Canadian industrial market update – Q4 2025

Canada’s industrial availability increased to 6.3% in Q4 2025, exposing regional divides that may define leasing, rents, and development strategy.

Key highlights

Source: Altus Data Studio market data and analysis

Elevated borrowing costs and trade-related uncertainties led to an 8% year-over-year decrease in industrial transaction volume, totalling $11.8 billion

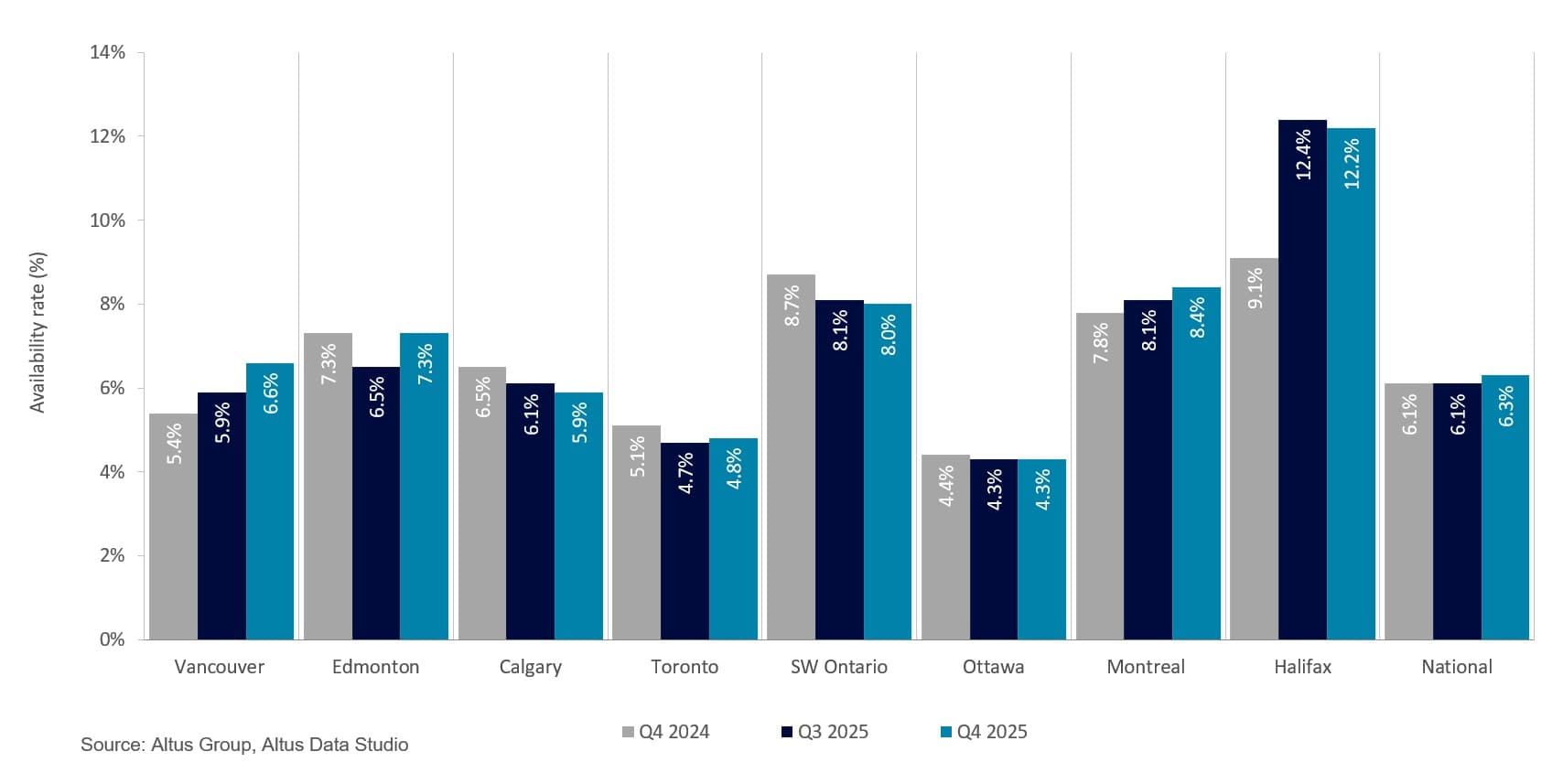

Canada’s national industrial availability rate increased by 20 basis points (bps) year-over-year to 6.3%

Ottawa reported the nation’s lowest availability at 4.3%, while Halifax’s hit 12.2%

Softer demand and a short-term oversupply caused rental rate appreciation to plateau or enter a downward trajectory in specific submarkets, shifting leverage toward well-capitalized occupiers

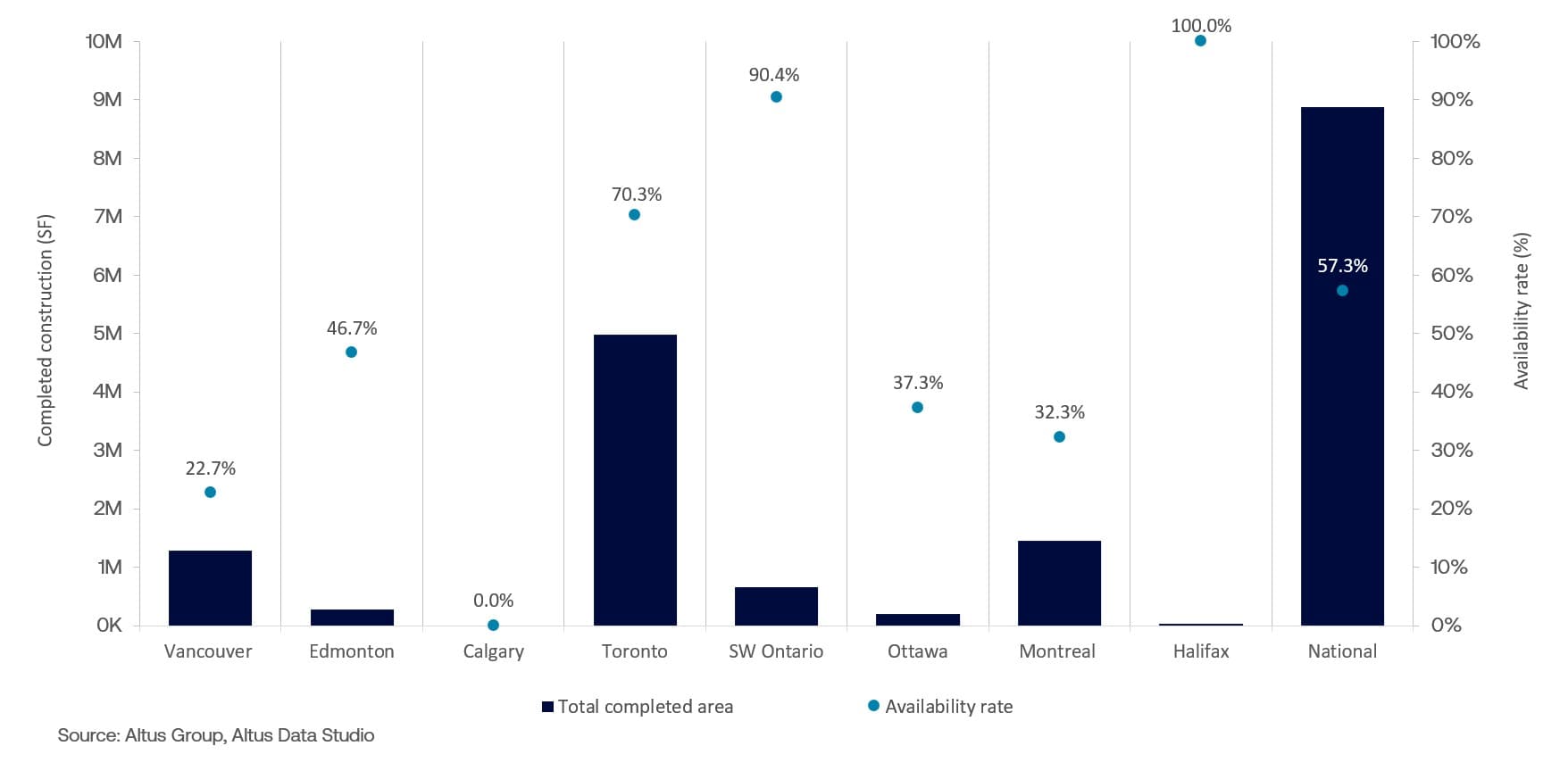

National construction completions saw a modest increase, with the delivery of 48 new industrial buildings adding approximately 8.9 million square feet to the national inventory

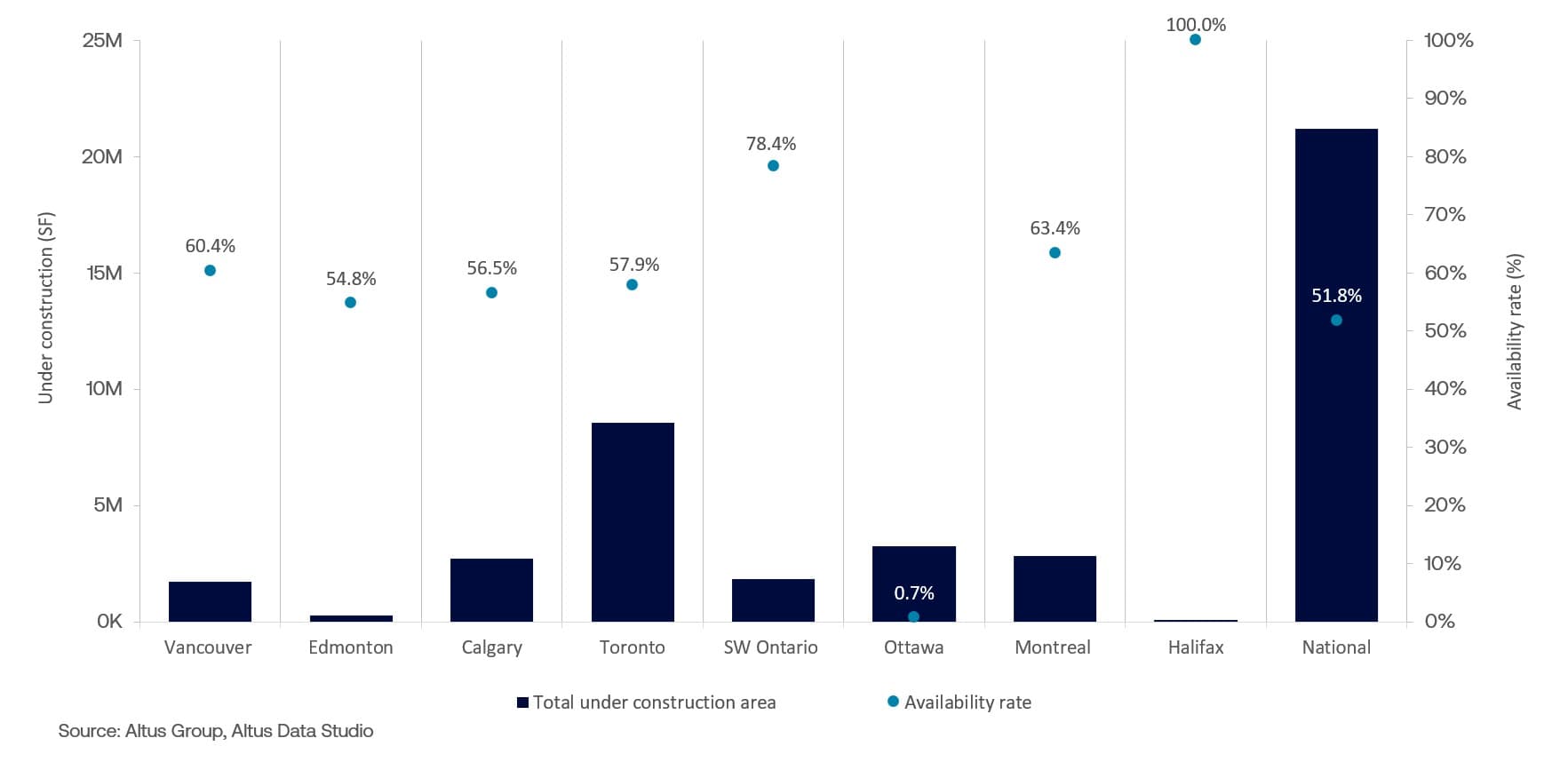

The national industrial construction pipeline comprised 110 active projects, representing an aggregate of 21.2 million square feet of future inventory, of which 52% remained available

The national industrial availability rate increased to 6.3% in the fourth quarter of 2025

During the fourth quarter of 2025, the Canadian industrial sector operated within a stabilizing yet complex macroeconomic landscape. Although borrowing costs remained elevated by historical standards, the Bank of Canada (BoC) signalled a transition toward a neutral monetary stance by maintaining its policy rate at 2.25% following an October reduction. Despite moderating inflation, the sector faced headwinds from subdued consumer spending and stalled trade negotiations with the United States, forcing logistics and manufacturing firms into a defensive operational stance. These challenges defined the sector’s investment activity, with transaction volume decreasing by 8% year-over-year to $11.8 billion as investors prioritized risk mitigation and portfolio reassessment over expansion.

Based on a market analysis conducted through Altus Data Studio, the national industrial availability rate increased by 20 bps, reaching 6.3% in the fourth quarter of 2025 (Figure 1). This figure was notably high for the Canadian market, representing a significant departure from the record lows of under 2.0% observed during the post-pandemic supply chain crisis. Across the major hubs, leasing velocity slowed as tenants prioritized footprint optimization and renewals over physical expansion. This transition, where supply began to outpace tapering demand, caused rental rate appreciation to plateau or enter a downward trajectory in specific submarkets, shifting leverage toward well-capitalized occupiers.

Figure 1: Industrial availability (Q4 2024 vs. Q3 2025 vs. Q4 2025)

Regional performance and market disparities

Regional performance revealed significant disparities driven by supply deliveries and shifting occupier strategies. The Greater Toronto Area’s (GTA) availability rate contracted to 4.8%, marking a 30 bps decrease year-over-year. This tightening occurred as the market received nearly 5 million square feet of new supply, a notable volume, yet a significant reduction compared to the record-setting deliveries seen in previous years. The market’s ability to compress the availability rate, despite this influx, was driven by a disciplined alignment between developers and occupiers. A significant portion of the new inventory was absorbed by users who had pre-committed to space to modernize their supply chains, transitioning from older, less efficient assets into state-of-the-art facilities. This strategic “flight-to-quality” allowed the GTA to maintain momentum and stabilize its availability rate as the construction pipeline began to normalize.

In contrast, Vancouver’s availability rate continued to climb, rising 120 bps year-over-year to 6.6%, the highest rate recorded in that market since 2010. This surge was primarily fuelled by an increase in vacancies within existing assets as occupiers proactively reassessed their space requirements in response to higher borrowing costs and a slowdown in consumer spending. Furthermore, a cooling in port-related logistics demand contributed to this rare surplus in a traditionally land-constrained market.

Similarly, Montreal and Southwestern Ontario registered availability rates of 8.4% and 8.0%, respectively, largely due to the arrival of speculative inventory. In Montreal, the availability rate continued to climb despite the market recording positive absorption for most of 2025. This upward pressure on availability was sustained by a significant influx of sublease space, including a notable release of assets by Amazon as the e-commerce giant optimized its national distribution network. Southwestern Ontario experienced a nuanced improvement in its supply-demand balance, reporting a 70 bps decrease year-over-year. While small- to mid-bay spaces remained in high demand, the large-bay segment struggled to secure tenants, resulting in localized upward pressure on availability rates. This surplus shifted market leverage towards tenants seeking large-format facilities, as developers worked to secure occupants for massive speculative footprints that entered the market without prior commitments.

Ottawa continued to report the lowest availability rate in the country at 4.3%. However, this figure represented only a 10 bps decrease year-over-year, corresponding to two consecutive quarters of negative absorption. This shift primarily resulted from a softening in the large-bay segment, where demand moderated as businesses adopted a more cautious “wait-and-see” approach amid macroeconomic and trade uncertainty. While small-bay warehouses remained in relatively high demand to support local service industries, the lack of activity in larger footprints resulted in an overall availability rate that remained at an elevated level for the region.

Halifax maintained the highest availability rate among the major industrial hubs, reaching 12.2% by the close of the year. While other regions saw availability climb due to ongoing construction cycles, Halifax’s elevated rate was primarily a consequence of a tepid demand environment that failed to keep pace with existing stock. The market saw minimal new supply, with only two buildings totalling approximately 263,000 square feet completed in 2025. Consequently, the rise in available square footage was not a product of overbuilding or a secondary market of subleases, but rather a fundamental inability to absorb existing direct vacancies. This lack of robust tenant activity for properties already on the market characterized a period of significant structural adjustment for the region.

National supply dynamics and inventory trends

National supply dynamics recorded a strategic uptick in construction completions during the fourth quarter, with the delivery of 48 new industrial buildings adding approximately 8.9 million square feet to the national inventory (Figure 2). While 57.3% of the newly delivered space remained available at year-end, the total volume reflected deliberate moderation relative to the historic peaks of 2023 and 2024.

Figure 2: Industrial completions and availability (Q4 2025)

The GTA accounted for approximately half of this national activity, with 23 properties totalling 5 million square feet reaching completion. The GTA’s supply was predominantly speculative, leaving 70.3% of new space available. While the region maintained positive net absorption for two consecutive quarters, this was largely concentrated in existing assets, as tenants bypassed the higher price points of newly delivered premium builds. The lack of immediate uptake for these new deliveries suggested that demand was being met by existing vacancies rather than the integration of new inventory.

Vancouver demonstrated comparatively strong pre-leasing velocity across 12 new industrial deliveries, totalling nearly 1.3 million square feet, with only 22.7% of the space remaining available at year-end. This high absorption of new supply was primarily driven by a chronic scarcity of large-format facilities, which compelled major players to commit to projects well in advance of their completion. Furthermore, a significant portion of these deliveries targeted the industrial condominium market, where smaller owner-occupier units saw rapid uptake as businesses sought long-term operational stability and equity within a land-constrained market. Montreal added five industrial buildings totalling nearly 1.5 million square feet, with 32.3% of the space available for lease. This relatively low level of uncommitted inventory indicated a healthy regional equilibrium, particularly as newly delivered assets continued to attract steady interest.

National industrial construction pipeline

The national industrial construction pipeline comprised 110 active projects, representing an aggregate of 21.2 million square feet of future inventory. Pre-leasing activity for these ongoing developments remained sluggish, as 51.8% of the space remained available for lease (Figure 3). This deceleration in pre-leasing velocity prompted a strategic moderation of new project commencements. This shift played a critical role in stabilizing conditions within oversupplied markets by preventing further inventory imbalances.

Figure 3: Industrial under construction and availability (Q4 2025)

The GTA maintained its status as the nation’s primary hub for industrial development, with 8.6 million square feet actively under construction. Consistent with recent trends, 57.9% of this pipeline remained available to the market. Given the GTA’s scale as Canada’s largest industrial gateway, this elevated availability indicated that developers continued to utilize speculative models. This approach reflected a cautious optimism regarding a medium-term market rebound, despite the short-term softening of tenant demand observed throughout the year. Developers particularly prioritized the construction of Class A facilities, betting that modern, state-of-the-art spaces would be the first to be absorbed when market conditions improved.

In Vancouver, the development pipeline consisted of 29 industrial buildings, totalling 1.7 million square feet, with 60.4% of this space remaining available at year-end. This figure represented a significant reduction in active projects as developers hesitated to break ground on new speculative ventures. This cautiousness was largely driven by the high cost of capital and a persistent bid-ask spread between buyers and sellers. As a result, the current slowdown in construction starts is expected to create a supply gap in 2026 and 2027, which will likely tighten market conditions once existing inventory is absorbed.

Similarly, Southwestern Ontario contributed 1.8 million square feet, though 78.4% of the space remained uncommitted. This volume represented a considerable decline compared to levels observed in 2023 and 2024. The slowdown was primarily attributed to trade-related uncertainties and geopolitical tensions, which prompted numerous regional manufacturing and distribution users to defer expansion plans in favour of a cautious approach. Consequently, developers moderated their production of new inventory to prevent exacerbating oversupply.

In Calgary, the development pipeline contracted to 2.7 million square feet under construction, with 56.5% available for lease. This reduction in volume reflected a deliberate move toward supply-side discipline following a period of rapid expansion that had previously pushed availability rates higher. Developers focused on rebalancing the market’s supply-demand equilibrium as a softer domestic economy led to a more risk-averse posture regarding speculative capital deployment.

Conversely, Ottawa’s pipeline was dominated by the development of a new Amazon fulfillment centre in Barrhaven. This multi-level facility, totalling approximately 3.1 million square feet across five floors, represented a landmark addition intended to solidify the city as a primary regional logistics hub. Upon reaching operational status, it will become the third Amazon fulfillment centre in Ottawa and the largest in the country. This project signalled a long-term commitment to the region’s distribution infrastructure as a central node between Toronto and Montreal.

Finally, in Montreal, developers maintained a high level of capital conviction in speculative growth, resulting in 12 buildings under construction totalling 2.8 square feet. With 63.4% of the space available for lease, this persistent activity was largely driven by a scarcity of modern, high-ceiling logistics space in core submarkets. Stakeholders moved forward with uncommitted projects to capture future demand from occupiers seeking to modernize their supply chains and leverage the city’s port and rail connections, despite broader macroeconomic headwinds and a temporary rise in sublease availability.

Navigating future market dynamics

Looking ahead to 2026, the Canadian industrial sector is expected to enter a period of deliberate recalibration, transitioning toward a more rationalized baseline. Market fundamentals are projected to stabilize as the BoC maintains a patient monetary stance, with the policy rate anticipated to hold at 2.25%. This should unlock pent-up capital and encourage more consistent transaction activity. While economic growth may remain modest, improving lender appetite and a clearer understanding of modern supply chain requirements support an outlook of cautious optimism.

The interplay between supply and demand will likely reach a healthier equilibrium as the current moderation in construction starts takes effect. While availability rates may remain elevated in the short term, the sharp reduction in the 2026-2027 pipeline, particularly with the elevated cost of land, suggests a supply gap could emerge by mid-year. This tightening should support moderate rental growth for high-specification Class A facilities. Furthermore, the sector remains bolstered by structural shifts, including the integration of artificial intelligence and a focus on domestic manufacturing. Despite trade-related risks, Canada’s industrial assets remain a stable haven for capital, well-positioned for a recovery defined by a disciplined flight-to-quality across major gateways.

Want to be notified of our new and relevant CRE content, articles and events?

Disclaimer

This publication has been prepared for general guidance on matters of interest only and does not constitute professional advice or services of Altus Group, its affiliates and its related entities (collectively “Altus Group”). You should not act upon the information contained in this publication without obtaining specific professional advice.

A number of factors may influence the performance of the commercial real estate market, including regulatory conditions and economic factors such as interest rate fluctuations, inflation, changing investor sentiment, and shifts in tenant demand or occupancy trends. We strongly recommend that you consult with a qualified professional to assess how these and other market dynamics may impact your investment strategy, underwriting assumptions, asset valuations, and overall portfolio performance.

No representation or warranty (express or implied) is given as to the accuracy, completeness or reliability of the information contained in this publication, or the suitability of the information for a particular purpose. To the extent permitted by law, Altus Group does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. The distribution of this publication to you does not create, extend or revive a client relationship between Altus Group and you or any other person or entity. This publication, or any part thereof, may not be reproduced or distributed in any form for any purpose without the express written consent of Altus Group.

Authors

Jennifer Nhieu

Senior Research Analyst

Ray Wong

Vice President, Data Solutions

Authors

Jennifer Nhieu

Senior Research Analyst

Ray Wong

Vice President, Data Solutions

Resources

Latest insights