CRE as an inflation hedge: How lease structure protects income

How valuation professionals could use CPI-linked escalators and expense passthroughs to protect income as inflation persists and rates decline.

Key highlights:

Commercial real estate can be an effective income hedge, but not necessarily a value hedge

Real estate NOI has outpaced inflation since 2013 (NCREIF), but values are driven by cap rate movement

Leases with CPI or M2-linked escalations and strong expense passthroughs help protect purchasing power

2025-2026 may create a unique window where inflation stays elevated while rates fall, benefiting both income and values

The opportunity: Inflation + falling rates

The market could be entering a period where inflation remains moderately elevated even as interest rates begin to fall. In that scenario, inflation can help support income growth, while declining rates can ease financing costs and reduce discount rates. For investors, it could present an attractive opportunity to hedge inflation through growing cash flows while valuations remain resilient as rates decline.

Although well-structured leases can help net operating income (NOI) keep pace with inflation, cap rate repricing can decrease values even as NOI rises. The practical implication for owners isn't to bet on appreciation, but to engineer the income line. Over full cycles, income growth tends to be more stable than value movement, so understanding how lease assumptions interact is critical for defensible underwriting.

Why lease structure matters for inflation protection

As inflation continues to drive investment strategies, commercial real estate (CRE) has historically served as a reliable hedge against rising price levels. However, this protection depends heavily on how income is structured at the lease level. While CRE can help preserve purchasing power, this protection is realized primarily through income growth, not asset appreciation.

Property values do not necessarily rise with inflation, especially when interest rates increase. The inflation hedge in CRE is strongest when the income line can adjust quickly through short-term lease terms, CPI-linked escalations, or market rent realization.

Income hedge vs. value hedge: What the data shows

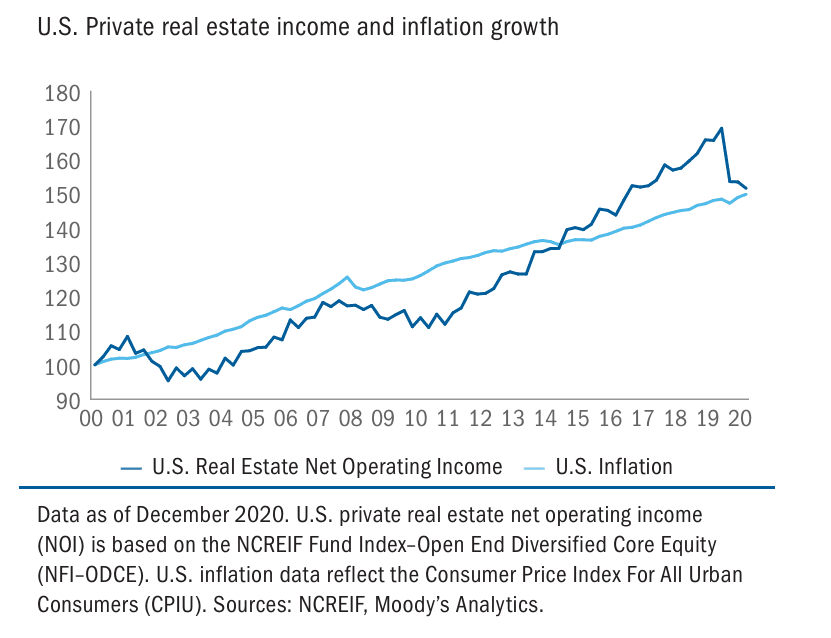

According to TIAA (The Teachers Insurance and Annuity Association of America), US private real estate NOI has closely tracked increases in the Consumer Price Index (CPI) between 2004 and 2019 and has exceeded CPI growth since 2013, as shown in Figure 1.

Figure 1: Real estate NOI vs. CPI (2004-2019)

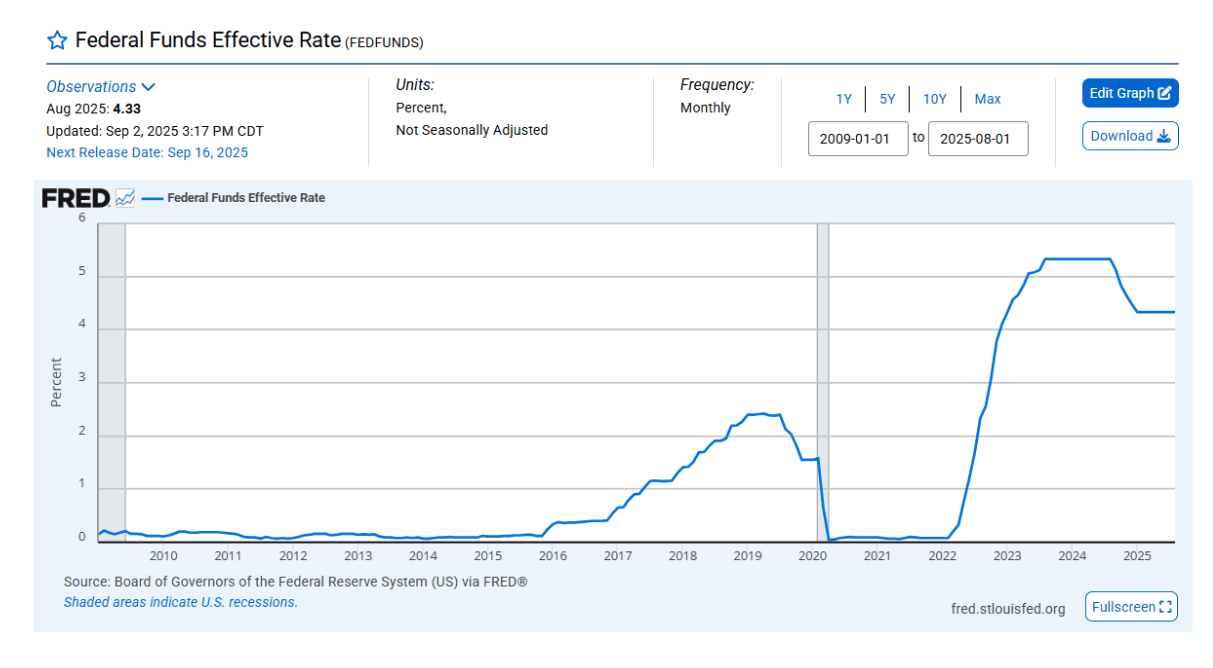

Following this period, during 2010-2016, the Federal Reserve maintained a zero interest rate policy (ZIRP). Many leases were signed during ZIRP, which informed the strong performance shown above. When the cost of capital is low, tenants are typically less price-sensitive with leasing decisions driven more by expansion potential than occupancy costs.

The Federal Reserve maintained ZIRP from 2010-2016

Given elevated inflation levels since the Quantitative Easing (QE) period, more recent NOI trends, especially from 2022 onward, likely have not kept pace with inflation, particularly for assets with long-term leases or fixed rent bumps. This is where lease structure becomes critical.

How CPI-linked escalators protect real income

From January 1971 to June 2025, M2 (money supply) has increased at a compounded annual rate of 5.5%. Most leases have fixed escalations below this rate, meaning real NOI growth is effectively negative unless leases include CPI-linked escalators with appropriate floors and caps.

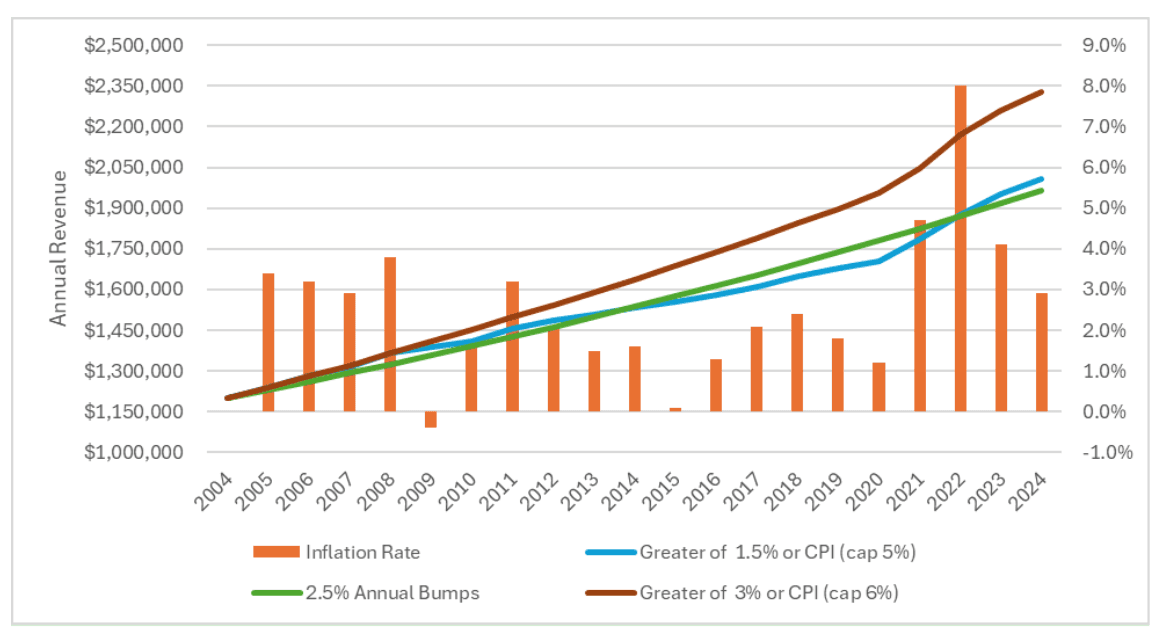

Consider three lease structures over a 20-year period (2004-2024):

Scenario A: CPI-linked with 1.5% floor and 5.0% cap

Scenario B: Fixed 2.5% annual escalator

Scenario C: CPI-linked with 3.0% floor and 6.0% cap

Key findings:

Scenario A captures inflation in the mid-2000s but gives back gains when inflation falls in 2013-2017

Scenario B delivers a smooth, compounding rent path but falls behind during high inflation

Scenario C keeps pace in base periods and captures far more late-cycle inflation without overexposing tenants (via the 6% cap)

Key takeaway: Floors and caps are essential. Higher floors protect real income when CPI is low, while reasonable caps maintain tenant viability without limiting upside.

Figure 3: Three rent escalation scenarios - cumulative rent over 20 years

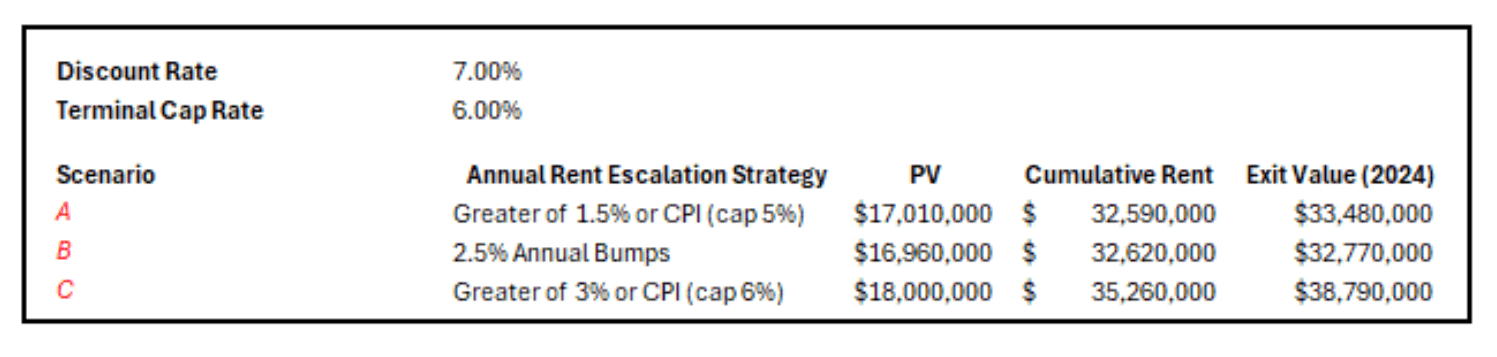

These structures translate into tangible economic outcomes. The present value of rent and cumulative rent make the tradeoffs clear:

With a 7.0% discount rate, a 1.5% to 5.0% clause performs similarly to a 2.5% fixed escalator because early-cycle CPI was modest, and the cap muted later upside

The 3% to 6% clause creates the strongest uplift by combining a protective floor with room to capture inflation shocks

At exit, using a 6.0% cap rate, Scenario A delivers a 2.1% increase over Scenario B, and Scenario C delivers approximately an 18% increase

Figure 4: Present value and exit value analysis

Property type considerations

Not all real estate behaves the same. Hedging ability varies depending on lease structure and property type. The inflation surge during the pandemic underscored where CRE truly excelled as an income hedge, particularly in sectors like multifamily. It also revealed the vulnerabilities of assets with long-term leases that lacked mark-to-market opportunities or rent escalations tied to CPI or monetary growth.

Apartments typically have one-year leases that mark-to-market annually (except in jurisdictions with rent stabilization policies). Industrial properties tend to have annual rent escalators, whereas big-box retail might have 10-year leases with 10% rent increases every five years.

Underwriting framework for valuation professionals

When underwriting CRE as an inflation hedge in 2025-2026, ask:

What is the lease term relative to inflation cycle timing? Shorter terms allow faster mark-to-market adjustments

Do escalators have both floors and caps? A 3-6% CPI-linked structure protects downside while capturing upside

How does the discount rate adjust for floating vs. fixed income streams? Replacing fixed escalations with CPI-linked structures may justify tighter discount rates and terminal cap rates due to reduced purchasing power risk

Are expense passthroughs comprehensive? Strong passthroughs protect NOI margins when operating costs inflate

Modern valuation and benchmarking tools help practitioners test these scenarios and translate economic theory into actionable portfolio strategy. Use ARGUS Intelligence to benchmark performance and stress-test portfolios against inflation scenarios before committing capital.

Want to be notified of our new and relevant CRE content, articles and events?

Disclaimer

This publication has been prepared for general guidance on matters of interest only and does not constitute professional advice or services of Altus Group, its affiliates and its related entities (collectively “Altus Group”). You should not act upon the information contained in this publication without obtaining specific professional advice.

A number of factors may influence the performance of the commercial real estate market, including regulatory conditions and economic factors such as interest rate fluctuations, inflation, changing investor sentiment, and shifts in tenant demand or occupancy trends. We strongly recommend that you consult with a qualified professional to assess how these and other market dynamics may impact your investment strategy, underwriting assumptions, asset valuations, and overall portfolio performance.

No representation or warranty (express or implied) is given as to the accuracy, completeness or reliability of the information contained in this publication, or the suitability of the information for a particular purpose. To the extent permitted by law, Altus Group does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. The distribution of this publication to you does not create, extend or revive a client relationship between Altus Group and you or any other person or entity. This publication, or any part thereof, may not be reproduced or distributed in any form for any purpose without the express written consent of Altus Group.

Author

Adam Mauro, CFA

Senior Manager, Valuation Advisory

Author

Adam Mauro, CFA

Senior Manager, Valuation Advisory

Resources

Latest insights