Key highlights

Despite elevated interest rates and inflationary pressures, investors continued to favour the industrial asset class for its minimal risk and stable returns

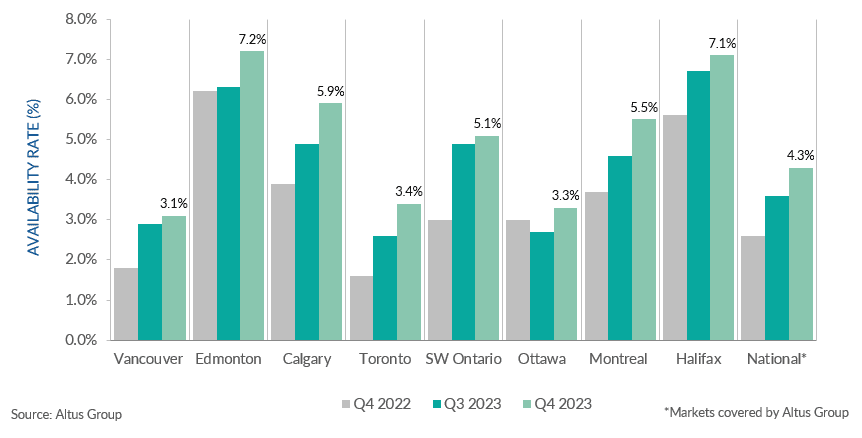

In the fourth quarter of 2023, the national availability rate increased by 0.7 percentage points to 4.3%, with increases observed in all major markets across Canada

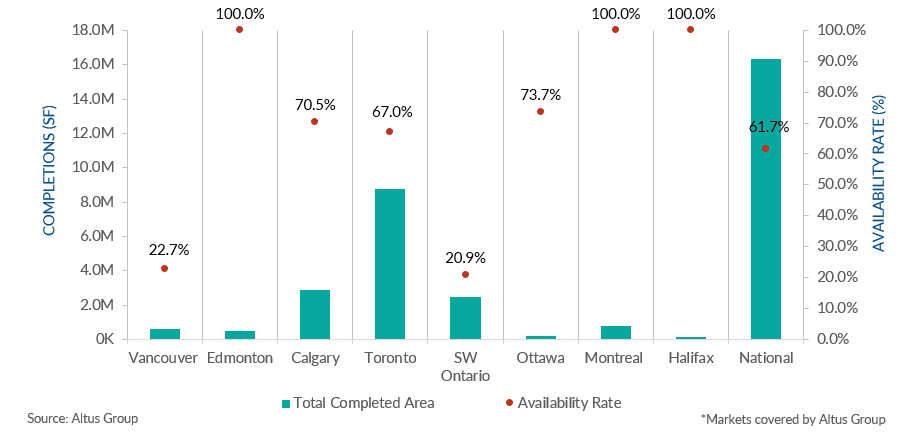

New construction completion contributed to the increase in availability rate, as Q4 was a record quarter for new industrial completions

While industrial completions continued steadily, demand for industrial space continued to outpace available supply

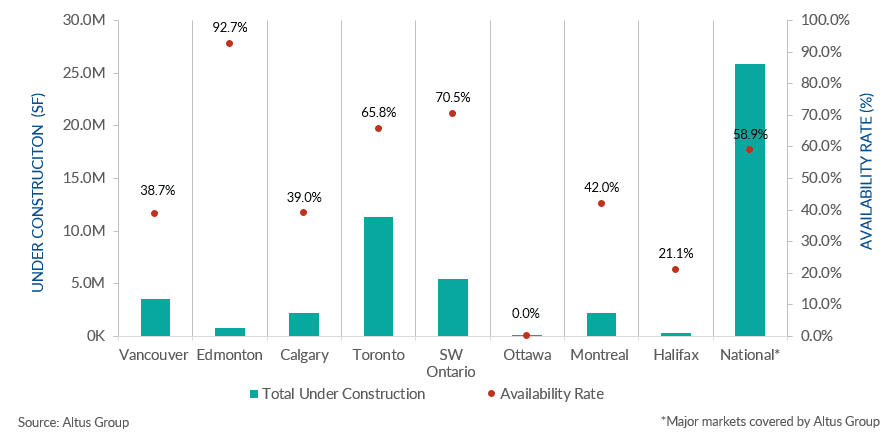

In the fourth quarter of 2023, there were 144 industrial projects in the construction pipeline, totaling 25.9 million square feet, with 41.1% pre-leased

Industrial availability rate continued to increase, but so have rental rates

Demand has not waned in Canada’s industrial sector. Despite elevated interest rates and inflationary pressures, investors continued to favour the asset class for its minimal risk and stable returns. In the fourth quarter of 2023, the national availability rate increased by 0.7 percentage points to 4.3%, with increases observed in all major markets (Figure 1). New construction completion also contributed to the increase in availability rate, with 16.3 million square feet and 62% of the new space available. This was a record quarter for new industrial completions; normally, Q4 is below ten million square feet.

The growth in e-commerce, changing consumer behaviour, and challenges associated with an aging and limited industrial infrastructure have fueled the demand for modern industrial facilities in the outer areas of major urban markets. As market conditions remain tight and are supported by strong underlying demographic and economic fundamentals, investors have rebalanced their portfolios with the asset class as a hedge against inflation. While industrial completions continued steadily – contributing to an increase in the national availability rate and demonstrating investor confidence in the sector – demand for industrial space continued to outpace available supply. Furthermore, tenants continued to be proactive in securing suitable spaces ahead of their lease expiration, and in response, landlords are pre-emptively listing their spaces ahead of their vacancy. This practice, along with a steady stream of industrial completions, has increased availability.

Figure 1 - Industrial availability Q4 2022 vs. Q3 2023 vs. Q4 2023

According to Statistics Canada, retail sales in September 2023 increased by 0.6% to $66.5 billion, with four of the nine subsectors experiencing an increase. This was primarily led by motor vehicle and parts dealers (1.5%), with credit to higher sales at new car dealers (2.4%). In core retail sales, general merchandise retailers observed the largest increase (0.3%). The largest decrease in retail sales was recorded in sporting goods, hobby, musical instrument, book and miscellaneous retailers (1.6%) and food and beverage retailers (0.4%). Furthermore, on a seasonally adjusted basis, retail e-commerce sales were down 0.6% to $3.8 billion.

Figure 2 - Industrial completions and availability (Q4 2023)

There were 79 buildings completed in Q4, totaling 16.3 million square feet, with 38.3% pre-leased. Toronto, Calgary, and Southwestern Ontario comprised the majority of new supply in terms of total square feet, at 8.7 million, 2.9 million, and 2.5 million square feet, respectively (Figure 2).

Figure 3 - Industrial under construction and availability (Q4 2023)

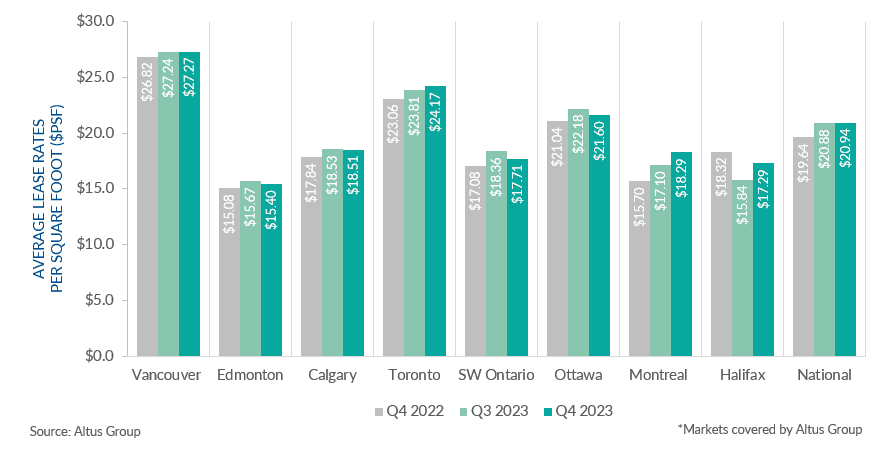

Figure 4 - Industrial gross lease rates

For the most part, with slightly increasing availability rates, lease rates continue to push up compared to the third quarter of 2023 due to continued strong demand for space.

In the fourth quarter of 2023, there were 144 industrial projects in the construction pipeline, totaling 25.9 million square feet, with 41.1% pre-leased (Figure 3). Toronto, Southwestern Ontario and Vancouver accounted for most of the projects in terms of total square footage, at 11.3 million, 5.4 million and 3.5 million square feet, respectively. Construction began to moderate after its initial peak in the first half of 2023.

The industrial sector saw a record level of industrial properties enter the market in 2023. Moreover, as 2023 comes to a close, some markets have observed a return to moderation after the feverish demand experienced in the first half of 2023. As a result, investors have exhibited a sense of cautious optimism, even despite the macroeconomic headwinds, as we enter a more balanced market.

Author

Jennifer Nhieu

Senior Research Analyst

Author

Jennifer Nhieu

Senior Research Analyst

Resources

Latest insights