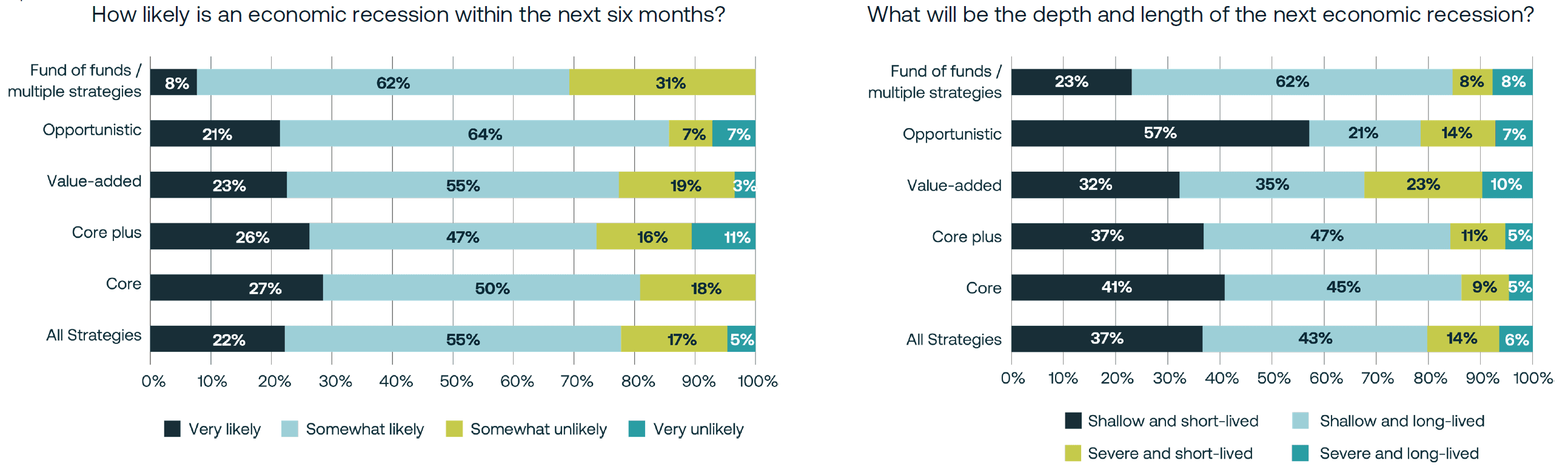

77% of survey respondents expect a recession within the next 6 months but also indicate overwhelmingly (80%) that it will be a shallow recession

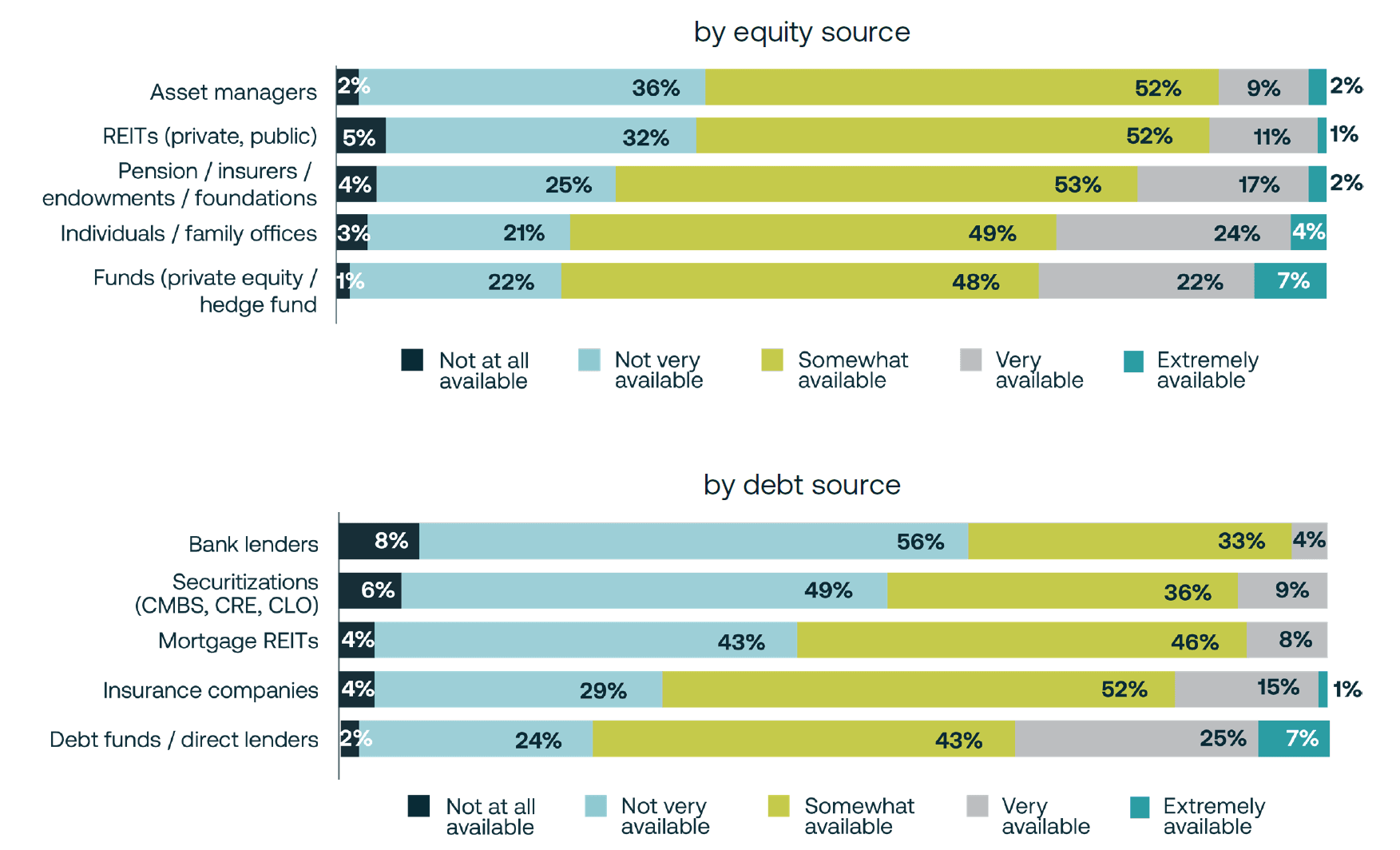

While capital availability expectations have slightly improved versus Q3 results, the survey still reflects constraints from both equity and debt sources; equity capital sources like high-net worth individuals, family offices, and funds are expected to be more available, while banks and securitizations are expected to remain constrained

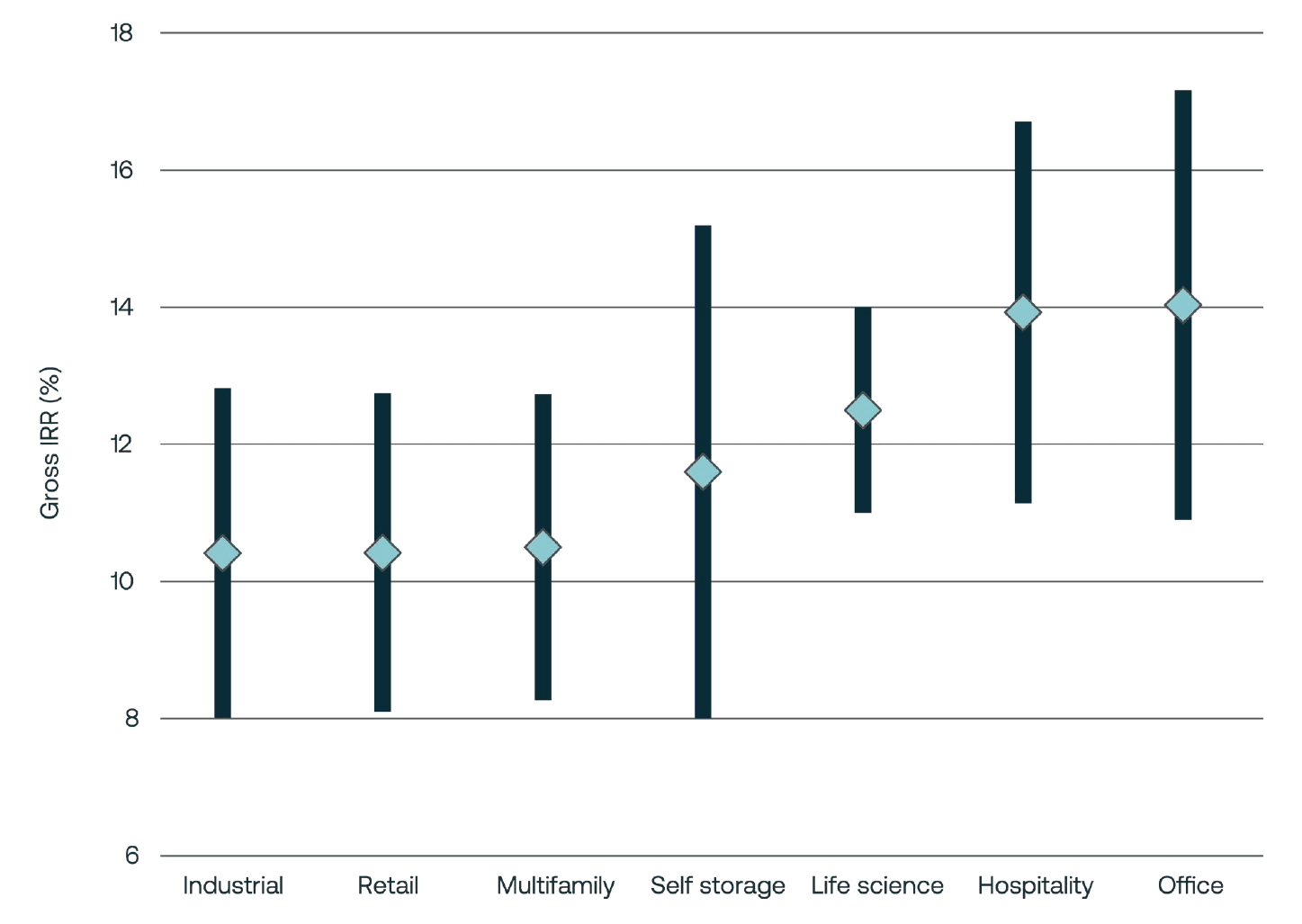

Reported gross IRRs for new funds averaged 11.9% across property types – self-storage had the most varied responses, with a midpoint of 11.6%, but low of 8.0% and high of 15.2%, and marketed office returns topped the IRR ranking with a midpoint of 14% and a wide range of responses (low of 10.9% and high of 17.2%)

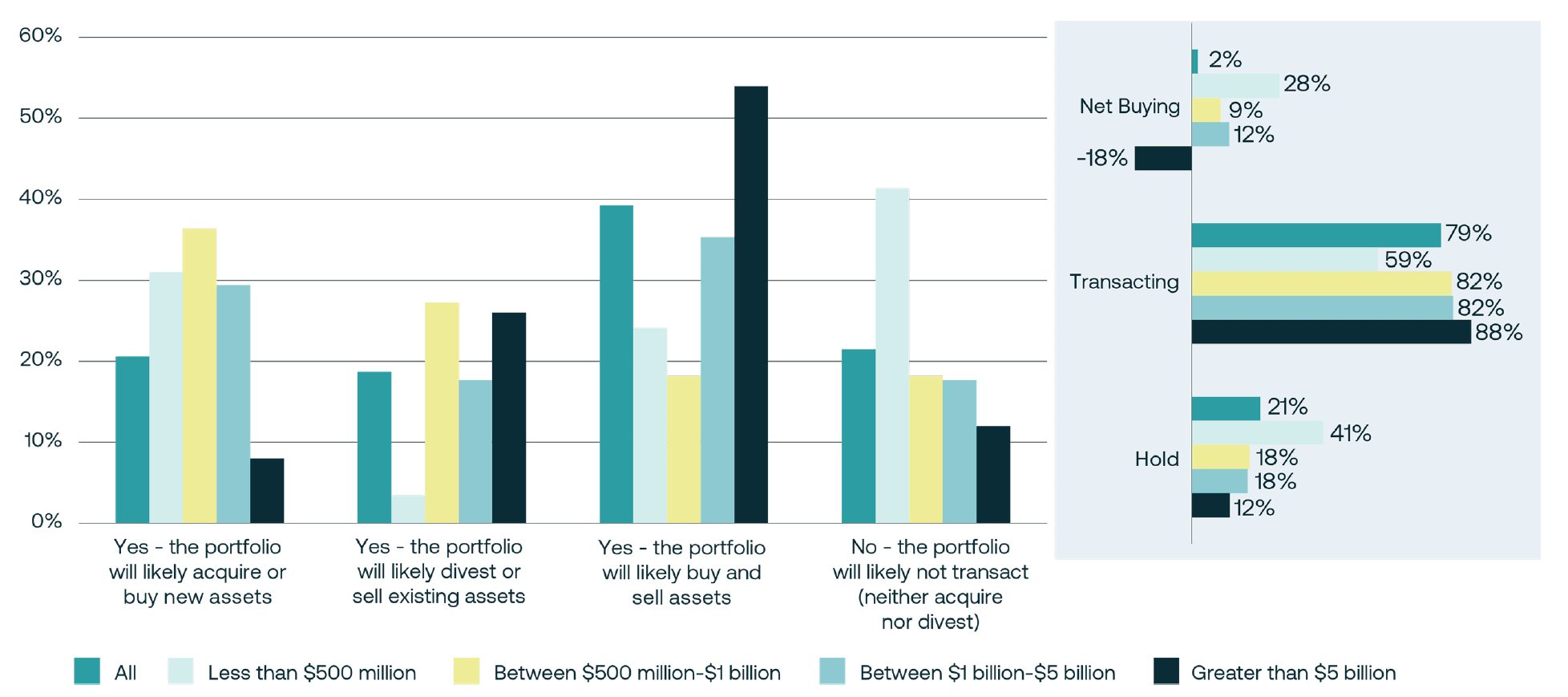

More transactions are expected in the market in the next 6 months; majority plan to transact, with larger firms (>$5 billion) planning to sell and smaller firms (<$5 billion) planning to buy

Perspectives amongst US commercial real estate participants indicate some shifts in Q4 2023 results

Altus Group conducted a survey across the US to provide insights into the market sentiment, conditions, metrics, and issues affecting the commercial real estate (CRE) industry. We are happy to announce that the Q4 2023 results for the US are now available for download.

The survey captured the individual practitioner's perspective, representing various functions and across the capital stack.

The Q4 installment of this US-based survey was conducted between October 13th and November 1st, 2023. There were 197 respondents, representing at least 51 different firms.

Questions in the survey focused on two main topics: current conditions and future expectations. Percentages used throughout the US survey results are representative of the share of all US responses received for each question, excluding “blank” or “not applicable” responses.

Download the results of the US Q4 2023 survey

View the top takeaways from the Q4 2023 results for Canada

Key questions explored

Current conditions:

What your team's primary focus will be over the next 6 months?

How have your expectations for your portfolio changed compared to 12 months ago?

How would you describe the level of competition among your firm's peer group?

How would you characterize current pricing by property type?

What is your current outlook for the following property types?

Future expectations:

What are your expectations for the availability of capital over the next 12 months?

What best describes your expectations for the operating environment over the next 12 months?

What changes do you anticipate to the following key metrics over the next 12 months? (Both direction and conviction)

Rank which property types you expect to be the best/worst performing in the next 12 months.

Which of the following do you expect will be high-priority issues for you professionally in the next 12 months?

Survey highlights

Consensus emerges, a shallow recession is expected within the next 6 months

A significant majority of respondents (77%) indicated that a recession is expected in the next 6 months, with 22% expecting a recession to be “very likely” and 55% expecting a recession to be “somewhat likely”. Recession expectations were relatively consistent across different risk profiles and strategies, but were most pronounced among core and opportunistic strategies. More than a quarter (27%) of respondents who identified as having a core strategy indicated that a near-term recession was “very likely”, while more than two-thirds (64%) of respondents who identified as having an opportunistic strategy said a near-term recession was “somewhat likely”. The shape of the next recession is expected to be shallow. While a majority (80%) of respondents expected the next recession to be shallow, the expected duration of the next recession was largely split, with 37% of participants expecting the next shallow recession to be short-lived and 43% expecting it to be long-lived. Expectations for severity (shallow or severe) and duration (short-lived or long-lived) varied most notably amongst the responses from the opportunistic and value-added strategies, which had the largest cohorts of “shallow and short-lived” and “severe” responses, respectively.

Figure 1 - What is the likelihood and extent of the next economic recession?

Capital is still available, but hard to come by

While there was a modest improvement in expectations for capital availability over the prior quarter, the current survey still reflects constrained expectations for capital availability from both equity and debt sources. Regarding sources of equity capital, responses indicate that the majority of equity will be “somewhat available” across different equity capital sources; responses ranged from 48% (Funds) to 52% (REITs). The equity capital sources expected to be least available were the asset managers and REITs, and the most available equity capital sources were the more nimble, high-net worth individuals, family offices, and funds (private equity / hedge funds).

On the debt side of the capital stack, responses indicated expectations for banks and securitizations to remain constrained, with a majority (>55%) of responses expecting these to be either “not at all available” or “not very available” over the next 12 months. Survey participants expect insurance companies (e.g., life cos.) and debt funds / direct lenders to be much more active, with nearly 32% of respondents expecting capital from the latter to be either “very available” or “extremely available”.

Figure 2 - What are your expectations for the availability of capital over the next 12 months?

Near-term transaction activity to pick up; big selling to small

After a prolonged period of muted transaction activity, respondents indicated that the market activity is likely to pick up over the coming 6 months. The majority (79%) of survey participants noted plans of transacting over the next 6 months, though these intentions vary significantly by firm size. Larger institutions (>$5 billion) plan to be net sellers, while smaller firms (<$5 billion) plan to be net buyers.

Figure 3 - Over the next 6 months, do you anticipate any transactions in your portfolio?

Return profiles by property type show a new “core” emerging

Reported gross IRRs seen marketed for new funds and deals averaged 11.9% across property types. While the reported gross IRR returns ranged widely by property type, the main property types (industrial, retail, and multi-family) showed very similar ranges (low of 8.0% and high of 12.8%, midpoints of 10.4% to 10.5%). Responses varied most for self-storage, which had a midpoint of 11.6%, but low of 8.0% and a high of 15.2%. Marketed office returns topped the IRR ranking, with a midpoint of 14.0% and the second widest range of responses (low of 10.9% and high of 17.2%) – likely reflecting more opportunistic style office deals being marketed.

Figure 4 - What are typical ranges for the gross IRRs seen across the current market for new funds?

Author

Omar Eltorai

Senior Director of Research, Altus Group

Author

Omar Eltorai

Senior Director of Research, Altus Group

Resources

Latest insights