Commercial real estate industry conditions and sentiment survey - Canada Q4 2023 results

Key highlights

Altus releases its second installment of the Commercial Real Estate Industry Conditions and Sentiment Survey for Canada, a quarterly survey of CRE professionals to gauge perspectives on current and future conditions for the industry

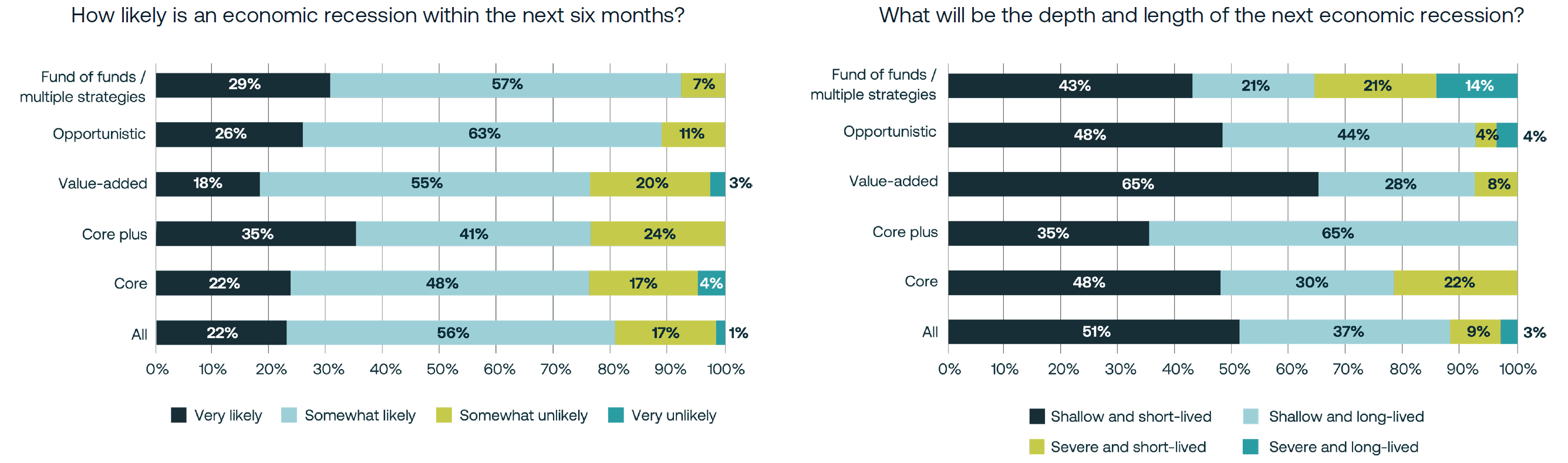

78% of survey respondents expect a recession within the next 6 months but also indicate overwhelmingly (88%) that it will be a shallow recession

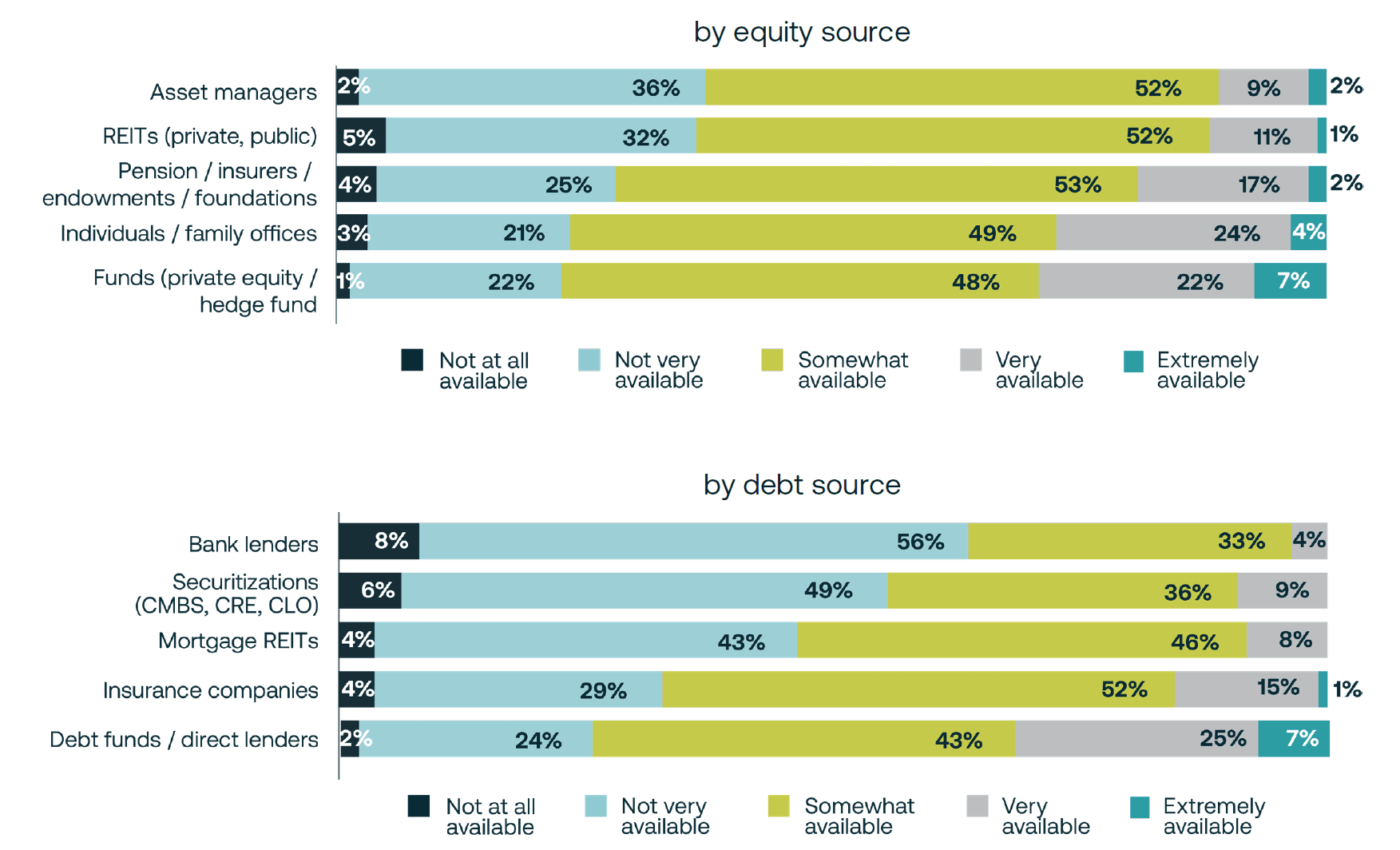

While capital availability is expected to decrease over the next year, survey respondents indicated that equity capital from individuals/family offices and PE/hedge funds is expected to be the most available, with REITs and asset managers expected to have the least availability

Debt funds and banks are expected to have the greatest amount of capital availability, while securitizations and mortgage REITs are expected to be the most constrained

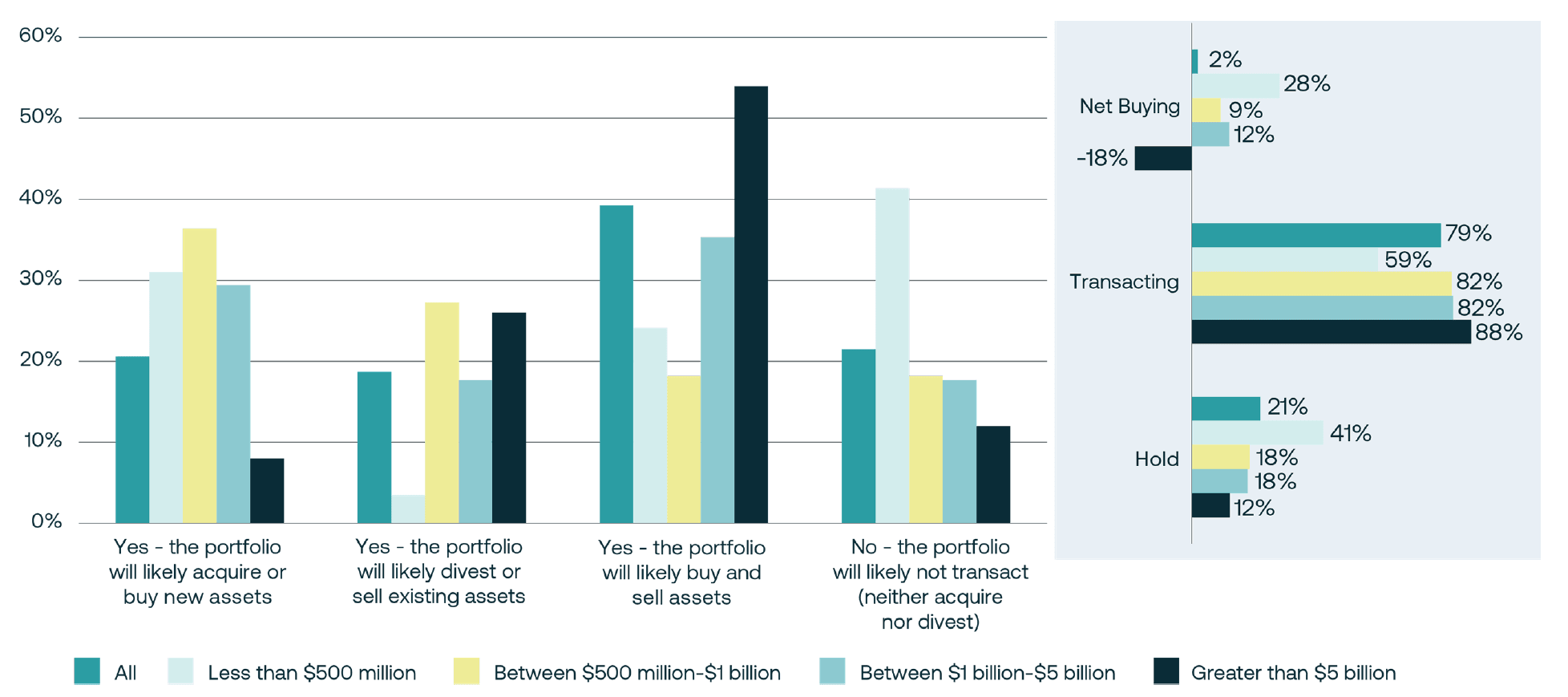

Respondents' 12-month forward view of fixed-rate financing was between 6.3-7.8% across portfolio strategies. Net levered IRRs ranged from 11.0% to 15.7%

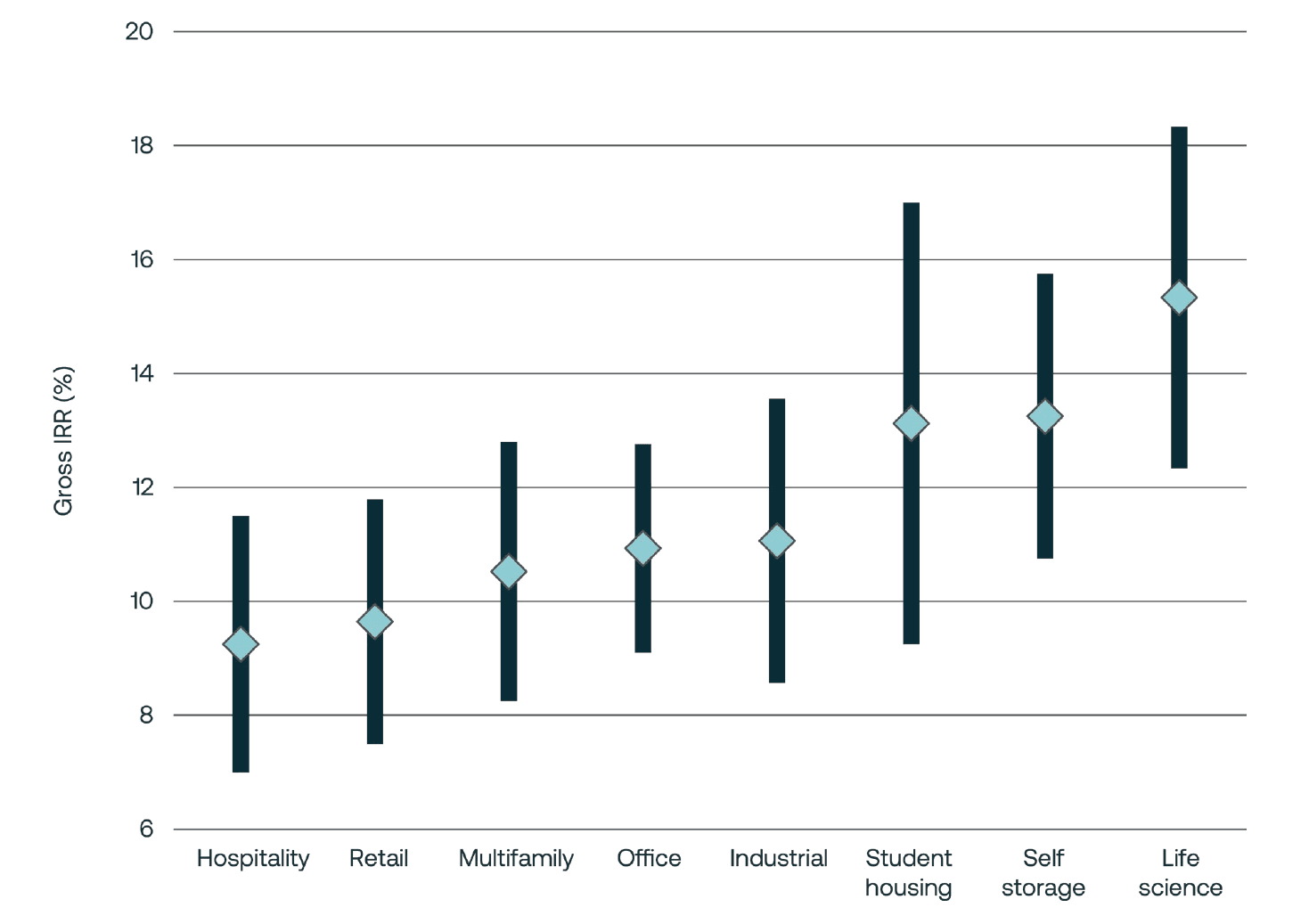

Targeted gross IRRs for new funds and deals averaged 11.6% across all property types and 10.5% for main property types; smaller "alternative" property types such as student housing, self-storage, and life sciences showed notably higher gross IRR midpoints reflecting expected attractive returns in these niche sectors

Perspectives amongst Canadian commercial real estate participants indicate some shifts in Q4 2023 results

Altus Group conducted a survey across the Canada to provide insights into the market sentiment, conditions, metrics, and issues affecting the commercial real estate (CRE) industry. We are happy to announce that the Q4 2023 results for Canada are now available for download.

The survey captured the individual practitioner's perspective, representing various functions and across the capital stack.

The Q4 installment of this Canada-based survey was conducted between October 13th and November 1st, 2023. There were 294 respondents, representing at least 54 different firms.

Questions in the survey focused on two main topics: current conditions and future expectations. Percentages used throughout the Canada survey results are representative of the share of all Canada responses received for each question, excluding “blank” or “not applicable” responses.

Download the results of the Canada Q4 2023 survey

View the top takeaways from the Q4 2023 results for the US

Key questions explored

Current conditions:

What your team's primary focus will be over the next 6 months?

How have your expectations for your portfolio changed compared to 12 months ago?

How would you describe the level of competition among your firm's peer group?

How would you characterize current pricing by property type?

What is your current outlook for the following property types?

Future expectations:

What are your expectations for the availability of capital over the next 12 months?

What best describes your expectations for the operating environment over the next 12 months?

What changes do you anticipate to the following key metrics over the next 12 months? (Both direction and conviction)

Rank which property types you expect to be the best/worst performing in the next 12 months.

Which of the following do you expect will be high-priority issues for you professionally in the next 12 months?

Survey highlights

Expectations align on a shallow recession within the next 6 months

Across investment strategies, a consensus emerges on near-term recession. A significant majority (78%) of respondents expect a recession to be likely (either “very likely” or “somewhat likely”) in the next 6 months. While there was a variance of responses across different investment strategies, those in the “likely” camp remained the majority. Most responses also indicated that expectations for the next recession to be “shallow” – with more than 88% of respondents indicating the next recession to be shallow as opposed to “severe”.

Figure 1 - What is the likelihood and extent of the next economic recession?

Greater capital availability expected from sources less exposed to capital markets

While the overall expectation is that capital availability will decrease over the coming year, responses suggest that capital partners are open for business, though much less so from sources with greater public market execution exposure. For sources of equity capital, survey participants indicated that they collectively expect the least amount of capital availability from REITs and asset managers – with responses of “not at all available” or “not very available” summing to 48% and 37%, respectively. Meanwhile participants expect greater availability of equity capital from individuals / family offices and PE / hedge funds – with 26% and 20%, respectively, expecting these sources of equity to be either “extremely” or “very” available.

The degree of capital market execution or exposure also seemed to be reflected in on the debt side of the capital stack. Aggregate responses indicated expectations for securitizations and mortgage REITs to be the most constrained, with 47% and 42% of responses expecting these to be either “not at all available” or “not very available” over the next year, respectively. Canadian CRE professionals expect debt funds and banks to have the greatest amount of capital availability over the next year, with 29% and 27% of responses expecting availability to be either “extremely” or “very” available. It is worth noting that the expectations for Canadian bank capital availability is in stark contrast to those of the US (see the US results for more detail).

Figure 2 - What are your expectations for the availability of capital over the next 12 months?

Interest rate expectations stabilizes, investor-level returns by strategy emerge

Respondents’ 12-month forward view of all-in, fixed-rate financing was range bound between 6.3-7.8%, across the main portfolio strategies. This tighter range of interest rate expectations across the strategies aligns with the shift to the “pause-or-cut” phase of monetary policy pursued by the Bank of Canada. Expectations for net levered IRRs (the returns an investor would expect) reported across the strategies differed, but reflected the different risk profiles targeted by the different strategies. Net levered IRRs ranged from 11.0% for core strategies to 15.7% for opportunistic strategies.

Figure 3 - Where do you anticipate the cost of capital to be over the next 12 months (on annualized basis)?

Target returns for new funds show attractiveness of “alternatives”

Targeted gross IRRs seen marketed for new funds and deals averaged 11.6% across all property types and 10.5% across the four main property types (retail, multifamily, office, industrial). Many of the smaller “alternative” property types, including student housing, self-storage, and life sciences showed notably higher gross IRR midpoints (13.1%, 13.3%, 15.3%, respectively), reflecting the attractive returns investors expect to find in these niche sectors. Responses varied most for student housing, with a low of 9.3% and high of 17.0%. Also of note is the lower reported gross IRRs for the consumer-driven hospitality and retail property types, the first and second lowest, respectively.

Figure 4 - What are typical ranges for the gross IRRs seen across the current market for new funds?

Author

Omar Eltorai

Director of Research

Author

Omar Eltorai

Director of Research