Canadian office market update – Q3 2023

Office availability rates begin to flatten across Canada

Key highlights

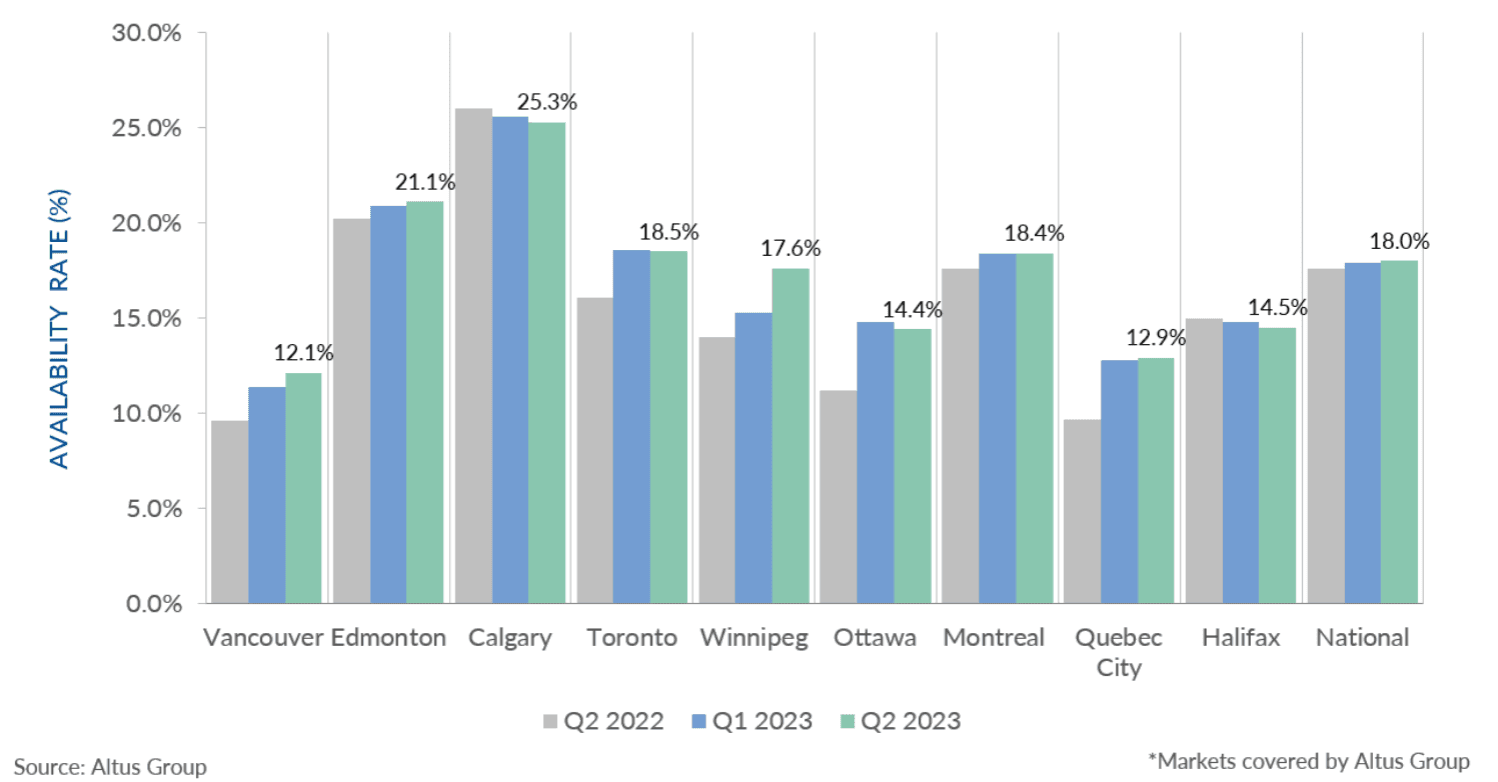

In Q3 2023, the national office availability rate flattened across Canada, with a slight increase of 0.1% from the previous quarter to 17.6%

Canadian office transaction activity has declined, with only $5.1 billion trading hands year-to-date

With the hybrid work model now a permanent fixture in many Canadian workplaces, companies and landlords have had to work together to incentivize workers back into the office

The Vancouver market reported the lowest office availability rate at 12%, followed by Quebec City and Ottawa

The Calgary market continued to have the highest availability rate at 23.9%, a slight decline of 0.7%

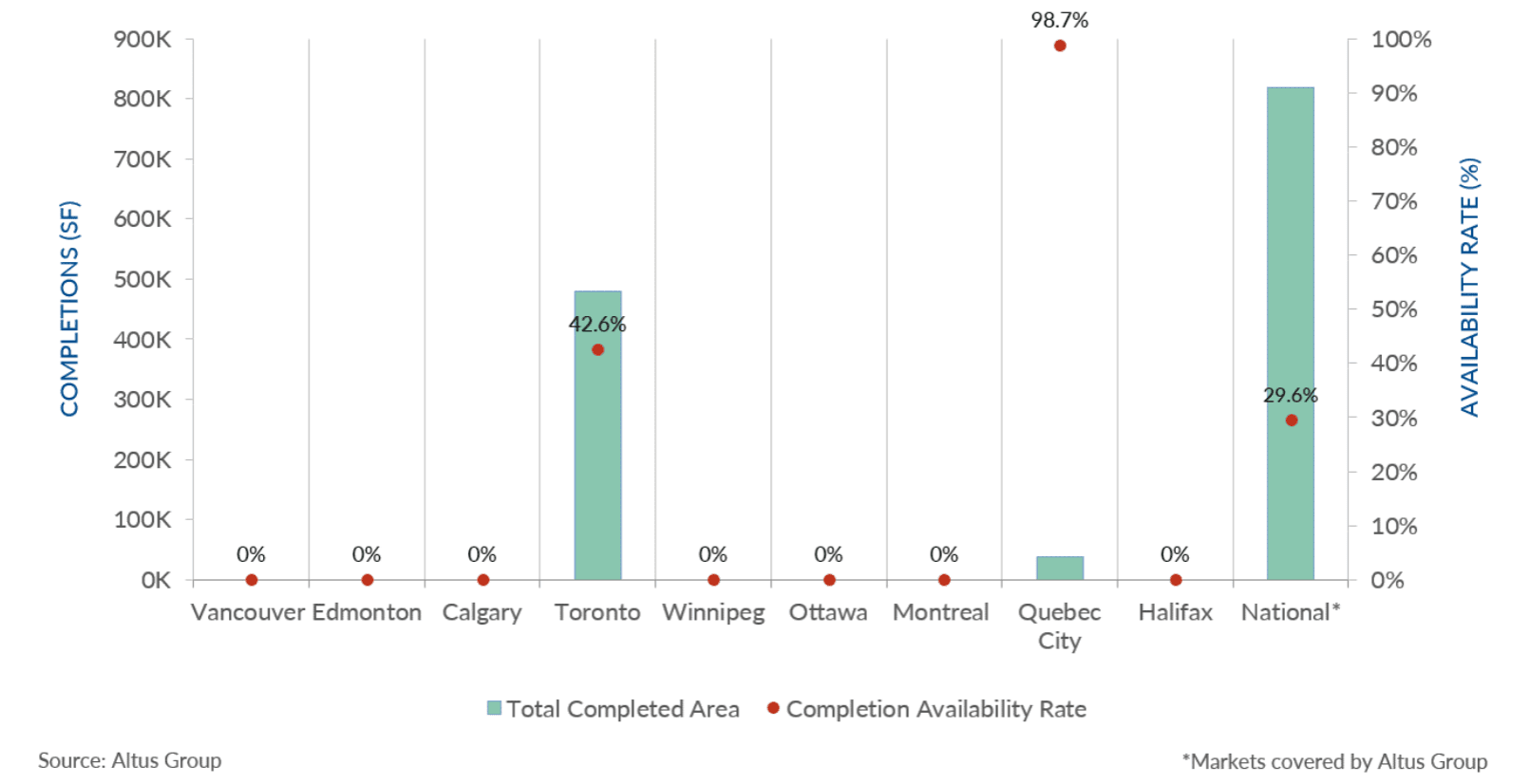

Amidst a continued economic slowdown and evolving market demands, no office buildings were completed in Canada in Q3 2023

National office transaction activity declined as investors sought to rebalance their portfolio with more stable, low-risk forms of real estate, such as multi-family and industrial assets

In the third quarter of 2023, the national office availability rate flattened across Canada, with a slight increase of 0.1% from the previous quarter to 17.6% (Figure 1), and sublet space representing 18.2% of the total available office space. Furthermore, office transaction activity has declined, with only $5.1 billion trading hands year-to-date, a 29% decrease year-over-year. As the hybrid work model became a permanent fixture in many Canadian workplaces, companies and landlords had to work together in their continued efforts to incentivize workers back into the office with amenitized spaces and rightsizing efforts.

According to Statistics Canada’s Labour Force Survey (LFS), as of September 2023, employment rose by 64,000 (0.3%), with the unemployment rate unchanged at 5.5%. This increase was insufficient to absorb all the new entrants into the labour market. Since the start of 2023, employment has grown by 30,000 per month on average. However, Statistics Canada estimates employment gains of 50,000 per month are needed to keep pace with population growth.

Moreover, employment gains were noted in educational services and transportation and warehousing, while employment losses were noted in finance, insurance, real estate, rental and leasing, construction, information, culture, and recreation. Furthermore, Statistics Canada reported that a greater proportion of Canadians remained unemployed for longer, and more were working multiple jobs year-over-year. These trends suggest job seekers were experiencing difficulties finding employment, and multiple job holdings were necessary to afford essential needs (e.g., groceries, clothing, transportation, mortgage, or rental payments).

Figure 1 - Office availability Q3 2022 vs. Q2 2023 vs. Q3 2023

The Vancouver market reported the lowest office availability rate at 12%, followed by Quebec City and then Ottawa (Figure 1). However, while Vancouver and Quebec City reported decreases in their availability rate, Ottawa reported a record high in its availability rate of 13.9%, representing a 0.9% increase. In addition to challenging market conditions, downsizing and relocation activity by the federal government and federal agencies have further exacerbated the difficulties around downtown office availability.

The Calgary market continued to have the highest availability rate at 23.9%, a slight decline of 0.7%. To address the market’s elevated availability rate, the Revised Downtown Calgary Development Incentive Program was introduced in 2021, which offered a grant for office to residential conversion of $75 per square foot based on the original square footage of the office to be converted. As of May 2023, ten office buildings, representing 1.35 million square feet of vacant space, are slated for office to residential conversion to create over 1,200 homes.

Figure 2 - Office completions and availability – Q3 2023

No office buildings were completed in Canada in the third quarter of 2023; however, this lack of office completions was not unexpected. Considering the economic slowdown and evolving market demands, it was no longer feasible to finance office-related projects for many major markets.

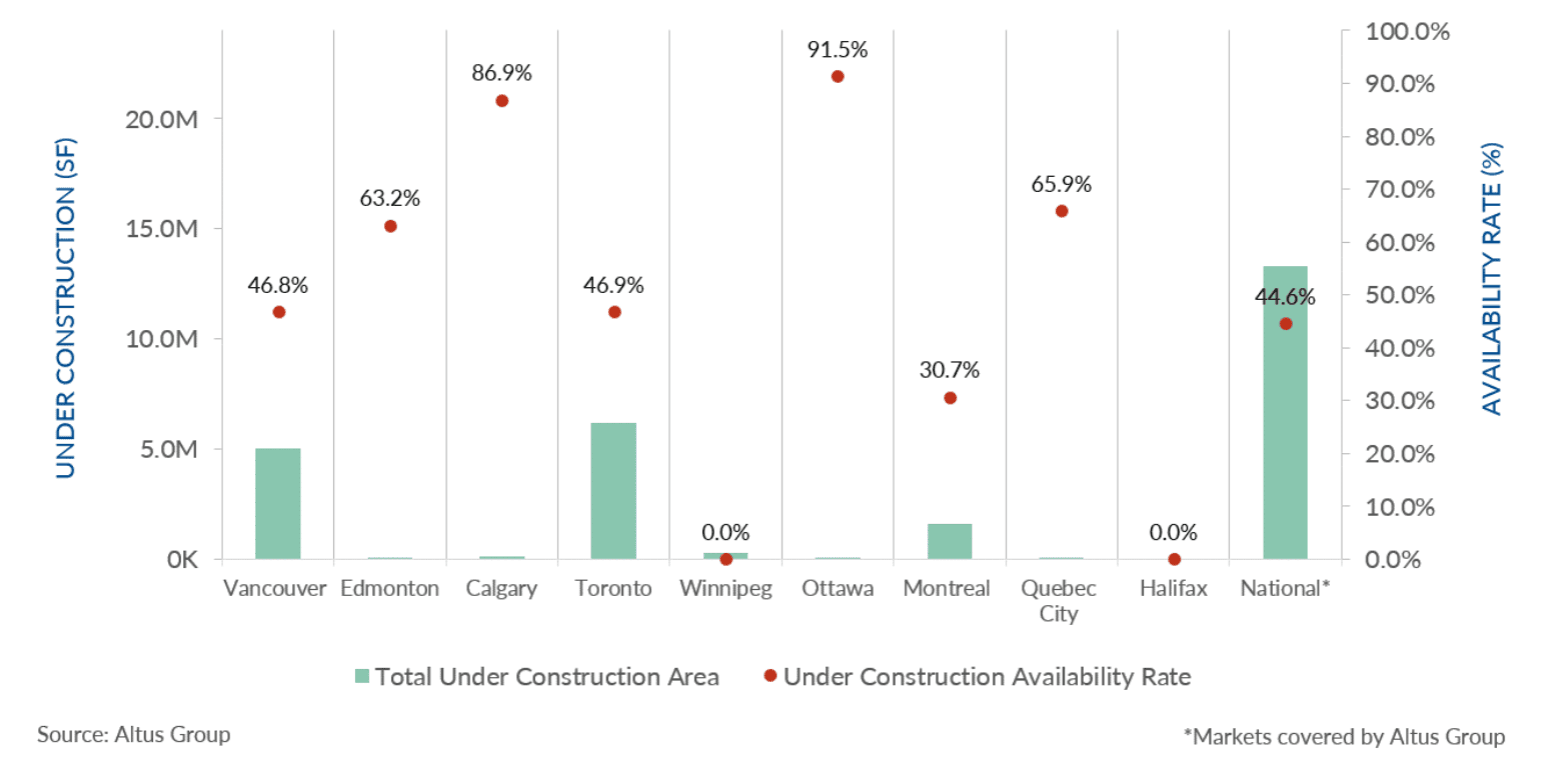

Figure 3 - Office under construction and availability – Q3 2023

Nationally, 67 office projects were under construction in the third quarter of 2023, totaling 13.7 million square feet, with 56.8% pre-leased. Vancouver and Toronto comprised the majority, with 30 and 23 projects, respectively, totaling approximately 11.4 million square feet under construction (Figure 3).

National office transaction activity declined as investors sought to rebalance their portfolio with more stable, low-risk forms of real estate, such as multi-family and industrial assets. As previously mentioned, the hybrid work model has become a permanent fixture in Canadian workplace arrangements as the market caters to flexible work arrangements. As a result, landlords and businesses have focused on retaining tenants. These efforts have ushered in a market where tenants have more bargaining power and prioritize quality over quantity regarding their spaces.

Author

Jennifer Nhieu

Senior Research Analyst

Author

Jennifer Nhieu

Senior Research Analyst

Resources

Latest insights