Commercial Real Estate Performance Benchmarking

Benchmark Manager

Transform valuation and cashflow data from ARGUS Enterprise into portfolio-to-market benchmarking and performance attribution.

Discover benchmark manager

Go from gut-feel to evidence-based certainty on how your CRE portfolio stacks up against the market.

With access to the industry’s broadest valuation dataset, Benchmark Manager lets you isolate allocation vs. selection effects and reveal the yield and cash-flow drivers behind out- or under-performance.

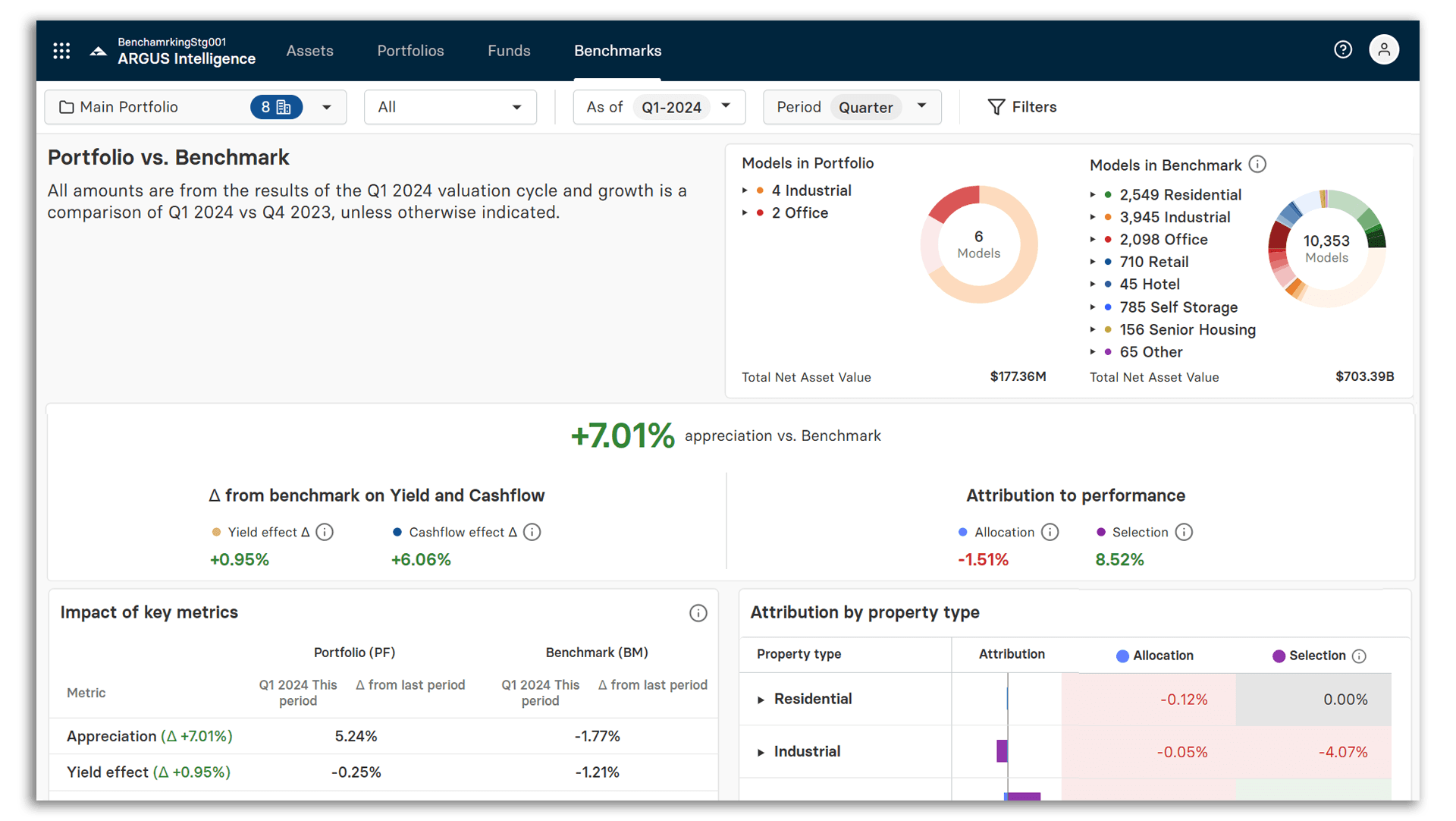

Market benchmarking

Compare your portfolio to market benchmarks. See how your portfolio stacks up - on multiple dimensions:

Benchmark against market indices, time periods, and peer sets by geography and property (sub)type

Surface performance gaps at fund, portfolio, or asset level in seconds

Leverage dashboards for investment committee packets and LP reporting

Access Altus’ industry-leading valuation and cashflow dataset

Attribution and performance

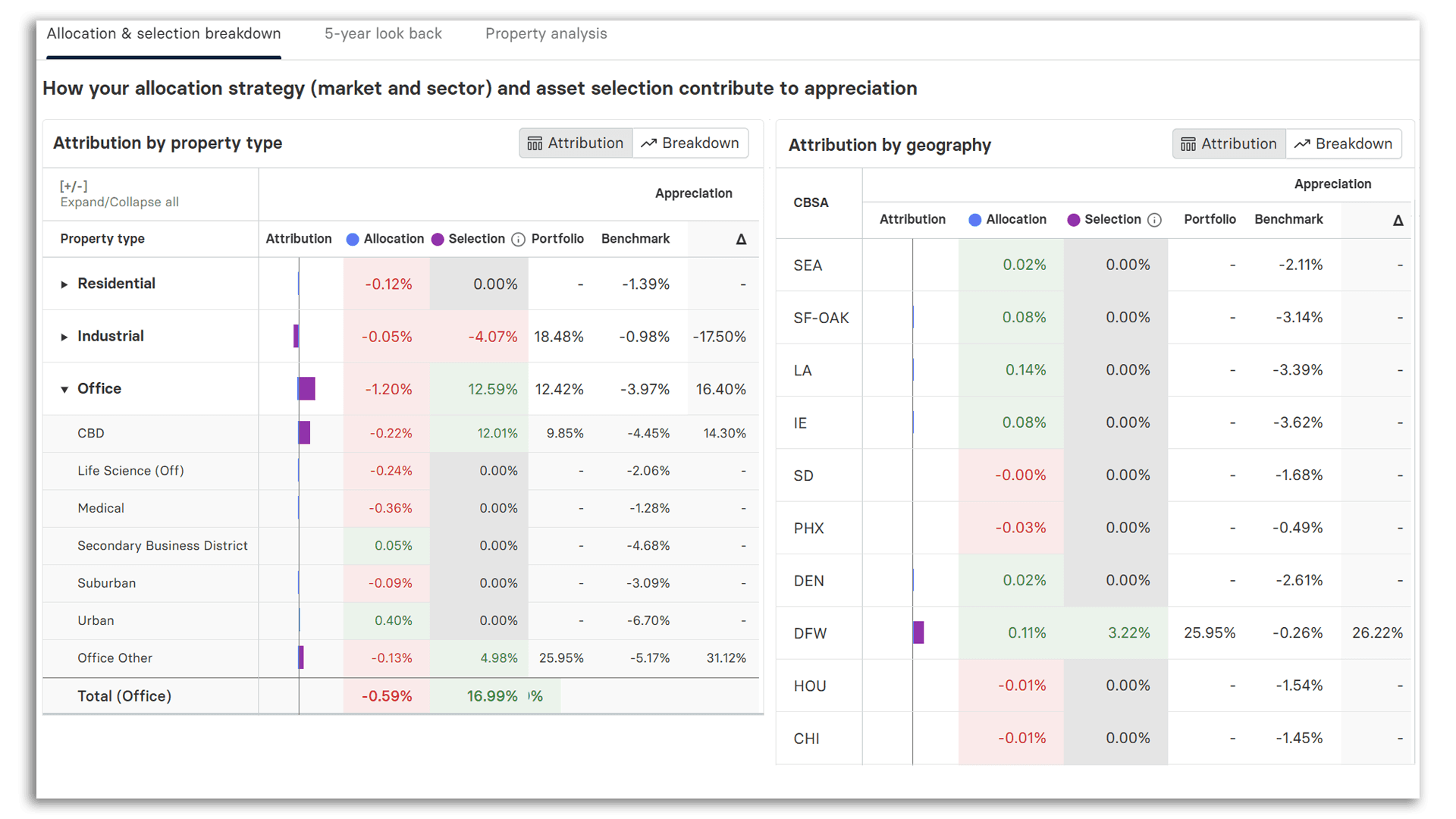

Pinpoint what’s driving or dragging performance. Break down performance with precision and granularity:

Quantify allocation vs. selection effects by sector, market, and asset

Drill into yield and cashflow components to pinpoint what’s moving results

Standardize driver analysis across teams for consistent decisioning

Turn insights into targeted rebalancing and asset plans

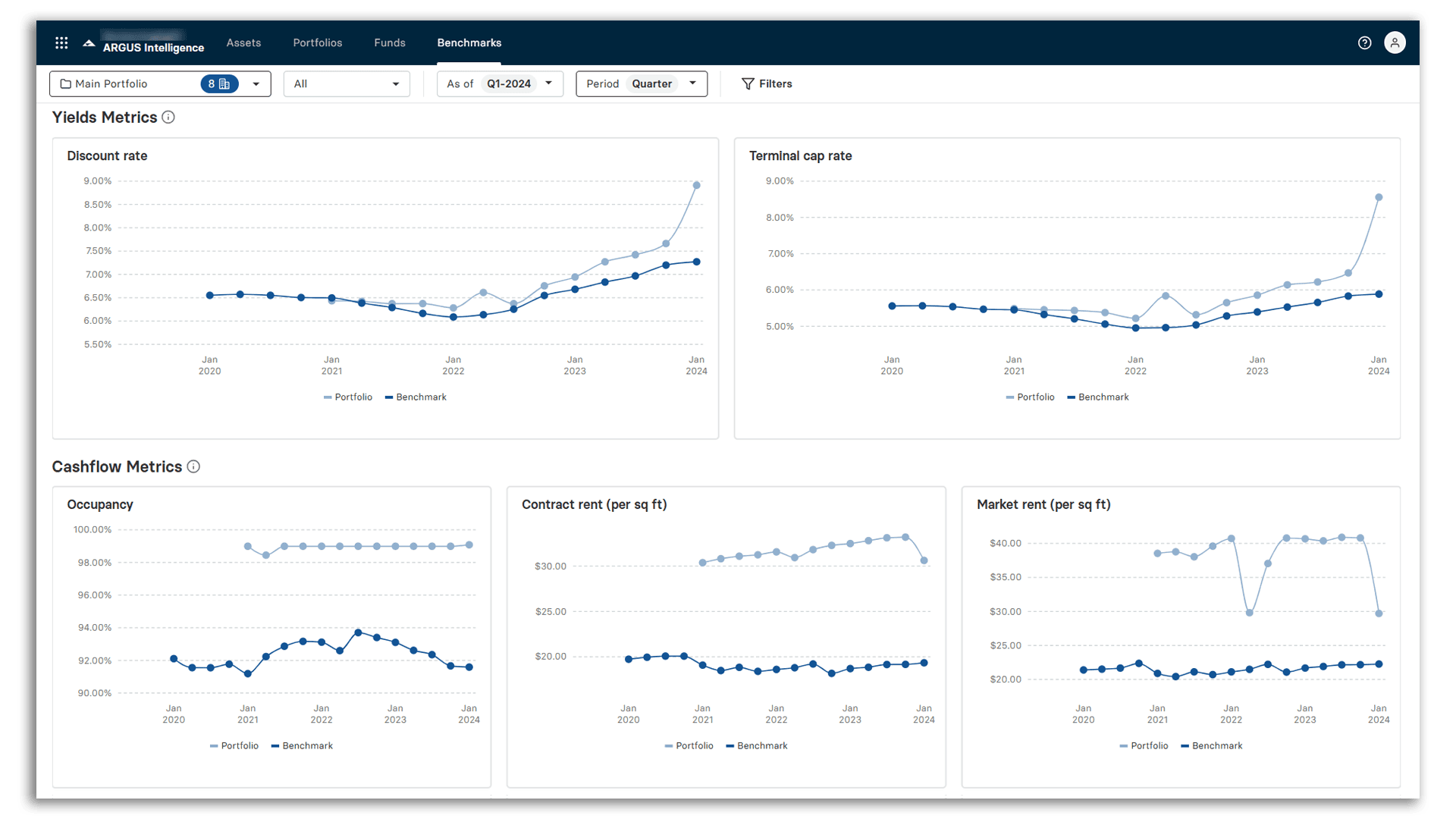

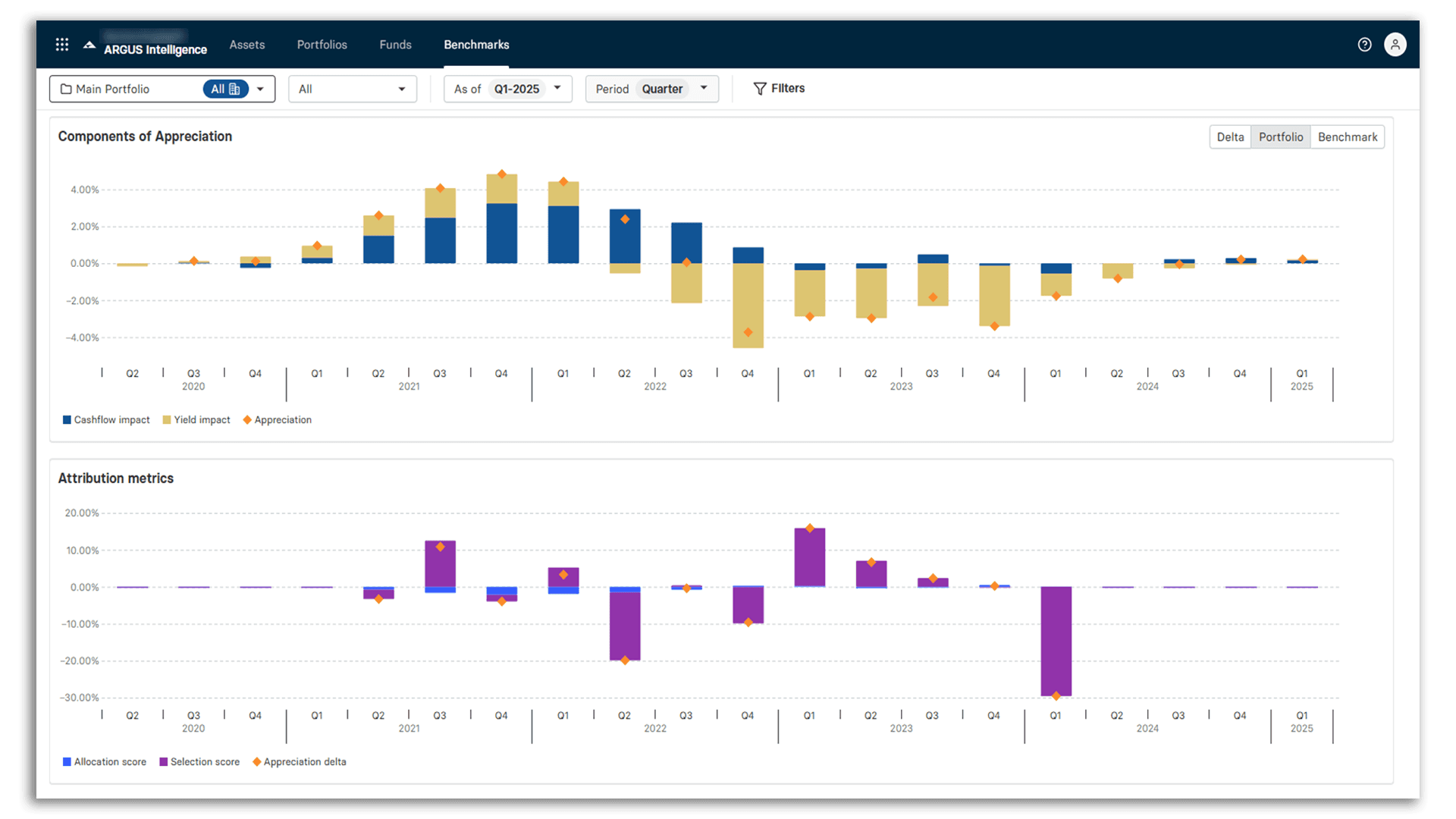

Historical trends and scenarios

Understand trendlines and test your strategy. Review performance history and model scenarios to anticipate change:

Track performance vs. market over multi-year horizons

See turning points by market and sub-type (e.g. Core Open End context)

Validate underwriting and exit timing assumptions with benchmarks

Align quarterly narratives with evidence, not anecdotes

Transaction and valuation impact

Get transparent, defensible decision support. Visualize how acquisitions, dispositions or re-allocations shift your benchmark position:

Link deal/valuation effects to benchmark-relative performance

Build “what-if” scenarios to test allocation changes

Defend decisions with transparent, benchmark-linked evidence

Package outputs for investment committees, boards, LPs, and auditors

Industry-leading capabilities delivered through ARGUS Intelligence

ARGUS Intelligence

Benchmark Manager

Transforms ARGUS Enterprise data into portfolio-to-market benchmarking and performance attribution

Portfolio Manager

Integrates ARGUS Enterprise valuations with scenario-based portfolio visualizations

FAQ

Get answers to commonly asked questions about Benchmark Manager

What is Benchmark Manager and who should use it?

What data is behind Benchmark Manager?

Can Benchmark Manager assess performance in a mixed portfolio of properties?

Why is Benchmark Manager better than other methods of benchmarking?

How does Benchmark Manager differ from Portfolio Manager?

$1.5T+

in asset value benchmarked

60K+

properties analyzed quarterly

70%

faster portfolio-vs-market analysis