Canada’s shifting fundamentals are reshaping housing and construction

Canada’s housing and construction markets are stabilizing as inflation cools, interest rates ease, and renovation activity gains momentum

Key highlights

Canada’s economy is stabilizing with growth near 1.4 percent in 2026 and inflation moving back within target

Slower population growth and shifting demographics are reshaping housing demand and long-term supply needs

Resale markets remain steady while new-home sales have fallen, yet construction pipelines and material demand stay strong

Lower borrowing costs and improving affordability are helping the housing market find better balance

Renovation and home improvement spending are rebounding, reinforcing their role in Canada’s housing economy

The modern construction and building-supply industry has long mirrored Canada’s broader economy, reflecting its strengths, exposing its weaknesses, and revealing its adaptability. In 2025, that reflection has become unusually complex. A combination of slower population growth, moderating inflation, stabilizing interest rates, and persistent labour-market frictions has created a landscape that challenges conventional forecasting but opens up new opportunities for those positioned to read the signals correctly.

As we look toward 2026, the data suggest a delicate but improving balance; an economy adjusting after years of volatility, an evolving housing market confronting both affordability and demographic change, and a home-improvement sector quietly regaining momentum.

Watch our 2025 State of the Market webinar

A clearing in the economic haze

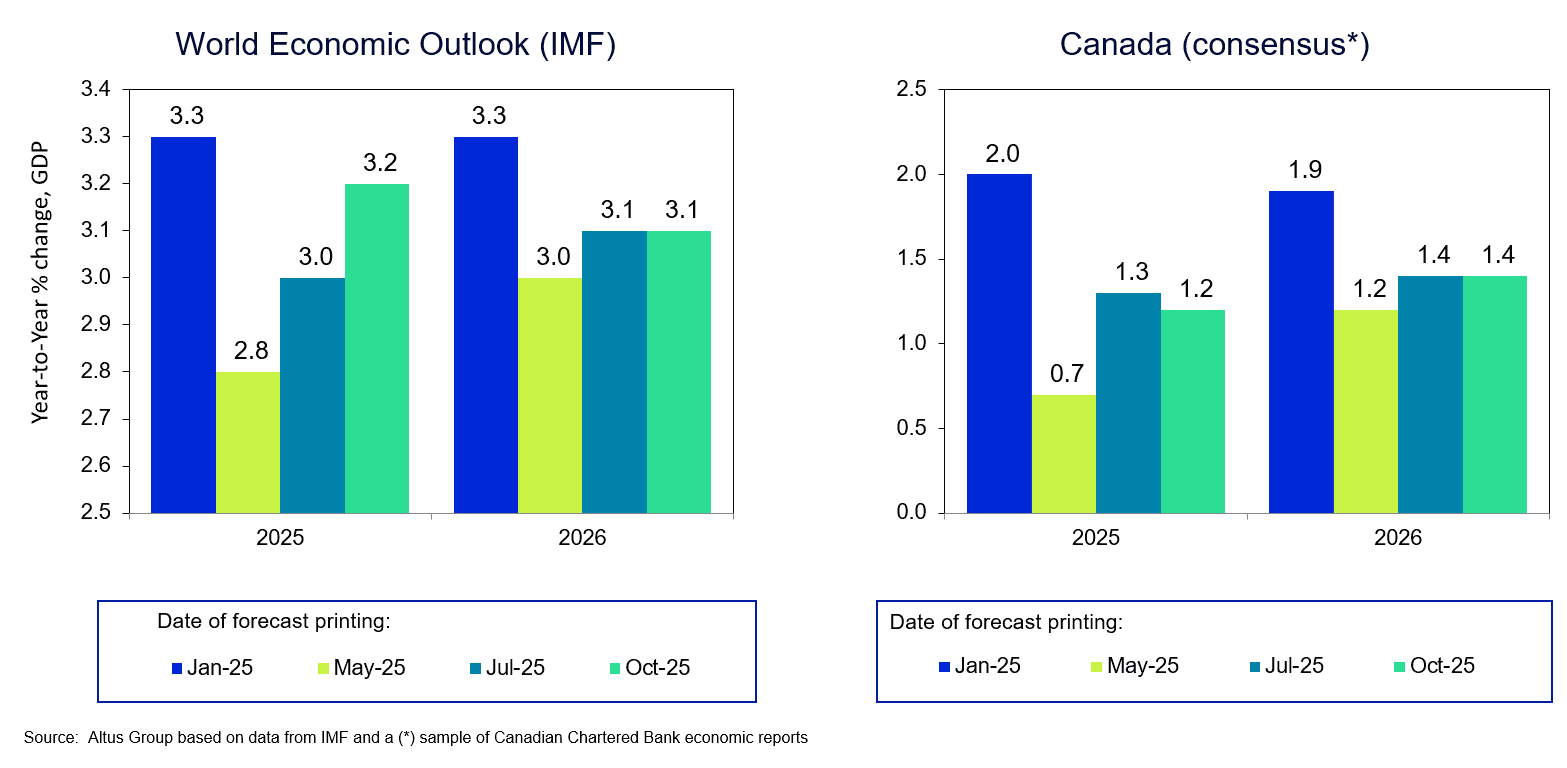

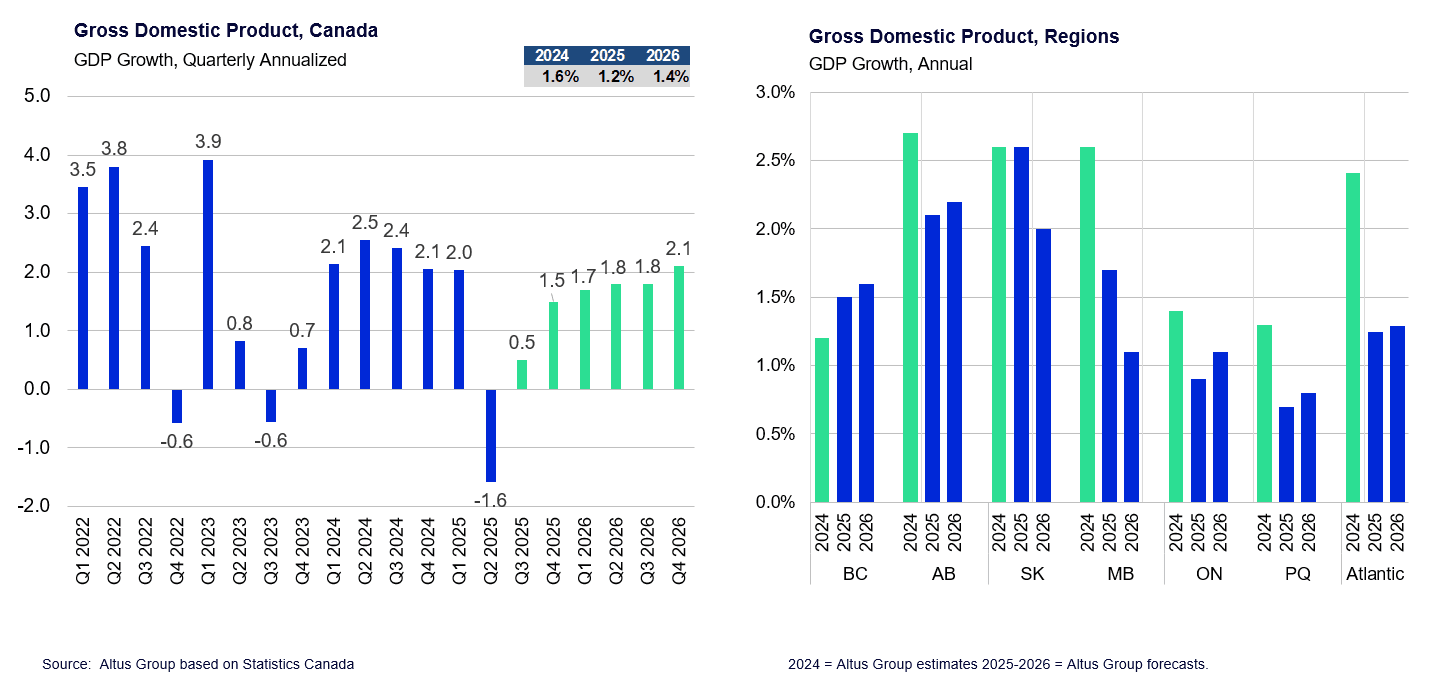

After a year of shifting policy conditions, both Canada and the global economy are moving toward clearer skies. Expectations for domestic GDP growth are around 1.4% in 2026, a modest but steady pace.

That stability is significant. Throughout 2025, businesses and consumers alike were paralyzed by what might be called “outlook haze”, caused less by hard economic fundamentals than by relentless headlines: tariff threats, leadership changes, sovereignty disputes, and trade-policy zigzags. The real economy has weathered these challenges better than sentiment suggested.

Figure 1: Left – World Economic Outlook (IMF); Right – Canada (consensus*)

Interest rate policy has followed suit. The Bank of Canada’s aggressive 2022-2023 tightening cycle - ten rate hikes totaling 4.75 percentage points - has now been partly unwound with eight cuts. Rates sit near a natural accommodative level, supportive of investment and consumption without reigniting inflation.

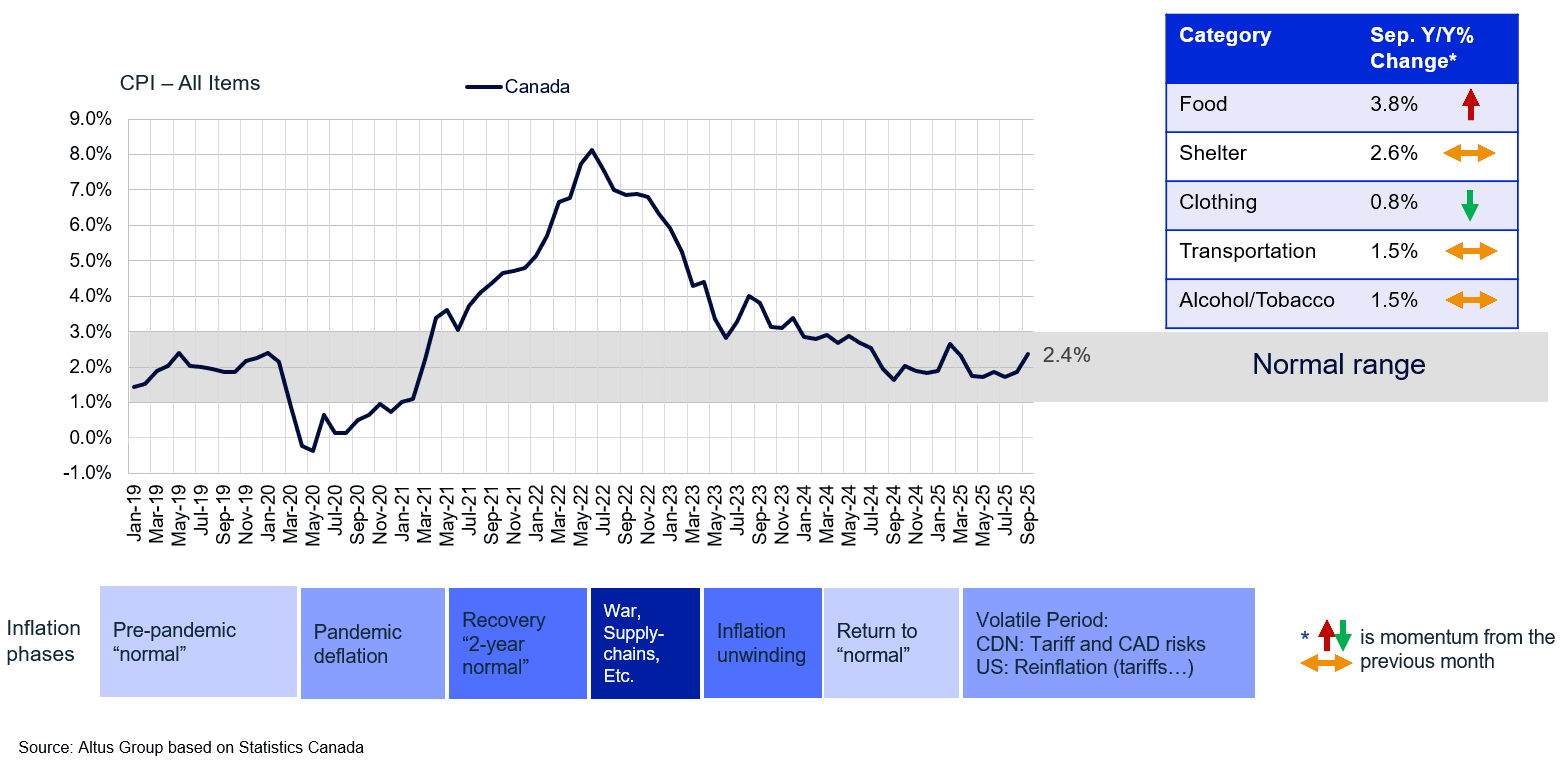

Inflation itself, once the top concern of households and policymakers, has largely normalized. Consumer prices are now moving within a healthy 1-3% band, with food and shelter costs easing, and transportation prices recently declining. For construction and retail, this predictability is invaluable, as it restores confidence in planning, budgeting, and consumer purchasing decisions.

Figure 2: Consumer Price Inflation (CPI) in Canada, 2019-2025

Steady consumer spending keeps the economy moving

Despite the noise, Canadian consumers never fully retreated. Retail sales volumes (adjusted for inflation) have stabilized and even turned positive in mid-2025, a testament to steady employment and the pent-up appetite for normalcy.

For those in building supply and renovation, this resilience is crucial. Homeowners and small contractors have shown that even when they delay large purchases, they rarely abandon them. The data suggests that households are adapting. They are trading down in scale, prioritizing essential projects, and timing expenditures around seasonal affordability.

The broader GDP numbers confirm the same pattern: a sharp but temporary setback in Q2 2025 followed by renewed, if modest, momentum. Commodity-driven provinces like Saskatchewan and Alberta have led the charge, benefitting from strong exports and public-infrastructure spending. Central Canada, by contrast, has cooled. This regional divergence is now one of the defining features of the post-pandemic cycle.

Figure 3: Gross Domestic Product growth in Canada

Labour and demographics: Two sides of the housing equation

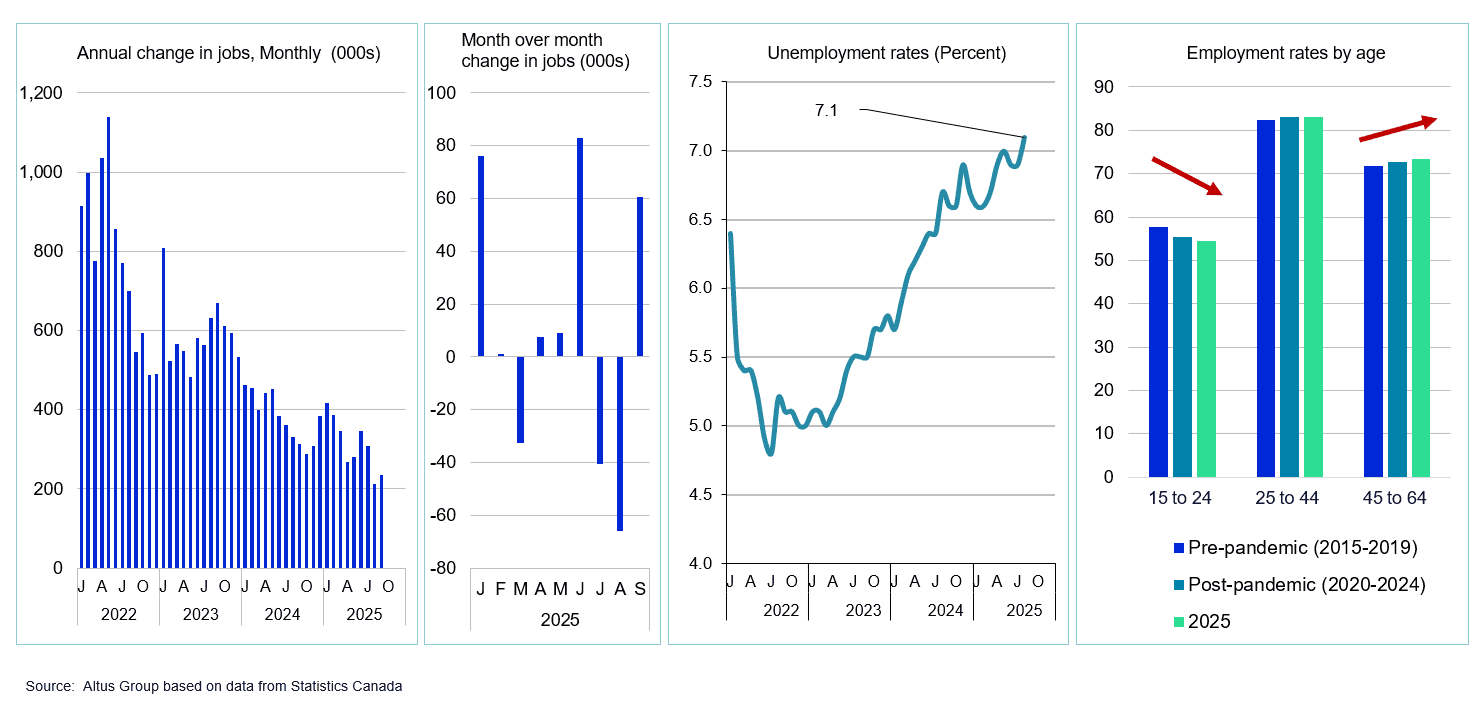

Canada’s labour market is cooling but not collapsing. The national unemployment rate has crept above 7%, but in a context of still-healthy job creation (roughly 200,000 net new positions over the past year) and moderating population growth, that capacity may prove a necessary recalibration for 2026. In fact, as population expansion slows, some labour “excess capacity” could help sustain modest employment growth without the wage inflation of a tight labour market.

Figure 4: Employment conditions, Canada

What’s more transformative is the demographic shift now unfolding beneath the surface.

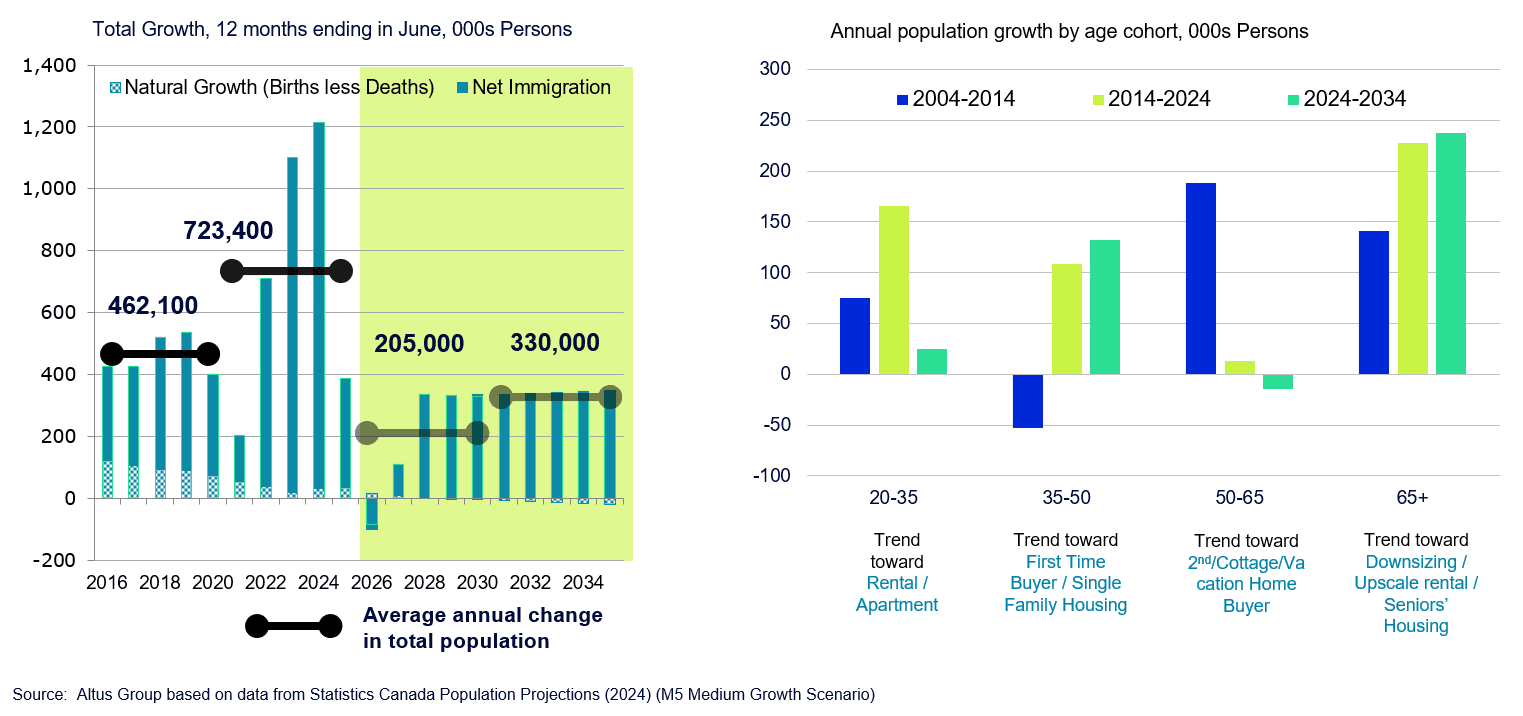

After several years of record population growth, 2025 has brought a dramatic slowdown. During the post-pandemic surge, Canada added more than 750,000 residents each year. New federal policies aimed at curbing immigration and reducing reliance on temporary residents could now push population growth toward zero or even into negative territory for the first time since Confederation. Beyond the shock value, this change could reshape long-term housing demand.

Over the next decade, growth in the 20–35 age cohort (the backbone of the rental and entry-level condo market) is expected to fade, while the 35–50 group (considered prime home-buying age) will likely dominate new household formation. The 65+ population will also expand rapidly, driving needs for downsizing, aging-in-place modifications, and purpose-built seniors’ housing.

For the home-improvement, renovation, and homebuilding industries, this means a shift in product mix and marketing focus. Expect greater emphasis on ground-oriented housing, multi-generational design, and renovation work that enhances accessibility and energy efficiency.

Figure 5: Population trends and projections, Canada

Contrasting trends define today’s housing market

Few sectors illustrate the current economic paradox as clearly as housing.

On one hand, resale markets have proven resilient. Roughly 500,000 transactions are expected nationally this year, which is comparable to pre-pandemic norms. Resale markets are generally showing balanced conditions and moderate price appreciation in the Prairies, Quebec, and Atlantic Canada, offsetting softness in Ontario and British Columbia.

The new home market, however, tells a different story. Across major metros, new-home sales have plunged. They are down more than 60% from 2022 levels in Toronto and Vancouver. Many developers face the dual constraints of high financing costs and misaligned product: too many small, investor-driven units designed for a demographic cohort that was dominant over the past decade but is now shrinking.

And yet, paradoxically, housing starts remain strong, likely to exceed 250,000 units across Canada over the course of 2025. Why? Because projects launched during the boom years are still moving through the pipeline. Construction activity, and the resulting demand for building materials, is expected to remain elevated into 2026, even as pre-construction sales continue to lag.

Affordability, meanwhile, is also starting to improve after sharp deterioration during the immediate post-pandemic period. The Bank of Canada’s housing-affordability index improved significantly since 2023, aided by lower rates, a sharp housing price adjustment, and policy measures rolling back some development fees. While affordability remains worse than the pre-pandemic “steady state,” the direction of travel is finally constructive.

Costs, capacity, and construction challenges

The steep post-pandemic rise in construction costs have eased but not disappeared. In Western Canada, costs are still rising 5–8% annually, which is higher than inflation but far below the 20–30% surges of 2022. Central Canada has experienced more relief, with costs in markets such as Toronto declining by roughly 20 percent in recent months. This moderation provides room for builders to re-price and for suppliers to regain margin discipline.

Figure 6: Construction cost change, Canada

For home improvement building centres, this is a moment to re-evaluate procurement and inventory strategies. With global shipping normalized, domestic production stabilizing, and commodity inputs less volatile, 2026 may reward those who establish long-term supplier relationships and emphasize local sourcing.

Home improvement is quietly powering the market

Perhaps the most underappreciated insight from the current data is the dominance of renovation in Canada’s residential-construction economy. In 2024, 56% of all residential investment was accounted for by renovations ($103 billion), as opposed to new housing ($86 billion).

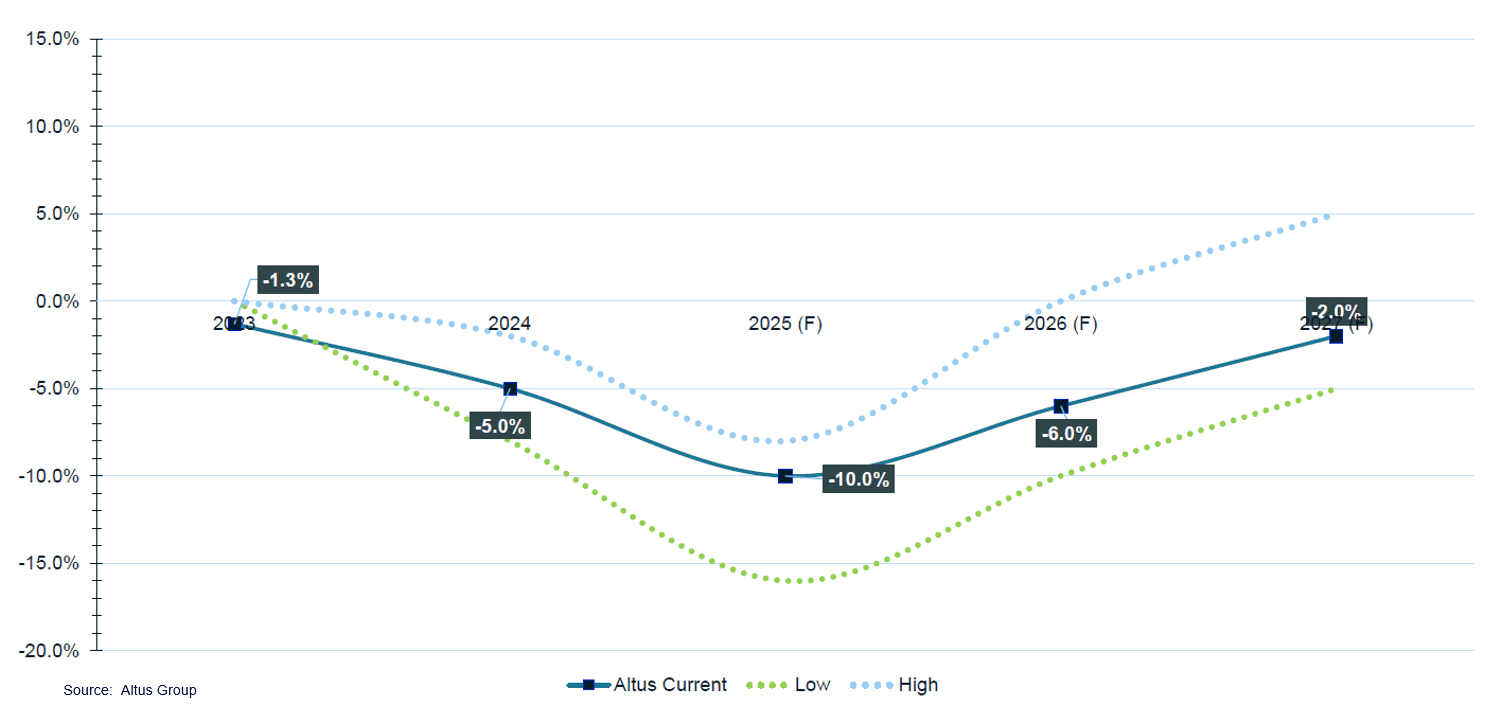

After an extraordinary pandemic boom, renovation spending declined for three consecutive years as households digested prior upgrades and faced higher borrowing costs. That downcycle now appears to be bottoming. Real spending has stabilized since mid-2025, and leading indicators, including home-improvement retail sales, are turning upward.

Historically, renovation activity closely tracks home-improvement sales, often with a short lag. The recent rebound in both suggests that Canadians are once again engaging with their homes, as falling interest rates, improving affordability, and an aging housing stock are aligning to reignite the upgrade cycle.

The implication is that as new construction cools, renovation will reclaim its place as a steady engine of Canada’s housing economy. For the home-improvement sector, this means sustained demand for materials, tools, and expertise that enhance quality of life and extend the lifespan of the existing housing stock.

What this means for the building-supply sector

From the vantage point of a home improvement building centre, the national economic narrative translates into several actionable realities:

Plan for steady, not spectacular, growth. With GDP expanding around 1.4% and housing starts gradually easing, margins will depend on operational efficiency, not volume alone.

Expect regional resilience. The Prairie provinces are outperforming and will remain the growth engines for both housing and renovation activity.

Re-engage the consumer. Confidence is returning, but price sensitivity remains high. Emphasize value, transparency, and financing flexibility.

Watch demographics. Product offerings should increasingly reflect mid-life homeowners upgrading or retrofitting, not just first-time buyers.

Position for the renovation renaissance. The next cycle of home-improvement growth will be driven less by pandemic-era indulgence and more by structural necessity such as aging homes, energy retrofits, and a maturing population.

A closing thought about building resilience

If 2024 was the year of volatility and 2025 the year of recalibration, then 2026 could mark the year of pragmatic rebuilding. Canada’s construction and building-supply sectors stand at the centre of that process.

The path ahead is neither smooth nor uniform, but the fundamentals are turning in the right direction: inflation under control, rates normalized, consumers re-engaged, and renovation on the rise. For those willing to interpret the signals and adapt, there is a clear aisle running from the economy to the building site.

Want to be notified of our new and relevant CRE content, articles and events?

Disclaimer

This publication has been prepared for general guidance on matters of interest only and does not constitute professional advice or services of Altus Group, its affiliates and its related entities (collectively “Altus Group”). You should not act upon the information contained in this publication without obtaining specific professional advice.

A number of factors may influence the performance of the commercial real estate market, including regulatory conditions and economic factors such as interest rate fluctuations, inflation, changing investor sentiment, and shifts in tenant demand or occupancy trends. We strongly recommend that you consult with a qualified professional to assess how these and other market dynamics may impact your investment strategy, underwriting assumptions, asset valuations, and overall portfolio performance.

No representation or warranty (express or implied) is given as to the accuracy, completeness or reliability of the information contained in this publication, or the suitability of the information for a particular purpose. To the extent permitted by law, Altus Group does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. The distribution of this publication to you does not create, extend or revive a client relationship between Altus Group and you or any other person or entity. This publication, or any part thereof, may not be reproduced or distributed in any form for any purpose without the express written consent of Altus Group.

Author

Peter Norman

Vice President and Economic Strategist

Author

Peter Norman

Vice President and Economic Strategist

Resources

Latest insights

Jul 22, 2025

EP4 - Modular, faster, smarter: How SAMI is redefining residential construction