Australian construction material price outlook - Q4 2023

Altus Group combines our market intelligence with a range of reliable and robust data sources to provide quarterly Australian construction material price indicators for the construction sector. Read the latest update on this article here.

Key highlights

Disruptions in the Red Sea are expected to raise prices for imported materials in Australia, as shipping reroutes around the Cape of Good Hope increase costs

High interest rates and labour costs have led to an increase in construction company failures, with 1,484 companies entering liquidation in financial year 2023

Western Australia has introduced measures like interest-free loans to support construction companies, indicating governmental responses to the crisis

Residential construction is not keeping up with population growth, exacerbated by a labour shortage that requires an estimated 450,000 extra workers

Rising input costs, along with shortages of labour, have made the residential sector much less attractive, reducing the participation rates of builders

As productivity continues to fall and inflation rises, we will see higher interest rates remain; this is particularly evident in the construction industry, where completion dates continue to lag, and failures are rising

China’s property crisis, including the liquidation of major companies like Evergrande Group, poses contagion risks and impacts investment in Australia's property sector

In December 2023, home construction approvals fell by 9.5%, significantly below the federal target of 240,000 new homes annually needed to meet the goal of 1.2 million homes over five years

The review of Australia's Infrastructure Investment Program underscores the need for greater pipeline visibility in Australia's construction industry to ensure businesses can plan effectively and manage costs

Altus Group combines our market intelligence with a range of reliable and robust data sources to provide quarterly Australian construction material price indicators for the construction sector.

With localized expertise and global cost management experience, we can help ensure the viability and success of your development and construction projects.

The standout theme for material costs in Australia’s construction industry this quarter was stability

Beneath the seemingly calm surface, however, ripples of disruption are causing cascading cost pressures.

Energy-intensive materials, including concrete, and bricks, continue to rise. After two years of eye-watering price hikes, wholesale energy prices are falling, but there is little expectation in the market that this will translate into energy price reductions.

Prices of imported materials, including equipment, cabinets, joinery, façades, tiling, and stone (particularly those sourced from Europe) are expected to rise due to current disruptions in the Red Sea. Multiple shipping companies have paused or rerouted shipments, sending billions of dollars in cargo around the Cape of Good Hope to avoid the Suez Canal. While Australia’s material supply chains aren’t usually dependent on the Red Sea route, there are flow-on effects in global supply chains. Delivery delays and availability of shipping containers in other parts of the world ultimately translate into rising prices in Australia.

The combined force of high interest rates and heightened labour costs continue to send construction companies to the wall. The latest high-profile casualty, St Hilliers, plunged into administration in February. The Australian Securities and Investments Commission’s latest insolvency data shows 1,484 construction companies have fallen into liquidation over the current financial year. The ripple effect is at play here too: lose one contractor and problems flow down the line to subcontractors. The pool of companies willing to rescue failing projects, especially at a larger scale, is shallow, and this is reflected in their prices.

In response to these headwinds, governments are beginning to step in to support crippled construction companies. In Western Australia, for example, builders can now access interest-free loans of up to $300,000 to help them complete unfinished homes, in a new measure announced in January.

Residential construction is also failing to keep up with population growth; in fact, in many states, it is trending backwards. Master Builders estimates that 450,000 extra workers are required to build houses to meet demand in Australia’s regions alone. There is a small silver lining – we may see surplus materials on the market, which will put downward pressure on costs.

At the same time, China’s ongoing construction crisis continues to trigger contagion fears. In January, a court in Hong Kong ordered the liquidation of Evergrande Group, once the world’s largest real estate company, following a failed attempt to restructure US$300 billion in debt. Country Garden has also recently sold its last remaining Australian asset. Most Chinese based developers have already withdrawn their capital from Australia, but the ripple effect of a potential property market collapse continues to cause concern. China’s central bank has announced measures to help boost the liquidity available to property developers. Locally, we expect to see more tender breakdowns by geography to provide transparency and to give clients alternatives to potentially higher-risk Chinese materials.

The number of dwellings approved fell by 9.5% in the December 2023 quarter. Last year, the federal government set an aspirational target of building 1.2 million well-located homes in the five years from July 2024. To achieve this target, 240,000 new homes will need to be built annually. However, only 162,194 homes were signed off for construction in 2023, compared to 190,918 homes in 2022 (14% lower), 224,853 homes in 2021 (27% lower), and an average of 215,000 homes annually during the pre-COVID period (24% lower).

Finally, the independent review of Australia's Infrastructure Investment Program, released in November, continues to create waves. Infrastructure investment remains a state-by-state story, but the national view is clear: Australia’s construction industry needs pipeline visibility so businesses can plan beyond the next six months, with confidence. Without that certainty, costs will continue to fluctuate.

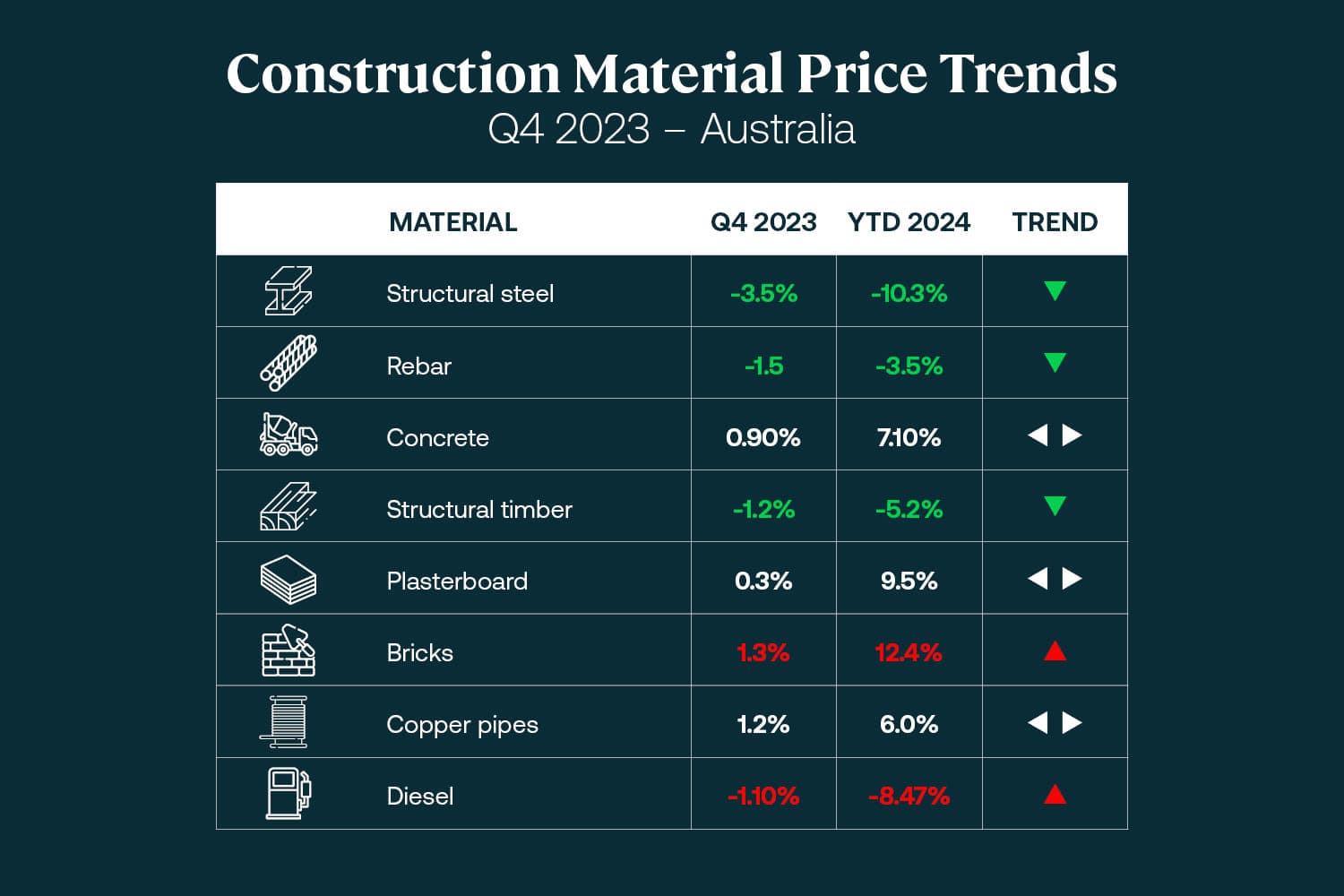

Material price snapshot

Figure 1 - A snapshot of Australian construction material price trends – Q4 2023

*AIQS: Price includes supply and installation

*ABS: Price is supply only (PPI)

*Web Data: Price is supply only

Altus Materials Escalation Index (Australia)

Figure 2 - Altus Materials Escalation Index (Australia)

Material price movements

Altus Group provides insight into the materials and commodities that are common across most projects and sectors, and that therefore have the greatest influence on costs. Of the eight materials we monitor, the costs of four are rising and four are falling.

Structural steel and rebar: Steel prices continued their decline this quarter, getting back to pre-pandemic levels as demand slows. We expect prices to remain stable, although steel manufacturers have flagged their expectation that the long pipeline of large infrastructure projects will continue to drive strong demand for steel and will underpin steady steel prices for at least the short- to medium-term.

Concrete: Concrete prices remained relatively stable this quarter but have risen by more than 7% year-on-year. Boral, Australia's largest building materials maker, is optimistic about 2024 and its half-year results are instructive. Prices for quarried products, cement, recycling, asphalt-spray, and concrete rose between 3% and 9% from the previous half-year. Boral’s input costs for transport and materials rose between 2% and 7%.

Structural timber: Prices are declining due to weak market demand in the coming quarters; however, as construction activities pick up again, structural timber prices will quickly increase, especially for residential projects, since they are early-stage construction materials.

Plasterboard: Plasterboard supply prices have remained stable this quarter. Given the sluggish demand, we do not anticipate an immediate increase in plasterboard prices. However, rising installation costs in certain states, including New South Wales, are significantly driving up the overall cost of plasterboard trade.

Bricks: The easing of energy prices will help reduce the cost of producing bricks. Prices rose further over the quarter due to heightened demand for later-stage materials and as a consequence of previous increases in energy prices.

Copper: With a wide range of applications across the building sector, copper is an industrious base metal and a litmus test for global economic health. After bottoming out in 2020, copper prices have turned a corner. However, we are seeing low demand in the near term which should keep prices stable.

Diesel: Escalating tensions in the Middle East have translated into fluctuating global fuel prices. Diesel prices, in particular, will hinge on the unfolding situation in the region.

Macro economic review – Q4 December 2023

Consumer Price Index

Figure 3 - All groups Consumer Price Index (CPI), Australia

The Consumer Price Index (CPI) rose 0.6% in the fourth quarter of 2024. Housing increased by 1.0%, while furnishings, household equipment and services decreased by 1.0%. The difference between housing and furnishing reflects cost-of-living pressures, as people cut back on discretionary spending where they can.

Over the 12 months to December 2023, the CPI rose by 4.1%. Housing increased 6.1% whereas furnishings, household equipment, and services remain stable at -0.2%.

Inflation remains high at 4.1%, which is outside the RBA's target range of 2-3%. However, as the CPI pressure valve releases, the market expects interest rates to remain stable and anticipates cuts later this year.

Announcing the RBA’s February 2024 monetary policy decision – to keep interest rates on hold – Governor Michelle Bullock warned that the economic outlook is still uncertain. The RBA remains “highly attentive” to inflation risks.

Producer Price Indices – Input

Figure 4 - Producer Price Indexes (PPI) – Input, Australia

Input prices for house construction recorded a slight rise of 0.3% in the December quarter. Over the past 12 months, input prices to house construction have risen by an average of 2.4%. The escalation rate has returned to the pre-pandemic level. Given the current reduced demand, we may expect the escalation rate to either further decrease or stabilize at this level in the coming quarters.

Producer Price Indices – Output

Figure 5 - PPI – Output, Australia

Building output prices rose 1.9% over the quarter and 5.4% over the past 12 months. Growth in output prices was driven by ongoing labour shortages for skilled tradespeople, with demand placing upward pressure on output costs.

Wage Price Index

Figure 6 - Wage Price Index (WPI), Australia

The seasonally adjusted Wage Price Index (WPI) increased by 0.9% for the December 2023 quarter and 4.2% year-on-year. Construction industry wages rose by 0.7% rise for the quarter and 4.1% over the year, marginally surpassing the overall average. This increase has been a primary factor behind the rise in the Producer Price Index for output.

Building approvals

Figure 7 - Building Approvals, Australia

The number of dwellings approved fell by 9.5% in the December 2023 quarter. Last year, the federal government set an aspirational target of building 1.2 million homes in the next five years. To achieve this target, 240,000 new homes will need to be built annually. However, only 162,194 homes were signed off for construction in 2023. Meanwhile, December 2023 also saw a fall in housing loans, with a 4.1% decrease compared to November 2023.

Summary

Construction costs are always dependent on a multitude of factors and fluctuations, from the asset class to the mix of trades to the material choices. With skilled advice and strategic decision-making, some costs can be carefully managed.

However, as the world is hit by wave after wave of geopolitical crises, governments are caught in the now. Predicting how 2024 will play out – and what that means for construction costs – is quite challenging.

In the long-term, however, Australia’s challenges are crystal clear: delivering affordable housing and infrastructure for a growing population; tackling climate change while ensuring a just transition to net zero and keeping the lights on; securing a steady pipeline of talent to underpin the nation’s economy and future. All of these will require a resilient construction industry able to navigate fluctuating costs and adapt to changing market dynamics.

Methodology

Market research into the supply cost of core materials is conducted on a quarterly basis with manufacturers and suppliers. Our market assessment also involves a thorough analysis of secondary sources of market data on materials and labour prices.

These sources include the Australian Bureau of Statistics (ABS), the Australian Institute of Quantity Surveyors (AIQS), Fuel Price Index, Metal and Raw Material Price, and proprietary cost data from Altus Group.

Disclaimer

This article is being provided for informational purposes only. No information included in this article constitutes, nor can it be relied upon as, legal, tax, investment, or other advice. Recipients should consult their independent advisors. The views and opinions expressed in this article are those of the authors themselves and do not necessarily reflect the views or positions of Altus Group Limited or its subsidiaries or affiliates (collectively, “Altus Group”). The article, the information contained therein, and any links to other sites are provided “as is” without any representations, warranties, or conditions of any kind, express or implied, including, without limitation, implied warranties, or conditions of fitness for a particular purpose or use, non-infringement or that any information is accurate, current, or complete. Altus Group has not independently verified any third-party information and makes no representation as to the accuracy or completeness of any such information. Altus Group and its advisors, directors, officers, and employees (collectively, its “Representatives”) are not liable or responsible to any person for any injury, loss, or damage of any nature whatsoever arising from or incurred by the use of, reliance on or interpretation of the information contained in the article or sites that are linked in the article. The foregoing limitation shall apply even if Altus Group or its Representatives have been advised or should have known of the possibility of such injury, loss, or damage. Any unauthorized use of the information is strictly prohibited. A user is not authorized to copy, circulate, disclose, disseminate, or distribute the information, either whole, or in part, to any third party unless first explicitly agreed by Altus Group.

Authors

Niall McSweeney

Head of Development Advisory, Asia-Pacific

Cody Bui

Quantity Surveyor

Alvin Yap Abidin

Quantity Surveyor

Authors

Niall McSweeney

Head of Development Advisory, Asia-Pacific

Cody Bui

Quantity Surveyor

Alvin Yap Abidin

Quantity Surveyor

Resources

Latest insights

Jan 9, 2025

Building the future - Key trends shaping Australia’s construction industry in 2025