Cracks are becoming crevices in Australia’s residential sector

Australia’s residential sector currently faces multiple headwinds, from unviable projects to dwindling confidence among builders, and an acute shortage of labour.

Key highlights

Economic feasibility remains a significant challenge for new projects in the residential sector, along with an acute shortage of labour which has kept construction costs high despite some stabilisation in material prices

A rise of insolvencies among contractors and subcontractors has also impacted the availability of the current workforce and blown out project delivery timelines

High interest rates are straining market dynamics, impacting affordability and exacerbating the shortage of affordable housing options, while placing additional strain on an already limited supply

Despite these challenges, national housing values have risen, primarily due to a persistent mismatch between supply and demand

Revisiting strategies used in the past, such as significant government-led housing projects and strategic land releases, could help alleviate current supply constraints and improve housing affordability

As we look to the future of Australia's residential construction sector, it is clear that a comprehensive approach is necessary — one that acknowledges the cyclical nature of the market and prioritizes innovative thinking and sustainable development practices

Australia's housing targets being critically undermined by a myriad of challenges

The residential sector faces multiple headwinds – key among them are unviable projects that don't stack up financially, dwindling confidence among builders, and an acute shortage of labour which has kept construction costs high despite some stabilisation in material prices. The construction landscape is further complicated by wage growth that has led to higher costs. Consequently, many builders are shifting their focus towards government sector work where the risk of financial loss is lower.

Economic viability and labour shortages: The dual culprits of stagnation

Economic feasibility remains a significant challenge for new projects in the residential sector. The value of total building work completed fell by 1.0% to $34.2 billion in the last quarter of 2023, with new residential builds decreasing by 4.4% to $16.9 billion. This alarming decline signifies a broader crisis in housing development, challenging Australia’s capacity to accommodate its growing population.

Specific trades have had a surge in costs, with steel fixers seeing a 300% increase and form workers a 50% increase in costs. Material shortages, such as timber, continue to exert high pressure on costs, despite stabilisation for other materials, like steel.

Though wage growth and healthy migration are contributing positively, the aging workforce and difficulty in attracting new, skilled workers still tip the scales for ongoing labour shortages. Predictions are pointing to a deficit of 61,400 workers by 2032. Overall productivity within the construction market has declined, impacted by slow regulatory and economic reforms and a cumbersome licensing and permit system affecting feasibility of new projects. Additionally, a rise of insolvencies among contractors and subcontractors has impacted the availability of the current workforce and blown out project delivery timelines.

Moreover, the ABS reports a cooling in the housing market post-pandemic recovery, with property price increases slowing down across major cities due to tighter credit conditions, rising interest rates, and ongoing geopolitical issues impacting funding in Australia.

Shifting tides in Australia’s housing market

Despite fluctuations in construction activity, economic pressures continue to shape the landscape of the Australian housing market. The number of dwellings under construction peaked at 241,926 in the Q2 2023, largely driven by private sector new houses. However, this figure decreased slightly to 238,475 by Q4 2023, reflecting ongoing volatility in the construction sector.

High interest rates are straining market dynamics, impacting affordability and exacerbating the shortage of affordable housing options, while placing additional strain on an already limited supply. Despite these challenges, national housing values have risen, primarily due to a persistent mismatch between supply and demand. Listings in major capital cities remain 17.6% below the five-year average, creating a market that favours sellers.

Housing Australia projects a sharp decline from 148,500 net new additions in 2022-23 to only 127,500 by 2024-25, deepening the crisis in housing availability. Despite over 110,000 new first home buyer loans in the past year, a slow recovery in loans for new investment purchases has not been sufficient to alleviate the overall demand for rentals.

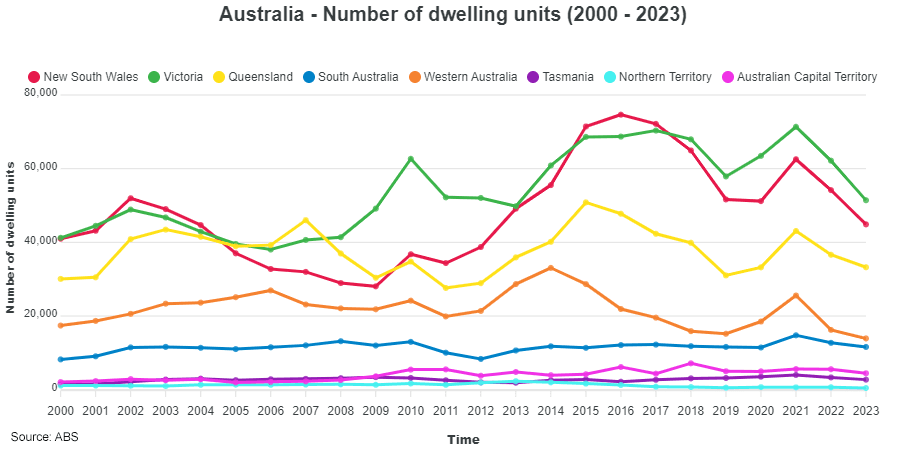

How do the states compare? According to the latest ABS data, all states and territories, except South Australia and Queensland, are recording lower approvals. Victorian approvals were flat, while total dwelling approvals fell in New South Wales (-4.5%), Western Australia (-0.9%) and Tasmania (-16.1%). In trend terms, total dwelling units approved have dropped 6.7% from a year earlier, while private sector dwellings (excluding houses) have plummeted 27.6%.

Figure 1 - Building Approvals, Australia

Each state is at a different point in the construction cycle with its own unique challenges. Queensland is experiencing a strong pipeline of work and a shortage of key trades, which will only worsen with Olympic-related construction. High land prices, persistent escalation and a loss of key trades to Queensland is challenging feasibilities in New South Wales. Victoria is struggling to meet the target of 80,000 new builds per year with tax burdens on developers and the existing housing supply's impending absorption. Like Queensland and New South Wales, rising construction costs in Western Australia are a significant obstacle, despite numerous projects receiving the green light to proceed. The leader of the pack, however, is South Australia with housing reform showing a number of residential projects underway namely due to land release and stamp duty being abolished for first time buyers.

Government intervention and the echoes of history

During the post-World War II era, Australia faced a significant housing supply shortage due to rapid population growth from immigration and the baby boom. To address this, the federal government, under Prime Minister Robert Menzies and in collaboration with state and local governments, launched a massive housing initiative.

This program involved freeing up government-owned land for private development and funding the construction of tens of thousands of homes through the issuance of bonds. These homes were used for public housing or sold directly to private buyers, significantly boosting the housing supply, which enabled a surge in homeownership from 53% in 1947 to 72% by 1961.

These historical government incentives could be relevant today as Australia faces a new housing supply crisis. Modern challenges, such as supply chain issues and increased construction costs, complicate direct intervention; however, revisiting strategies, such as significant government-led housing projects and strategic land releases, could help alleviate current supply constraints and improve housing affordability.

Additional solutions may include leveraging modern construction techniques like modular housing to enhance efficiency and reduce costs, alongside enhanced government incentives that could invigorate the sector amidst ongoing economic pressures.

Navigating future uncertainties: A strategic call to action

As we look to the future of Australia's residential construction sector, it is clear that a comprehensive approach is necessary — one that acknowledges the cyclical nature of the market and prioritizes sustainable development practices. A productivity lag necessitates a ramp-up in residential building and a simplification of development policies. The persistent issues with feasibility, particularly around construction costs and returns, underscore the need for systemic reform.

The introduction of measures such as the Build-to-Rent (BTR) scheme has attempted to ease some pressures, yet challenges like unrecoverable GST highlight deeper systemic hurdles. These problems are not unique to Australia; however, learning from global counterparts remains complex due to unique local conditions. What Australia requires is a strong internal focus — improving planning efficiencies and incentivising development, while also fostering a cooperative relationship between industry and local authorities to address these overarching issues.

By embracing a long-term perspective that integrates cyclical market understanding with the pursuit of sustainability — such as reducing carbon content in projects — we can ensure a resilient housing market. This dual focus will not only address immediate challenges but also secure a sustainable future, supporting growth and innovation across the sector.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Barry McBeth

Director, Cost Management

Author

Barry McBeth

Director, Cost Management

Resources

Latest insights

Jan 9, 2025

Building the future - Key trends shaping Australia’s construction industry in 2025