Canadian industrial market update – Q2 2023

Q2 2023: Industrial availability rate continues to increase

Key highlights

Despite continued economic headwinds, the industrial sector has remained relatively unscathed and favoured by investors compared to other sectors, such as office

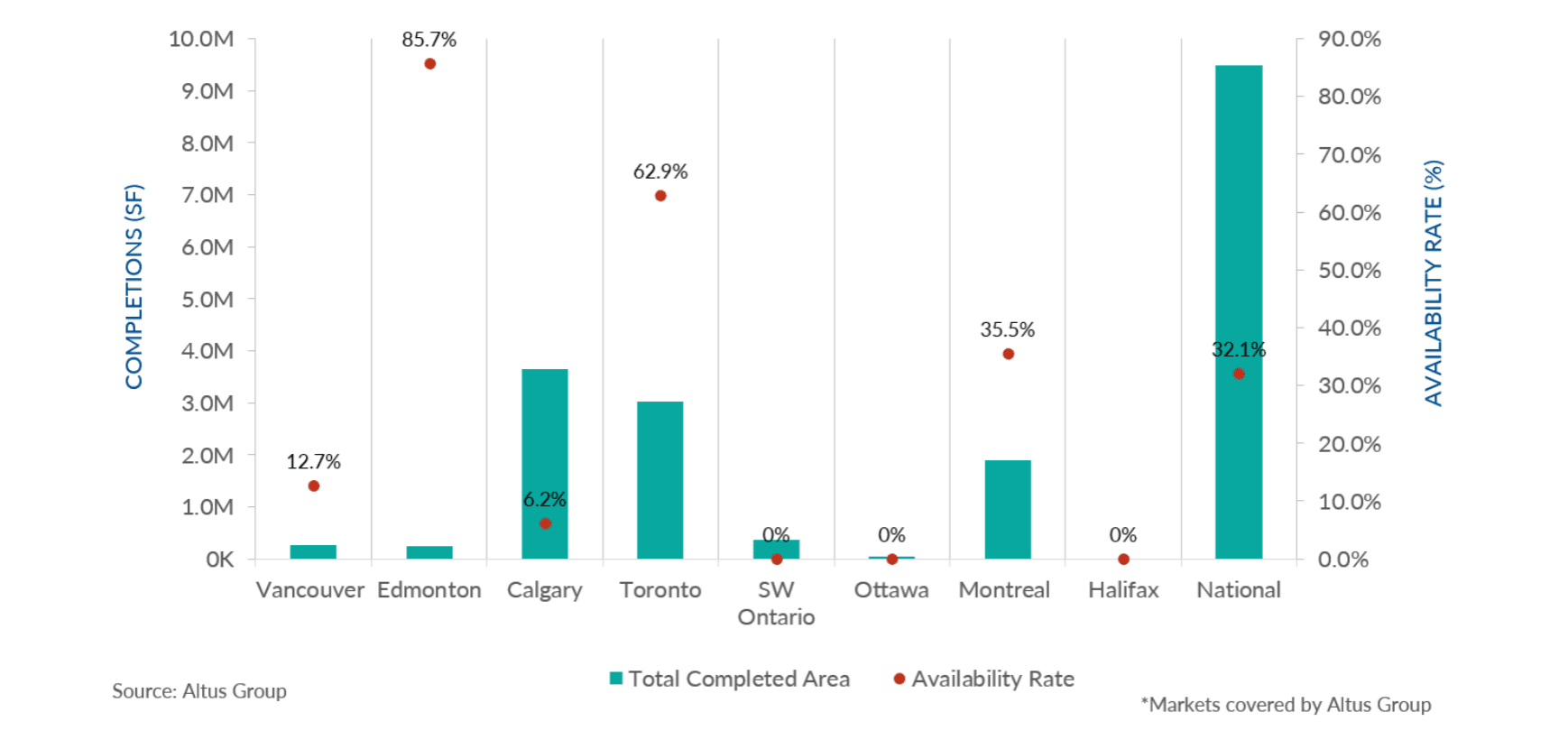

There were 39 industrial building completions in the second quarter of 2023, totaling 9.49 million square feet, with an availability rate of 32.1%

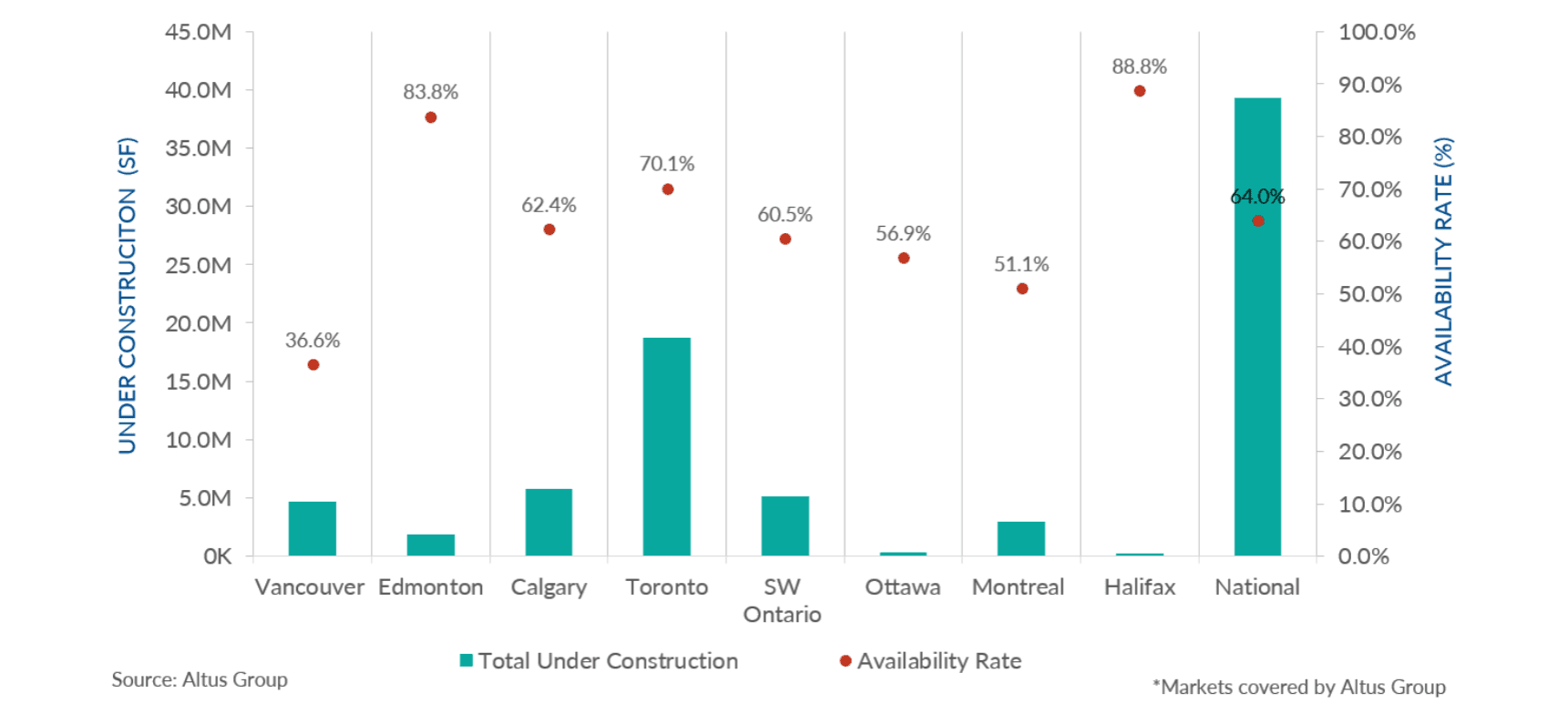

Toronto, Calgary, and Southwest Ontario comprised the majority of industrial projects underway in Q2

Although investors have demonstrated a preference for single-tenant and multi-tenant industrial assets in this challenging environment, industrial cap rates have continued to increase across all markets apart from Quebec City in Q2 2023

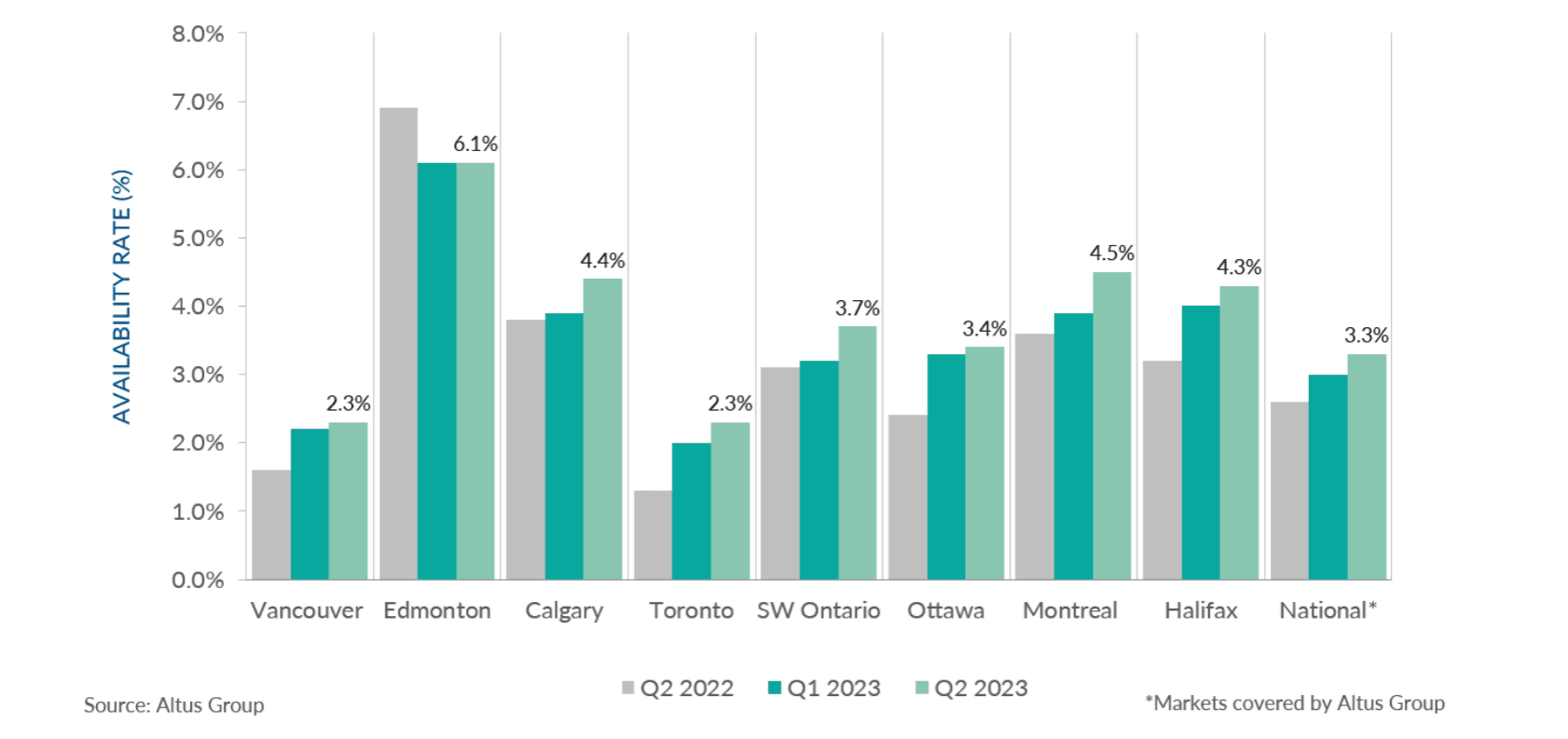

Amidst rising interest rates and inflation, the industrial sector has continued to be favoured amongst investors for its minimal risk and stable returns. In the second quarter of 2023, the national availability rate increased to 3.3% (Figure 1). Additionally, rental rates have also continued to increase year-over-year. While supply has been unable to keep up with demand, rising construction costs and interest rates have not deterred the construction of new supply.

Figure 1 - Industrial availability Q2 2022 vs. Q1 2023 vs. Q2 2023

According to Statistics Canada, retail sales in April 2023 increased by 1.1% to $65.9 billion. Eight of the nine subsectors experienced an increase, with increases led by general merchandise retailers (3.3%) and beverage retailers (1.1%). The largest decrease in retail sales was observed in furniture, home furnishing, electronics, and the appliance retailer’s subsector (-1.6%). Furthermore, e-commerce sales decreased by 6.1% to $3.6 billion on a seasonally adjusted basis in April.

Figure 2 - Industrial completion and availability – Q2 2023

There were 39 building completions in the second quarter of 2023, totaling 9.49 million square feet, with an availability rate of 32.1% (as shown in Figure 2), with Calgary and Toronto comprising the majority of the new supply. In Calgary, Alberta, a new Amazon warehouse totaling 2.6 million square feet will join the growing number of facilities in the area.

Figure 3 - Industrial Under Construction and Availability – Q2 2023

In the second quarter of 2023, there were 192 projects underway, totaling 39.2 million square feet, with 36% pre-leased. Toronto, Calgary, and Southwest Ontario comprised the majority, with 74, 25, and 23 projects, respectively, totaling 29.6 million square feet under construction (Figure 3).

According to Altus Group’s most recent Investment Trends Survey, macroeconomic headwinds have led investors to turn to assets with minimal risk and stable returns, specifically for single-tenant and multi-tenant industrial assets. However, industrial cap rates have continued to increase across all markets apart from Quebec City in Q2 2023, mainly due to higher interest rates, which has led investors to be more cautious. Regardless of higher rates and costs, the second quarter of 2023 has seen an increase in new supply, driving up availability rates marginally, and rental rates continue to increase across most of the markets.

Author

Jennifer Nhieu

Senior Research Analyst

Author

Jennifer Nhieu

Senior Research Analyst

Resources

Latest insights