November 2025

TRREB professional newsletter

Altus Group's monthly snapshot of Toronto’s new home and commercial market - giving TRREB professionals the data and trends they need to stay one step ahead.

COMMERCIAL

Featured property transactions

Greater Toronto Area: Apartment

100 Tyndall Avenue, Old Toronto

$14,531,750

$302,745 per unit

Greater Golden Horseshoe: Industrial

160 McGovern Drive, Cambridge

$6,000,000

$357 per sq. ft.

Greater Toronto Area transactions

Sector | Municipality | Address | Price | Unit price | Parameter | Transaction Date | Brokers |

|---|---|---|---|---|---|---|---|

Industrial | Brampton | 85 Inspire Boulevard, Units C11-C14 | $13,176,350 | $550 | per sq. ft. | Nov. 14, 2025 | Kamal Chohan & Aitzaz Ahmad (Citi Brokers Realty Inc.) |

Industrial | Markham | 180 Allstate Parkway, Unit 101 | $9,625,680 | $577 | per sq. ft. | Nov. 13, 2025 | James Mildon, Dan Hubert, Peter Schmidt, D'Arcy Bak (Cushman & Wakefield) |

Industrial | Vaughan | 227 Bowes Road | $9,250,000 | $500 | per sq. ft. | Nov. 14, 2025 | Aaron Wright (Century 21 United Realty Inc.) & Joaquim Lains (Royal LePage Supreme Realty) |

Industrial | Mississauga | 150 Brunel Road | $7,430,000 | $498 | per sq. ft. | Nov. 10, 2025 | Ben Williams, Matt Albertine, Eric Margo (Colliers) & Bill Saini (iCloud Realty) |

Greater Golden Horseshoe Area transactions

Sector | Municipality | Address | Price | Unit price | Parameter | Transaction Date | Brokers |

|---|---|---|---|---|---|---|---|

Retail | Niagara Falls | 5077 Centre Street | $1,725,000 | $261 | per sq. ft. | Nov. 7, 2025 | Luigi D. Tassone (HomeLife Principle Real Estate) |

Apartment | Hamilton | 1284 Fennell Avenue East | $1,670,000 | $139,167 | per unit | Nov. 14, 2025 | Stacey Winn & Stephanie Ammendolia (Re/Max Escarpment Realty), Jagroop Bhangu (Royal LePage Flower City Realty) |

Office | Barrie | 143 Ferndale Drive North | $1,525,000 | $266 | per sq. ft. | Nov. 4, 2025 | Jennifer Jones & Lorena Nalon (eXp Realty), Daljit Singh Sekhon (Royal Canadian Realty) |

Retail | Brantford | 7 Burnley Avenue | $1,200,000 | $602 | per sq. ft. | Nov. 3, 2025 |

Sector spotlight

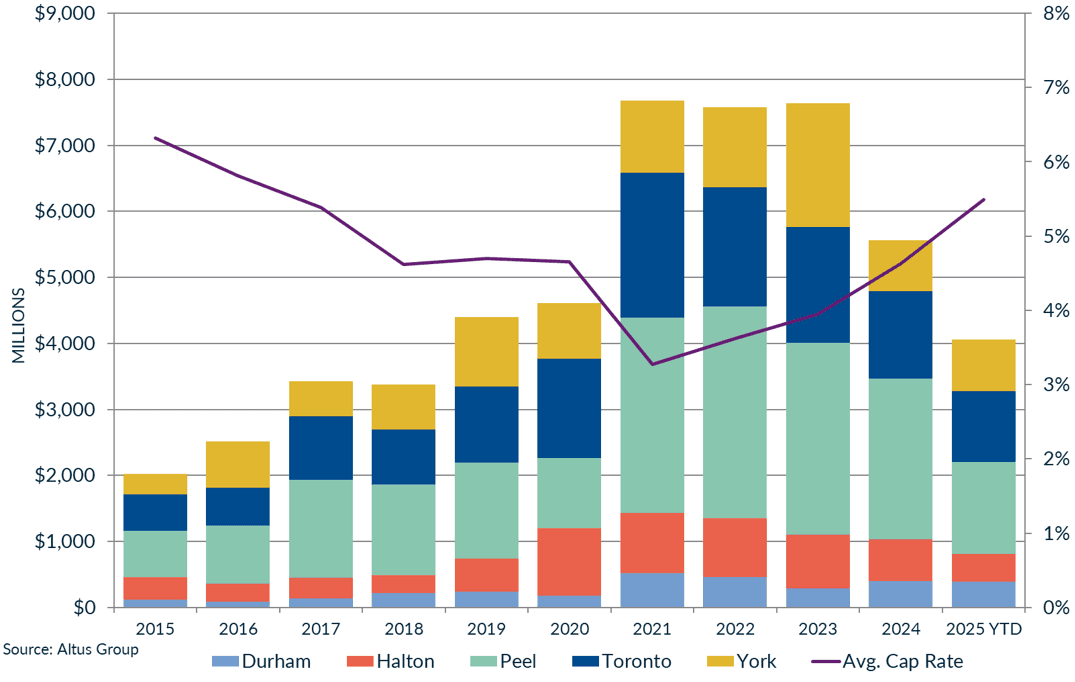

Greater Toronto Area industrial investment sales by region, 2015 - 2025

This chart displays the total dollar volume invested and the average cap rate for all industrial transactions above $1M in the Greater Toronto Area (GTA). By the close of Q3 2025, industrial investment volume in the GTA plateaued, with nearly $4B in investment volume, a modest decrease of 1% year-over-year.

Halton and Peel regions reported a contraction in their year-over-year investment volume, down 26% and 15%, respectively. Conversely, York and Durham regions reported year-over-year increases, up 55% and 10%, respectively. Toronto's investment volume plateaued, with a slight 2% increase year-over-year.

The average cap rate for the industrial transactions in the GTA in Q3 2024 YTD was 5.50%. This is an increase of 110 basis points compared to the same period last year.

Canadian industrial sector navigated a challenging period marked by disruptions from the Canada-US trade tensions and broader economic shifts. These factors tempered investor confidence, leading to a stagnant national industrial availability rate and a pullback in investment volumes.

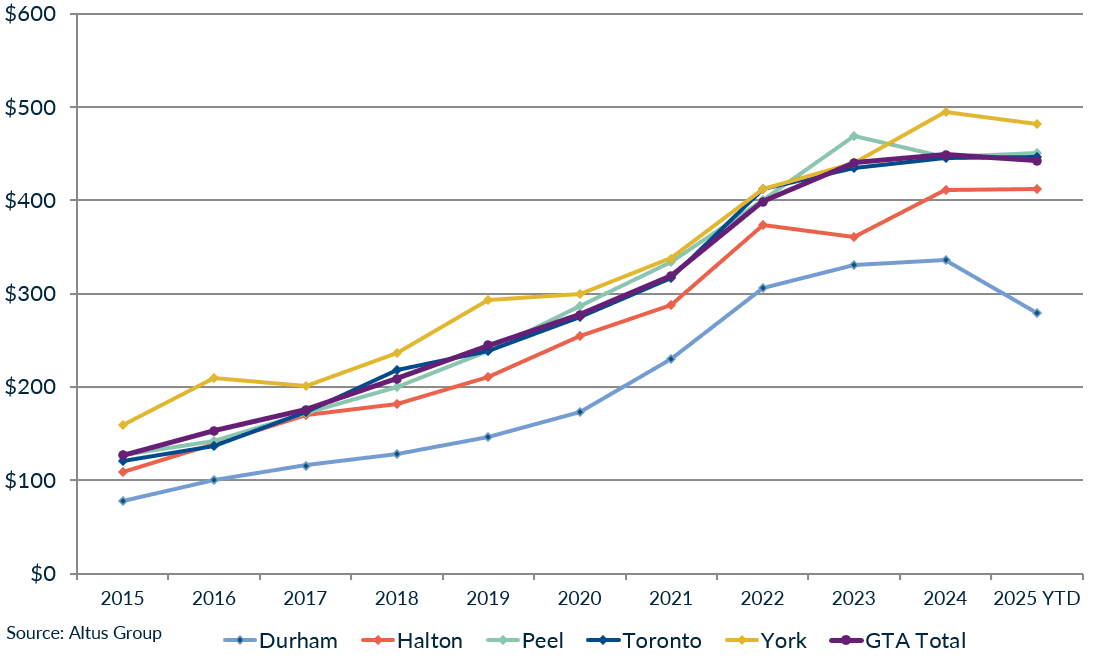

Greater Toronto Area industrial average price per square foot by region, 2015-2025

This chart displays the average price per square foot by region for all industrial transactions over $1M in the GTA.

The average price per square foot for industrial assets across the GTA has plateaued. The GTA reported a small decrease of 2% from 2024 to 2025, from $452 to $442 per square foot.

Most regions in the GTA saw a year-over-year decrease or signs of flattening in their average price per square foot. The most significant increase was observed in Durham region, recording a 18% decrease. Conversely, Halton's average price per square foot has remained sticky, up 4% year-over-year.

RESIDENTIAL

New project openings

Coming soon

Creekview Collective

by Branthaven Homes

9755 Derry Road

Milton, ON

Expected opening: Early 20256

Description:

Coming soon to Milton, Creekview Collective by Branthaven Homes will feature a collection of freehold common element townhomes. Phase 1 will include 122 back-to-back, rear-lane, and traditional 2-storey models. Broker previews have begun, with signings expected in early 2026 and occupancies scheduled for Summer 2027.

Builder commissions & incentives

North Oak Condos at Oakvillage - Tower 4C

by Minto Developments

5% commission (as of November 12, 2025)

Price range: $587,900 - $990,900

Oakville (3065 Trafalgar Road)

Occupancy: October 1, 2028

Westshore

by Minto Developments

3.5% commission (as of November 12, 2025)

Price range: $586,900 - $1,126,900

W6 - Toronto/Etobicoke (3580-3600 Lake Shore Boulevard West)

Occupancy: February 1, 2025

Dupont

by Tridel

4% commission (as of November 11, 2025)

Price range: $580,000 - $1,795,000

W2 - Toronto/York (840 Dupont Street)

Occupancy: May 1, 2026

Queen Church

by Tridel

November 11, 2025)

Price range: $695,000 - $2,309,000

C8 - Toronto (60 Queen Street East)

Occupancy: June 1, 2027

INSIGHTS Spotlight

Catch the latest research and insights from Altus

The unintended consequences of Canada’s rising housing costs and delays

In testimony before the Canadian Senate’s Standing Committee on Banking, Commerce and the Economy, Peter Norman, Vice President and Economic Strategist at Altus Group, outlined a pressing issue facing Canada today: the structural costs embedded in new housing.

Read the full article

Canadian CRE valuation analysis – Q3 2025

Our latest update shows overall CRE values holding steady in Q3, with retail posting modest gains and office facing ongoing pressure. The article breaks down quarterly shifts across major asset classes and what they signal for the market heading into 2026.

Get the full breakdown

Toronto commercial market update – Q3 2025

Our latest analysis of the Toronto market shows investment activity easing in Q3 2025 as capital remains cautious. Retail and industrial sectors continue to hold steady, while office, land, and multifamily adjust to shifting economic and financing conditions.

Explore our analysis

For more details on any of the projects or transactions in this newsletter, access Data Studio for TRREB members from within your MLS application. For support, please call the TRREB Help desk at (416) 443-8111.

Disclaimer: The opinions expressed in this newsletter are solely those of the authors and are not endorsed by Altus Group Limited, its affiliates and its related entities (collectively “Altus Group”). This publication has been prepared for general guidance on matters of interest only and does not constitute professional advice or services of Altus Group. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy, completeness or reliability of the information contained in this publication, or the suitability of the information for a particular purpose. To the extent permitted by law, Altus Group does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. The distribution of this publication to you does not create, extend or revive a client relationship between Altus Group and you or any other person or entity. This publication, or any part thereof, may not be reproduced or distributed in any form for any purpose without the express written consent of Altus Group.